Global Vitamin B9 Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Folic Acid and Folate), By Application (Dietary Supplements, Food Fortification, Pharmaceuticals, and Animal Feed), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Vitamin B9 Market Size Insights Forecasts to 2035

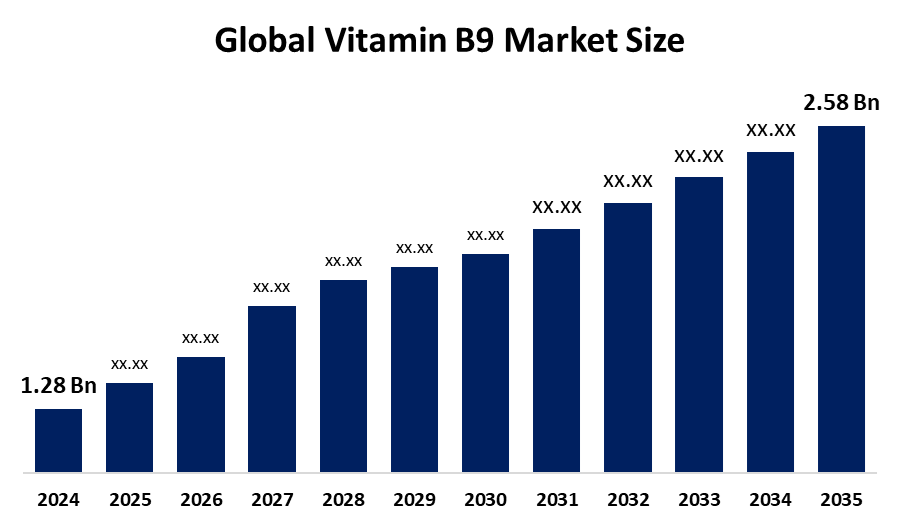

- The Global Vitamin B9 Market Size Was Estimated at USD 1.28 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.58 % from 2025 to 2035

- The Worldwide Vitamin B9 Market Size is Expected to Reach USD 2.58 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Vitamin B9 Market Size was valued at around USD 1.28 billion in 2024 and is predicted to grow to around USD 2.58 billion by 2035 with a compound annual growth rate (CAGR) of 6.58 % from 2025 to 2035. Growing demand for prenatal care, fortified food items, dietary supplements, growing health consciousness, aging populations, new markets, and the promotion of innovation, product diversification, and strategic alliances worldwide are all potential opportunities in the vitamin B9 market.

Market Overview

The global market, which includes the production, sale, and marketing of Vitamin B9 (folic acid), a water-soluble B vitamin that plays a crucial role in DNA synthesis, the production of red blood cells, and the prevention of neural tube defects during prenatal care, is enormous. The main methods of obtaining it are synthetic processes and microbial fermentation, while the vitamins A and D, vita and the nutritional supplements, natural for therapeutics, food fortification, and animal feed, all use it. It is mainly utilized in healthcare through chronic and preventive treatment. Both the synthetic and natural forms of vitamin B9 are the main ingredients of the pharmaceutical, food and beverage, and animal feed industries. The primary factor propelling the vitamin B9 market is consumers' growing awareness of folic acid's benefits to overall health and its ability to prevent birth abnormalities. Folic acid fortification of staples like wheat, rice, and cereals has been a regular technique in various areas, increasing market expansion and population coverage.

Report Coverage

This research report categorizes the vitamin B9 market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the vitamin B9 market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the vitamin B9 market.

Vitamin B9 Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 1.28 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.58% |

| 2035 Value Projection: | 2.58 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | BASF SE, Garden of Life, Glanbia Nutritionals, GNC Holdings, Inc., Jiangxi Tianxin Pharmaceutical Co., Ltd., Kirkman Group, Inc., Koniklijke DSM N.V., Merck KGaA, Nature’s Bounty Co., NutraScience Labs, Pure Encapsulations, LLC, Shandong Xinfa Pharmaceutical Co., Ltd., Swanson Health Products, Thorne Research, Inc., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising prevalence of diseases linked to unhealthy lifestyles and an increasingly elderly population, who are more prone to health problems caused by vitamin B9 deficiency, are factors that considerably contribute to the market growth of this vitamin. One of the main reasons for this is the growing consciousness about nutritional deficiencies and the important part of vitamin B9 in DNA creation, blood cell production, and fetal neural development. Market growth is significantly supported by the increased need for prenatal and maternal health supplements since folic acid intake is widely recommended to be started before pregnancy.

Restraining Factors

High production costs, strict regulations, little consumer knowledge in some areas, possible negative effects from excessive intake, and the availability of substitute supplements or alternative nutritional sources are some of the factors restricting the vitamin B9 market.

Market Segmentation

The vitamin B9 market share is classified into product type and application.

- The folic acid segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product type, the vitamin B9 market is divided into folic acid and folate. Among these, the folic acid segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The extensive usage of folic acid in pharmaceutical products intended to treat deficiency-related illnesses further increases demand for the substance. Because of its stability and affordability, folic acid, a synthetic version of vitamin B9, is frequently found in supplements and fortified meals.

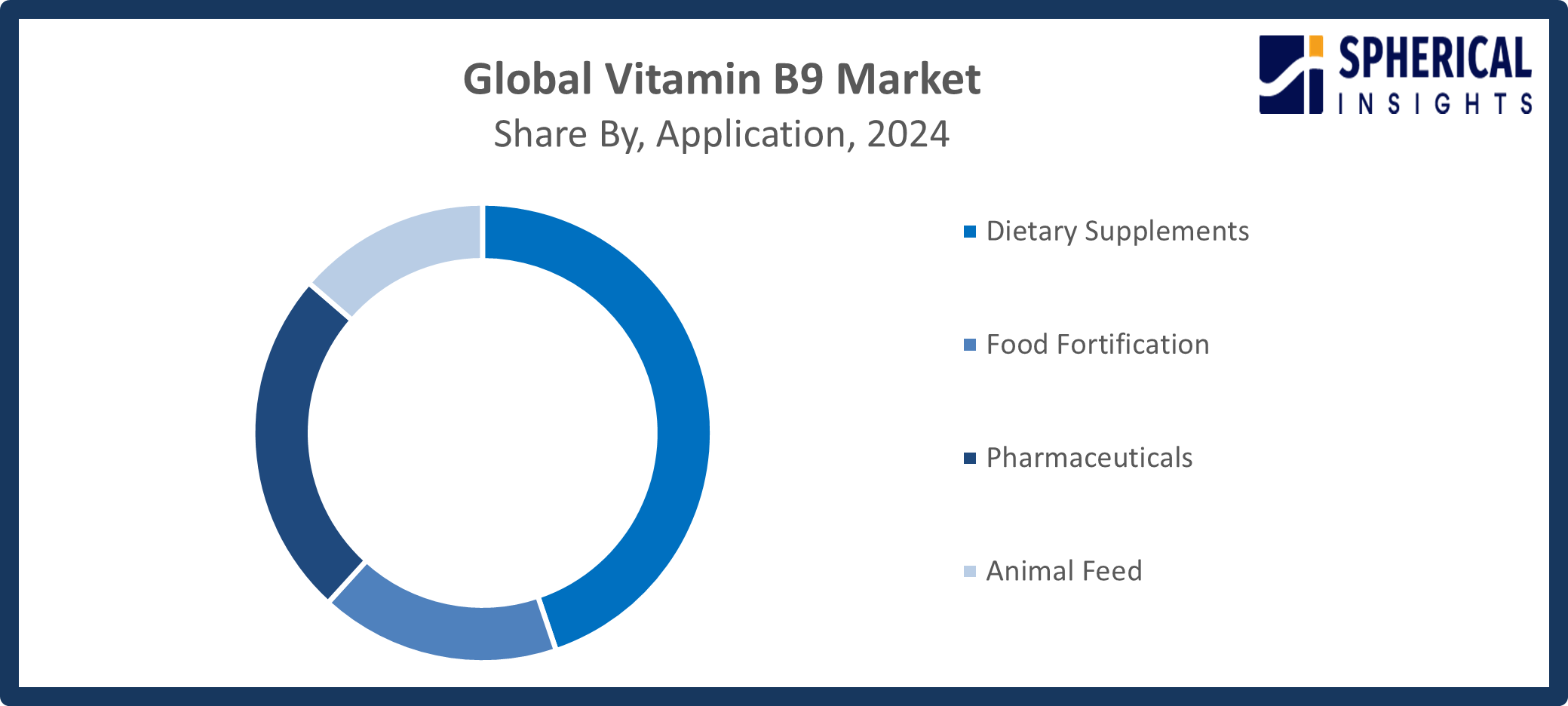

- The dietary supplements segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the vitamin B9 market is divided into dietary supplements, food fortification, pharmaceuticals, and animal feed. Among these, the dietary supplements segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Dietary supplements are a result of consumers' growing preference for wellness and preventive healthcare. Pregnant women, the elderly, and people with certain medical disorders that require increased folate intake have a particularly high demand for vitamin B9 supplements.

Get more details on this report -

Regional Segment Analysis of the Vitamin B9 Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the vitamin B9 market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the vitamin B9 market over the predicted timeframe. The region gains from the extensive use of dietary and prenatal supplements, which are encouraged by public health groups and medical professionals. Because of its developed supplement sector and the effectiveness of folic acid fortification efforts in enhancing public health outcomes, the United States, in particular, has a significant market presence. In order to reduce neural tube defects among Hispanic communities and address dietary inequities, California implemented mandated folic acid fortification in corn masa flour and wet masa in January 2026, requiring 0.7 mg and 0.4 mg per pound, respectively.

Asia Pacific is expected to grow at a rapid CAGR in the vitamin B9 market during the forecast period. Government initiatives encouraging folic acid consumption have resulted from the region's focus on enhancing mother and child health, especially in nations like China and India, where birth rates are still high. Market expansion is greatly aided by government programs that use food fortification and supplementation to lower anemia, birth abnormalities, and malnutrition. Important government initiatives include Malaysia's Ministry of Health directive, which goes into effect in 2025 and requires vitamin B9 fortification in wheat flour packaged up to 25 kg.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the vitamin B9 market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Garden of Life

- Glanbia Nutritionals

- GNC Holdings, Inc.

- Jiangxi Tianxin Pharmaceutical Co., Ltd.

- Kirkman Group, Inc.

- Koniklijke DSM N.V.

- Merck KGaA

- Nature's Bounty Co.

- NutraScience Labs

- Pure Encapsulations, LLC

- Shandong Xinfa Pharmaceutical Co., Ltd.

- Swanson Health Products

- Thorne Research, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2024, Northern Ireland’s Department of Health launched mandatory folic acid fortification in non-wholemeal flour, aiming to reduce birth defects such as spine and brain abnormalities in newborns.

- In June 2024, Balchem Corporation launched Optifolin, a choline-enriched folate supplement, across the U.S., enhancing Vitamin B9 intake and supporting prenatal health and overall nutritional supplementation nationwide.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the vitamin B9 market based on the below-mentioned segments:

Global Vitamin B9 Market Size, By Product Type

- Folic Acid

- Folate

Global Vitamin B9 Market Size, By Application

- Dietary Supplements

- Food Fortification

- Pharmaceuticals

- Animal Feed

Global Vitamin B9 Market Size, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the vitamin B9 market over the forecast period?The Global Vitamin B9 Market Size is projected to expand at a CAGR of 6.58% during the forecast period.

-

2. What is the market size of the vitamin B9 market?The Global Vitamin B9 Market Size is expected to grow from USD 1.28 billion in 2024 to USD 2.58 billion by 2035, at a CAGR of 6.58 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the vitamin B9 market?North America is anticipated to hold the largest share of the vitamin B9 market over the predicted timeframe.

-

4. Who are the top companies operating in the Global Vitamin B9 Market Size?BASF SE, Garden of Life, Glanbia Nutritionals, GNC Holdings, Inc., Jiangxi Tianxin Pharmaceutical Co., Ltd., Kirkman Group, Inc., Koniklijke DSM N.V., Merck KGaA, Nature's Bounty Co., NutraScience Labs, Pure Encapsulations, LLC, Shandong Xinfa Pharmaceutical Co., Ltd., Swanson Health Products, Thorne Research, Inc., and Others.

-

5. What factors are driving the growth of the vitamin B9 market?The market is developing due to a number of factors, including increased demand for prenatal supplements, government fortification programs, growing health issues connected to deficiencies, an aging population, and a growing desire for dietary supplements and preventative healthcare.

-

6. What are the market trends in the vitamin B9 market?Fortified foods, novel supplement formulations, plant-based and natural sources, individualized nutrition, e-commerce distribution, growing clinical research, and growing consumer interest in maternal and prenatal health support services are some of the trends.

-

7. What are the main challenges restricting the wider adoption of the vitamin B9 market?Global adoption of vitamin B9 products is hampered by high production costs, rigid regulations, low knowledge in some areas, possible overdose dangers, and competition from other nutrients or supplements.

Need help to buy this report?