Global Vinyl Acetate Monomer Market Size, Share, and COVID-19 Impact Analysis, By Product (Liquid VAM, Solid VAM, Stabilized VAM, and Others), By Application (Polyvinyl Acetate (PVA), Polyvinyl Alcohol (PVOH), Vinyl Acetate-Ethylene (VAE) Copolymer, and Others), By End-User (Adhesives & Sealants, Textile, Paints & Coatings, Paper & Packaging, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Vinyl Acetate Monomer Market Insights Forecasts To 2035

- The Global Vinyl Acetate Monomer Market Size Was Estimated At USD 11223.5 Million In 2024

- The Market Size Is Expected To Grow At A CAGR Of Around 5.3% From 2025 To 2035

- The Worldwide Vinyl Acetate Monomer Market Size Is Expected To Reach USD 19812.7 Million By 2035

- North America Is Expected To Grow The Fastest During The Forecast Period.

Get more details on this report -

According To A Research Report Published By Spherical Insights And Consulting, The Global Vinyl Acetate Monomer Market Size Was Worth Around USD 11223.5 Million In 2024 And Is Predicted To Grow To Around USD 19812.7 Million By 2035 With A Compound Annual Growth Rate (CAGR) Of 5.3% From 2025 To 2035. The market for vinyl acetate monomer is increasing with increasing demand from adhesive, coating, and textile applications, and with increasing industrialization, construction activity, and packaging demand, and is driven extensively through the use of VAM-based resin such as PVAc and EVA.

Market Overview

The Global Vinyl Acetate Monomer (VAM) Market Size Involves Both The Production And Consumption Of VAM, Which Refers To A Colorless Volatile Organic Liquid. VAM Is A Crucial Building Block For The Production Of Polymers As Well As Resins. VAM finds wide applications in the form of a precursor for the production of polyvinyl acetate (PVAc) and Ethylene-vinyl acetate (EVA) resins in the following applications: adhesive applications, paint applications, textile applications, packaging applications, footwear applications, as well as automotive applications. The drivers for market growth are the applications of VAM as a precursor for the production of PVAc & EVA materials due to rapid industrialization & urbanization.

Growth Opportunities Are The Development Of New Eco-Friendly VAM Materials. The Major Market Size Players Are Celanese Corporation, Wacker Chemie AG, Dow Inc., Chang Chun Group, And Anhui BBCA Chemicals. The market is also driven by raw materials, government regulations, and environmental factors. In February 2024, India’s Ministry of Chemicals and Fertilisers approved a new Quality Control Order (QCO) for VAM. According to this, VAM sold in India is required to be IS 12345:1988. These activities have been taken to improve quality and quality compliance in manufacturing and imports related to chemicals in India.

Report Coverage

This Research Report Categorizes The Vinyl Acetate Monomer Market Size Based On Various Segments And Regions, Forecasts Revenue Growth, And Analyzes Trends In Each Submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the vinyl acetate monomer market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the vinyl acetate monomer market.

Global Vinyl Acetate Monomer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 11223.5 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 5.3% |

| 2023 Value Projection: | 19812.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By End-User By Product |

| Companies covered:: | Celanese Corporation, Dow Inc., Wacker Chemie AG, Anhui BBCA Chemicals, LyondellBasell Industries, Chang Chun Group, KURARAY CO., Arkema, Sinopec Group, Kuraray Co., Ltd., Solventis, DuPont de Nemours, Inc., Exxon Mobil Corporation, Dairen Chemical Corporation, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Vinyl Acetate Monomer (VAM) Market Size Is Largely Fueled By The Growing Demand For Adhesives, Paint, Coating, And Textiles, For Which VAM Is A Major Raw Material. Industrialisation, urbanisation, and growth in the construction industry trigger the use of VAM derivatives. The increasing demand for polyvinyl acetate (PVAc) and ethylene-vinyl acetate (EVA) resin in packaging materials, footwear, and vehicles spurs the market for VAM further. In addition to this, increasing demand from emerging nations and advancements in VAM polymerization technology trigger growth in VAM production.

Restraining Factors

The Global Vinyl Acetate Monomer (VAM) Market Size Is Restrained By Fluctuating Raw Material Prices, High Production Costs, And Strict Environmental Regulations On Account Of Toxic Emissions. Health and safety concerns during handling, coupled with competition from alternative monomers and polymers, would also limit wider adoption and slow down the market growth globally.

Market Segmentation

The vinyl acetate monomer market share is classified into product, application, and end-user.

- The liquid VAM segment dominated the market in 2024, approximately 54% and is projected to grow at a substantial CAGR during the forecast period.

Based On The Product, The Vinyl Acetate Monomer Market Size Is Divided Into Liquid VAM, Solid VAM, Stabilized VAM, And Others. Among these, the liquid VAM segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The liquid VAM segment dominated the market growth due to its ease of handling, storage, and transportation compared to the gaseous one. Further, it has been considered versatile for the production of PVAc and EVA resins in adhesives, paints, coatings, and packaging applications, hence increasing demand and becoming the preferred choice for manufacturers globally.

- The polyvinyl acetate (PVA) segment accounted for the largest share in 2024, approximately 50% and is anticipated to grow at a significant CAGR during the forecast period.

Based On The Application, The Vinyl Acetate Monomer Market Size Is Divided Into Polyvinyl Acetate (PVA), Polyvinyl Alcohol (PVOH), Vinyl Acetate-Ethylene (VAE) Copolymer, And Others. Among these, the polyvinyl acetate (PVA) segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. PVA held the largest share in the market owing to its wide application in adhesives, paintings, coatings, and construction materials. Its strong bonding nature, cost-effectiveness, and compatibility with various substrates will spur high demand for PVA; further, the growth in the construction, packaging, and textiles sectors is reinforcing the dominance of PVA in the global vinyl acetate monomer market.

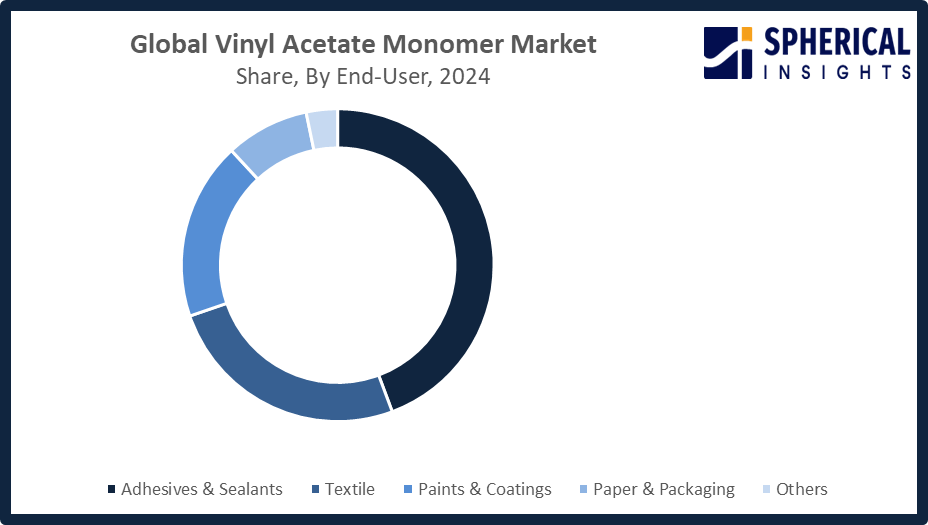

- The adhesives & sealants segment accounted for the highest market revenue in 2024, approximately 44% and is anticipated to grow at a significant CAGR during the forecast period.

Based On The End-User, The Vinyl Acetate Monomer Market Size Is Divided Into Adhesives & Sealants, Textile, Paints & Coatings, Paper & Packaging, And Others. Among these, the adhesives & sealants segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The adhesives & sealants application growth in the market is due to the increasing demand from industries such as the construction industry, the automotive industry, and the packaging industry. Vinyl acetate monomer-based resins, PVAc, and EVA resins have high adhesive properties and are also flexible and durable. For this reason, they are ideal for producing high-performance adhesives and sealants.

Get more details on this report -

Regional Segment Analysis of the Vinyl Acetate Monomer Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the vinyl acetate monomer market over the predicted timeframe.

Asia Pacific Is Anticipated To Hold The Largest Share Of The Vinyl Acetate Monomer Market Size Over The Predicted Timeframe. Asia Pacific is anticipated to occupy the 48% share in the vinyl acetate monomer (VAM) market on the back of the strong chemical and polymer production backdrop in the region. Infrastructure development in the Asia Pacific region due to the increase in the application of adhesives in the paints industry is another major reason for the growth in the VAM market in the Asia Pacific region. In the March 2024 update, Asian Paints (Polymers) Pvt. Ltd. started the construction of the Rs. 2,100 crore VAM and VAE plant in Dahej, Gujarat. The project includes the storage of ethylene worth Rs. 460 crore, strengthening local production and supply chains.

North America Is Expected To Grow At A Rapid CAGR In The Vinyl Acetate Monomer Market Size During The Forecast Period. The market in North America is expected to have a 20% market share of the VAM industry. The increased demands in the construction, car, and consumer goods sectors with regard to adhesives, coatings, and packaged goods are expected to be responsible for this. The United States is leading in this region. Advanced infrastructure in its chemical manufacturing industry and technological advancements in polymerization technologies are causing this. The increasing support of the government for growth in the industry and demand for environment-friendly and quality products is adding fuel to the growth of the market in North America.

Europe Is Observing An Increase In Its Vinyl Acetate Monomer (VAM) Market Size With Rising Demands From Sustainable Adhesives, Paints, Coatings, And Construction Materials. The German market is leading this region with its sophisticated production facilities in chemicals. The rise in demand from the automotive and packaging industry, along with strict environmental laws that promote environmentally sustainable manufacturing practices, is encouraging industry players to choose environmentally responsible VAM production that is certified to have low Greenhouse Gas Emissions.

Competitive Analysis:

The Report Offers The Appropriate Analysis Of The Key Organizations/Companies Involved Within The Vinyl Acetate Monomer Market Size, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Celanese Corporation

- Dow Inc.

- Wacker Chemie AG

- Anhui BBCA Chemicals

- LyondellBasell Industries

- Chang Chun Group

- KURARAY CO.

- Arkema

- Sinopec Group

- Kuraray Co., Ltd.

- Solventis

- DuPont de Nemours, Inc.

- Exxon Mobil Corporation

- Dairen Chemical Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Kuraray Co., Ltd. announced that five vinyl acetate-related products, including VAM, PVOH, and EVOH resins and films, produced at its Okayama, Kurashiki, and Saijo plants in Japan, received ISCC PLUS certification, establishing a certified sustainable supply chain starting with VAM production at the Okayama Plant.

- In March 2025, Celanese Corporation announced price increases for vinyl acetate monomer (VAM), vinyl-based emulsions, redispersible powders, and related derivatives across the Western Hemisphere. The revised pricing took effect from March 17, 2025, or as permitted under existing contracts, reflecting market and cost pressures.

- In March 2021, Celanese Corporation announced new investments to expand its emulsion polymers and vinyl acetate production through facility expansions, new units, and debottlenecking projects in Europe and Asia. The move reinforces Celanese’s commitment to strengthening its vinyls portfolio and leadership across its Acetyl Chain and derivative businesses.

- In May 2020, Celanese Corporation signed a memorandum of understanding with Anhui Wanwei Group to supply green, ethylene-based vinyl acetate monomer (VAM). The long-term agreement aims to meet about 50% of Wanwei’s captive demand for chemicals, fibers, and advanced materials manufacturing in Anhui Province, China.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the vinyl acetate monomer market based on the below-mentioned segments:

Global Vinyl Acetate Monomer Market, By Product

- Liquid VAM

- Solid VAM

- Stabilized VAM

- Others

Global Vinyl Acetate Monomer Market, By Application

- Polyvinyl Acetate (PVA)

- Polyvinyl Alcohol (PVOH)

- Vinyl Acetate-Ethylene (VAE) Copolymer

- Others

Global Vinyl Acetate Monomer Market, By End-User

- Adhesives & Sealants

- Textile

- Paints & Coatings

- Paper & Packaging

- Others

Global Vinyl Acetate Monomer Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the vinyl acetate monomer market over the forecast period?The global vinyl acetate monomer market is projected to expand at a CAGR of 5.3% during the forecast period.

-

2. What is the market size of the vinyl acetate monomer market?The global vinyl acetate monomer market size is expected to grow from USD 11223.5 million in 2024 to USD 19812.7 million by 2035, at a CAGR of 5.3% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the vinyl acetate monomer market?Asia Pacific is anticipated to hold the largest share of the vinyl acetate monomer market over the predicted timeframe.

-

4. What is the vinyl acetate monomer market?The vinyl acetate monomer (VAM) market involves the production and use of VAM, a key chemical for adhesives, coatings, and resins.

-

5. Who are the top 10 companies operating in the global vinyl acetate monomer market?Celanese Corporation, Dow Inc., Wacker Chemie AG, Anhui BBCA Chemicals, LyondellBasell Industries, Chang Chun Group, KURARAY CO., Arkema, Sinopec Group, Kuraray Co., Ltd., and Others.

-

6. What factors are driving the growth of the vinyl acetate monomer market?The vinyl acetate monomer market is driven by rising demand for adhesives, paints, coatings, and textiles, industrial growth, expanding construction and packaging sectors, and increasing use of VAM-based resins like PVAc and EVA.

-

7. What are the market trends in the vinyl acetate monomer market?Key trends in the vinyl acetate monomer market include sustainable production, increased use in eco-friendly adhesives and coatings, and growing demand in emerging economies.

-

8. What are the main challenges restricting wider adoption of the vinyl acetate monomer market?The vinyl acetate monomer market faces challenges from fluctuating raw material costs, high production expenses, strict environmental regulations, health and safety concerns, and competition from alternative monomers and polymers, limiting broader adoption.

Need help to buy this report?