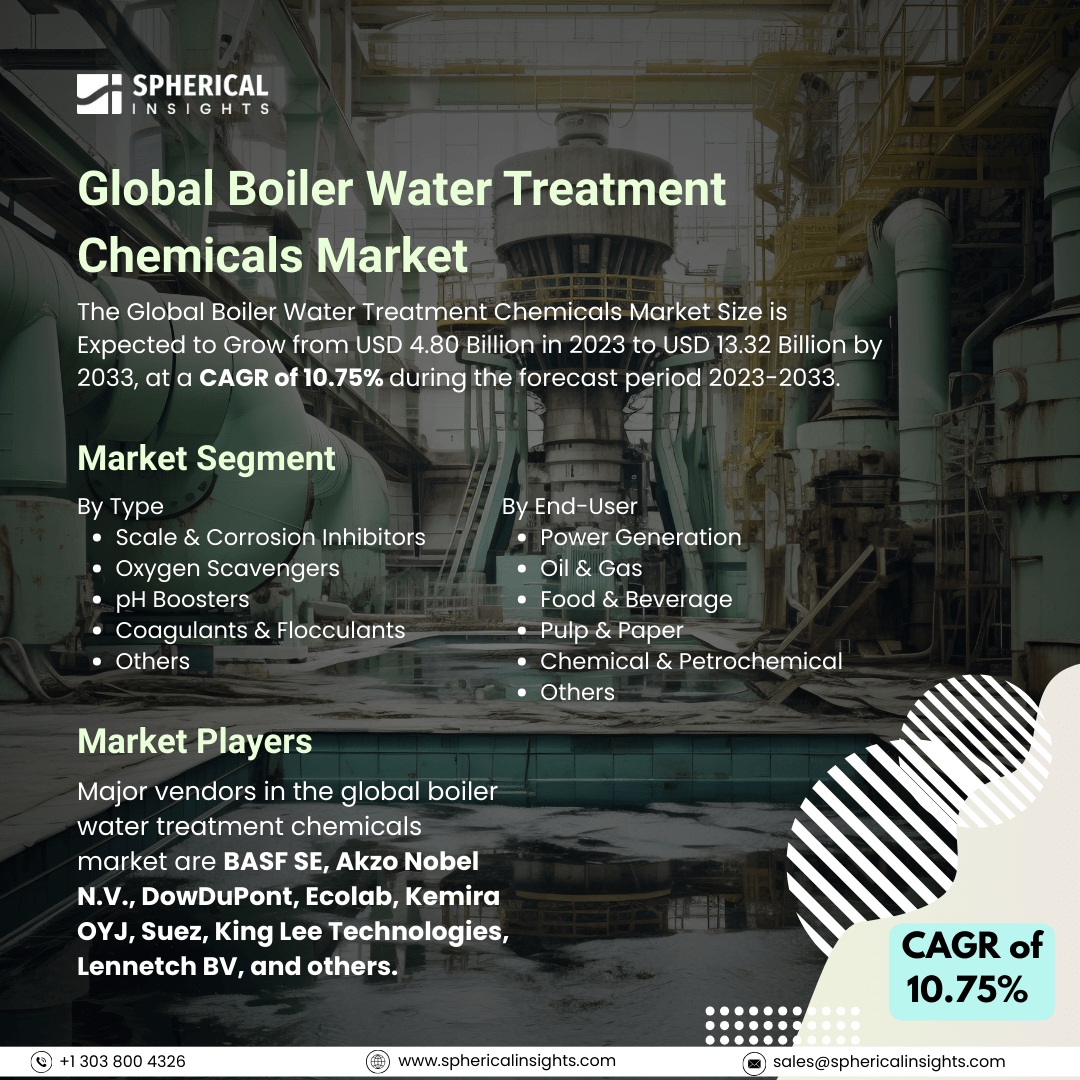

Global Boiler Water Treatment Chemicals Market Size To Exceed USD 13.32 Billion By 2033

According to a research report published by Spherical Insights & Consulting, The Global Boiler Water Treatment Chemicals Market Size is Expected to Grow from USD 4.80 Billion in 2023 to USD 13.32 Billion by 2033, at a CAGR of 10.75% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Boiler Water Treatment Chemicals Market Size, Share, and COVID-19 Impact Analysis, By Type (Scale & Corrosion Inhibitors, Oxygen Scavengers, pH Boosters, Coagulants & Flocculants, and Others), By End-User (Power Generation, Oil & Gas, Food & Beverage, Pulp & Paper, Chemical & Petrochemical, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The boiler water treatment chemicals market refers to the global industry involved in the production, distribution, and application of chemical formulations designed to improve the performance, efficiency, and lifespan of industrial and commercial boilers. These chemicals help prevent scale formation, corrosion, sludge buildup, and microbial growth in boiler systems, ensuring safe operation and reducing maintenance costs across various sectors, including power generation, manufacturing, oil & gas, and food processing. Furthermore, the global boiler water treatment chemicals market is primarily driven by the escalating demand for energy, leading to increased power generation activities that necessitate efficient boiler operations. Industries such as oil and gas, chemical and petrochemical, and food and beverage rely heavily on boilers, further propelling the need for water treatment chemicals to prevent scaling and corrosion. Additionally, stringent environmental regulations mandate the use of effective water treatment solutions to ensure compliance and operational efficiency. Rapid industrialization, particularly in emerging economies, amplifies these demands, fostering market growth. However, the stringent environmental regulations, high operational costs, limited awareness in developing regions, and the availability of alternative water treatment technologies, hindering widespread adoption, are key restraints for the growth of the market.

The scale & corrosion inhibitors segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of the type, the global boiler water treatment chemicals market is divided into scale & corrosion inhibitors, oxygen scavengers, pH boosters, coagulants & flocculants, and others. Among these, the scale & corrosion inhibitors segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is attributed to their essential role in enhancing boiler efficiency, reducing maintenance costs, and prolonging equipment life. Rising industrialization, increasing energy demand, and stringent regulations on equipment protection are driving their widespread adoption, supporting significant CAGR growth during the forecast period.

The power generation segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

On the basis of the end-user, the global boiler water treatment chemicals market is divided into power generation, oil & gas, food & beverage, pulp & paper, chemical & petrochemical, and others. Among these, the power generation segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The segmental growth is attributed to the high demand for an efficient and uninterrupted energy supply. Boiler water treatment chemicals are critical for preventing scale and corrosion in power plants. Increasing global energy needs and infrastructure expansion are expected to drive remarkable CAGR growth in this segment over the forecast period.

North America is projected to hold the largest share of the global boiler water treatment chemicals market over the forecast period.

North America is projected to hold the largest share of the global boiler water treatment chemicals market over the forecast period. The regional growth is attributed to its well-established industrial base, high energy consumption, and strict regulations on water and equipment safety. The presence of key market players, technological advancements, and increasing demand for efficient power generation further contribute to the region’s market dominance.

Asia Pacific is expected to grow at the fastest CAGR growth of the global boiler water treatment chemicals market during the forecast period. The regional growth is attributed to the rapid industrialization and urbanization in countries like China and India, which have led to increased demand for energy, resulting in the expansion of power generation facilities. For instance, China's plans to add 300-500 new coal power plants by 2030 highlight this trend. Additionally, the growing manufacturing sector in the region necessitates efficient boiler operations, further propelling the demand for water treatment chemicals. Supportive government initiatives and stringent environmental regulations also encourage the adoption of effective water treatment solutions, contributing to the market's robust growth.

Company Profiling

Major vendors in the global boiler water treatment chemicals market are BASF SE, Akzo Nobel N.V., DowDuPont, Ecolab, Kemira OYJ, Suez, King Lee Technologies, Lennetch BV, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2023, the goal of Bond Water is to supply the most environmentally friendly products to the water treatment sector. By eliminating any heavy metals from our manufacturing process and lowering reactive phosphate, Bond is giving their clients better and more environmentally friendly chemical solutions. The company wants to give its clients a green choice as well as a range of products designed to meet the most exacting cooling requirements and upgrade their establishment to the newest green technology. Bond declared that the roll-out of the EcoTraceTM product line was complete.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global boiler water treatment chemicals market based on the below-mentioned segments:

Global Boiler Water Treatment Chemicals Market, By Type

- Scale & Corrosion Inhibitors

- Oxygen Scavengers

- pH Boosters

- Coagulants & Flocculants

- Others

Global Boiler Water Treatment Chemicals Market, By End-User

- Power Generation

- Oil & Gas

- Food & Beverage

- Pulp & Paper

- Chemical & Petrochemical

- Others

Global Boiler Water Treatment Chemicals Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa