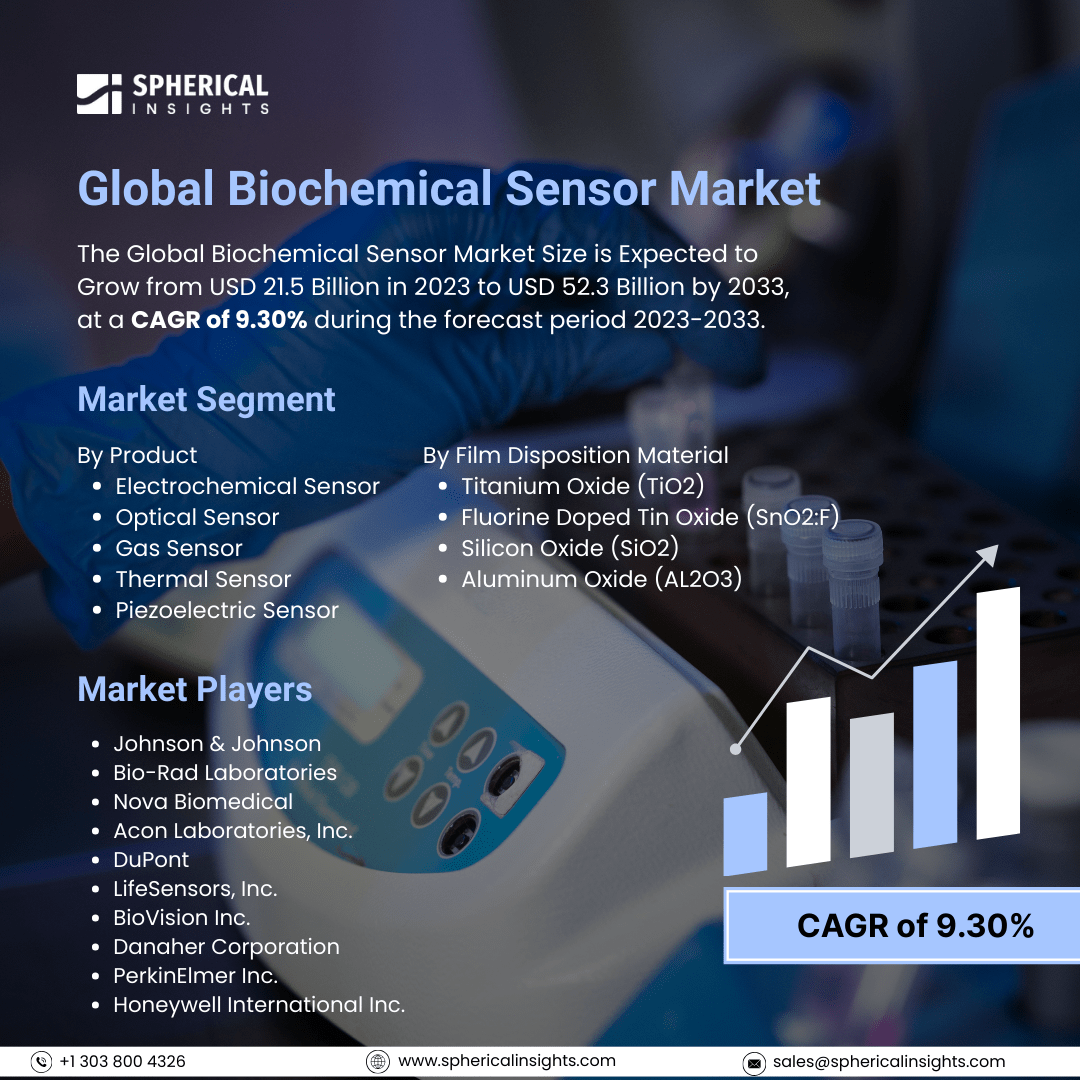

Global Biochemical Sensor Market Size To Exceed USD 52.3 Billion By 2033

According to a research report published by Spherical Insights & Consulting, The Global Biochemical Sensor Market Size is Expected to Grow from USD 21.5 Billion in 2023 to USD 52.3 Billion by 2033, at a CAGR of 9.30% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Biochemical Sensor Market Size, Share, and COVID-19 Impact Analysis, By Product (Electrochemical Sensor, Optical Sensor, Gas Sensor, Thermal Sensor, and Piezoelectric Sensor), By Film Disposition Material (Titanium Oxide (TiO2), Fluorine Doped Tin Oxide (SnO2:F), Silicon Oxide (SiO2), and Aluminum Oxide (AL2O3)), By Application (Clinical Diagnosis, Environmental Monitoring, Food Quality Control, and Military), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The biochemical sensor market refers to the global industry focused on the development, production, and sale of biochemical sensors and analytical devices that convert a biological or chemical response into a measurable signal. These sensors are widely used in medical diagnostics, environmental monitoring, food safety, and biotechnology to detect specific substances like glucose, pathogens, toxins, or gases. The market encompasses various sensor types, including electrochemical, optical, and piezoelectric, and is driven by advances in nanotechnology, healthcare demand, and real-time monitoring solutions. Furthermore, the global biochemical sensor market is experiencing significant growth, driven by several key factors. The increasing demand for early disease diagnosis and personalized medicine has heightened the need for advanced biochemical sensors in healthcare. Technological advancements in material chemistry and wireless sensor networks have enhanced sensor sensitivity and reliability, broadening their applications. Additionally, the rising prevalence of chronic diseases necessitates rapid and accurate diagnostic tools, further propelling market expansion. Government initiatives aimed at ensuring food safety and environmental monitoring also contribute to the growing adoption of biochemical sensors. However, the global biochemical sensor market faces several restraining factors, including high development and deployment costs, stringent regulatory requirements, complex approval processes, data security and privacy concerns, and a lack of standardization across regions.

The electrochemical sensor segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of the product, the global biochemical sensor market is divided into electrochemical sensor, optical sensor, gas sensor, thermal sensor, and piezoelectric sensor. Among these, the electrochemical sensor segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is attributed to its high sensitivity, rapid response time, and wide application in medical diagnostics, environmental monitoring, and food safety. Its cost-effectiveness, portability, and continuous advancements in miniaturization and nanotechnology are expected to drive significant CAGR growth throughout the forecast period.

The silicon oxide (SiO2) segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

On the basis of the film disposition material, the global biochemical sensor market is divided into titanium oxide (TiO2), fluorine doped tin oxide (SnO2: F), silicon oxide (SiO2), and aluminum oxide (AL2O3). Among these, the silicon oxide (SiO2) segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The segmental growth is attributed to its small size and extensive use in clinical diagnostic and environmental monitoring devices. Its role as an insulating layer and protective coating enhances sensor stability and reliability. These advantages are projected to drive significant growth during the forecast period.

The clinical diagnosis segment accounted for the greatest share in 2023 and is anticipated to grow at a substantial CAGR over the forecast period.

On the basis of the application, the global biochemical sensor market is divided into clinical diagnosis, environmental monitoring, food quality control, and military. Among these, the clinical diagnosis segment accounted for the greatest share in 2023 and is anticipated to grow at a substantial CAGR over the forecast period. The segmental growth is attributed to the rising demand for rapid, accurate disease detection and monitoring. The increasing prevalence of chronic conditions, advancements in point-of-care technologies, and growing healthcare awareness are driving adoption. Continuous innovation in biochemical sensors enhances diagnostic capabilities, supporting substantial CAGR growth throughout the forecast period.

North America is projected to hold the largest share of the global biochemical sensor market over the forecast period.

North America is projected to hold the largest share of the global biochemical sensor market over the forecast period. North America's projected dominance in the global biochemical sensor market is driven by several key factors. The region boasts a concentration of major industry players and advanced technological infrastructure, fostering innovation and rapid adoption of sensor technologies. Significant investments in research and development within the medical sector have further propelled market growth. Additionally, the region's substantial defense budget supports advancements in sensor applications. Collectively, these elements position North America as a leader in the biochemical sensor market during the forecast period.

Asia Pacific is expected to grow at the fastest CAGR growth of the global biochemical sensor market during the forecast period. Asia Pacific's biochemical sensor market is projected to grow at the fastest compound annual growth rate (CAGR) during the forecast period, driven by several key factors. The region is experiencing a significant increase in chronic diseases, necessitating advanced diagnostic tools. Additionally, rapid technological advancements in sensor technologies are enhancing their applications across various sectors. Supportive government initiatives and increased healthcare spending are further propelling market expansion. Collectively, these elements position Asia Pacific as a rapidly growing market for biochemical sensors.

Company Profiling

Major vendors in the global biochemical sensor market are Johnson & Johnson, Bio-Rad Laboratories, Nova Biomedical, Acon Laboratories, Inc., DuPont, LifeSensors, Inc., BioVision Inc., Danaher Corporation, PerkinElmer Inc., Honeywell International Inc., GE Healthcare, Bio-Rad Laboratories, Inc., Xsensio, Thermo Fisher Scientific, Microchip Technology Inc., Universal Biosensors, Texas Instruments Inc., Emerson Electric Co., and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global biochemical sensor market based on the below-mentioned segments:

Global Biochemical Sensor Market, By Product

- Electrochemical Sensor

- Optical Sensor

- Gas Sensor

- Thermal Sensor

- Piezoelectric Sensor

Global Biochemical Sensor Market, By Film Disposition Material

- Titanium Oxide (TiO2)

- Fluorine Doped Tin Oxide (SnO2:F)

- Silicon Oxide (SiO2)

- Aluminum Oxide (AL2O3)

Global Biochemical Sensor Market, By Application

- Clinical Diagnosis

- Environmental Monitoring

- Food Quality Control

- Military

Global Biochemical Sensor Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa