Global Vitamin B4 Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Tablets, Capsules, Powders, and Liquids), By Application (Dietary Supplements, Pharmaceuticals, Animal Feed, Functional Food and Beverages, and Others), By Distribution Channel (Online Stores, Supermarkets/Hypermarkets, Specialty Stores, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Vitamin B4 Market Size Insights Forecasts to 2035

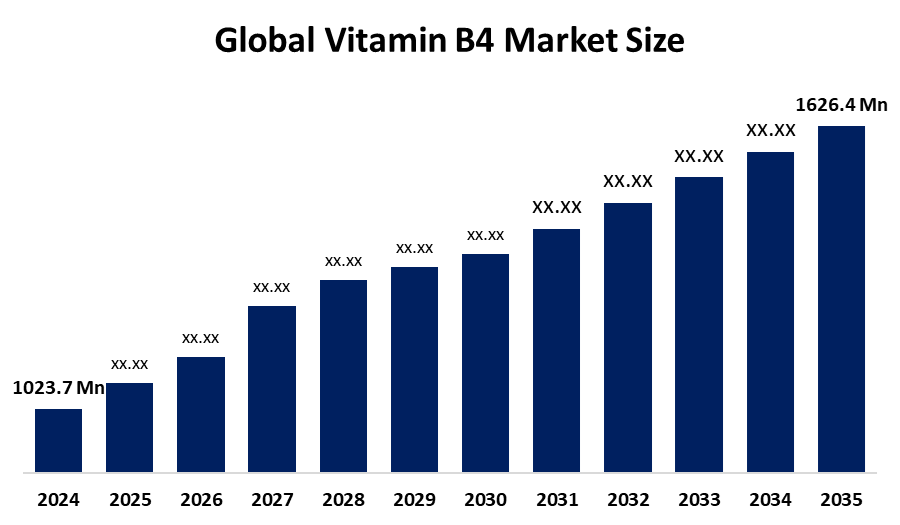

- The Global Vitamin B4 Market Size Was Estimated at USD 1023.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.3% from 2025 to 2035

- The Worldwide Vitamin B4 Market Size is Expected to Reach USD 1626.4 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Vitamin B4 Market Size was worth around USD 1023.7 Million in 2024 and is predicted to grow to around USD 1626.4 Million by 2035 with a compound annual growth rate (CAGR) of 4.3% from 2025 to 2035. The global Vitamin B4 Market Size is expanding because people are becoming more health aware, and they need more dietary supplements and pharmaceutical products that use vitamin B4 for treating cognitive and liver health conditions.

Market Overview

The Global Vitamin B4 Market Size encompasses the production and consumption of vitamin B4 (adenine), a water-soluble vitamin used in dietary supplements, pharmaceuticals, animal nutrition, and cosmetics. The substance functions as a vital component for energy expenditure processes and cellular multiplication and complete body functioning, which makes it useful in functional foods, fortified drinks and nutraceutical products. Health awareness among people drives market expansion because more people develop lifestyle-related health conditions, which create a higher need for athletic dietary products and wellness solutions. The market expansion results from customers who prefer natural foods and plant-based products and fortified items that meet dietary requirements, which government programs support.

Emerging markets, where middle-class populations are expected to grow, present significant opportunities for the development of new product formulations that offer easy-to-use delivery formats and multi-ingredient supplement solutions. Balchem Corporation, GHW International, Jubilant Ingrevia Limited, and BASF SE are key market players expanding their business presence through product portfolio expansion and strategic corporate partnerships.

From a regulatory standpoint, the Philippines Food and Drug Administration (FDA) introduced Circular No. 2025-001 in 2025 to update regulations for vitamins and minerals used in dietary supplements. The circular defines classification and labeling requirements for processed foods and dietary supplements and establishes compliance standards that products must meet to be marketed in the Philippines, thereby enhancing consumer protection and ensuring regulatory compliance.

Report Coverage

This research report categorizes the Vitamin B4 Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Vitamin B4 Market Size. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Vitamin B4 Market Size.

Vitamin B4 Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1023.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.3% |

| 2035 Value Projection: | USD 1626.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | BASF SE, Lonza Group Ltd, DSM Nutritional Products, GHW International, Jubilant Ingrevia Limited, Balchem Corporation, ADM (Archer Daniels Midland Company), Evonik Industries AG, Cargill Incorporated, Merck KGaA, Adisseo France SAS, Glanbia PLC, Kemin Industries, Inc., DuPont de Nemours, Inc., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global vitamin B4 (adenine/choline) market experiences growth because people become more health aware and preventive healthcare practices gain popularity, which creates a need for dietary supplements that maintain metabolic functions, mental abilities and body energy production. The rising demand for nutritional products that combat age-related health problems exists because of the worldwide population growth, which affects all regions, but especially the Asia Pacific countries. The pharmaceutical sector keeps expanding while people increasingly choose fortified foods and beverages, which especially benefit their liver and brain health, so these trends become the main drivers of market development. The market growth occurs because people now understand their nutritional deficiencies better, and they use choline as an animal feed additive to boost livestock production.

Restraining Factors

The global vitamin B4 (adenine) market faces major obstacles because of two main factors, which include expensive production costs, the need for specialized manufacturing processes and the unpredictable changes in raw material prices. The market faces three obstacles, which include low consumer awareness in developing areas, the need for strict regulatory compliance and the rising competition from synthetic product alternatives.

Market Segmentation

The Vitamin B4 Market Size share is classified into product type, application, and distribution channel.

- The tablets segment dominated the market in 2024, approximately 40% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the Vitamin B4 Market Size is divided into tablets, capsules, powders, and liquids. Among these, the tablets segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Tablets are one of the most preferred dosage forms due to their easy character, stability and precise dosage. They find the highest favor in consumerist developed markets, it is there that simplicity in supplementation within the busy routines of consumers has a lot to offer. The segment to grow is the fact that the formulation technology has advanced at an unprecedented pace, enhancing bioavailability and efficacy.

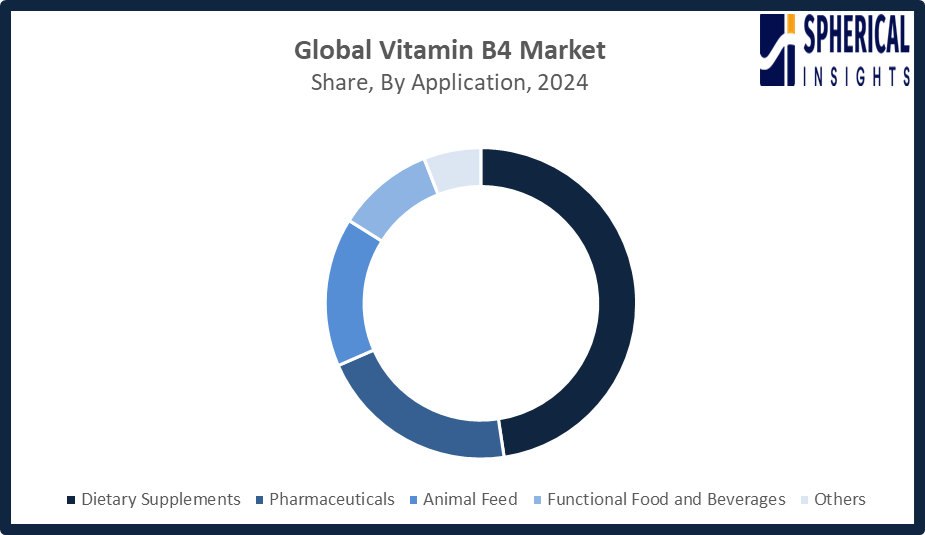

- The dietary supplements segment accounted for the largest share in 2024, approximately 48% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the Vitamin B4 Market Size is divided into dietary supplements, pharmaceuticals, animal feed, functional food and beverages, and others. Among these, the dietary supplements segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dietary supplements segment scored the maximum through massive interest on the part of consumers in decent health and well-being, preventive care, growth of lifestyle-related ailments, and the increase in demand for products supporting energy, metabolism, and immunity. Skin supplements, such as vitamin C, acting against ageing, are deeply ingrained within the ingredients.

Get more details on this report -

- The online stores segment accounted for the highest market revenue in 2024, approximately 35% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the Vitamin B4 Market Size is divided into online stores, supermarkets/hypermarkets, specialty stores, and others. Among these, the online stores segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The online stores, witnessing great popularity, owing to the proliferation of the internet across the landscape and the luxury of doorstep service, now serve as a medium of great comparison on some very broad product offerings, price comparison simplification, and online product reviews. The mounting dominance of e-commerce platforms and digital marketing strategies is sure to make the segment grow further.

Regional Segment Analysis of the Vitamin B4 Market Size

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the Vitamin B4 Market Size over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the Vitamin B4 Market Size over the predicted timeframe. North America is expected to become the 35% share market segment for global vitamin B4 sales because consumers there show strong health and wellness knowledge, while dietary supplements have become common, and pharmaceutical and nutraceutical companies have established a strong market presence. The United States and Canada lead regional demand because people become more concerned about their health, which leads them to choose nutritious products that contain no artificial additives and processed foods with added vitamins. The U.S. FDA published its Unified Regulatory Agenda in September 2025, which included a proposed GRAS notification rule and final front-of-package labeling and the reclassification of a previously excluded dietary supplement ingredient that would change how products were regulated and marketed.

Asia Pacific is expected to grow at a rapid CAGR in the Vitamin B4 Market Size during the forecast period. The Vitamin B4 Market Size in the Asia Pacific region is expected to have a 25% market share and experience fast growth because more people become health-conscious and their disposable incomes rise, which increases their demand for dietary supplements and functional foods. China, India and Japan emerge as key contributors because their large populations and growing middle-class consumers enable their governments to implement nutrition and food fortification initiatives. In January 2026, Amway India requested the government to recognize food and dietary supplements as vital products that required customs duty adjustments because the 2025 GST reform made India’s nutraceutical market easier to access through its tax system and cost reductions.

The European Vitamin B4 Market Size experiences steady development because dietary supplements, functional foods and pharmaceutical products drive growing consumer demand for these products. Germany, France and the UK currently dominate the market because their consumers possess strong knowledge about nutrition, which drives them to choose products that contain natural ingredients and their strict regulatory standards guarantee product quality. The European Commission established anti-dumping duties on Choline Chloride from China in December 2025, which applied to Shandong Aocter at 115.9% and, Shandong FY and Yinfeng at 90% and all other companies at 94.9% across multiple CN codes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Vitamin B4 Market Size, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Lonza Group Ltd

- DSM Nutritional Products

- GHW International

- Jubilant Ingrevia Limited

- Balchem Corporation

- ADM (Archer Daniels Midland Company)

- Evonik Industries AG

- Cargill Incorporated

- Merck KGaA

- Adisseo France SAS

- Glanbia PLC

- Kemin Industries, Inc.

- DuPont de Nemours, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2024, Jubilant Ingrevia announced plans to expand Vitamin B4 (Choline Chloride) production with a new GMP-compliant facility in India. The move aims to boost domestic leadership and capitalize on EU anti-dumping measures against Chinese imports, creating promising export opportunities for the company.

- In June 2024, Balchem launched Optifolin+, a choline-enriched folate combining L-5-MTHF and VitaCholine to support cellular health from pregnancy through adulthood. Offering superior stability and solubility, Optifolin+ simplifies supplement formulation, marking a significant advancement in the US dietary supplement market.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Vitamin B4 Market Size based on the below-mentioned segments:

Global Vitamin B4 Market Size, By Product Type

- Tablets

- Capsules

- Powders

- Liquids

Global Vitamin B4 Market Size, By Application

- Dietary Supplements

- Pharmaceuticals

- Animal Feed

- Functional Food and Beverages

- Others

Global Vitamin B4 Market Size, By Distribution Channel

- Online Stores

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

Global Vitamin B4 Market Size, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Vitamin B4 Market Size over the forecast period?The global Vitamin B4 Market Size is projected to expand at a CAGR of 4.3% during the forecast period.

-

2. What is the market size of the Vitamin B4 Market Size?The global Vitamin B4 Market Size is expected to grow from USD 1023.7 million in 2024 to USD 1626.4 million by 2035, at a CAGR of 4.3% during the forecast period 2025-2035.

-

3. What is the global Vitamin B4 Market Size?The global Vitamin B4 Market Size involves the production and consumption of vitamin B4 for dietary supplements, pharmaceuticals, animal nutrition, and functional foods worldwide.

-

4. Which region holds the largest share of the Vitamin B4 Market Size?North America is anticipated to hold the largest share of the Vitamin B4 Market Size over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global Vitamin B4 Market Size?BASF SE, Lonza Group Ltd, DSM Nutritional Products, GHW International, Jubilant Ingrevia Limited, Balchem Corporation, ADM (Archer Daniels Midland Company), Evonik Industries AG, Cargill Incorporated, Merck KGaA, and Others.

-

6. What factors are driving the growth of the Vitamin B4 Market Size?Rising health consciousness, increasing adoption of dietary supplements, and growing demand for fortified foods are driving the Vitamin B4 Market Size, supported by its critical role in metabolism and cellular health.

-

7. What are the market trends in the Vitamin B4 Market Size?The Vitamin B4 Market Size trends include rising demand for cognitive and liver health supplements, increased focus on plant-based and natural sources, personalized nutrition, innovative formulations, and expanding research on health benefits globally.

-

8. What are the main challenges restricting wider adoption of the Vitamin B4 Market Size?Key challenges restricting the vitamin B4 (adenine) market include high production costs, complex synthesis, stringent regulatory compliance, limited awareness of benefits, and the fact that it is not considered essential.

Need help to buy this report?