Textile Market Summary

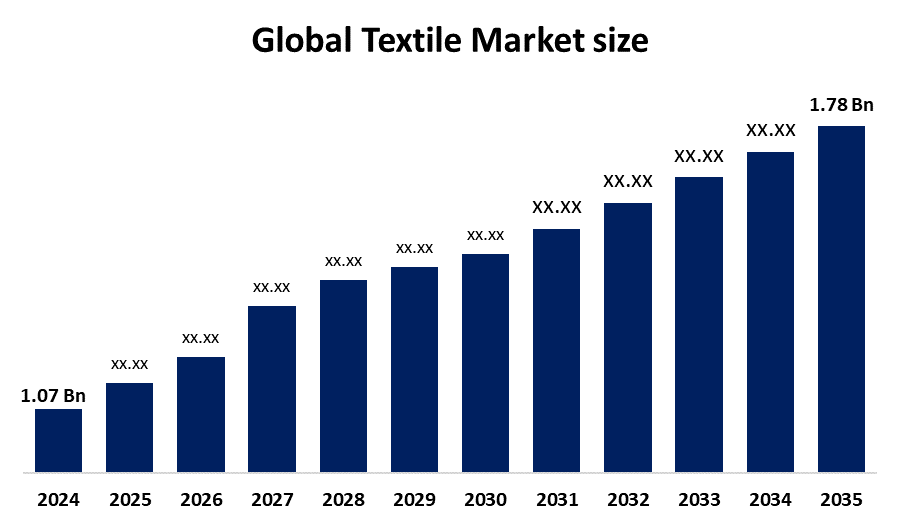

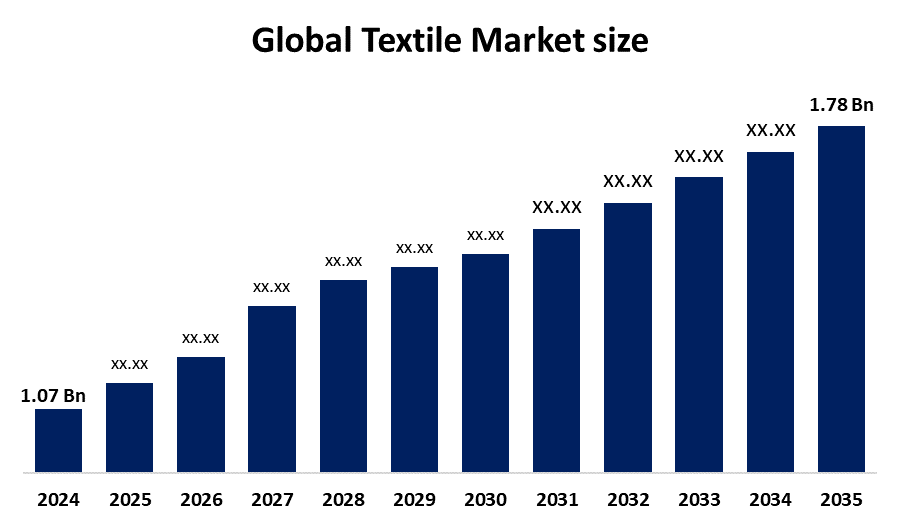

The Global Textile Market size was estimated at USD 1.07 Billion in 2024 and is projected to Reach USD 1.78 Billion by 2035, growing at a CAGR of 4.74% from 2025 to 2035. The proliferation of technical textiles in numerous sectors, the growing global demand for apparel and textiles, and growing urbanization are some of the reasons propelling the textile market's growth. This rise can also be attributed to government backing, technological breakthroughs, and the growing significance of sustainability.

Key Regional and Segment-Wise Insights

- In 2024, Asia Pacific held the largest revenue share of over 48.6% and dominated the market.

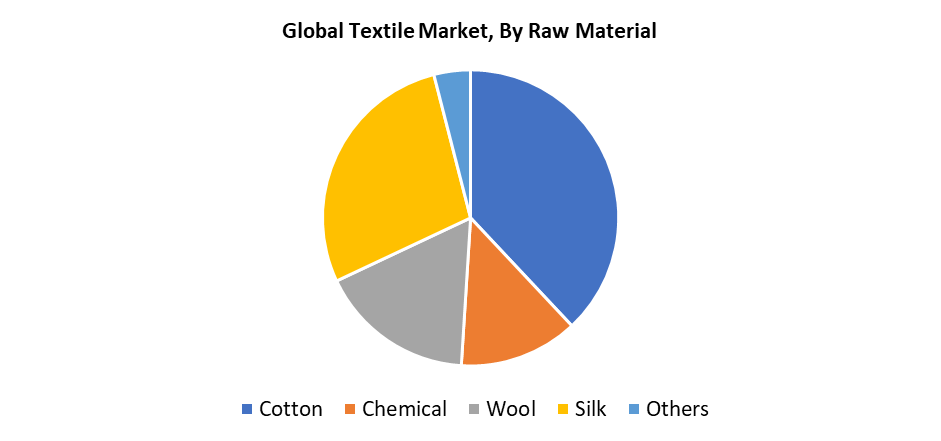

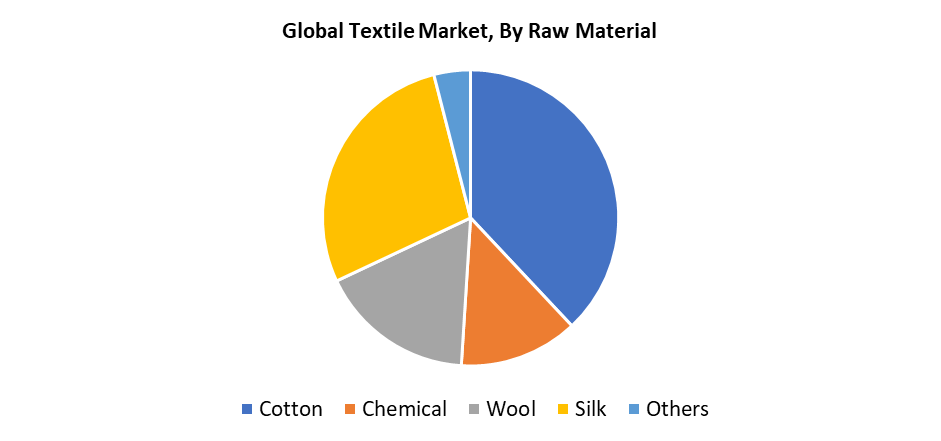

- In 2024, the cotton segment had the highest market share by raw material, accounting for 38.5%.

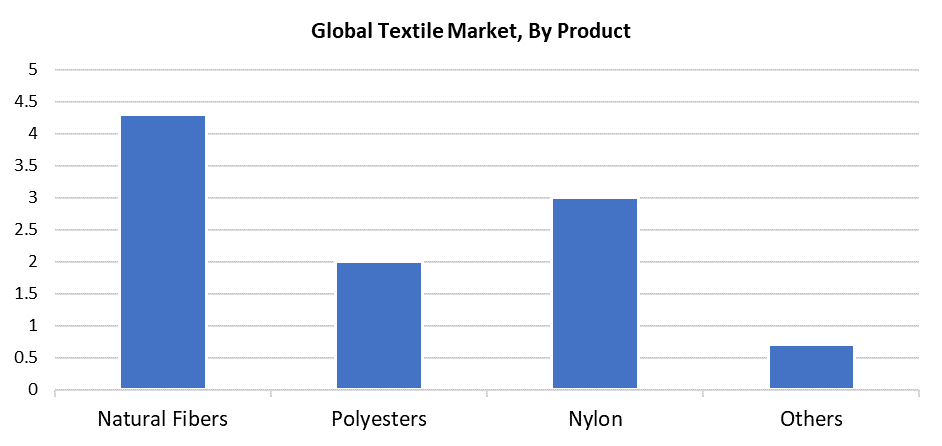

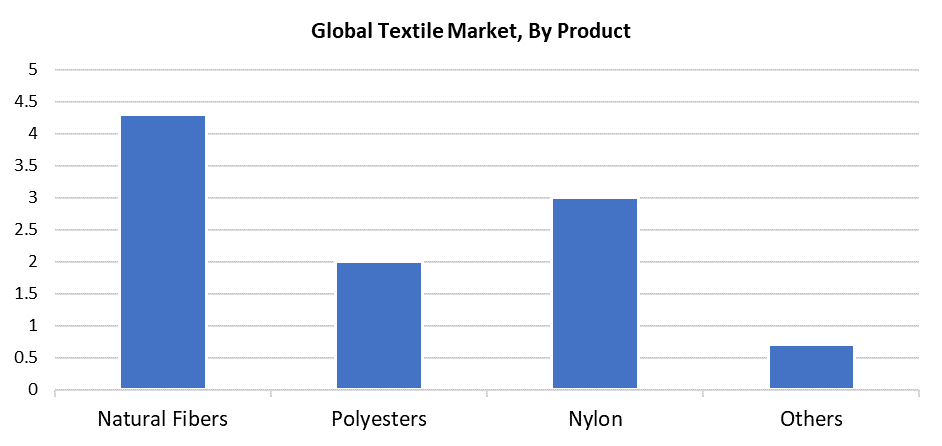

- In 2024, the natural fibers segment had the biggest market share by product, accounting for 43.5%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1.07 Billion

- 2035 Projected Market Size: USD 1.78 Billion

- CAGR (2025-2035): 4.74%

- Asia Pacific: Largest Market in 2024

The global industry that produces, distributes, and sells textile products, including fibers, yarns, textiles, and final goods like clothing and home furnishings, is referred to as the textile market. Several interrelated factors are driving strong growth in the textile industry. The growing organized retail industry, along with the expanding worldwide garment industry, has driven increased material consumption across various sectors. Urbanization and rising disposable incomes have led consumers to show increased interest in fashion, home decor, and practical textile products. Modern textile production benefits from technological advancements such as digital printing and 3D knitting, which improve manufacturing speed and fabric quality while minimizing material usage. The expansion of e-commerce has made textile products more accessible to consumers and increased their availability. The industrial applications of textiles in healthcare, automotive, and construction fields are experiencing rapid growth, especially for specialized textiles, including flame-retardant fabrics and geotextiles.

The rising popularity of organic and recycled fibers, together with biodegradable materials among eco-friendly customers, is reshaping the textile market structure. Supply chain transparency through blockchain technology and closed-loop production systems represents modern innovations that are gaining increasing popularity. Fashion manufacturers now incorporate zero-waste and biodegradable collections, while smart textiles with health monitoring sensors gain popularity alongside bio-based materials. The post-pandemic recovery period has led to higher consumer interest in fashion as well as rising industrial demands for textiles. Fashion manufacturers must innovate consistently because influencer-driven marketing, alongside seasonal trends, has accelerated the speed of fashion cycles. Government programs that provide export incentives and textile park support contribute to increased production capabilities. The result of these trends creates an active global textile market that combines diverse elements with sustainability.

Raw-material Insights

The cotton segment led the textile market with 38.5% revenue share in 2024, because of its broad appeal to consumers and natural fabric characteristics. The material works best in hot climates because it absorbs moisture while allowing air flow, which makes it suitable for both tropical and subtropical environments. The softness and skin-friendly nature of cotton, along with its adaptability, make consumers choose it for industrial products and home textiles, medical fabrics, and everyday apparel. The simplicity of cotton's blending and dying process allows manufacturers to expand their design possibilities. Global initiatives that promote sustainable organic cotton farming have raised the profile of cotton as an environmentally safe crop. Cotton enjoys established supply networks that support its cultivation in the United States, China, and India. Market confidence, together with steady growth for cotton-based products, becomes certain through continuous institutional and governmental backing.

During the forecast period, silk will register the fastest growth at 3.8% CAGR. The market growth stems from the increasing preference toward luxurious natural textiles, which support environmental preservation. Silk maintains growing popularity because of its attractive qualities, gentle nature, and environmental friendliness, so people select luxurious, sustainable materials for their accessories and home decor, and clothing. The expanding wealthy middle class, particularly in the Middle East and Asia-Pacific, significantly drives market demand. Sericulture advancements, together with new mixed textiles and peace silk products, make production costs more attractive and environmentally friendly. The hypoallergenic and breathable characteristics of silk make it suitable for both classic and contemporary uses. E-commerce platforms have expanded worldwide accessibility, which leads to greater visibility and increased sales of silk-based products.

Product Insights

The natural fibers segment dominated the market during 2024, accounting for 43.5% because of rising consumer interest in sustainable products. People aware of sustainability choose these products because they offer biodegradability and cause minimal environmental harm. The combination of cotton with wool and linen serves as a natural material for clothing and home furnishings, industrial applications, because they deliver outstanding comfort, breathability, and moisture absorption characteristics. The growing support from government agencies and fashion brands for sustainable practices, together with enhanced organic farming methods and GOTS certification, drives additional market growth. The continuous supply chain operates from established manufacturers located in China and India, and their high appeal and flexible nature continue to attract environmentally minded customers from around the world.

During the forecast period, nylon will experience the fastest growth rate of 3.5% because of its superior strength, flexibility, and long-lasting properties. Technical textiles for automotive and industrial sectors, as well as performance wear and intimate clothing, benefit from its outstanding qualities. The worldwide demand for nylon continues to increase due to the rising popularity of athleisure and activewear, especially among urban youth. The lightweight nature, combined with wrinkle resistance and quick-drying functionality, makes it the preferred choice for travel and outdoor clothing. The development of recycled and bio-based nylon products helps improve its environmental standing, which attracts environmentally conscious consumers. Nylon serves various applications because of its economical price point and its capability to merge with different fibers to produce blended fabrics, which drives its growth across established and developing textile markets.

Regional Insights

The textile industry in North America is expected to grow significantly due to developments in smart fabrics, sustainable textiles, and reshoring programs. The United States leads funding investments that focus on protective and specific textile applications for automotive, defense, and healthcare industries. The USMCA trade system promotes consumer interest in recycled and organic material garments through regional market accessibility. The fashion industry uses on-demand manufacturing along with digital customization to meet evolving consumer preferences. The region maintains its competitive advantage through strong wearable technology and smart fabric research despite ongoing challenges from labor shortages and expensive production costs. The United States leads the cotton supply market because various end-use sectors continue to increase their demand. Market growth will expand at a faster pace through both industrial production growth and advancements in fashion and sports.

U.S. Textile Market Trends

The United States textile industry experiences fast expansion through reshoring combined with sustainable practices and innovative developments. The changing priorities of the industry stem from growing consumer preference for goods made with recycled fibers and organic cotton. Domestic production gains support through reshoring incentives and supply chain flexibility, yet government contracts from the defense and healthcare sectors maintain stable revenue streams. The technological integration through automation combined with digitalization enables businesses to achieve higher output rates and quicker product development times. Smart textiles and circular fashion development enable multiple applications across residential home products, industrial uses, and clothing designs. Major retailers now promote American-made product lines because consumers want items that have traceable origins, customizable features, and domestic production. The region maintains its strength and progression through this strategic transformation.

Asia Pacific Textile Market Trends

The Asia Pacific textile sector holds the largest market share in 2024, accounting for 48.6% because of its expansive manufacturing facilities and economical workforce, combined with its efficient export system. Major producers, including China, India, and Bangladesh, control both worldwide production and export volumes, but the expanding local markets in India and Southeast Asia offer dual growth opportunities. Modern equipment, along with digital printing adoption, receives assistance from government programs, skilled workforce, and industrial cluster development to boost productivity and innovation. The expanding e-commerce industry now enables companies to access both metropolitan and countryside markets. The region solidifies its leadership position while building resilience through increasing functional and technical textile market demand and rising environmental standards for sustainable operations.

Europe Textile Market Trends

The European textile industry experiences significant growth because of EU Green Deal policies that promote circular textiles, biodegradable materials, and eco-certifications. The luxury fashion and home textile industry thrives because Italy and Germany lead in high-quality textile production and machinery manufacturing. Technical fabrics gain increasing popularity because of their temperature-regulating, flame-resistant, and antimicrobial characteristics across automotive and aerospace, healthcare, and activewear sectors. The development of smart textiles occurs through digital transformation as companies invest in 3D knitting and digital fabric printing, which enhances design capabilities and improves small-batch production methods. European textile products achieve better quality through transparent supply chains and intelligent production systems, increased consumer understanding of ethical sourcing and environmental impact, which leads to higher brand loyalty and worldwide competitiveness.

Key Textile Companies:

The following are the leading companies in the textile market. These companies collectively hold the largest market share and dictate industry trends.

- Hengli Petrochemical Co., Ltd.

- Sasa Polyester Sanayi A.S.

- Eclat Textile Co. Ltd

- Shenzhou International Group Holdings Ltd

- Far Eastern New Century Corporation

- TJX Companies

- Toray Industries, Inc.

- Chargeurs SA

- Inditex

- Vardhman Textiles

- Others

Recent Developments

- In May 2025, Defi Design introduced their Spring/Summer 2025 Capsule Collection, which featured the versatile denim Skirt X together with gender-neutral streetwear pieces. The brand focused on delivering one-of-a-kind designs along with top-quality materials and innovative shapes.

- In March 2025, Decathlon launched its new casual clothing collection following a successful trial run during 2024. The brand introduced lifestyle essentials for male and female customers that featured unisex designs across sweatshirts and leggings. The upcoming collections would take inspiration from outdoor trends and historical elements.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the textile market based on the below-mentioned segments:

Global Textile Market, By Raw Material

- Cotton

- Chemical

- Wool

- Silk

- Others

Global Textile Market, By Product

- Natural Fibers

- Polyesters

- Nylon

- Others

Global Textile Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa