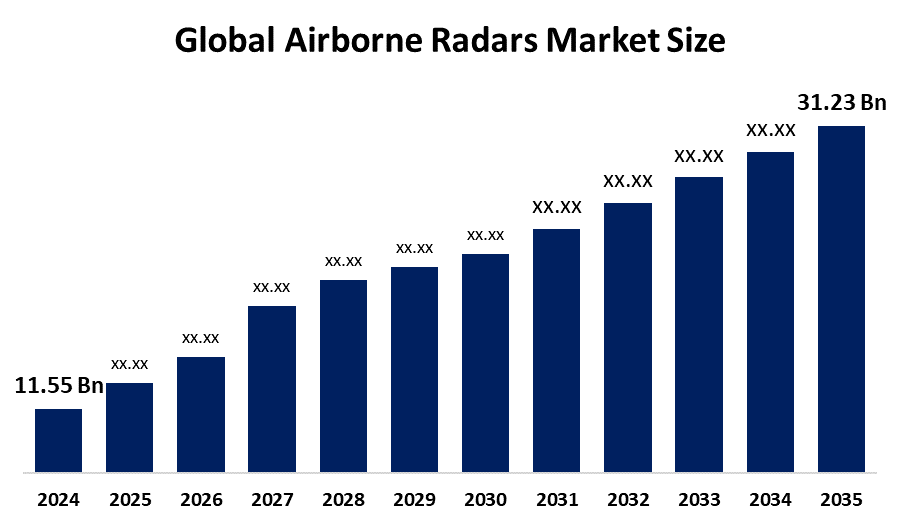

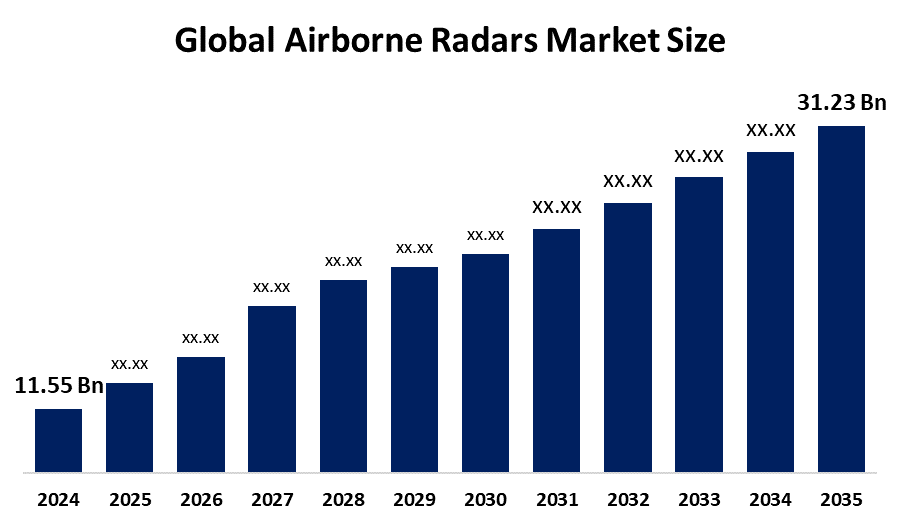

Global Airborne Radars Market Insights Forecasts to 2035

- The Global Airborne Radars Market Size Was Estimated at USD 11.55 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.46% from 2025 to 2035

- The Worldwide Airborne Radars Market Size is Expected to Reach USD 31.23 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Airborne Radars Market

The global airborne radars market encompasses radar systems mounted on aircraft for surveillance, navigation, targeting, and weather monitoring. These radars are vital for defense, commercial aviation, and space exploration. Market growth is driven by increasing demand for advanced surveillance systems, rising geopolitical tensions, and the modernization of air forces. Government initiatives worldwide, such as the U.S. Department of Defense’s radar modernization programs and Europe's investment in multi-role aircraft, boost innovation and adoption. Additionally, civil aviation authorities are promoting enhanced weather radar systems for flight safety. Technological advancements in AESA (Active Electronically Scanned Array) and lightweight radar systems have expanded capabilities while reducing operational costs. The market sees significant contributions from players in the U.S., Europe, and Asia-Pacific. With increasing UAV deployment and integrated radar technologies, the airborne radar market is expected to witness steady growth, catering to both defense and commercial sectors in the coming years.

Attractive Opportunities in the Airborne Radars Market

- Increasing demand for enhanced weather radar systems and air traffic control solutions opens new avenues for airborne radar applications beyond defense. This drives innovation in radar technologies tailored for safer and more efficient civil aviation operations.

- The expanding use of unmanned aerial vehicles (UAVs) in both military and commercial sectors, especially in Asia-Pacific, Latin America, and the Middle East, offers significant growth potential. Innovations like AI-integrated radars and multi-sensor fusion systems provide enhanced performance and new application possibilities.

Global Airborne Radars Market Dynamics

DRIVER: Increasing geopolitical tensions

The airborne radars market is experiencing robust growth due to rising defense budgets, increasing geopolitical tensions, and the need for advanced surveillance and reconnaissance systems. The growing adoption of UAVs and next-generation aircraft is driving demand for compact, lightweight radar solutions. Technological advancements, such as Active Electronically Scanned Array (AESA) radars, enhance detection capabilities and reliability. Additionally, modernization programs across air forces and investments in weather monitoring for civil aviation contribute to market expansion. Increasing border security concerns and joint defense initiatives further support the market's upward trajectory, particularly in regions like North America, Europe, and Asia-Pacific.

RESTRAINT: High development and installation costs of advanced radar systems

High development and installation costs of advanced radar systems, such as AESA, pose financial challenges, especially for developing countries. Integration complexities with existing aircraft platforms can delay deployment. Strict regulatory requirements and export restrictions on military radar technology hinder international trade. Additionally, electromagnetic spectrum congestion and vulnerability to cyber threats limit radar efficiency and security. The long lifecycle of radar systems also slows repeat sales. Budget constraints in some nations and shifting priorities toward other defense technologies may further impact market growth in certain regions.

OPPORTUNITY: Growing emphasis on air traffic management and weather monitoring in civil aviation opens new avenues

The airborne radars market presents significant growth opportunities driven by increasing demand for unmanned aerial vehicles (UAVs) in both military and commercial sectors. As nations modernize their air defense systems, the need for advanced radar technologies like AESA and multi-mode radars is expanding. Emerging markets in Asia-Pacific, Latin America, and the Middle East offer untapped potential due to rising defense spending and geopolitical concerns. Additionally, the growing emphasis on air traffic management and weather monitoring in civil aviation opens new avenues. Technological innovations such as AI-integrated radar systems, miniaturization, and multi-sensor fusion enhance radar performance and broaden applications. Collaborative international defense projects and public-private partnerships further support future market growth and innovation in airborne radar systems.

CHALLENGES: Compatibility issues with legacy aircraft platforms add to technical complexity

Compatibility issues with legacy aircraft platforms add to technical complexity. Export restrictions and strict regulatory frameworks hinder global trade and collaboration. Cybersecurity threats and electromagnetic interference pose risks to radar performance and data security. Additionally, the need for continuous technological upgrades demands significant R&D investment, creating barriers for smaller players and slowing overall market penetration.

Global Airborne Radars Market Ecosystem Analysis

The global airborne radars market ecosystem comprises OEMs like Lockheed Martin and Thales, component suppliers, system integrators, and end-users including defense and civil aviation agencies. Key drivers include rising demand for ISR, UAV integration, and radar modernization programs. R&D institutions and government bodies support innovation in AESA and AI-driven radar technologies. Challenges include high costs, integration issues, and regulatory barriers. Growth opportunities lie in emerging markets, advanced radar tech, and public-private partnerships, fostering a dynamic and evolving market landscape.

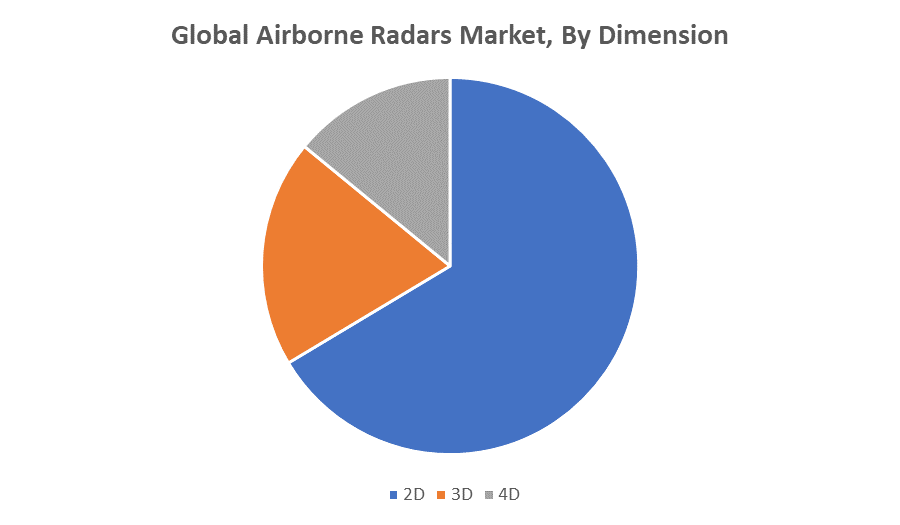

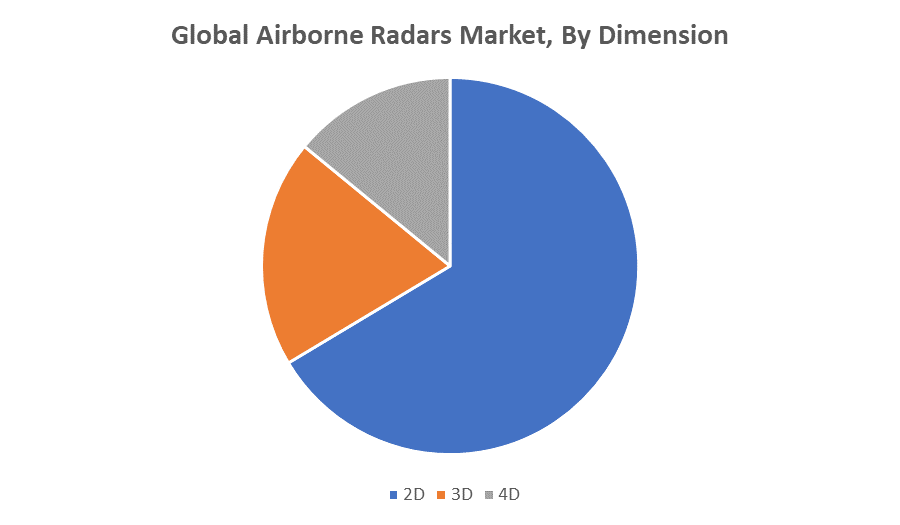

Based on the dimension, the 2D segment led the market with the largest revenue share over the forecast period

The 2D segment led the global airborne radars market, capturing the largest revenue share over the forecast period. This dominance is attributed to the widespread use of 2D radar systems for basic surveillance, target detection, and navigation functions, particularly in legacy and cost-effective aircraft platforms. These systems offer reliable performance with simpler architecture and lower costs compared to 3D and AESA radars, making them suitable for developing markets and retrofitting older fleets, thereby sustaining strong market demand.

Based on the frequency band, the X-band segment led the market with the highest revenue share during the forecast period

The X-band segment dominated the airborne radars market, securing the highest revenue share during the forecast period. X-band radars are widely used due to their high resolution, accuracy, and ability to perform effectively in adverse weather conditions. They are ideal for target tracking, mapping, and navigation, making them essential in both military and commercial aviation applications. Their compact size and versatility further contribute to their broad adoption across various airborne platforms, including fighter jets, UAVs, and surveillance aircraft.

North America is anticipated to hold the largest market share of the airborne radars market during the forecast period

North America is anticipated to hold the largest market share in the airborne radars market during the forecast period. This leadership is driven by substantial defense budgets, ongoing modernization of military aircraft, and strong investments in advanced radar technologies like AESA. The presence of major aerospace and defense companies, combined with government initiatives focused on enhancing surveillance, reconnaissance, and air traffic management capabilities, further strengthens the region’s dominance. Additionally, North America’s advanced R&D infrastructure supports continuous innovation and deployment of cutting-edge airborne radar systems.

Asia Pacific is expected to grow at the fastest CAGR in the airborne radars market during the forecast period

Asia Pacific is expected to grow at the fastest CAGR in the airborne radars market during the forecast period. This rapid growth is driven by increasing defense spending, modernization of air forces, and rising adoption of UAVs and advanced radar technologies in countries like China, India, Japan, and South Korea. Expanding geopolitical tensions and government initiatives to strengthen border security and surveillance further boost demand. Additionally, growing investments in civil aviation and disaster management applications contribute to the region’s accelerated market expansion.

Recent Development

- In June 2024, Anduril introduced the WISP Swarm Radar, an ultra-wideband (UWB) system designed to support coordination and surveillance of over 1,000 drones simultaneously. This cutting-edge radar boosts persistent situational awareness and enhances operational efficiency in complex, dynamic environments, making it especially valuable for large-scale drone swarm management, defense applications, and border security. Its ability to handle massive drone networks marks a significant advancement in airborne radar technology.

Key Market Players

KEY PLAYERS IN THE AIRBORNE RADARS MARKET INCLUDE

- Lockheed Martin

- Raytheon Technologies

- Northrop Grumman

- Thales Group

- BAE Systems

- Saab AB

- Israel Aerospace Industries (IAI)

- Hensoldt

- Leonardo S.p.A.

- Elta Systems

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the airborne radars market based on the below-mentioned segments:

Global Airborne Radars Market, By Dimension

Global Airborne Radars Market, By Frequency Band

- X-band

- C-band

- KU-band

- S-band

- HF/VHF/UHF

- KA-band

- Multi-band

- L-band

Global Airborne Radars Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa