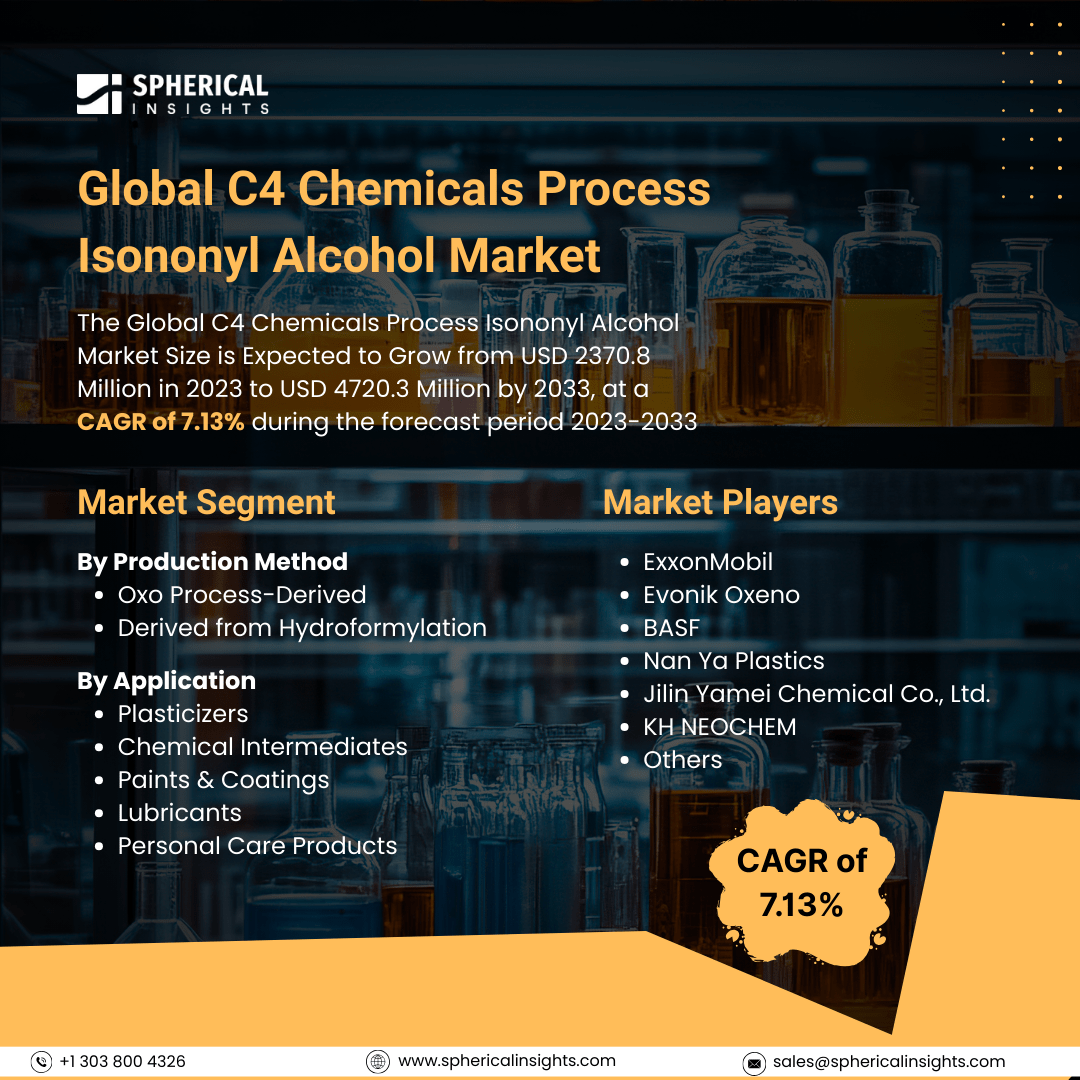

Global C4 Chemicals Process Isononyl Alcohol Market Size To Exceed USD 4720.3 Million By 2033

According to a research report published by Spherical Insights & Consulting, The Global C4 Chemicals Process Isononyl Alcohol Market Size is Expected to Grow from USD 2370.8 Million in 2023 to USD 4720.3 Million by 2033, at a CAGR of 7.13% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global C4 Chemicals Process Isononyl Alcohol Market Size, Share, and COVID-19 Impact Analysis, By Production Method (Oxo Process-Derived and Derived from Hydroformylation), By Application (Plasticizers, Chemical Intermediates, Paints & Coatings, Lubricants, and Personal Care Products), By End-User (Construction, Automotive, Manufacturing & Industrial, and Pharmaceuticals), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The C4 chemicals process isononyl alcohol market refers to the sector focused on the production and distribution of isononyl alcohol (INA) manufactured through the C4 chemicals process. This method involves the hydroformylation of C4 olefins, such as butenes, resulting in INA, a branched-chain alcohol known for its high stability and compatibility with polymers. INA is predominantly utilized in producing plasticizers like diisononyl phthalate (DINP) and diisononyl cyclohexane dicarboxylate (DINCH), which enhance the flexibility and durability of polyvinyl chloride (PVC) products. Additionally, INA serves as a solvent and intermediate in the manufacture of paints, coatings, lubricants, and personal care products. Furthermore, the global C4 chemicals process isononyl alcohol market is primarily driven by the escalating demand for environmentally sustainable plasticizers, particularly in the polymer industry. Isononyl alcohol serves as a crucial component in producing non-phthalate plasticizers, aligning with stringent environmental regulations and the industry's shift toward eco-friendly practices. Additionally, its expanding applications in specialty chemicals, including paints, coatings, and adhesives, contribute significantly to the market. Rapid industrialization and urbanization in emerging economies further amplify the need for isononyl alcohol, supporting its market expansion. However, the global C4 chemicals process isononyl alcohol market faces restraining factors such as fluctuating raw material prices, stringent environmental regulations, high production costs, and limited awareness in developing economies, impacting market growth.

The oxo process-derived segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of the production method, the global C4 chemicals process isononyl alcohol market is divided into oxo process-derived and derived from hydroformylation. Among these, the oxo process-derived segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is attributed to its efficiency in producing high-purity isononyl alcohol, which is essential for plasticizer production. Its cost-effectiveness, scalability, and widespread industrial adoption support strong demand, driving significant CAGR growth throughout the forecast period, especially in construction and automotive applications requiring flexible PVC materials.

The plasticizers segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

On the basis of the application, the global C4 chemicals process isononyl alcohol market is divided into plasticizers, chemical intermediates, paints & coatings, lubricants, and personal care products. Among these, the plasticizers segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The segmental growth is attributed to the high demand for flexible PVC in construction, automotive, and consumer goods. Isononyl alcohol is a key ingredient in producing non-phthalate plasticizers. Growing environmental awareness and regulations favoring safer alternatives are driving its adoption, supporting a remarkable CAGR during the forecast period.

The construction segment accounted for the largest share in 2023 and is anticipated to grow at a substantial CAGR during the forecast period.

On the basis of the end-user, the global C4 chemicals process isononyl alcohol market is divided into construction, automotive, manufacturing & industrial, and pharmaceuticals. Among these, the construction segment accounted for the largest share in 2023 and is anticipated to grow at a substantial CAGR during the forecast period. The segmental growth is attributed to rising infrastructure development and urbanization, especially in emerging economies. Isononyl alcohol-based plasticizers are widely used in flexible PVC for pipes, flooring, and cables. Increasing demand for durable, flexible construction materials is expected to drive substantial CAGR in this segment during the forecast period.

North America is projected to hold the largest share of the global C4 chemicals process isononyl alcohol market over the forecast period.

North America is projected to hold the largest share of the global C4 chemicals process isononyl alcohol market over the forecast period. The regional growth is attributed to its robust construction and automotive industries, advanced manufacturing infrastructure, and strong demand for high-performance plasticizers. The presence of key chemical producers and stringent regulations promoting non-phthalate plasticizers further support regional market dominance during the forecast period.

Asia Pacific is expected to grow at the fastest CAGR growth of the global C4 chemicals process isononyl alcohol market during the forecast period. The regional growth is attributed to rapid industrialization, urbanization, and expanding construction and automotive sectors in countries like China and India. Rising demand for flexible PVC products, increasing infrastructure investments, and growing awareness of non-phthalate plasticizers are fueling regional market growth.

Company Profiling

Major vendors in the global C4 chemicals process isononyl alcohol market are ExxonMobil, Evonik Oxeno, BASF, Nan Ya Plastics, Jilin Yamei Chemical Co., Ltd., & KH NEOCHEM, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global C4 chemicals process isononyl alcohol market based on the below-mentioned segments:

Global C4 Chemicals Process Isononyl Alcohol Market, By Production Method

- Oxo Process-Derived

- Derived from Hydroformylation

Global C4 Chemicals Process Isononyl Alcohol Market, By Application

- Plasticizers

- Chemical Intermediates

- Paints & Coatings

- Lubricants

- Personal Care Products

Global C4 Chemicals Process Isononyl Alcohol Market, By End-User

- Construction

- Automotive

- Manufacturing & Industrial

- Pharmaceuticals

Global C4 Chemicals Process Isononyl Alcohol Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa