IoT Security Market Summary

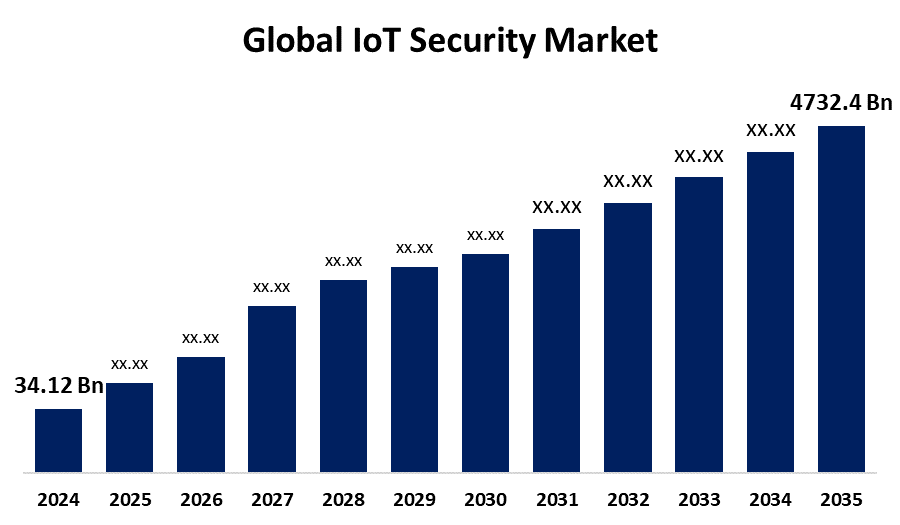

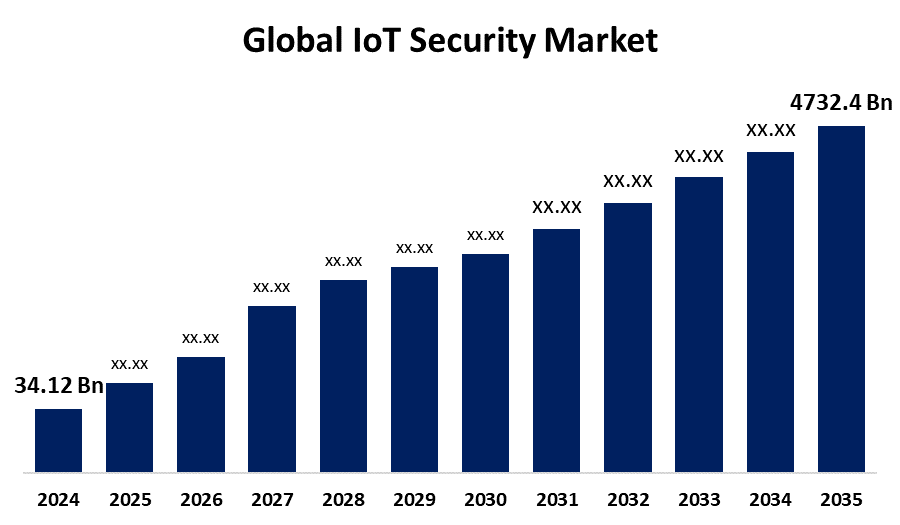

The Global IoT Security Market Size Was Estimated at USD 34.12 Billion in 2024 and is Projected to Reach USD 473.24 Billion by 2035, Growing at a CAGR of 27.01% from 2025 to 2035. Due to growing cybersecurity risks, the need to protect sensitive data, and the growing number of connected devices, the IoT security industry is expanding significantly.

Key Regional and Segment-Wise Insights

- In 2024, the Internet of Things (IoT) security market, dominated by the North America region, accounted for 34.5% of worldwide revenue.

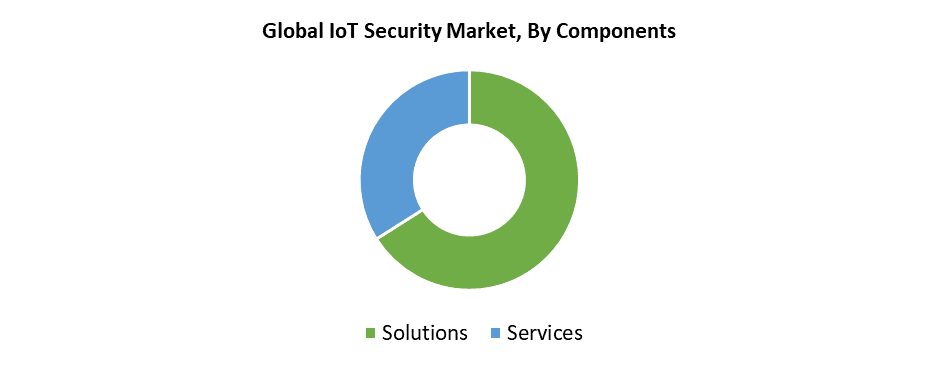

- In 2024, the solutions segment held the largest revenue share by component, accounting for 66.3% of revenue.

- In 2024, the network security category accounted for the greatest market share by security type.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 34.12 Billion

- 2035 Projected Market Size: 473.24 Billion

- CAGR (2025-2035): 27.01%

- North America: Largest market in 2024

Internet of Things (IoT) security refers to the comprehensive approach for defending IoT systems and devices and their data from cyber threats while protecting their availability and data integrity, and privacy. The rapid expansion of IoT devices throughout consumer and business markets stands as a leading driver for the IoT security market. Connected cars and smart home systems, together with industrial sensors, provide operational benefits, but they also expose multiple security vulnerabilities. The devices that manage sensitive information along with crucial operational functions face a high risk of becoming targets for cyberattacks. The growing implementation of IoT throughout smart infrastructure manufacturing and healthcare sectors underscores the necessity for advanced security solutions because it expands the available attack surface. The implementation of stringent data protection laws such as GDPR and HIPAA requires businesses to establish robust security frameworks for data protection, which drives additional market growth.

Technological advancements drive faster implementation of IoT security solutions, together with increased adoption rates. Through artificial intelligence and machine learning integration, security platforms enable real-time monitoring and proactive threat detection along with anomaly detection across IoT networks. The complex algorithms perform continuous adjustments by analysing big data to address new threats and changing ones. Blockchain technology enhances both transparency and trust in IoT interactions through its decentralised data management system and tamper-proof record-keeping features. When these solutions work together, enterprises achieve improved protection for their remote IoT environments. Advanced intelligent security platforms with scalability features have become fundamental for businesses because they face growing data breaches and insider threats, which drive the continuous growth of the IoT security market.

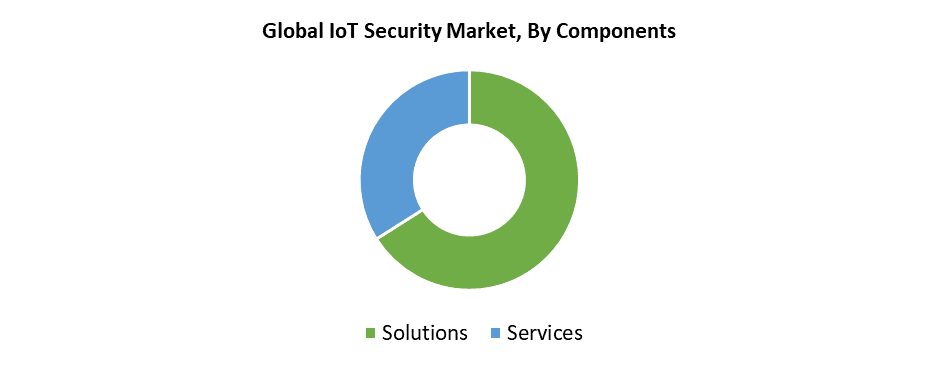

Component Insights

The solutions category held a 66.3% market share in 2024 because IoT ecosystems face increasingly complex cyberattacks that require protection solutions. The need for advanced security solutions covering network and endpoint, and application security has become essential because IoT devices are widely distributed across manufacturing and healthcare and transportation sectors. Endpoint security defends individual connected devices from viruses and unauthorised access, but network security protects data transmission between devices. The integrated solutions implement firewalls and threat detection and encryption, and authentication to reduce risks and guarantee system dependability. The advancements in blockchain, together with AI and machine learning, enable these technologies to detect threats more effectively. The increasing demand for comprehensive security solutions that are compliant and adaptable supports ongoing market growth.

The services sector of the IoT security market will witness substantial growth because of the expanding complexity and size of IoT ecosystems. Organisations need professional consultation and integration together with managed security services, to build and sustain efficient security frameworks during their implementation of an increasing number of connected devices. Consulting services require the identification of vulnerabilities along with risk assessment and the development of tailored mitigation strategies for multiple IoT deployments. The proper implementation of strict security protocols, along with platform and device interoperability, requires integration services. Through their continuous threat detection and incident response, and monitoring services, managed security providers enable companies to focus on their main business operations. The comprehensive service approach handles evolving security matters and regulatory standards, which drives consistent market expansion.

Security Type Insights

The network security segment experienced substantial expansion in 2024 because of rising cyberattack numbers, which targeted complex digital infrastructures. The attack surface expanded at a fast pace because businesses implemented IoT devices to enhance connectivity and operational efficiency, which made traditional security solutions insufficient. The growing security vulnerabilities required modern network security solutions, which included AI-driven threat intelligence platforms along with next-generation firewalls and intrusion detection systems. Organisations focused intensely on protecting sensitive information and maintaining system integrity because they needed to satisfy regulatory requirements and preserve customer trust. The rising remote workforce, combined with cloud computing, demonstrated the essential need for comprehensive network security, which drove this sector's substantial market development.

The cloud security market will experience the fastest growth at 28.3% CAGR during the forecast period because businesses increasingly depend on cloud platforms to handle Internet of Things-generated data. Cloud computing's scalability and flexibility enable the handling of large data quantities; however, introduces new security risks which demand advanced safeguards. Advanced cloud security solutions, including secure APIs and access controls, together with data encryption, protect private data during its travel between devices and cloud environments. The requirement of standardised security procedures by governments pushes organisations to adopt cloud security solutions. Cloud providers' continuous investment in advanced technologies and compliance frameworks makes cloud security the preferred solution for protecting distributed and networked IoT networks across the world.

Regional Insights

North America led the worldwide IoT security market in 2024 with a 34.5% revenue share because of its developed technological landscape and rising cyber threat situations. The expanding cyber-attack surfaces from the rising number of connected devices in healthcare, manufacturing and transportation and smart home sectors have driven higher demand for sophisticated IoT security solutions. The combination of large technology corporations and reliable infrastructure networks drives organisations to implement increasingly advanced security frameworks for quick IoT adoption and innovation. The market growth receives additional support from U.S. and Canadian regulations that require comprehensive cybersecurity protocols. Major regional players in North America drive the IoT security market forward through their investments into cloud-based and AI-driven security solutions, which also enhance protection capabilities, thus making North America the leading and fastest-growing IoT security market globally.

Asia Pacific IoT Security Market Trends

The Asia Pacific IoT security market held 24.8% market share in 2024 as IoT adoption across smart cities, manufacturing, healthcare and transportation expands rapidly. The deployment of 5G networks brought about an increase in device connections within the automotive and industrial automation sectors, which required robust security measures to protect against cyber threats. The IoT infrastructure investments made by China, India, Japan and South Korea lead to market expansion while simultaneously increasing cybersecurity risks. Government initiatives such as Digital India and the IoT Master Plan from South Korea push for secure IoT systems throughout the region. The demand for cloud-based IoT security solutions is growing because of edge computing and artificial intelligence progress, which makes the APAC market dynamic and quickly evolving.

Europe IoT Security Market Trends

The European IoT security market held 25.0% of the revenue share in 2024 because of the rapid expansion of IoT devices in smart cities and manufacturing, and healthcare industries. System integrity protection and sensitive data defence requirements continue to rise as connected systems expose new security risks. Businesses need strong cybersecurity solutions to meet GDPR requirements, which establish strict standards for data protection. The automotive sector drives significant market expansion because secure communication networks form an essential part of connected vehicles. The market experiences additional growth because of the increasing adoption of IoT technology within the retail and energy sectors. The rising cybersecurity threats across multiple European countries drive the continuous market expansion of IoT security solutions throughout the region.

Key IoT Security Companies:

The following are the leading companies in the IoT security market. These companies collectively hold the largest market share and dictate industry trends.

- Microsoft

- Atos SE

- Cisco Systems, Inc.

- Allot

- Amazon Web Services, Inc.

- IBM

- Telefonaktiebolaget LM Ericsson

- Thales TCT

- Intel Corporation

- Google

- Others

Recent Developments

- In October 2024, to address the vulnerabilities in consumer Internet of Things (IoT) devices, the European Telecommunications Standards Institute (ETSI) has published new security standards. These recommendations stress the significance of putting security safeguards in place at every stage of an IoT product's lifetime, especially as the number of connected devices is predicted to increase.

- In September 2024, Oracle and AWS launched Oracle Database@AWS, which enables Oracle Autonomous Database operation on dedicated infrastructure together with Oracle Exadata Database Service on AWS. The new solution creates a unified interface which enables users to manage their databases and obtain support and billing services easily through both AWS and Oracle Cloud Infrastructure (OCI).

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the IoT security market based on the below-mentioned segments:

Global IoT Security Market, By Component

Global IoT Security Market, By Security Type

- Network Security

- Endpoint Security

- Application Security

- Cloud Security

- Others

Global IoT Security Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa