China Dietary Supplements Market Size, Share, By Ingredients (Vitamins, Botanicals, Minerals), By Form (Tablets, Capsules, Soft Gels, Powders, Gummies, Liquid, and Others), China Dietary Supplements Market Insights, Industry Trend, Forecasts to 2035. By Ingredients, By Form

Industry: Food & BeveragesChina Dietary Supplements Market Insights & Forecasts to 2035

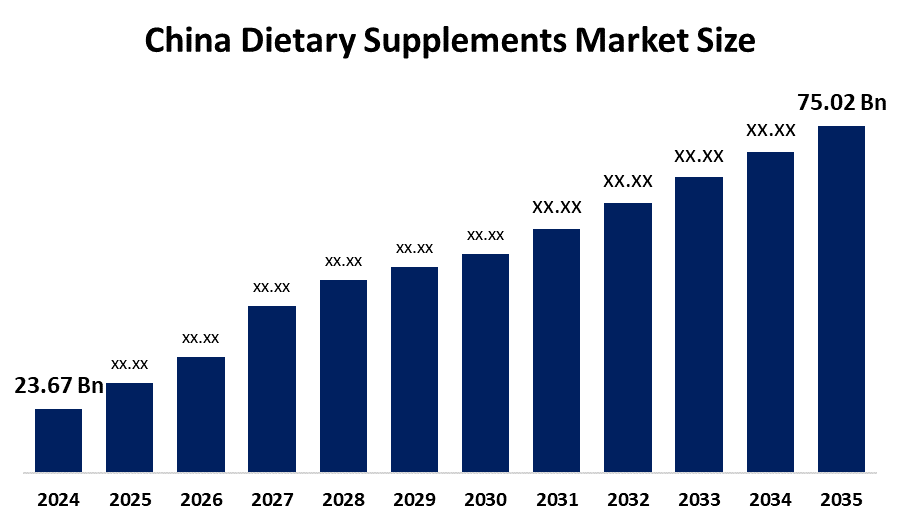

• China Dietary Supplements Market Size (2024): USD 23.67 Bn

• China Dietary Supplements Market Size (2035): USD 75.02 Bn

• China Dietary Supplements Market CAGR (2024–2035): 11.06%

• China Dietary Supplements Market Segments: Ingredients and Form

Get more details on this report -

The China dietary supplements market is a large and rapidly growing sector, which is covering the vitamins, minerals, herbal supplements, probiotics, and the functional nutrition products, shifting from basic formulations towards the innovative, value-added offerings high domestic demand, rising health consciousness, urbanization, e-commerce growth, government support for health and wellness, and intense competition between domestic producers and international brands driven by shifting consumer preferences, digital adoption, and nutrition-focused regulations are some of its unique characteristics. Product innovation, customized nutrition, premiumization tendencies, and the incorporation of functional ingredients all functioning within a convoluted legislative and economic framework are rapidly defining China's industry.

The Healthy China 2030 Initiative promotes preventive healthcare, balanced nutrition, and healthy lifestyles to combat rising chronic diseases, encouraging the use of functional foods and dietary supplements. This policy framework supports innovation, premiumization, and market expansion, providing strong growth opportunities for China’s dietary supplement and wellness industry.

The China dietary supplements market offers significant growth which is driven by the rising health and wellness awareness, increasing demand for the functional nutrition, and the innovations in vitamins, minerals, probiotics, and the herbal supplements. Immunity boosters, prenatal and baby nutrition, sports supplements, and anti-aging formulations which are backed by government regulations encouraging preventative healthcare and quality standards are the main industries. Clean-label trends, e-commerce growth, digital marketing, AI-assisted product development, personalization, and consumer desire for premium, safe, and convenient supplements are all driving market expansion and opening doors for both local and foreign competitors.

China Dietary Supplements Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 23.67 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 11.06% |

| 2035 Value Projection: | USD 75.02 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 196 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Ingredients, By Form |

| Companies covered:: | BY-HEALTH Co., Ltd., Infinitus Company Ltd,Amway Nutrilite (Amway China Enterprises) Herbalife Ltd., Nestlé Health Science; China Shineway Pharmaceutical Group Ltd,Xianle Health Technology Co., Ltd., Beijing Tong Ren Tang Technology Development Co., Ltd., Glanbia plc.and other key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the China Dietary Supplements Market

The China dietary supplements market is driven by a growing health-conscious population, rising disposable incomes, and strong government support for preventive healthcare, quality standards, and functional nutrition development. The expansion of e-commerce, rapid urbanization, and evolving consumer preferences are increasing demand for immunity boosters, sports nutrition, prenatal and infant supplements, and anti-aging formulations. China is transitioning from a commodity-focused supplement market to a global innovation hub, supported by rising demand for vitamins, minerals, probiotics, herbal products, and personalized nutrition solutions. Advancements in smart manufacturing, AI-assisted product development, clean-label trends, and international collaborations are enabling China to emerge as a major supplier of high-quality dietary supplements in both domestic and global markets.

Despite strong growth potential, the China dietary supplements market faces several restraints, including intense price competition, quality and safety concerns, fragmented industry standards, intellectual property risks, and a shortage of skilled talent. In addition, reliance on imported raw materials, active ingredients, and proprietary formulations, along with complex regulatory frameworks and geopolitical uncertainties, continues to challenge domestic innovation and profitability.

The future of China’s dietary supplements market remains highly promising, driven by continuous product innovation, supportive government policies, and rising consumer demand for health, wellness, and functional nutrition products. Growth opportunities are expanding across vitamins, minerals, probiotics, herbal supplements, and personalized formulations, supported by AI-assisted product development, clean-label innovations, and functional beverage launches. Furthermore, advances in smart manufacturing, quality monitoring systems, big data analytics, and digitalized supply chains are improving production efficiency, regulatory compliance, and product accessibility, positioning China as a global hub for innovative and premium nutrition solutions.

Market Segmentation

The China dietary supplements market share is classified into ingredients and form.

By Ingredients

The China dietary supplements market is divided by ingredients into vitamins, botanicals, minerals. Among these, the vitamins segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because Consumers strongly associate vitamins with supporting general health, immunity, energy levels, and addressing nutritional deficiencies, making them a preferred choice for daily wellness and preventive healthcare.

By Form

The China dietary supplements market is divided by form into tablets, capsules, soft gels, powders, gummies, liquid, and others. Among these, the tablets segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is due to their convenience, cost-effectiveness, and consumer familiarity.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the China dietary supplements market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the China Dietary Supplements Market

• BY-HEALTH Co., Ltd.

• Infinitus Company Ltd.

• Amway Nutrilite (Amway China Enterprises)

• Herbalife Ltd.

• Nestlé Health Science

• China Shineway Pharmaceutical Group Ltd.

• Xianle Health Technology Co., Ltd.

• Beijing Tong Ren Tang Technology Development Co., Ltd.

• Glanbia plc.

• Other key players

Key Target Audience

-

Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China dietary supplements market based on the below-mentioned segments:

China Dietary Supplements Market, By Ingredients

- Vitamins

- Botanicals

- Minerals.

China Dietary Supplements Market, By Form

- Tablets

- Capsules

- Soft Gels

- Powders

- Gummies

- Liquid

- Others.

Frequently Asked Questions (FAQ)

-

Q: What is the China dietary supplements market size?A: China dietary supplements market is expected to grow from USD 23.67 billion in 2024 to USD 75.02 billion by 2035, growing at a CAGR of 11.06% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the growing health-conscious population, rising disposable incomes, and the strong government support for the preventive healthcare, quality standards, and the functional nutrition development.

-

Q: What factors restrain the China dietary supplements market?A: Constraints include the intense price competition, quality and safety concerns, fragmented industry standards, intellectual property risks, and shortages of skilled talent.

-

Q: How is the market segmented by ingredients?A: The market is segmented into vitamins, botanicals, minerals.

-

Q: Who are the key players in the China dietary supplements market?A: Key companies include BY‑HEALTH Co., Ltd., Infinitus Company Ltd., Amway Nutrilite / Amway China Enterprises, Herbalife Ltd., Nestlé Health Science, China Shineway Pharmaceutical Group Ltd., Xianle Health Technology Co., Ltd., Beijing Tong Ren Tang Technology Development Co., Ltd., and Glanbia plc., and Others

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?