Animal Health Market Summary

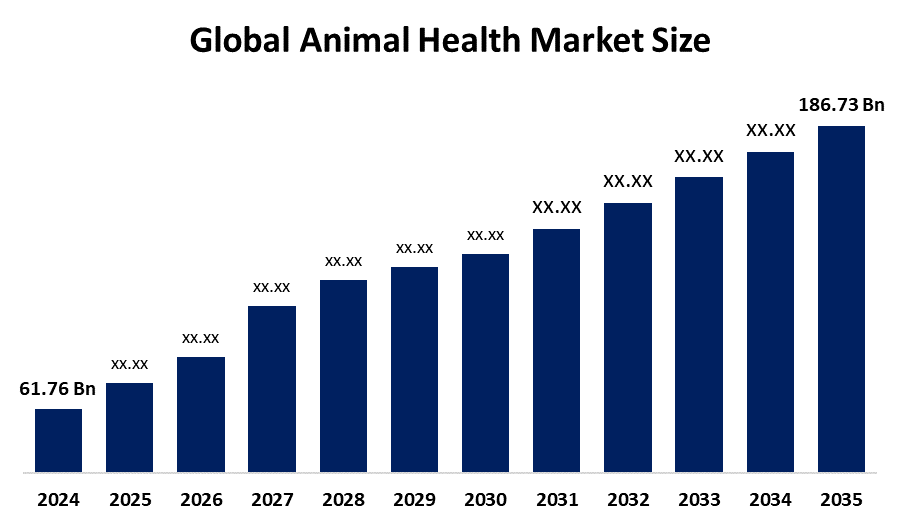

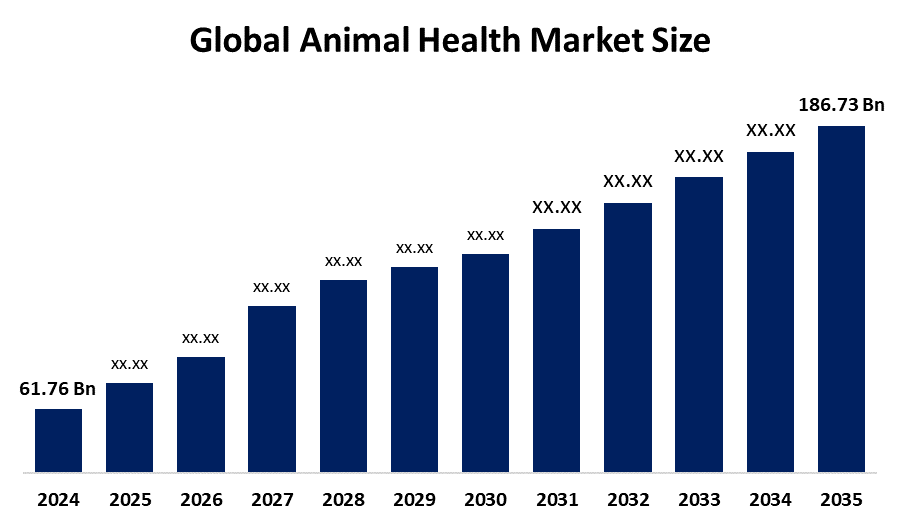

The Global Animal Health Market Size Was Valued at USD 61.76 Billion in 2024 and is Projected to Reach USD 186.73 Billion by 2035, Growing at a CAGR of 10.58% from 2025 to 2035. A number of factors are driving the expansion of the animal health market, including as the rise in pet ownership, the demand for food products derived from animals, and the increasing incidence of zoonotic diseases.

Key Regional and Segment-Wise Insights

- In 2024, the North American animal health market had the largest share, at over 34.72%.

- In 2024, the U.S. animal health market accounted for the largest portion of the North American market.

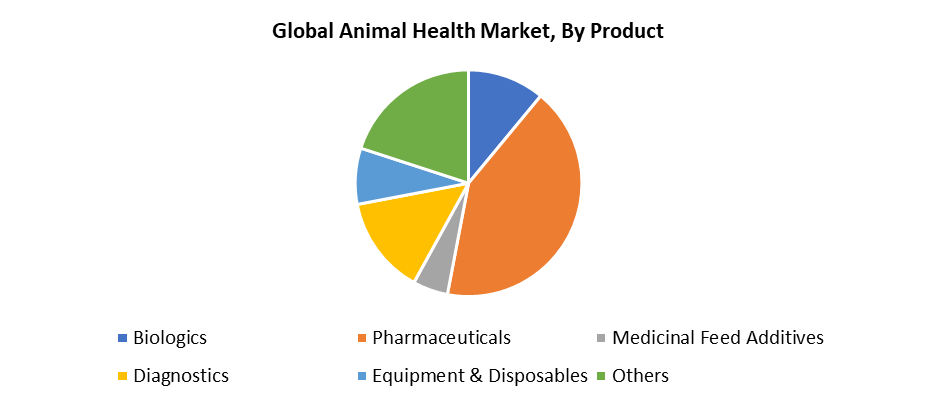

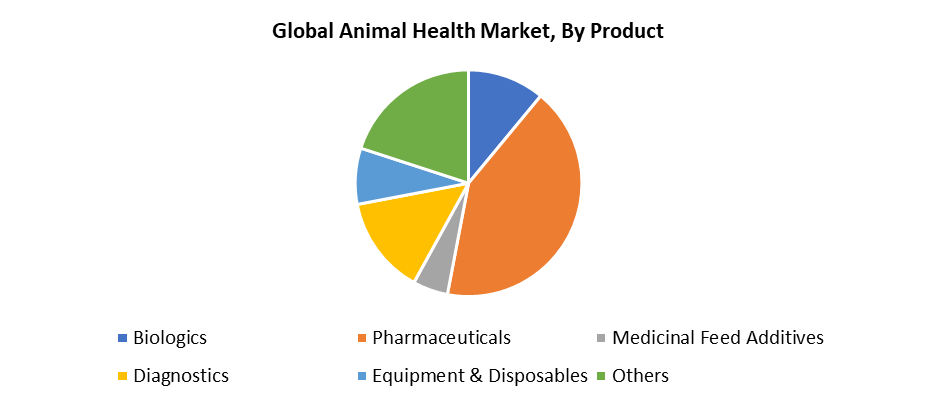

- With a market share of 42.72% in 2024, the pharmaceutical segment led the market based on products.

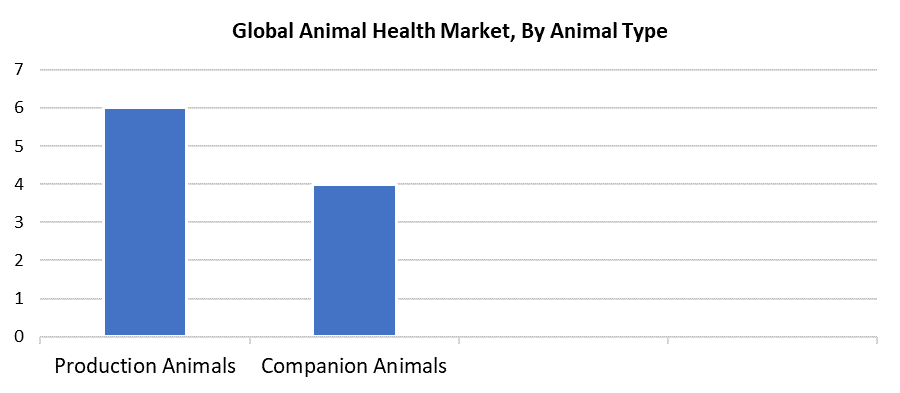

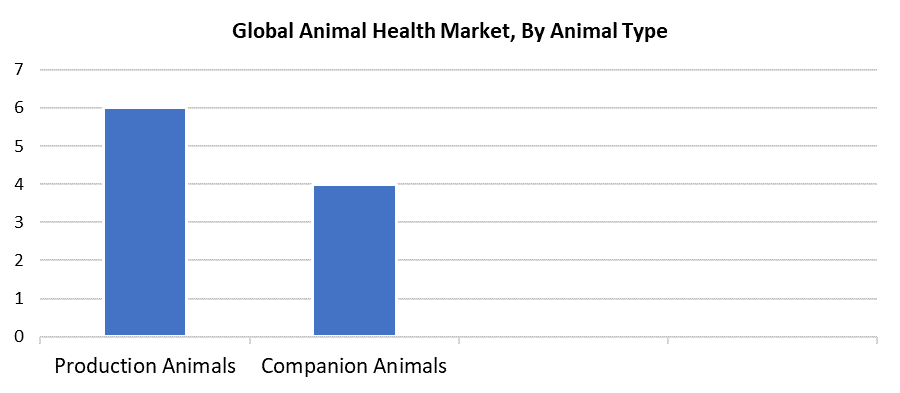

- In 2024, the production animal segment held the biggest revenue share and dominated the market based on animal type.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 61.76 Billion

- 2035 Projected Market Size: USD 186.73 Billion

- CAGR (2025-2035): 10.58%

- North America: Largest market in 2024

The animal health market encompasses all worldwide industries that produce goods and services for animal health maintenance and enhancement of companion animals and livestock. The global animal health market experiences rapid growth because of increasing animal health spending alongside rising pet insurance coverage and ongoing pet humanization trends. The primary factor driving this market expansion stems from AI adoption across disease monitoring and diagnosis, and treatment systems. Through AI-enabled technologies, veterinarians now possess the ability to detect illnesses sooner while delivering more accurate treatments, which substantially improves outcomes for companion animals and livestock. The animal health market receives additional direction from advancements in precision medicine and rising veterinary appointments, together with evolving regulatory standards. The animal health industry improves its responsiveness and effectiveness while becoming more accessible through AI advancements in remote consultations, real-time monitoring, and individualized treatment protocols.

The rising public concern regarding zoonotic diseases has become a key factor leading to increased demand for this industry. Livestock outbreaks have forced industries to spend huge amounts on vaccinations, diagnostic tools, and treatment methods, while government surveillance programs and new biosecurity requirements in animal farming have supported these measures. Pharmaceutical companies create biological products and recombinant vaccines, while digital tools enable faster outbreak information exchange and prediction capabilities. The market expansion receives additional support from veterinary dermatology breakthroughs, which include new nutraceutical products, specialized diets, and targeted therapeutic approaches. Telemedicine enables veterinary services to reach remote areas by delivering both general and dermatological animal health care. Modern developments in food security and livestock production, as well as pet wellness, contribute to market expansion along with enhanced animal health systems.

Product Insights

The pharmaceutical category dominated the animal health industry, accounting for 42.72% of the market share in 2024. Veterinary medicine continues to expand because of ongoing developments in antibiotics, parasiticides, anti-inflammatories, and chronic disease medications. The market expansion occurred because pet owners, together with farmers and animal caregivers, now understand how to prevent diseases and provide immediate care. Major pharmaceutical corporations dedicate extensive funds to research and development for producing specific drugs that target particular species and medical conditions. New therapeutic approaches, including precision medicine, together with controlled-release formulations, help enhance treatment results. The pharmaceutical industry experiences consistent growth through these advancements because they enhance animal welfare while simultaneously increasing livestock production.

The other category in the animal health market will experience the fastest growth during the forecast period because of the quick adoption of digital tools and telehealth platforms. The COVID-19 pandemic functioned as a catalyst to speed up the switch to virtual veterinary consultations because it reduced the availability of in-person visits. Digital health record systems, remote monitoring, along telehealth apps saw a substantial rise in usage during this time. Numerous startups entered the market in 2020 while established businesses simultaneously enhanced their digital product offerings. The technologies enable continuous health monitoring and better accessibility, and help manage ongoing health conditions. Digital care adoption by more pet owners, together with veterinarians, will drive the rapid expansion of this market in the future.

Animal Type Insights

The production animal segment held the largest revenue share of the animal health market in 2024 because of rising concerns about food safety, sustainability, and worldwide livestock production challenges. As the global population grows, the demand for a secure food supply places increasing pressure on animal husbandry operations. The implementation of planned vaccination programs together with biosecurity procedures and precision livestock farming represents modern methods that have been adopted. International organizations and government agencies actively fund animal health initiatives to prevent zoonotic disease transmission while improving meat and dairy quality and disease control. The segment's leading position will persist throughout the forecast period due to the combined effects of these efforts, along with technological progress and increased funding for livestock health services.

The companion animal segment is expected to grow at a significant CAGR throughout the forecast period because of increasing numbers of pet owners and rising trends of pet humanization and medicalization. The trend of pets becoming family members has led owners to dedicate funds to advanced medical approaches, including diagnostic services and preventive care, along with modern pharmacological solutions. The cultural transformation has led to increased pet insurance adoption because this insurance reduces veterinary costs and encourages regular health check-ups along with long-term disease management. The combination of increased awareness about pet wellbeing, together with better access to veterinary services and advanced medical treatments, explains the rising investments in companion animal health. The different factors combine to drive this segment toward consistent and strong development.

Regional Insights

North America holds a 34.72% market share in 2024 and dominates the animal health market globally because it experiences high rates of zoonotic and cattle diseases, which need proper medical attention. The area stands out because of its large healthcare spending and advanced veterinary facilities alongside its leading pharmaceutical and diagnostics companies operating in the region. The rising interest in animal protection and pet care has led to a higher need for veterinary services, together with related products. Groups such as the North American Pet Health Insurance Association work to raise awareness and build partnerships to enhance pet healthcare. The government supports industry innovation and investment through funding programs and biosecurity regulations. The market continues to expand because of the expanding livestock business and animal welfare groups' active emergency response initiatives.

U.S. Animal Health Market Trends

The United States led the North American animal health market in 2024 because national animal care organizations took aggressive action and received strong government backing. These organizations work to control disease outbreaks and implement prevention methods and pathogen elimination strategies that safeguard both public health and animal welfare. Market expansion occurs from rising consumer interest in animal-derived products, together with improved treatment standards for domestic animals and growing awareness of animal health issues. Pharmaceutical and diagnostic developments, together with vaccine innovations mainly targeting zoonotic and chronic diseases, represent key market growth factors. Food safety concerns have driven up the need for healthier animals, which directly affects the quality of meat and dairy products. Government regulations, including antimicrobial stewardship programs, encourage ethical animal treatment and the development of environmentally friendly animal health solutions.

Europe Animal Health Market Trends

Europe holds a significant revenue share of the worldwide animal health market in 2024 because of its large population of companion and production animals, and is projected to experience steady growth. The European Medicines Agency, through its regulatory support, including MUMS and DISCONTOOLS programs, promotes quick access to animal medicines and vaccines, which enhances both public and animal health. The region's dedication to ethical livestock production and sustainable agriculture has driven up the need for medical treatments, diagnostics, immunizations, and veterinary services. The EU has implemented rigorous animal health regulations because it maintains strict food safety and biosecurity standards. The European market continues to expand because of growing zoonotic disease incidents combined with rising awareness of pet healthcare and advanced diagnostic and treatment technologies.

Asia Pacific Animal Health Market Trends

The animal health segment in Asia Pacific will experience substantial growth because of substantial research investments, together with affordable veterinary treatments and vaccines. Advanced diagnostics, together with specialized therapies, have become essential because zoonotic diseases like Ebola and swine flu continue to spread. Urbanization has led to more pet ownership, which in turn has driven up demand for veterinary services and pet product supplies. Animal health receives substantial investment because both governments and health organizations focus on food safety and disease prevention to maintain high-quality, risk-free food production. Market growth receives additional support from shifting eating habits and rising economic conditions. Producers face increased pressure to improve livestock welfare through ethical and sustainable farming practices because of worldwide movements toward responsible agriculture, which drives the animal health market development in this region.

Key Animal Health Companies:

The following are the leading companies in the animal health market. These companies collectively hold the largest market share and dictate industry trends.

- Zoetis

- Merck & Co., Inc.

- Virbac

- Mars nc.

- Boehringer Ingelheim Gmbh

- Vetoquinol S.A.

- Dechra Pharmaceuticals Plc

- Elanco

- Ceva Santé Animale

- Idexx Laboratories, Inc.

- Others

Recent Developments

- In October 2024, VMD Sciences established Expanded Access Programs (EAPs) for dogs and cattle to offer veterinarians access to advanced life-saving therapies that conventional channels do not provide. Through collaboration with community veterinarians, this project delivers safe and legal access to innovative treatments to address veterinary medical needs that remain unmet.

- In May 2024, the Animal and Plant Health Inspection Service (APHIS) of the USDA announced more than USD 22.2 million in funding to improve the prevention, early detection, readiness, and quick response to the most common livestock diseases in the United States.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the animal health market based on the below-mentioned segments:

Global Animal Health Market, By Product

- Biologics

- Pharmaceuticals

- Medicinal Feed Additives

- Diagnostics

- Equipment & Disposables

- Others

Global Animal Health Market, By Animal Type

- Production Animals

- Companion Animals

Global Animal Health Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa