Global Vitamin B5 Market Size, Share, and COVID-19 Impact Analysis, By Sales Channel (Direct and Indirect), By End User (Animal Feed Additives, Pharmaceuticals, Food & Beverages, Personal Care, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Vitamin B5 Market Size Insights Forecasts to 2035

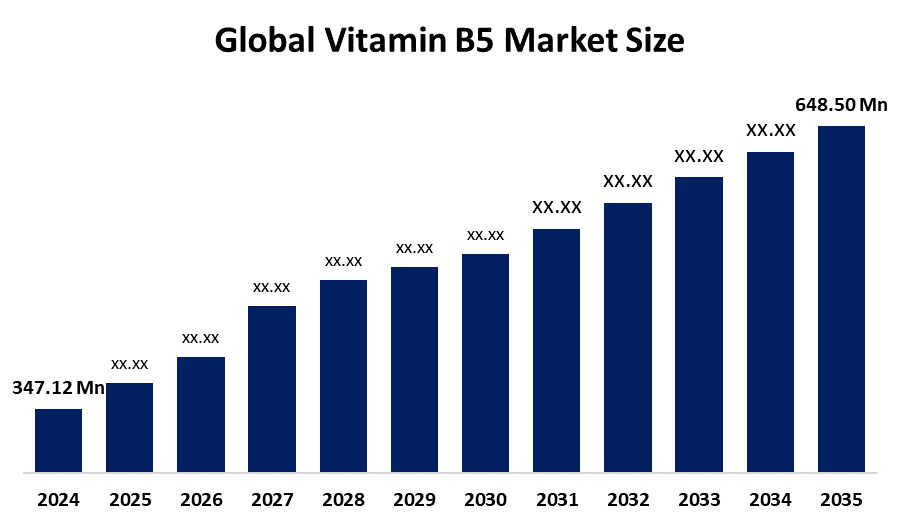

- The Global Vitamin B5 Market Size Was Valued at USD 347.12 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.85 % from 2025 to 2035

- The Worldwide Vitamin B5 Market Size is Expected to Reach USD 648.50 Million by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Vitamin B5 Market Size was worth around USD 347.12 Million in 2024 and is predicted to Grow to around USD 648.50 Million by 2035 with a compound annual growth rate (CAGR) of 5.85 % from 2025 to 2035. Opportunities in dietary supplements, functional foods, pharmaceuticals, and cosmetics are presented by the vitamin B5 market, which is fueled by increased worldwide demand for nutraceuticals, anti-aging trends, chronic disease prevention, and growing health consciousness.

Market Overview

The global production, distribution, and commercialization of vitamin B5 (pantothenic acid) and its derivatives, mainly as an essential water-soluble B-complex vitamin used in dietary supplements, pharmaceuticals, animal feed, functional foods, beverages, and cosmetics for energy metabolism, skin health, and nutrient fortification, are all included in the vitamin B5 market, also known as the pantothenic acid or calcium pantothenate market. The U.S. Dietary Supplement Listing Act of 2026, which Senator Durbin reintroduced to require FDA product registration and improve safety and market control, is one of the recent government initiatives that support dietary supplement transparency. For Instance, in December 2025, Zhejiang NHU introduced a complete bio-fermentation method for producing Calcium D-Pantothenate, which enables them to create sustainable, high-quality vitamin B5 products while minimizing energy consumption and environmental impact and enhancing worldwide animal feed and human health product availability. Vitamin B5 is essential for enhancing metabolic function and growth rates in poultry and swine. Increasing adoption in animal feed and livestock nutrition is an important driver for the vitamin B5 market.

Report Coverage

This research report categorizes the vitamin B5 market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the vitamin B5 market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the vitamin B5 market.

Global Vitamin B5 Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 347.12 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.85% |

| 2035 Value Projection: | USD 648.50 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 288 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Sales Channel, By End User and COVID-19 Impact Analysis |

| Companies covered:: | Anhui Tiger Biotech Co., Ltd, Avanscure Lifesciences Pvt. Ltd, BASF SE, Brother Enterprises Holding Co., Ltd, Chongqing Yifan Pharmaceutical Co., Ltd, DSM-Firmenich, Shandong Huachen Pharmaceutical Co., Ltd, Shandong Hwatson Biochem Co., Ltd, Vet-Chem Ltd, Xinfa Pharmaceutical Co., Ltd, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing use of vitamin B5 in the functional food, cosmetic, and pharmaceutical sectors also supports market expansion. Demand is greatly fueled by growing consumer awareness of the significance of dietary supplements and key nutrients as people look to avoid deficiencies and preserve general health. Because of its role in energy metabolism, adrenal function, and coenzyme A synthesis, vitamin B5 consumption is further driven by the increasing prevalence of chronic diseases, metabolic disorders, and lifestyle-related health difficulties. The extensive use of vitamin B5-enriched goods is further supported by the growing trend of health-conscious lifestyles, rising disposable income, and urbanization.

Restraining Factors

High production costs, strict regulations, low consumer awareness in developing nations, reliance on raw material availability, and competition from synthetic and alternative vitamins can all restrict the growth and uptake of the vitamin B5 market.

Market Segmentation

The vitamin B5 market share is classified into sales channel and end user.

- The direct segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the sales channel, the vitamin B5 market is divided into direct and indirect. Among these, the direct segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The increased demand for high-quality, traceable Vitamin B5 in numerous industries further supported the desire for direct buying. Bypassing middlemen, manufacturers increasingly favored direct sales to important end users like pharmaceutical corporations, food and beverage manufacturers, and personal care manufacturers.

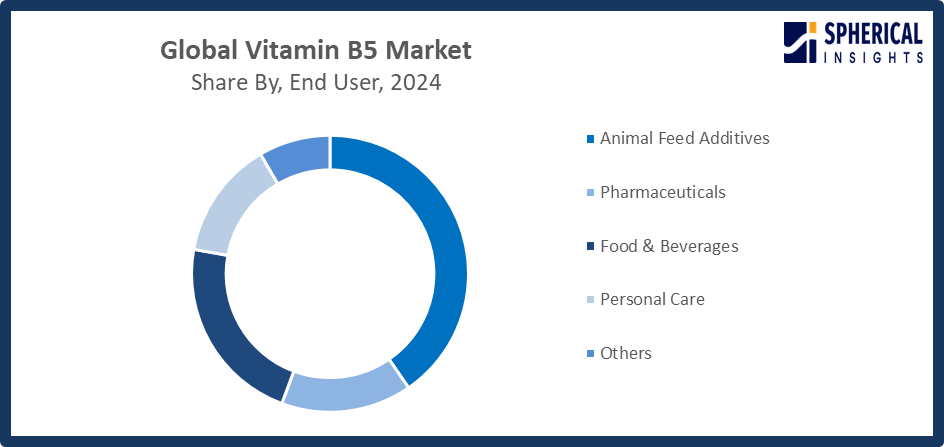

- The animal feed additives segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the vitamin B5 market is divided into animal feed additives, pharmaceuticals, food & beverages, personal care, and others. Among these, the animal feed additives segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The vitamin's vital role in promoting livestock development, metabolism, and general health makes it a crucial supplement in animal nutrition, which accounts for a substantial portion of the animal feed additives market. The demand for enriched feed has increased because to rising demand for premium meat, dairy, and poultry products.

Get more details on this report -

Regional Segment Analysis of the Vitamin B5 Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the vitamin B5 market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the vitamin B5 market over the predicted timeframe. The region experiences ongoing demand for Vitamin B5-enriched products because consumers in the area possess strong knowledge about health and nutrition and dietary supplements. The existing cosmetic industry in the United States and Canada drives strong market demand for pantothenic acid used in personal care products. North America's dominance strengthens through government product launches and regulatory progress which includes the U.S. Dietary Supplement Listing Act (2026) that requires FDA product registration to improve transparency and safety protection.

Asia Pacific is expected to grow at a rapid CAGR in the vitamin B5 market during the forecast period. The demand for vitamin B5-enriched functional beverages, fortified foods, and dietary supplements is rising due to urbanization, growing middle-class populations, and rising disposable incomes. The expanding pharmaceutical, nutraceutical, and cosmetic businesses in the area further encourage market growth. R&D in natural and bio-based derivatives, increased emphasis on women's health, longevity, and personal care goods, and the Asia Pacific's substantial share of next-generation B5 applications are some of the new advancements.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the vitamin B5 market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Anhui Tiger Biotech Co., Ltd

- Avanscure Lifesciences Pvt. Ltd

- BASF SE

- Brother Enterprises Holding Co., Ltd

- Chongqing Yifan Pharmaceutical Co., Ltd

- DSM-Firmenich

- Shandong Huachen Pharmaceutical Co., Ltd

- Shandong Hwatson Biochem Co., Ltd

- Vet-Chem Ltd

- Xinfa Pharmaceutical Co., Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2025, DSM-Firmenich launched an extended Vitamin B5 distribution with Brenntag, now covering Poland and Czech Republic, ensuring high-quality supply for pharmaceutical applications across Central and Eastern Europe.

- In January 2025, Anhui Huaheng Biotechnology launched its sustainable Vitamin B5 series production using fermentation, earning recognition among the “Top Ten Excellent Cases of Industrialization of Biomanufacturing” for eco-friendly, efficient biomanufacturing processes.

- In February 2024, DSM-Firmenich launched the separation of its ANH business, a leading Vitamin B5 producer, to focus on health and nutrition growth while enabling ANH to pursue independent animal nutrition strategies.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the vitamin B5 market based on the below-mentioned segments:

Global Vitamin B5 Market, By Sales Channel

- Direct

- Indirect

Global Vitamin B5 Market, By End User

- Animal Feed Additives

- Pharmaceuticals

- Food & Beverages

- Personal Care

- Others

Global Vitamin B5 Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the vitamin B5 market over the forecast period?The global vitamin B5 market is projected to expand at a CAGR of 5.85% during the forecast period.

-

2. What is the market size of the vitamin B5 market?The global vitamin B5 market size is expected to grow from USD 347.12 million in 2024 to USD 648.50 million by 2035, at a CAGR of 5.85 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the vitamin B5 market?North America is anticipated to hold the largest share of the vitamin B5 market over the predicted timeframe.

-

4. Who are the top companies operating in the global vitamin B5 market?Anhui Tiger Biotech Co., Ltd, Avanscure Lifesciences Pvt. Ltd, BASF SE, Brother Enterprises Holding Co., Ltd, Chongqing Yifan Pharmaceutical Co., Ltd, DSM-Firmenich, Shandong Huachen Pharmaceutical Co., Ltd, Shandong Hwatson Biochem Co., Ltd, Vet-Chem Ltd, Xinfa Pharmaceutical Co., Ltd, and Others.

-

5. What factors are driving the growth of the vitamin B5 market?The burgeoning consumer awareness of health issues, rising use of dietary supplements, burgeoning applications in medicines, cosmetics, and functional foods, production technology improvements, urbanization, and an increase in the market for wellness and preventative healthcare products worldwide.

-

6. What are the market trends in the vitamin B5 market?Current market trends are driven by biofermentation production, natural and sustainable sourcing, fortified foods and drinks, customized nutrition, expanding application in cosmetics, growing emphasis on high-purity supplements, and growth in new markets.

-

7. What are the main challenges restricting the wider adoption of the vitamin B5 market?Market expansion is restricted by high production costs, difficult regulatory compliance, a lack of raw materials, low consumer awareness in developing nations, and competition from synthetic vitamins and other dietary supplements.

Need help to buy this report?