Pet Diabetes Care Market Summary

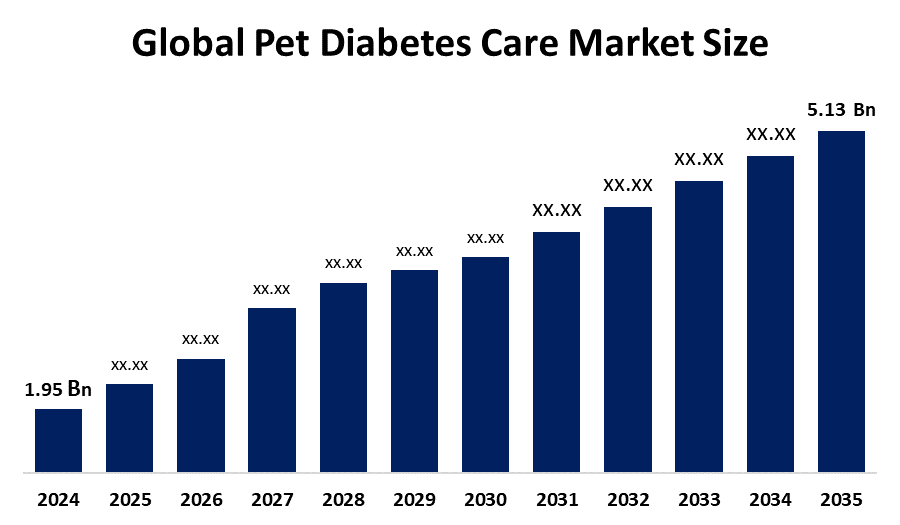

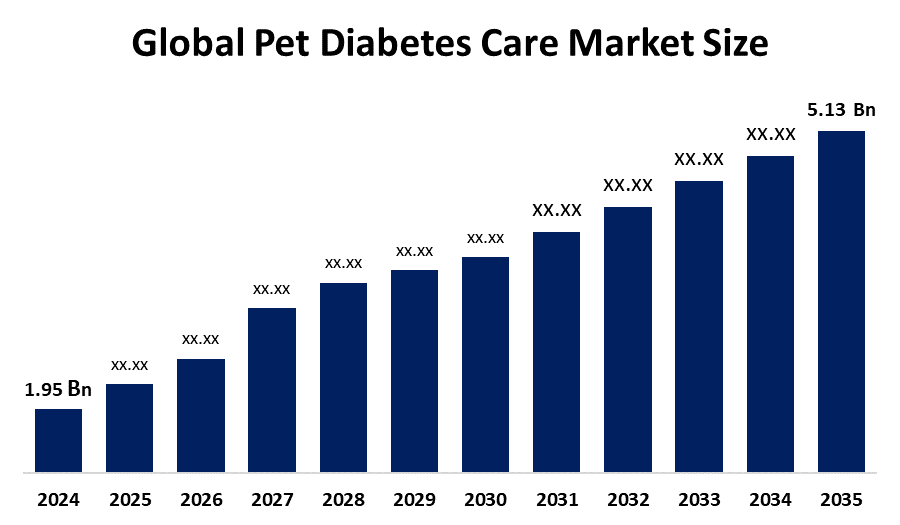

The Global Pet Diabetes Care Market Size Was Estimated at USD 1.95 Billion in 2024 and is Projected to Reach USD 5.13 Billion by 2035, Growing at a CAGR of 9.19% from 2025 to 2035. The market for pet diabetic care is expanding mainly due to rising pet ownership, more knowledge of pet diabetes, and improvements in treatment technology.

Key Regional and Segment-Wise Insights

- In 2024, the North American pet diabetes care market accounted for over 39.4% of the market's revenue.

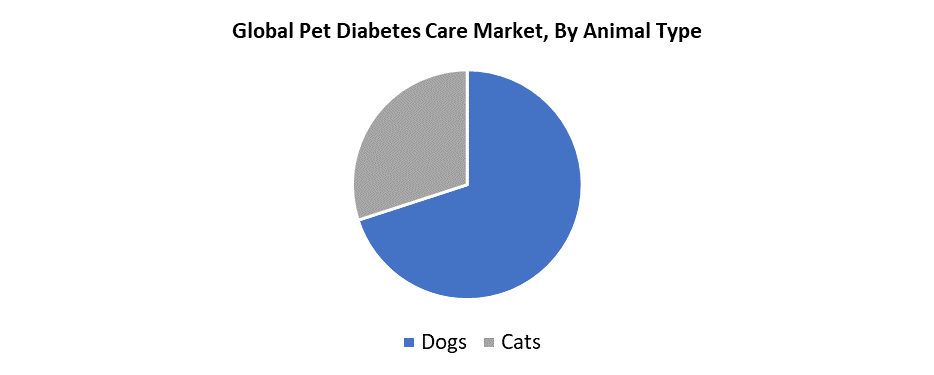

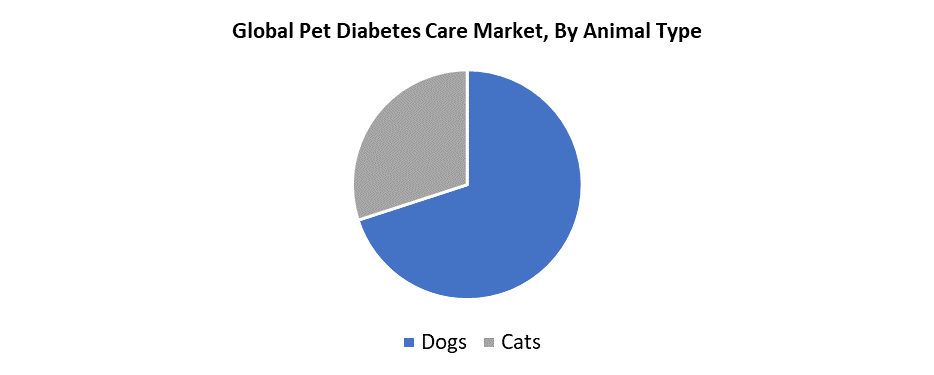

- In 2024, the dog segment held the largest revenue share by animal type.

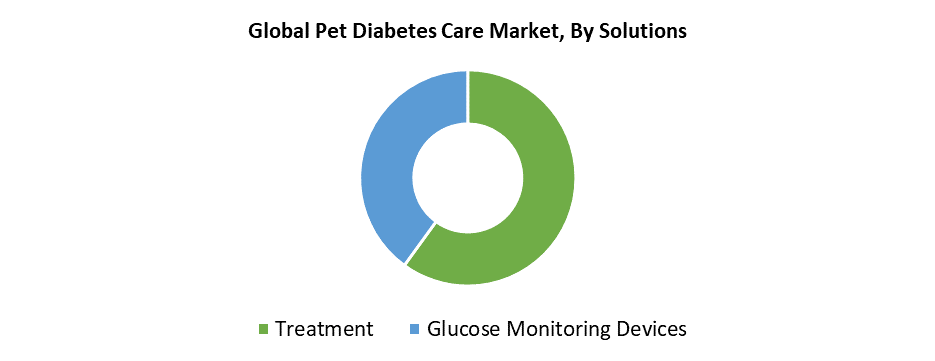

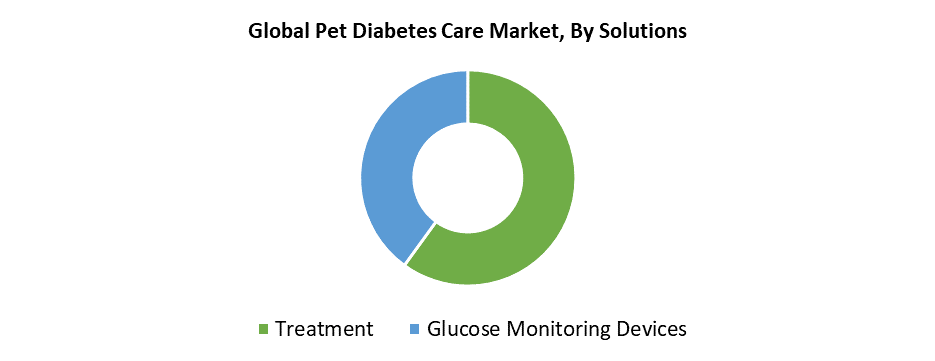

- In 2024, the treatment category accounted for the greatest market share by solution.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1.95 Billion

- 2035 Projected Market Size: USD 5.13 Billion

- CAGR (2025-2035): 9.19%

- North America: Largest market in 2024

The market that targets medical equipment alongside medications and services to manage diabetes in companion animals, predominantly including dogs and cats, is referred to as the pet diabetes care market. The growing number of diabetic companion animals, because of sedentary lifestyles combined with unhealthy diets, obesity, and advancing age, stands as the major driver behind the pet diabetes care market. Pet ownership and the need for advanced veterinary care and long-term disease management are rising across the world, especially within urban areas. The pandemic first hampered market growth because of restricted veterinary access, yet it eventually led to greater animal health understanding among pet owners and accelerated their acceptance of pet insurance. People now show increased readiness to invest in extended medical care services, which include diabetes treatment. The trend of pet humanization has caused pet owners to seek specialized care, which drives up the demand for diabetes management products and services.

Technological progress in veterinary medicine continues to expand the market for diabetes treatment in pets. Veterinary medicine has advanced through improved insulin formulations, continuous glucose monitoring devices, and telemedicine solutions, which enhance both veterinary and pet owner diabetes management. These tools enhance results and boost uptake through their ability to provide immediate diagnosis, superior disease monitoring, and precise therapeutic management. The critical role of veterinary associations and pet healthcare businesses in diabetes awareness campaigns helps educate pet owners and encourages them to start proactive diabetes treatment. The market for specialist diabetic pet meals, along with vitamins, has expanded, which supports better disease management. The market projections indicate that these factors will sustain the market's growth trajectory throughout the forecast period

Animal Type Insights

The dog segment dominated the pet diabetes care market in 2024, primarily because of rising dog ownership, together with growing public awareness about canine health conditions, particularly diabetes. Dogs experience diabetes more frequently than other pets because obesity serves as a major risk factor for this species. Pet owners who learn about dog diabetes symptoms and treatment methods drive up the demand for diabetic dog food, insulin therapy, and glucose monitoring devices, along with veterinary services. Veterinary visits have increased, as well as specialized disease management techniques, because of this growing awareness. The pet diabetes care market shows substantial growth because of dogs, since this segment receives dedicated product development work and educational programs.

The cat market segment will expand at a CAGR of over 8.3% throughout the forecast period because of rising feline diabetes cases, together with expanding pet owner understanding of disease symptoms. According to Boehringer Ingelheim, cats have triple the probability of developing diabetes compared to dogs, and obesity serves as a major risk factor for this condition because it affects half of all cats. The rising number of pet owners who recognize diabetes symptoms has led to improved diagnosis and continuous medical care for affected animals. The segment's strong growth results from rising awareness, which drives increased demand for diabetic care products designed for cats, including insulin therapy, blood sugar monitoring tools, and cat-specific nutrition.

Solution Insights

The treatment segment dominated the market in 2024 because insulin therapy maintains a crucial position in diabetic pet treatment. The most effective treatment remains insulin because it normalizes blood sugar levels and improves the quality of life for pets. The constant requirement of insulin administration tools, such as pens, needles, and syringes, makes veterinary clinics and pet owners interested in purchasing these products. The market segment retains continuous demand because it includes vital components such as glucose meters, together with test strips and diabetic pet food. The development of advanced treatment options enables veterinary professionals to establish customized care plans that include enhanced insulin formulations alongside improved glucose monitoring tools. The availability of multiple efficient treatment options leads to market expansion since it improves both disease management outcomes and owner adherence to treatment plans.

The increasing number of diabetes diagnoses among companion animals, together with precise monitoring equipment requirements, will drive the glucose monitoring devices market to achieve substantial market share throughout the forecast period. The inaccuracy of human glucometers for pet readings prompted manufacturers to develop specialized glucose monitoring equipment that aligns with animal physiology. These devices provide veterinary professionals and pet owners with precise data, which enhances their ability to handle diabetes effectively. Digital technology integration of cloud platforms and companion mobile applications enables users to measure and assess their blood sugar levels seamlessly through smartphones and tablets. Real-time monitoring through advanced glucose monitoring solutions drives the increasing demand for these solutions that enable early treatment, better disease management, as well as treatment adherence.

Regional Insights

The pet diabetes care market in North America led globally with 39.4% revenue share in 2024 because of its large pet population and its commitment to animal healthcare. The Association for Pet Obesity Prevention reports that more than half of dogs experience obesity, which leads to diabetes development. Diabetic care products face an increasing demand because of this trend. The region maintains an advanced veterinary network that enables modern clinics and hospitals to research diabetic treatment for pets. Public-private partnerships, together with extensive awareness campaigns, work to increase both early diabetes detection and treatment compliance. The large pharmaceutical and healthcare industry presence in North America reinforces its market leadership because these organizations maintain a steady insulin and glucose monitoring supply along with specialized nutritional products.

Europe Pet Diabetes Care Market Trends

Europe maintained its position as the second-largest revenue generator for the pet diabetes care market in 2024 because of the major industry players, Boehringer Ingelheim, Zoetis, and Merck, who operate within the region. Industry leaders Boehringer Ingelheim Zoetis and Merck play a fundamental role in advancing innovative diabetes care products that serve the European market. The rising need for precise and prompt diabetes diagnosis in pets, mainly from the UK and German markets, drives the market expansion. The trend of humanizing pets has triggered increased spending on healthcare for companion animals, which includes advanced diabetes care. The strong veterinary infrastructure combined with rising disease awareness among pet owners in Europe, creates additional momentum for regional market development.

Asia Pacific Pet Diabetes Care Market Trends

The Asia Pacific pet diabetes care market is projected to sustain rapid development throughout the forecast period. The rising economic conditions and higher disposable income in China and India have led to increased pet adoption rates, particularly in developing countries. This tendency is mostly responsible for this expansion. The demand for diabetes care products continues to rise because pet owners now show greater awareness about their animals' health and improved veterinary services. The population of companion animals is expanding in the region while individual spending on animal care continues to rise. The Asia Pacific region shows substantial growth in pet diabetes care services because of rising pet ownership rates combined with government initiatives supporting veterinary healthcare delivery.

Key Pet Diabetes Care Companies:

The following are the leading companies in the pet diabetes care market. These companies collectively hold the largest market share and dictate industry trends.

- Merck & Co. Inc.

- AccuBioTech Co. Ltd

- Nova Biomedical

- I-SENS, Inc.

- Allison Medical, Inc.

- Boehringer Ingelheim International GmbH

- Zoetis

- BD

- TaiDoc Technology Corporation

- Others

Recent Developments

- In August 2023, the U.S. Food and Drug Administration has approved SENVELGO, a ground-breaking new drug produced by Boehringer Ingelheim for diabetic cats.

- In September 2022, Zoetis, a US-based manufacturer of pet medication vaccinations, acquired New Metrica, a UK-based company that manufactures diabetic care devices for pets.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the pet diabetes care market based on the below-mentioned segments:

Global Pet Diabetes Care Market, By Animal Type

Global Pet Diabetes Care Market, By Solution

- Treatment

- Glucose Monitoring Devices

Global Pet Diabetes Care Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa