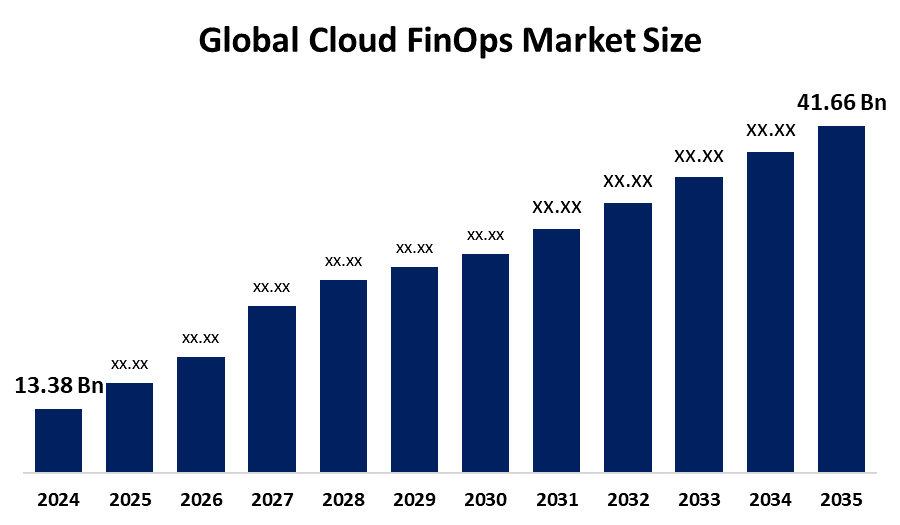

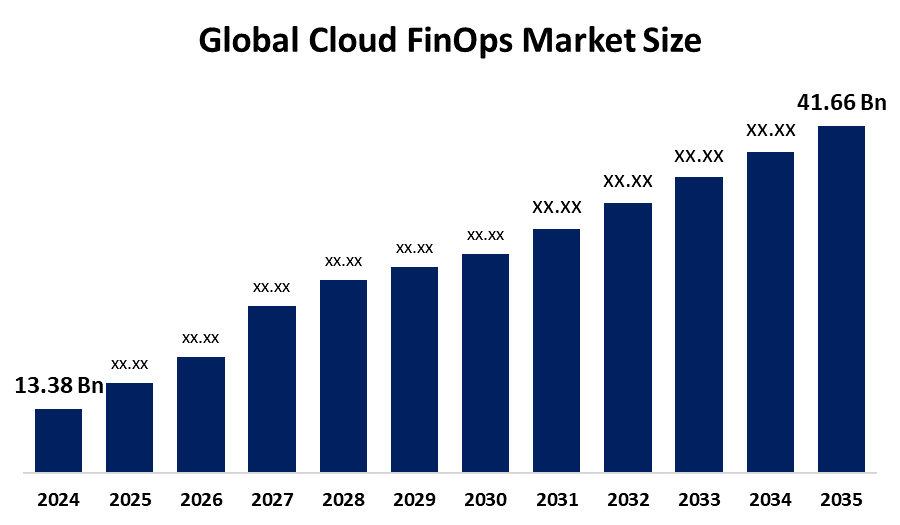

Global Cloud FinOps Market Insights Forecasts to 2035

- The Global Cloud FinOps Market Size Was Estimated at USD 13.38 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.88% from 2025 to 2035

- The Worldwide Cloud FinOps Market Size is Expected to Reach USD 41.66 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Cloud FinOps Market

The global cloud FinOps market focuses on optimizing cloud financial management, helping organizations control cloud spending while maximizing value. FinOps combines finance, operations, and technology to provide real-time visibility, cost allocation, and budgeting for cloud resources. Increasing cloud adoption and rising complexity of cloud billing drive market growth. Governments worldwide are supporting cloud financial management through initiatives promoting cloud adoption, digital transformation, and cost efficiency. For example, programs like the U.S. Federal Cloud Computing Strategy encourage cloud optimization, while the European Union invests in cloud infrastructure and governance. Cloud FinOps enables businesses to align cloud usage with budgets, reduce waste, and improve financial accountability. The market includes software platforms, consulting services, and analytics tools that assist enterprises in managing multi-cloud environments. Key trends include automation, AI integration, and enhanced governance frameworks. As cloud spending grows rapidly, Cloud FinOps is becoming essential for cost control and operational efficiency across industries globally.

Attractive Opportunities in the Cloud FinOps Market

- With accelerating cloud adoption in regions like Asia Pacific, Latin America, and parts of the Middle East & Africa, developing markets offer vast growth potential. Businesses in these regions are increasingly prioritizing cloud cost efficiency and digital transformation, creating a strong demand for scalable and localized FinOps solutions tailored to their needs.

- Previously hesitant due to cost and complexity, SMEs are now embracing cloud services more aggressively. This opens a new customer base for FinOps providers offering affordable, easy-to-implement tools that enable SMEs to monitor, forecast, and optimize cloud spending, driving market growth.

- The use of AI and ML for predictive analytics and intelligent cost optimization presents a key opportunity. These technologies can enable more accurate forecasting, automate cost-saving recommendations, and enhance decision-making, making FinOps platforms more powerful and indispensable for enterprises managing complex multi-cloud environments.

Global Cloud FinOps Market Dynamics

DRIVER: Rapid cloud adoption across enterprises

Rapid cloud adoption across enterprises increases the need for effective cost management. Rising complexity in multi-cloud environments makes financial visibility and optimization critical. The shift toward digital transformation and remote work further accelerates cloud usage. Additionally, the demand for real-time analytics and automation tools enhances FinOps implementation. Government initiatives promoting cloud efficiency and accountability support market expansion. Increased awareness of cloud waste and the need for cost governance also push organizations to adopt FinOps practices. Together, these factors significantly boost the market's growth trajectory.

RESTRAINT: Lack of skilled professionals who understand both finance and cloud technologies

One major challenge is the lack of skilled professionals who understand both finance and cloud technologies, creating a talent gap. Resistance to cultural and organizational change also hinders adoption, as FinOps requires close collaboration between IT, finance, and operations teams. Additionally, the complexity of integrating FinOps tools with existing cloud infrastructure can delay implementation. High initial setup costs and concerns over data privacy and compliance in multi-cloud environments further limit market expansion. These barriers slow down the adoption of FinOps solutions, particularly among small and medium-sized enterprises (SMEs).

OPPORTUNITY: Expansion into developing markets

The cloud FinOps market presents significant opportunities as businesses increasingly prioritize cost efficiency in cloud environments. With growing multi-cloud and hybrid cloud adoption, there is a rising demand for advanced FinOps tools that provide real-time cost monitoring, forecasting, and automation. Emerging technologies like AI and machine learning offer new possibilities for predictive analytics and intelligent cost optimization. SMEs, previously hesitant due to costs, are now adopting cloud services, creating a new customer base for FinOps solutions tailored to their needs. Additionally, as regulatory requirements around cloud usage tighten, organizations are seeking better governance and compliance tools, further boosting FinOps demand. Expansion into developing markets, where cloud adoption is accelerating, also provides vast growth potential for vendors offering scalable, localized FinOps services.

CHALLENGES: Inconsistent cloud billing models across providers hinder standardization

Organizations often struggle with cultural resistance, as FinOps requires cross-functional collaboration. Integrating FinOps tools into complex, existing cloud infrastructures can be technically difficult and time-consuming. Additionally, inconsistent cloud billing models across providers hinder standardization and accurate cost tracking. Data security, compliance concerns, and lack of clear ownership of cloud costs further complicate successful FinOps implementation and adoption across enterprises.

Global Cloud FinOps Market Ecosystem Analysis

The global cloud FinOps market ecosystem includes cloud providers, FinOps platform vendors, consulting firms, enterprises, governments, and practitioner communities. Cloud providers offer native cost tools, while vendors enhance visibility, automation, and analytics. Consulting firms help implement and manage FinOps strategies. Enterprises across sectors adopt FinOps to control multi-cloud spending. Government initiatives support cloud cost efficiency and governance. The FinOps Foundation and online communities promote standards and best practices, fostering collaboration and continuous innovation across this rapidly evolving financial cloud management landscape.

Based on the application, the cost management & optimization segment accounted for the largest revenue share over the forecast period

The cost management and optimization segment accounted for the largest revenue share in the global cloud FinOps market during the forecast period. This dominance is driven by the rising need among enterprises to monitor, control, and optimize cloud spending across increasingly complex multi-cloud environments. Organizations are prioritizing real-time cost tracking, budget forecasting, and automated cost-control measures to reduce waste and improve return on cloud investments. As cloud adoption accelerates, the demand for robust cost optimization tools continues to grow, making this segment central to FinOps strategies.

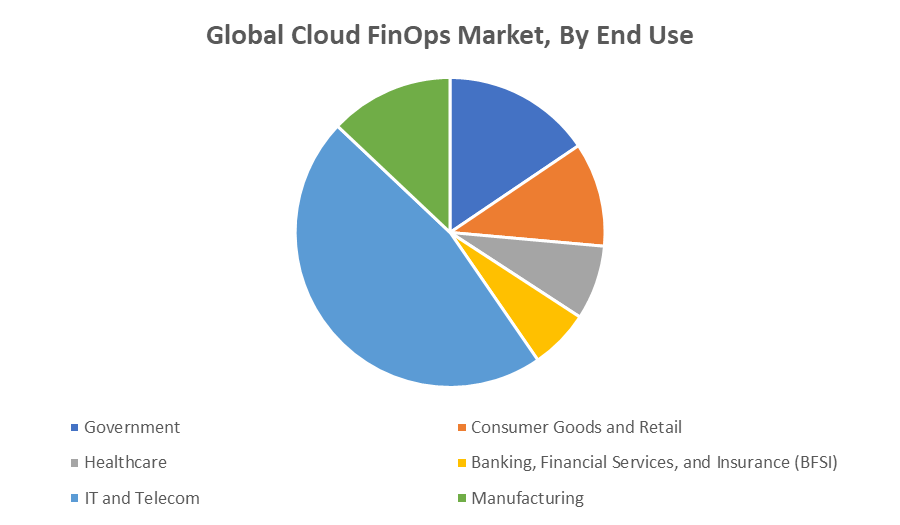

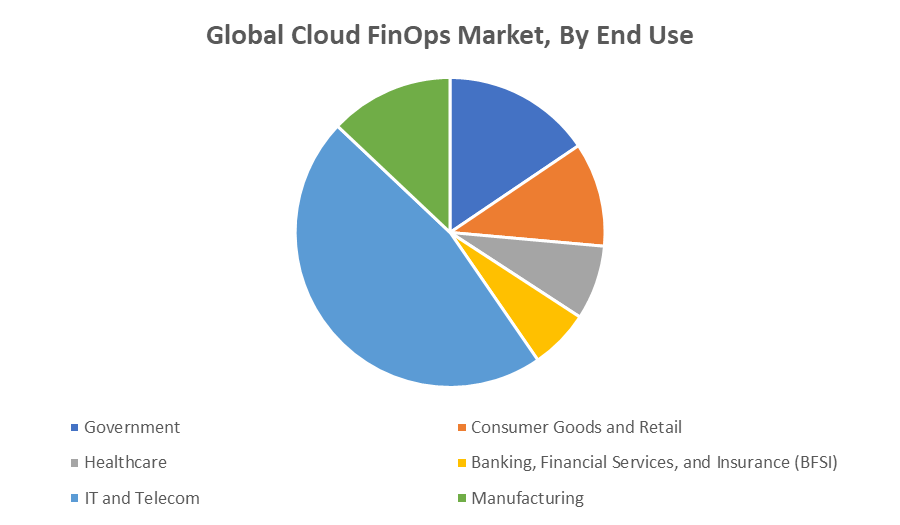

Based on the end use, the IT & Telecom segment accounted for the largest revenue share during the forecast period

The IT & Telecom segment accounted for the largest revenue share during the forecast period in the Cloud FinOps market. This is due to the heavy reliance of IT and telecom companies on cloud infrastructure to support their digital services, data storage, and communication networks. These industries generate massive cloud consumption, making cost management and optimization crucial for maintaining profitability and operational efficiency. Their early adoption of advanced FinOps practices and tools drives significant market revenue in this segment.

North America is anticipated to hold the largest market share of the cloud FinOps market during the forecast period

North America is anticipated to hold the largest market share in the global cloud FinOps market during the forecast period. This leadership is driven by the region’s early cloud adoption, presence of major cloud providers like AWS, Microsoft Azure, and Google Cloud, and a high concentration of enterprises prioritizing cloud cost optimization. Additionally, strong government initiatives promoting cloud efficiency and robust FinOps ecosystems, including skilled professionals and technology innovation, further boost North America’s dominant position in the market.

Asia Pacific is expected to grow at the fastest CAGR in the cloud FinOps market during the forecast period

Asia Pacific is expected to grow at the fastest CAGR in the cloud FinOps market during the forecast period. This rapid growth is fueled by increasing cloud adoption among enterprises, digital transformation initiatives, and expanding IT infrastructure in countries like China, India, and Japan. Additionally, rising awareness of cloud cost management and growing investments in cloud technologies by small and medium-sized businesses are driving demand. Government support and emerging startup ecosystems further accelerate the adoption of FinOps solutions across the region.

Recent Development

- In March 2025, AWS launched the Cost Optimization Hub along with the new CUDOS Dashboard to help users better manage and optimize their cloud expenses. These tools provide enhanced visibility into spending patterns specifically for services like Amazon ElastiCache and Amazon EMR. The Cost Optimization Hub offers tailored recommendations to reduce unnecessary costs and improve resource efficiency. Meanwhile, the CUDOS Dashboard delivers detailed insights and tracking, enabling real-time monitoring of cloud usage. Together, they empower organizations to make smarter financial decisions and maximize the value of their AWS investments.

Key Market Players

KEY PLAYERS IN THE CLOUD FINOPS MARKET INCLUDE

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform (GCP)

- Flexera

- VMware

- IBM

- Oracle

- ServiceNow

- SAP

- HCL Technologies

- Apptio (Cloudability)

- CloudHealth by VMware

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the cloud FinOps market based on the below-mentioned segments:

Global Cloud FinOps Market, By Application

- Cost Management & Optimization

- Resource Allocation & Planning

- Budgeting & Forecasting

- Billing & Chargeback

Global Cloud FinOps Market, By End Use

- Government

- Consumer Goods and Retail

- Healthcare

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecom

- Manufacturing

Global Cloud FinOps Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa