World’s Top 15 Companies in Technology Spending on Core Administration in Healthcare Market 2025 Watchlist: Statistical Report (2024–2035)

RELEASE DATE: Oct 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

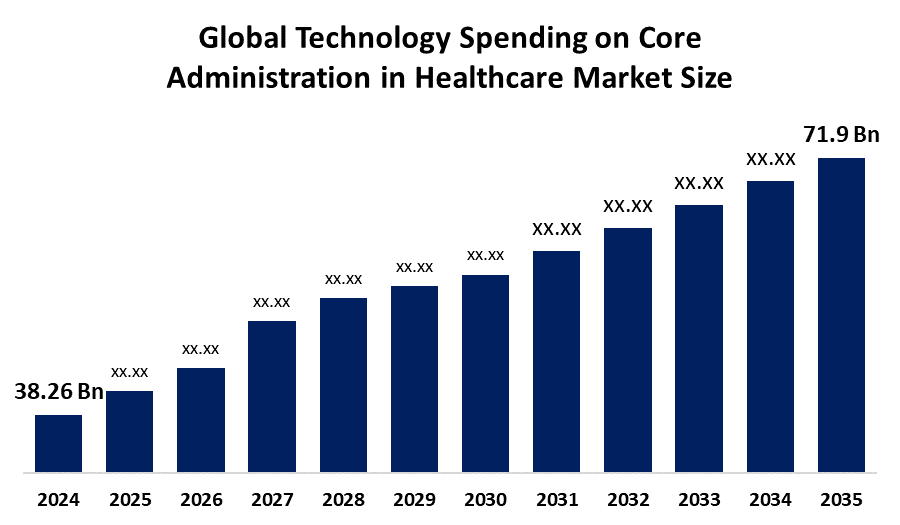

According to a research report published by Spherical Insights & Consulting, The Global Technology Spending on Core Administration in Healthcare Market Size is projected to Grow from USD 38.26 Billion in 2024 to USD 71.9 Billion by 2035, at a CAGR of 5.9% during the forecast period of 2025–2035. The market is driven by growing demand for individualized healthcare services, the desire to increase operational efficiency, and the growing use of electronic health records (EHRs).

Introduction

In the healthcare industry, technology spending on core administration refers to funding digital tools and systems that oversee important non-clinical tasks, including revenue management, member enrollment, and claims processing. Software, hardware, and services are the three primary categories of technology expenditure on core administration in the healthcare industry. Technology spending on core administration in the healthcare sector refers to the money spent by healthcare organizations on information technology (IT) solutions designed to improve and speed up the operational facets of core administrative tasks. The development of a business depends on stability and predictability, which are fostered by a well-organized regulatory environment. By ensuring that legal requirements are met, regulations serve to reduce the likelihood of legal issues, penalties, and economic disruptions.

It is projected that the increasing use of telemedicine will drive the growth of technology spending on core administration in the healthcare sector in the years to come. Telemedicine is the practice of providing medical care remotely through digital tools, including messaging applications, webinars, and smartphone apps for patient monitoring, diagnosis, and treatment.

IBM revealed in April 2025 new storage features that let customers choose and manage the data center to optimize performance.

Cotiviti in March 2025, combining payment integrity and FHIR- native data management solutions for 200 U.S. payers.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions. The increased propensity for online shopping and rising internet penetration worldwide are likely to fuel significant growth in the online stores' Technology Spending on Core Administration in Healthcare Market in the upcoming years.

Unlock exclusive market insights-Download the Brochure now and dive deeper into the future of the Global Technology Spending on Core Administration in Healthcare Market.

Global Technology Spending on Core Administration in Healthcare Market Size & Statistics

- The Market Size for Global Technology Spending on Core Administration in Healthcare was estimated to be worth USD 38.26 billion in 2024.

- The Market Size is Going to Expand at a CAGR of 5.9% between 2025 and 2035.

- The Global Technology Spending on Core Administration in Healthcare Market Size is anticipated to reach USD 71.9 billion by 2035.

- North America is expected to generate the highest demand during the forecast period in the Global Technology Spending on Core Administration in Healthcare Market

- Asia Pacific is expected to grow the fastest during the forecast period in the Global Technology Spending on Core Administration in Healthcare Market.

Regional growth and demand

North America is expected to generate the highest demand during the forecast period in the global technology spending on core administration in healthcare market.

North America is the region that uses the most technology for basic healthcare administration. North America accounted for more than half of all healthcare spending on state-of-the-art core administration technologies. This is due to a robust medical infrastructure as well as the rapid adoption of cloud-based technology in the healthcare sector. The market's expansion was aided by the presence of significant healthcare IT firms in the area. These businesses have played a significant role in bringing cutting-edge solutions that simplify administrative duties, enhance patient care, and lower operating expenses.

Asia Pacific is expected to grow the fastest during the forecast period in the global technology spending on core administration in healthcare market.

It is anticipated that the Asia Pacific will become the most attractive region for investments in core administration technology for the healthcare sector. expanding multinational involvement in the healthcare industry, the robust and active medical tourism industry, and rising consumer spending power on technologically improved facilities will all contribute to the Asia Pacific healthcare sector's continued growth in technology spending.

Top 10 Trends in the Global Technology Spending on Core Administration in Healthcare Market.

- Integration of advanced technologies such as AI, IoT, blockchain, and big data.

- Integration of AI and Automation

- Rising Demand for Digital Solutions

- Growing Investments in Cloud and Data Analytics

- Focus on Long-Term Efficiency and Patient Experience

- Cloud migration and service-based models

- Interoperability and API-first ecosystems

- Enhanced patient engagement

- Growing market and strategic consolidation

- Increased investment in AL and automation for tasks like Scheduling and billing

1. Integration of advanced technologies such as AI, IoT, blockchain, and big data.

These developments are helping companies make better decisions, streamline processes, and provide customer-focused solutions. Predictive analytics and automation are also becoming vital instruments for supply chain optimization and increased efficiency.

2. Integration of AI and Automation

Growth is being further accelerated by the combination of automation and artificial intelligence. AI-driven solutions have been implemented by more than 40% of providers to enhance scheduling, billing, and recordkeeping. These technologies facilitate improved efficiency and resource use by decreasing administrative workload and improving accuracy.

3. Rising Demand for Digital Solutions

The market's embrace of digital platforms is one of its main priorities. Claims management systems and electronic health record (EHR) solutions account for about half of healthcare administration costs. In healthcare operations, these tools are essential because they enhance patient data management, reduce operational errors, and improve coordination.

4. Growing Investments in Cloud and Data Analytics

Additionally, more money is being spent on analytics and cloud solutions. Nowadays, cloud adoption accounts for about 45% of administrative spending since it offers scalability, data security, and quicker access to patient data. When combined with sophisticated analytics, these platforms offer predictive insights that promote improved operational efficiency and decision-making.

5. Focus on Long-Term Efficiency and Patient Experience

The focus of the long-term strategy is on patient experience and efficiency. Clinical, operational, and financial data are connected by integrated administration platforms, which are being adopted by over 35% of healthcare providers. These expenditures are turning core administration into a force for better patient satisfaction and sustainable healthcare delivery.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the Global Technology Spending on Core Administration in Healthcare Market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 15 Companies Leading the Global Technology Spending on Core Administration in Healthcare Market

- Health Solutions Plus, Inc.

- ikaSystems Corporation

- HealthEdge Software, Inc.

- Plexis Healthcare Systems

- IBM

- Evolent Health

- Aldera Holdings Inc.

- TriZetto Corporation

- DST System Inc.

- UPP Technology

- Volent Health,

- Visiant Health

- UPP Technology

- SAP

- Wonderbox Technologies

- Others

1. Health Solutions Plus, Inc.

Headquarters: South Service Road, Suite

Health Solutions Plus, Inc. headquarters in South Service Road, Suite. One American software company, Health Solutions Plus (HSP), provides the most recent payer administration software. Having been successfully used for over two decades, HSP's entire payer solutions provide the automation and adaptability needed to oversee the processing of claims and benefits for medical, dental, vision, and specialty health. On one instance of the program, the HSP Payer Suite supports several business lines, including commercial, Medicaid, Medi-Cal, and Medicare Advantage.

2. IkaSystems Corporation

Headquarters: New Jersey, U.S

ikaSystems Corp.'s headquarters are in New Jersey, U.S. ikaSystems Corporation provides business automation and process solutions. The services provided by the company include enrollment, revenue optimization, utilization management, regulatory compliance, claim processing, and payment reconciliation. IkaSystems operates in the United States.

3. HealthEdge Software, Inc

Headquarters: Massachusetts, United States

HealthEdge is headquartered in Massachusetts, United States. HealthEdge was established in 2005 to provide a next-generation Core Administrative Processing System that would boost productivity and accuracy while also allowing health plans to quickly develop and launch new business lines. Five solutions and Global Professional Services make up the HealthEdge solution suite. For health plans of all sizes, HealthRules Payer is a next-generation core administrative processing solution that is intended to produce revolutionary results and unparalleled business agility. Claims pricing, editing, and real-time analytics are all combined into one convenient platform by HealthEdge Source, a state-of-the-art payment accuracy and integrity solution.

4. Plexis Healthcare Systems

Headquarters: Oregon, United States

Plexi’s Healthcare Systems is headquartered in Oregon, United States. For healthcare payers and delivery systems worldwide, PLEXIS Healthcare Systems is a top payer technology provider of dependable enterprise core administration and claims management solutions. Over 100 companies in all 50 states and worldwide rely on PLEXIS' fundamental administrative enterprise solutions to handle over 55 million lives. PLEXIS, which has led the market for 20 years, keeps producing a more skilled group of seasoned local and foreign subject matter experts.

5. IBM

Headquarters: Armonk, United States.

IBM’s headquarters are in the United States. In November 2024, it launched the most sophisticated quantum computers, advancing the field's advancement toward quantum advantages and adding new scientific value. This international technology corporation is based in the United States and operates in more than 175 countries. With 19 research facilities spread across 12 countries, IBM is the biggest industrial research organization in the world. IBM, one of the biggest and oldest tech companies in the world, is credited with a number of technological advancements, such as the ATM and UPC.

Are you ready to discover more about the Global Technology Spending on Core Administration in Healthcare Market?

The report provides an in-depth analysis of the leading companies operating in the Global Technology Spending on Core Administration in Healthcare Market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

1. Health Solutions Plus, Inc.

1. Business Overview

2. Company Snapshot

3. Products Overview

4. Company Market Share Analysis

5. Company Coverage Portfolio

6. Financial Analysis

7. Recent Developments

8. Merger and Acquisitions

9. SWOT Analysis

- ikaSystems Corporation

- HealthEdge Software, Inc.

- Plexis Healthcare Systems

- IBM

- Evolent Health

- Aldera Holdings Inc.

- TriZetto Corporation

- DST System Inc.

- UPP Technology

- Volent Health,

- Visiant Health

- UPP Technology

- SAP

- Wonderbox Technologies

- Others

Conclusion

The Global Technology Spending on Core Administration in Healthcare Market Size is driven by increasing usage of electronic health records (EHRs), the need to improve operational efficiency, and the growing demand for personalized healthcare services. Healthcare organizations' expenditures on information technology (IT) solutions that enhance and expedite the operational aspects of core administrative chores are referred to as technology spending on core administration in the healthcare industry. North America is the largest growing market in Technology Spending on Core Administration in Healthcare, and Asia Pacific is the fastest growing market in Technology Spending on Core Administration in Healthcare.

Browse Related Reports

Global Truffle Market Size To Exceed USD 1339.7 Million by 2035 | CAGR of 7.15% : Market Insight Report

Global Date Syrup Market Size To Exceed USD 760.8 Million by 2035 | CAGR of 6.04% : Market Study Report

Global Contrast Agents Market Size Exceed to USD 15.69 Billion by 2035| CAGR of 8.57%: Market Study Report

Global Cloud FinOps Market Size Exceed to USD 41.66 Billion by 2035| CAGR of 10.88% : Industry Analysis Report

Global Airborne Radars Market Size Exceed to USD 31.23 Billion by 2035| CAGR of 9.46% : Industry Report

France cricket Protein powders Market Size Insights Forecasts to 2035

France croissant Market Size Insights Forecasts to 2035

France Crop Micronutrient Market Size Insights Forecasts to 2035

France Crop breeding Technology Market Size Insights Forecasts to 2035

France Crop Oil Concentrates Market Size Insights Forecasts to 2035

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter

Need help to buy this report?