Beer Packaging Market Summary

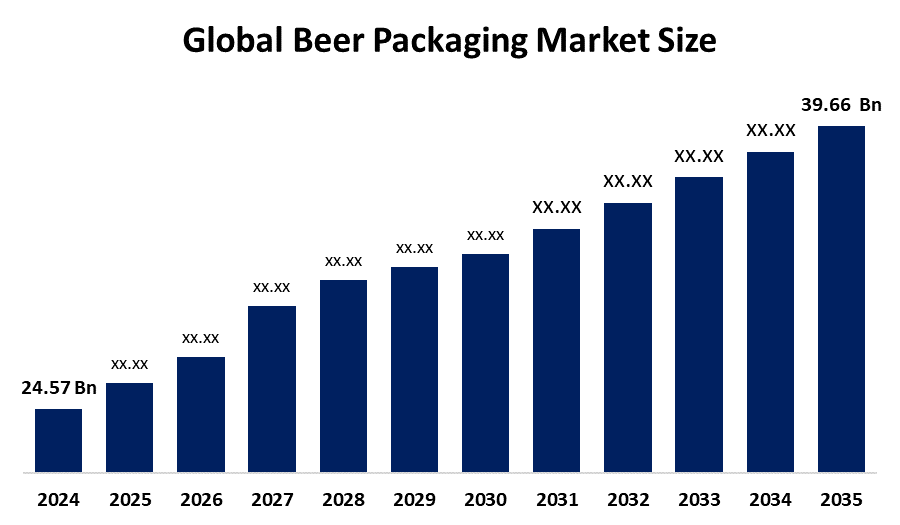

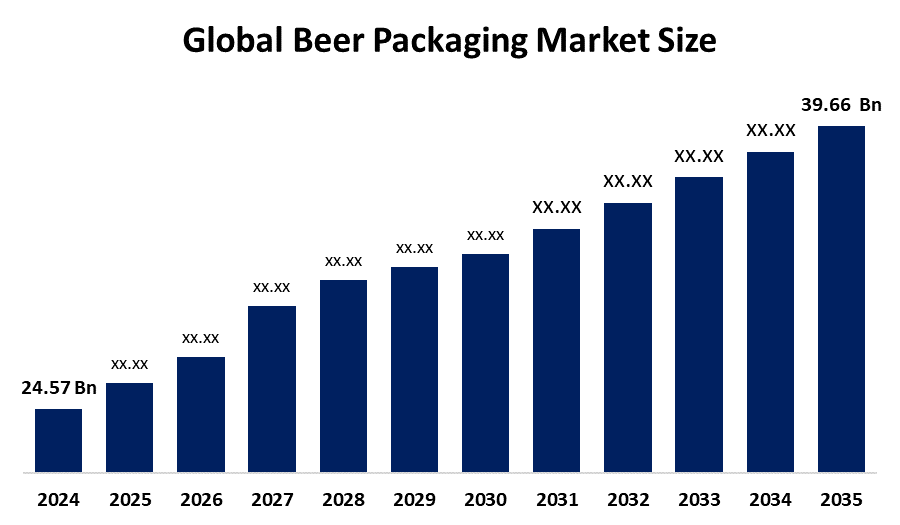

The Global Beer Packaging Market Size Was Estimated at USD 24.57 Billion in 2024 and is Projected to Reach USD 39.66 Billion by 2035, Growing at a CAGR of 4.45% from 2025 to 2035. Due to consumers' rising desire for craft and specialty beers, which necessitate creative and eye-catching packaging solutions, the beer packaging industry is expanding. Additionally, the industry is adopting eco-friendly packaging designs and materials as a result of growing sustainability consciousness.

Key Regional and Segment-Wise Insights

- With a revenue share of more than 36.3% in 2024, Asia Pacific led the beer packaging market.

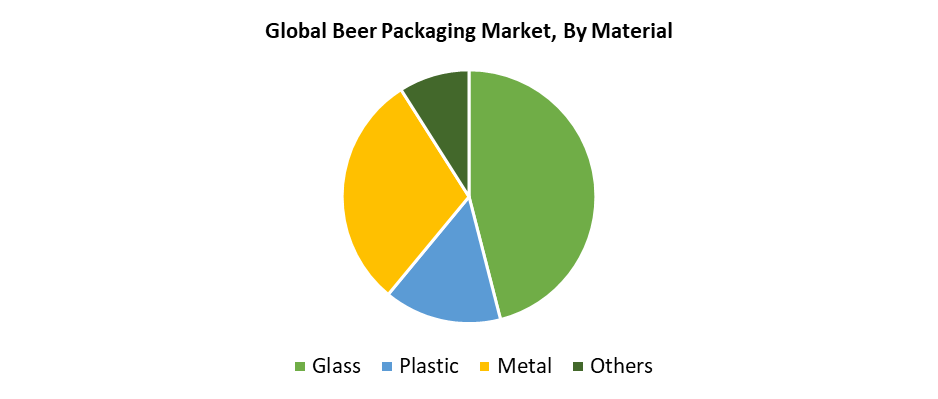

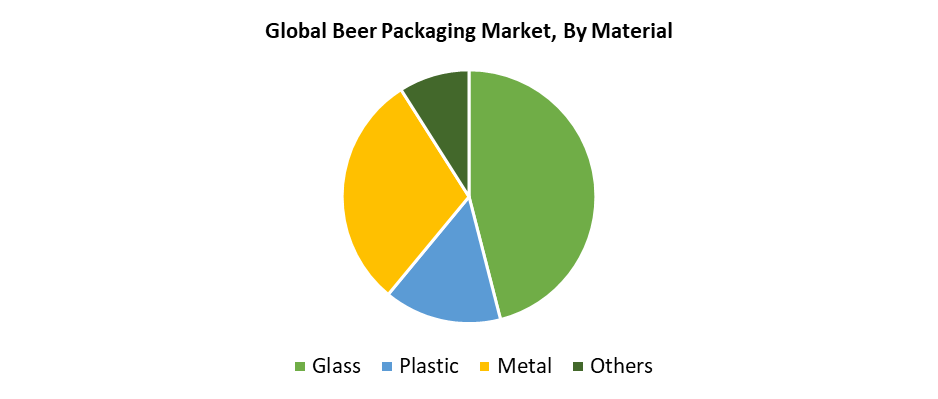

- In 2024, the glass material segment had the biggest market share by material, accounting for about 46.3%.

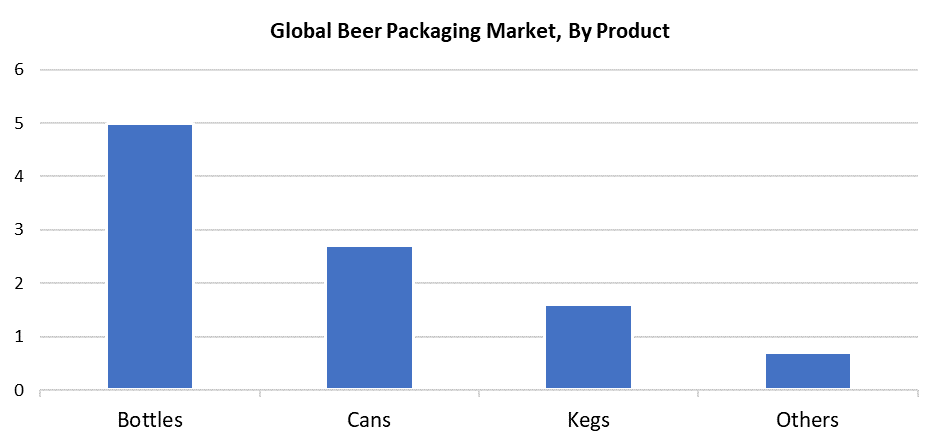

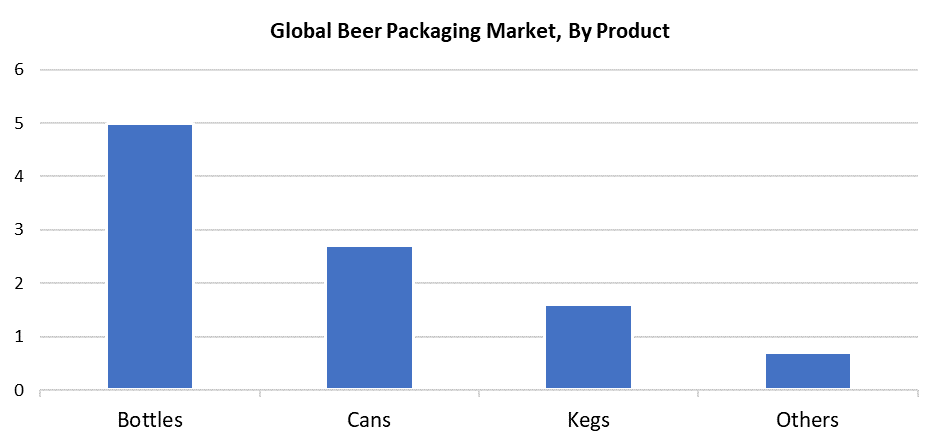

- In 2024, the bottles section had the highest revenue share by product, accounting for 50.7%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 24.57 Billion

- 2035 Projected Market Size: USD 39.66 Billion

- CAGR (2025-2035): 4.45%

- Asia Pacific: Largest market in 2024

The beer packaging market represents the industry that manufactures and delivers specialized packaging solutions for beer products. Beer packaging demand continues to grow at a steady rate because of the rapid growth of craft breweries and value-added beer offerings. Craft brewers need innovative bottle designs, together with eco-friendly cans and personalized labels, to achieve their goal of developing distinctive packaging that stands out in the competitive market. The industry sees growth because people across the world are consuming more beer, especially in developing nations, which include China, India, Brazil, and Vietnam. The rising disposable incomes and urbanization in these areas have shifted consumer preferences toward craft and premium beers, which require multiple useful packaging options, including kegs, PET bottles and glass bottles. The evolving consumer market drives packaging manufacturers to develop packaging solutions that combine visual appeal with brand enhancement and regional customization.

Additionally, the beer packaging industry grows because breweries adopt environmentally friendly materials and processes to address rising environmental concerns. The rising popularity of sustainable packaging among consumers, including Millennials and Gen Z, has pushed the market toward rejecting traditional plastics. The need for green packaging enables brands to enhance their market position and advance broader environmental programs. The growing trend of e-commerce and direct-to-consumer alcohol sales requires packaging solutions that combine durability and mobility to handle shipping challenges while keeping an appealing visual design intact. The COVID-19 pandemic's boost of online sales drove increased demand for tamper-evident packaging solutions that are shelf-ready and creatively designed for digital retail environments.

Material Insights

The premium status of glass material in the beer market results in segment dominance accounting for 46.3% of revenue share in 2024. The non-reactive and sealed nature of glass makes it the optimal choice for preserving beer quality in terms of flavor and aroma, and carbonation. The rapid growth of craft and premium beers drove a substantial increase in demand for glass packaging solutions. The sustainable nature of glass packaging stands as a key advantage because it allows 100% recycling without any quality degradation, which meets both regulatory requirements and environmental consumer demands. The clear and elegant appearance of glass packaging makes products more attractive to customers, which establishes glass as the preferred packaging solution for businesses that seek long-term market development.

The metal segment, which includes aluminum cans, is expected to grow at a 3.8% CAGR throughout the forecast period. Beer packaging made from aluminum cans has become the primary choice of consumers who live active lifestyles. Aluminum cans chill beverages quickly while protecting beer quality through their excellent light and air resistance properties, which enhances the drinking experience at social and outdoor occasions. Young customers increasingly choose packaged beers, which drives this trend forward. The growth of the market stems from sustainability concerns since aluminum produces fewer carbon emissions than other materials, and it can be recycled endlessly. The metal segment gains market share because its convenience and product safety combine with environmental friendliness to drive its growth.

Product Insights

The bottles segment led the market in revenue with a 50.7% share during 2024 because of its direct connection to craft beers and premium beer products. Glass bottles offer excellent barrier properties, which make them the preferred choice for customers who want to maintain beer quality through flavor preservation, fragrance retention and carbonation protection. The classic transparent bottle design increases product value perception among customers who frequent premium establishments such as pubs and restaurants. The expansion of premium products along with rising consumer interest in craft and artisanal beers drives market growth. Glass material allows for recycling, which advances sustainability goals and draws in customers who care about the environment. The flexibility of bottle design enables diverse branding options, which maintains bottles as a trusted and widely used packaging solution in the beer industry.

The cans category will grow at 3.7% CAGR throughout the projection timeframe because of increasing consumer preferences toward sustainable products, portable solutions, and convenience. The lightweight construction of aluminum cans makes them ideal for both retail and off-premise sales because they stack efficiently to reduce transportation expenses. The airtight seal combined with rapid cooling technology protects beer from light exposure and oxygen contact to preserve its original flavor and freshness. The ability to perform 360-degree printing enables brands to explore various marketing possibilities. The growing popularity of ready-to-drink drinks and expanding e-commerce distribution channels make canned beer even more attractive to consumers. The beer market's sustainability transformation makes cans an ideal eco-friendly packaging solution because they offer high recyclability and low environmental impact, which aligns with sustainability trends.

Region Insights

The Asia Pacific region emerged as the leader in the beer packaging market at 36.3% of revenue share in 2024 because of its large population base, along with rising middle-class spending power. The increasing urbanization, together with Western drinking culture adoption in China, India, and Southeast Asian nations, has created a rising demand for packaged beer. The growing craft and premium beer markets in metropolitan areas enable brands to develop innovative packaging solutions that emphasize their unique identity through environmentally sustainable options. The growing consumption of beer by young people and changing lifestyles continue to expand the market. The local consumer base shows a preference for spending less on convenient packaging solutions. The combination of robust investment initiatives and expanding regional market presence will sustain this development pattern throughout the upcoming years.

North America Beer Packaging Market Trends

The North American beer packaging market experiences significant growth through the combination of strong craft beer culture alongside increasing demand for elegant, environmentally conscious packaging. Thousands of microbreweries, along with craft manufacturers, require distinctive packaging solutions that enable them to differentiate themselves from competitors. Environmental packaging solutions like glass bottles and cans receive regulatory support through recycling requirements and bottle deposit programs. Advanced cold chain logistics, together with retail infrastructure, simplify the adoption of premium packaging solutions. The expanding market of hard seltzers and flavored alcoholic beverages needs innovative packaging solutions that protect product freshness while enhancing brand appeal. The North American beer packaging industry continues to expand through its focus on both convenience factors and quality assurance programs alongside sustainability initiatives.

Europe Beer Packaging Market Trends

The development of the beer packaging market throughout Europe depends heavily on customer loyalty to traditional glass bottles, as well as environmental regulations and long-standing beer traditions. The example of Germany as Europe's leading beer market clearly shows how its robust recycling system and glass-related cultural traditions influence the market. The increasing popularity of cans among younger consumers and Oktoberfest attendees points toward packaging solutions that prioritize convenience. The EU Single-Use Plastics Directive drives accelerated implementation of sustainable alternatives, which include reusable bottles and biodegradable packaging. The demand from consumers for both eco-friendly products and high-quality goods forces breweries to maintain a balance between traditional methods and new developments. The European market growth depends mainly on cultural values, together with sustainability measures and changing consumer behavior, to maintain a diverse traditional beer packaging market.

Key Beer Packaging Companies:

The following are the leading companies in the beer packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Ardagh Group

- AGI glaspac

- Berry Global Inc.

- Smurfit Westrock

- WestRock Company

- Crown Holdings, Inc.

- TricorBraun

- ALPLA

- P. Wilkinson Containers Ltd.

- CANPACK

- Gamer Packaging

- INOXCVA

- THIELMANN

- Amcor plc

- Ball Corporation

- Others

Recent Development

- In November 2023, Ardagh Group S.A. launched New Boston Round beverage containers through its BuyOurBottles platform. Ardagh demonstrates its commitment to delivering a diverse selection of appealing packaging products through its recent product line expansions. The Boston Round bottles maintain their classic design while offering flexibility to package multiple beverage products, including beer. The new product reveals how Ardagh Group dedicates itself to delivering flexible packaging solutions to the beverage market, which meet the current needs of beverage manufacturers and brewing operations.

- In October 2023, The Ball Corporation, as a leading entity in beer packaging, has declared the implementation of a Cycle Reverse Vending Machine (RVM) at Red Rocks Amphitheatre. The sustainable initiative provides rewards to customers who return their used beverage containers to promote recycling. Ball Corporation maintains environmental stewardship through its support of the RVM's promotion of correct recycling practices. Ball Corporation demonstrates its industry sustainability commitment through innovative solutions placed at prominent locations like Red Rocks to establish environmentally friendly practices for beer packaging.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the beer packaging market based on the below-mentioned segments:

Global Beer Packaging Market, By Material

- Glass

- Plastic

- Metal

- Others

Global Beer Packaging Market, By Product

Global Beer Packaging Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa