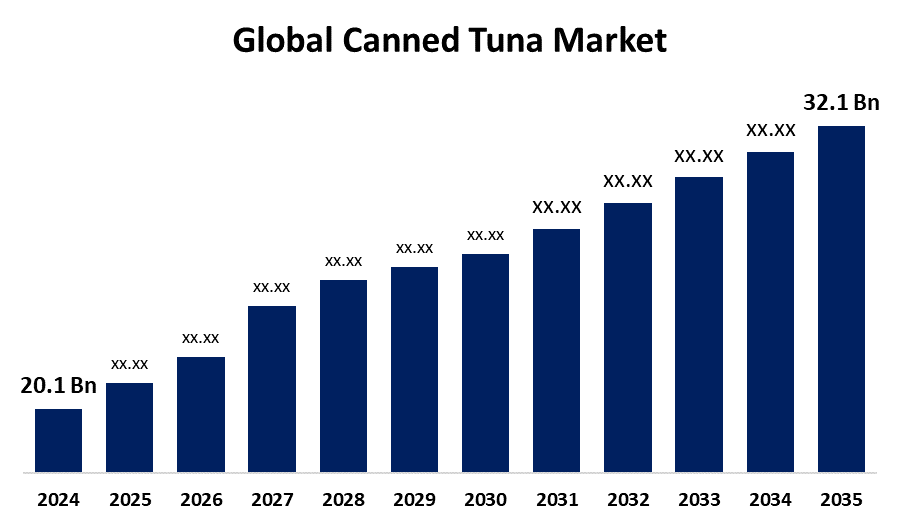

Global Canned Tuna Market Insights Forecasts to 2035

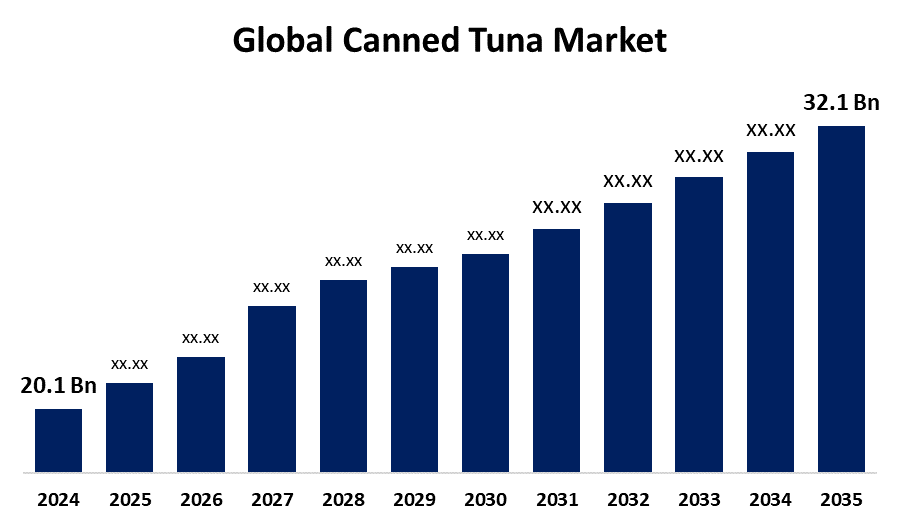

- The Global Canned Tuna Market Size Was Estimated at USD 20.1 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.35% from 2025 to 2035

- The Worldwide Canned Tuna Market Size is Expected to Reach USD 32.1 Billion by 2035

- Latin America is expected to grow the fastest during the forecast period.

Canned Tuna Market

The global canned tuna market encompasses the processing, packaging, and distribution of tuna preserved in cans, providing a convenient and long-lasting source of protein. Canned tuna is a popular choice among consumers due to its affordability, nutritional value, and versatility in a variety of meals, including salads, sandwiches, and casseroles. The market is characterized by a range of products varying in size, flavor, and packaging formats to cater to diverse consumer preferences. Key industry players emphasize quality control and sustainable sourcing to ensure product safety and environmental responsibility. Technological advancements in processing and packaging have improved the shelf life and freshness of canned tuna, enhancing its appeal to consumers. As a staple within the seafood industry, canned tuna maintains a strong presence in both retail and foodservice sectors. The market continues to develop in response to evolving consumer tastes and the increasing demand for convenient, ready-to-eat protein options.

Attractive Opportunities in the Canned Tuna Market

- Introducing flavored tuna, organic, and sustainably certified products allows brands to attract health-conscious and environmentally aware consumers, catering to evolving tastes and preferences.

- Growing middle-class populations in emerging regions offer untapped potential for increased canned tuna consumption, driven by rising income levels and changing dietary habits.

- Advances in recyclable and biodegradable packaging materials appeal to environmentally conscious buyers, improving brand reputation and meeting sustainability demands.

- Leveraging online platforms enables brands to reach a broader consumer base, enhance engagement, and boost sales through convenient, direct-to-consumer distribution models.

Global Canned Tuna Market Dynamics

DRIVER: Increasing consumer demand for convenient and ready-to-eat food products

Increasing consumer demand for convenient and ready-to-eat food products plays a major role, as canned tuna offers a quick and easy protein source without the need for refrigeration. Rising health awareness also contributes, with many consumers recognizing tuna as a low-fat, high-protein option rich in omega-3 fatty acids, which support heart health. Additionally, expanding urbanization and changing lifestyles have led to greater consumption of packaged and shelf-stable foods. Improvements in packaging technology, such as vacuum sealing and BPA-free cans, enhance product safety and freshness, further attracting buyers. The growing penetration of modern retail formats like supermarkets and e-commerce platforms has made canned tuna more accessible to a wider audience. Moreover, increased promotion of seafood consumption by health organizations and governments encourages adoption of canned tuna as a nutritious dietary staple, supporting market expansion globally.

RESTRAINT: Fluctuating availability and high cost of raw tuna

One major concern is the fluctuating availability and high cost of raw tuna due to overfishing and environmental regulations, which can lead to supply shortages and price volatility. Additionally, sustainability issues and increasing awareness of overfishing have raised consumer concerns about the environmental impact of tuna fishing practices. Health-related worries, such as mercury contamination in tuna, also affect consumer preferences, prompting some to limit their consumption. Competition from alternative protein sources like plant-based and other seafood options presents another challenge. Moreover, strict regulatory standards regarding food safety, packaging materials, and labeling requirements can increase production costs and complexity for manufacturers. Finally, the canned tuna market faces stiff competition from fresh and frozen seafood, which some consumers prefer for perceived better taste and nutritional value. These factors collectively restrain the overall growth potential of the canned tuna industry.

OPPORTUNITY: Innovations in product variety, such as flavored tuna

Innovations in product variety, such as flavored tuna, organic, and sustainably certified options, allow brands to appeal to health-conscious and environmentally aware consumers. Expanding into emerging markets with growing middle-class populations presents untapped potential for increased consumption. Additionally, the rising popularity of ready-to-eat meals and meal kits offers new distribution channels for canned tuna products. Advances in eco-friendly packaging, like recyclable and biodegradable cans, can attract environmentally conscious buyers and improve brand reputation. Collaborations with foodservice providers and restaurants to incorporate canned tuna in diverse menus also offer growth avenues. Furthermore, digital marketing and e-commerce expansion enable brands to reach a broader audience, boosting sales and consumer engagement. These opportunities support the market’s evolution by aligning with changing consumer lifestyles and preferences while promoting sustainability and innovation.

CHALLENGES: Intense competition not only from other protein sources but also from private-label

One significant issue is the complex global supply chain, which can be disrupted by geopolitical tensions, trade restrictions, or logistical inefficiencies, affecting timely product availability. Additionally, the industry faces intense competition not only from other protein sources but also from private-label and low-cost brands, pressuring profit margins for established players. Ensuring consistent quality and safety across different regions with varying regulatory standards can also be difficult and costly. Moreover, consumer skepticism regarding the nutritional claims and labeling accuracy of canned tuna products can undermine trust and brand loyalty. The market must also navigate the high costs associated with adopting sustainable fishing and production practices, which may deter smaller manufacturers. Lastly, fluctuating fuel and transportation costs add unpredictability to overall operational expenses, posing financial challenges for producers and distributors alike. These challenges collectively complicate market growth and stability.

Global Canned Tuna Market Ecosystem Analysis

The global canned tuna market ecosystem includes tuna fisheries that supply raw fish to processors who clean, cook, and can the product. Packaging suppliers provide materials, while distributors and wholesalers move the products to retailers and foodservice providers. Retailers and restaurants make canned tuna accessible to consumers, whose preferences influence demand and innovation. Regulatory bodies ensure food safety, environmental sustainability, and compliance with trade standards. Together, these stakeholders create an interconnected network that supports the production, distribution, and consumption of canned tuna worldwide.

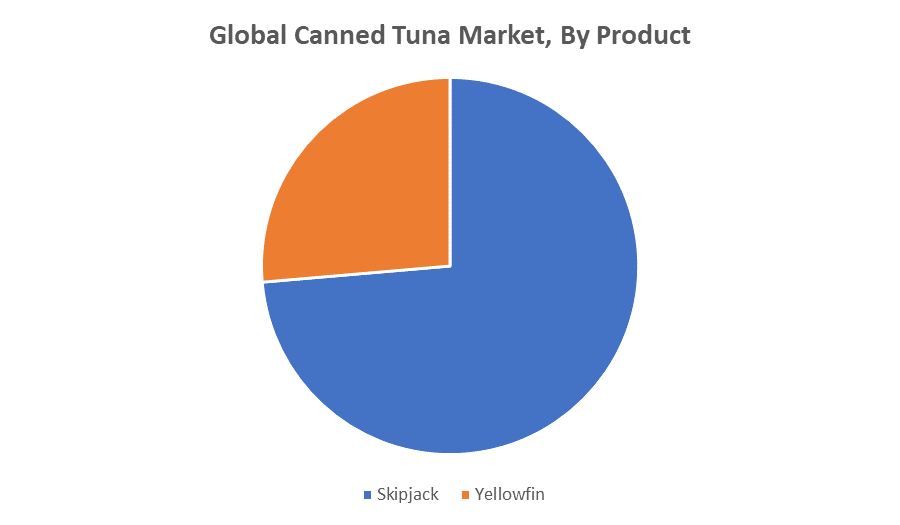

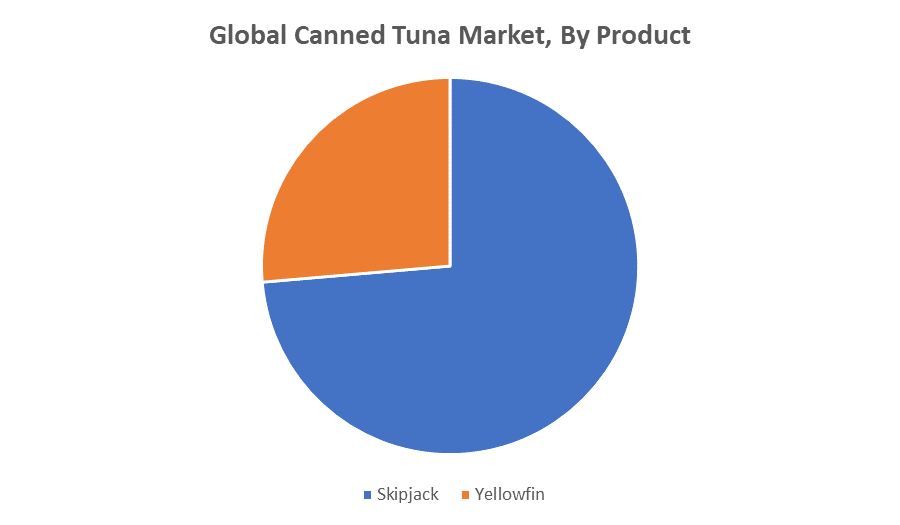

Based on the product, the skipjack accounted for the largest revenue share and is expected to grow at a significant CAGR over the forecast period

The skipjack tuna accounts for the largest revenue share in the global canned tuna market. Known for its relatively lower cost and abundant availability, skipjack is widely preferred for canning due to its mild flavor and firm texture. This segment is expected to grow at a significant CAGR over the forecast period, driven by steady demand from consumers seeking affordable and nutritious seafood options. The sustainability efforts and efficient fishing methods related to skipjack tuna also contribute to its prominence in the market, reinforcing its leading position among canned tuna varieties globally.

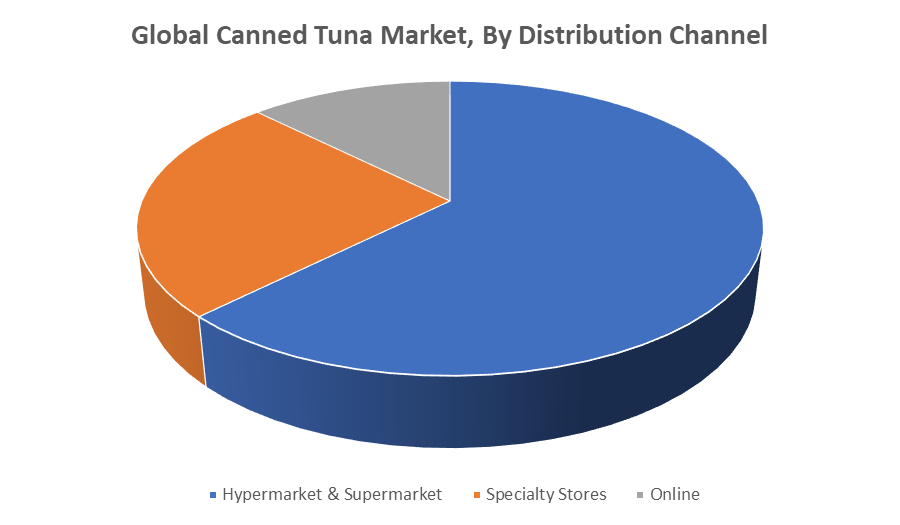

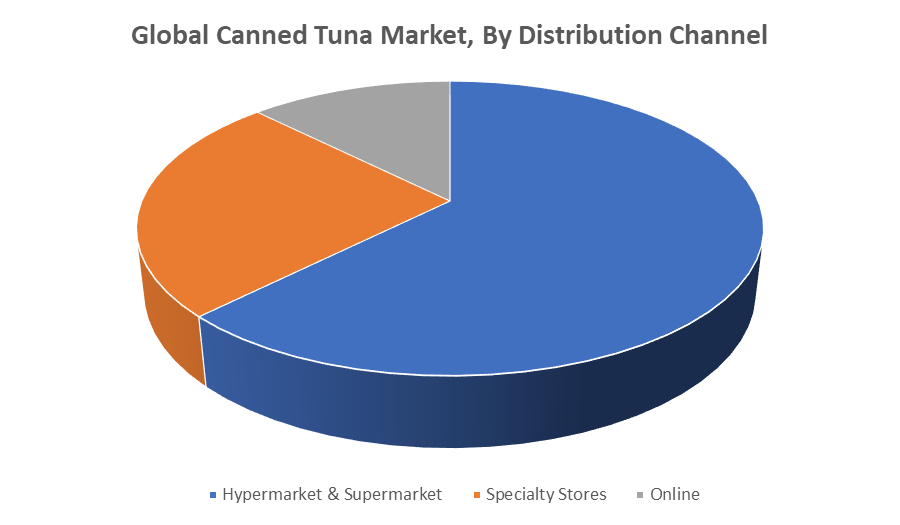

Based on the distribution channel, the hypermarkets & supermarkets accounted for the largest revenue share over the forecast period

The hypermarkets and supermarkets accounted for the largest revenue share in the global canned tuna market over the forecast period. These retail formats offer a wide variety of canned tuna products from numerous brands, making them convenient one-stop shopping destinations for consumers. Their extensive product selection, competitive pricing, and widespread presence contribute to their dominance in the market. Additionally, the ability for consumers to physically inspect products and benefit from promotions enhances their appeal. While online sales channels are growing rapidly, hypermarkets and supermarkets remain the preferred choice for purchasing canned tuna due to their accessibility and comprehensive offerings.

Europe is anticipated to hold the largest market share of the canned tuna market during the forecast period

Europe is anticipated to hold the largest market share in the canned tuna market during the forecast period. This is due to the region's high per capita consumption of tuna, particularly in countries such as Spain, Italy, France, and Germany. Spain plays a key role, producing a significant portion of Europe’s canned tuna supply. The market growth in Europe is supported by increasing consumer demand for convenient, healthy, and ready-to-eat seafood options, along with a strong preference for sustainably sourced products. Additionally, Europe’s well-established retail infrastructure and longstanding consumer habits contribute to its dominant position in the global canned tuna market.

Latin America is expected to grow at the fastest CAGR in the canned tuna market during the forecast period

Latin America is expected to grow at the fastest rate in the canned tuna market during the forecast period. This growth is driven by increasing consumer demand for convenient and ready-to-eat seafood options, along with rising health consciousness. Expanding retail infrastructure in the region also supports market development. Additionally, the growing preference for sustainable and responsibly sourced seafood products is influencing purchasing decisions, further contributing to the market’s rapid expansion in Latin America.

Recent Development

- In March 2023, Thai Union Group PLC announced its commitment of sourcing produce from those vessels only that implement practices to protect ocean wildlife from bycatch. This move comes after the research by Sustainable Fisheries Partnership about the risks that sharks, turtles, and seabird face in wildlife fishery.

Key Market Players

KEY PLAYERS IN THE CANNED TUNA MARKET INCLUDE

- Thai Union Group

- StarKist Co.

- Bumble Bee Foods, LLC

- Dongwon Industries Co., Ltd.

- Parlevliet & van der Plas B.V.

- Wild Planet Foods, Inc.

- GE Seafoods

- Tri Marine Group

- Clover Leaf Seafoods

- Princes Group Ltd.

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the canned tuna market based on the below-mentioned segments:

Global Canned Tuna Market, By Product

Global Canned Tuna Market, By Distribution Channel

- Hypermarket & Supermarket

- Specialty Stores

- Online

Global Canned Tuna Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa