United States Pain Patch Market Size, Share, By Product Type (Heat Patch, Cold Patch, Medicated Patch, Herbal Patch, And Transdermal Patch), By Distribution Channel (Online, Offline, Pharmacies, Supermarkets, And Specialty Stores), By Application (Chronic Pain Relief, Acute Pain Relief, Muscle Pain Relief, Joint Pain Relief, And Post-Operative Pain Relief), And United States Pain Patch Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Pain Patch Market Size Insights Forecasts to 2035

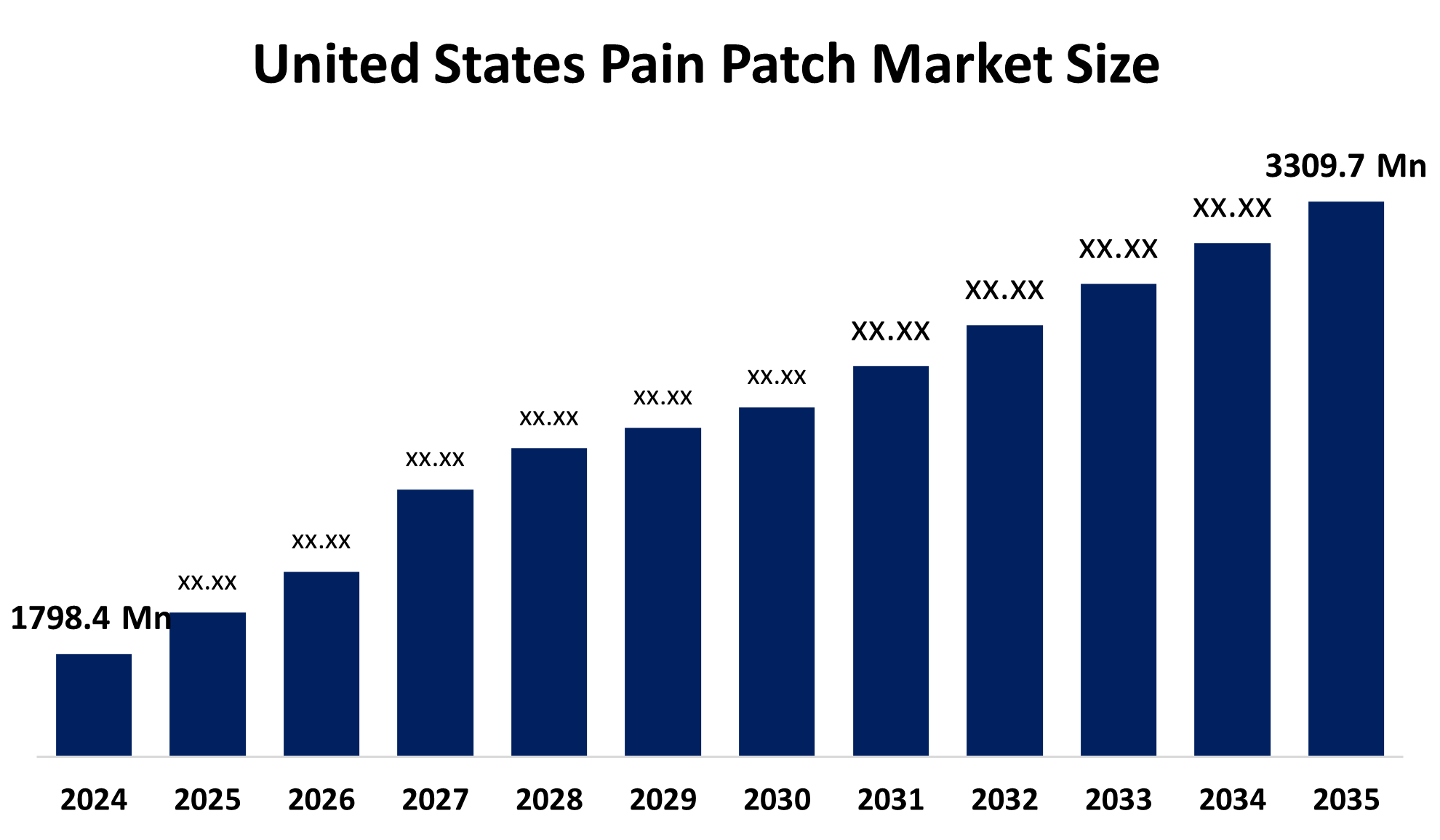

- United States Pain Patch Market Size 2024: USD 1798.4 Mn

- United States Pain Patch Market Size 2035: USD 3309.7 Mn

- United States Pain Patch Market CAGR 2024: 5.7%

- United States Pain Patch Market Segments: Product Type, Distribution Channel, and Application

Get more details on this report -

The United States Pain Patch Market Size refers to the sector of transdermal and topical patches containing medication to treat pain. They provide an alternative to providing drug therapy with prolonged and local effects. Pain patches have become widely available, mainly to treat chronic pain, including patients suffering from neuropathy, arthritis, back pain, migraines, as well as acute events, such as sports injuries and other forms of acute pain. Therefore, the pain patch represents a greater potential market, as it is part of the entire transdermal drug delivery system than just a particular class of drug. The industry continues to grow steadily over the next several years.

The pain patch in United States are backed by government support, including the NIH HEAL initiative is a US government research program that was designed to facilitate the development of scientific solutions to the national opioid and other pain-related public health emergencies by promoting the advancement of Non-Opioid therapies to treat pain and limiting the need for opioid addiction. According to the Center for Disease Control, approximately 50 Million adults experience chronic pain, which equates to roughly 20.9% of the United States' Adult population. Therefore, there is a great need to find suitable alternatives for pain patch relief in order to meet the needs of these individuals.

As technology advances, US pain patch providers are now using transdermal delivery systems improve drug absorption, provide controlled release profiles to help enhance patient experience. Multi-layer drug-in-adhesive designs are the next step in transdermal development; they will be equipped with 'smart' patch technology that allows for real-time monitoring of patient conditions and dosing adjustments to increase accuracy and convenience for patients.

Market Dynamics of the United States Pain Patch Market:

The United States Pain Patch Market Size is driven by the increasing prevalence of chronic pain conditions, aging population, greater preference within the healthcare industry for non-opioid and non-invasive solutions to manage chronic pain, increase in the number of cases of musculoskeletal disorders, increased access to education about these products and increased access to over-the-counter products through retail stores and online retailers.

The United States Pain Patch Market Size is restrained by the limited drug loading capacity when compared with systemic therapies, possibility of skin irritation or allergic reactions, some patches have a slower onset of action, and stringent regulation can delay product approval and result in higher levels of compliance costs.

The future of United States Pain Patch Market Size is bright and promising, with versatile opportunities emerging new technology made transdermal drug delivery systems more effective, easier to wear, and last longer than previous transdermal systems. The rise in e-commerce and retail distribution channels means consumers can access these products more easily than ever before. Additionally, U.S. manufacturers have a unique opportunity to capitalize on the potential growth of developing smart, long-acting, and combination-drug patches.

United States Pain Patch Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1798.4 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.7% |

| 2035 Value Projection: | USD 3309.7 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product Type, By Distribution Channel |

| Companies covered:: | Viatris Inc., Johnson & Johnson, Teva Pharmaceuticals Industries Ltd., Hisamitsu Pharmaceutical Co., Inc., Endo International plc, GlaxoSmithKline plc, Novartis AG, Amneal Pharmaceuticals LLC, Teikoku Pharma USA, Inc., Purdue Pharma L.P., 3M Company, Sanofi S.A., Noven Pharmaceuticals, Inc., Corium LLC, Abbott Laboratories, and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The United States Pain Patch Market share is classified into product type, distribution channel, and application.

By Product Type:

The United States Pain Patch Market Size is divided by product type into heat patch, cold patch, medicated patch, herbal patch, and transdermal patch. Among these, the medicated patch segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Non-invasive nature, offering sustained, controlled pain relief with higher patient compliance than oral meds, growing demand for convenient, effective pain management and improving patient adherence all contribute to the medicated patch segment's largest share and higher spending on pain patch when compared to other product type.

By Distribution Channel:

The United States Pain Patch Market Size is divided by distribution channel into online, offline, pharmacies, supermarkets, and specialty stores. Among these, the online segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The online segment dominates because of unparalleled convenience, a broad product selection, and competitive pricing that caters to modern consumer preferences for self-care and home healthcare solutions, and shift to self-medication and non-opioid options.

By Application:

The United States Pain Patch Market Size is divided by application into chronic pain relief, acute pain relief, muscle pain relief, joint pain relief, and post-operative pain relief. Among these, the chronic pain relief segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Growing population suffering from long-term conditions, a shift towards non-opioid, convenient, non-invasive treatments, aging population and advanced healthcare systems supporting innovation all contribute to the chronic pain relief segment's largest share and higher spending on pain patch when compared to other application.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United States Pain Patch Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United States Pain Patch Market:

- Viatris Inc.

- Johnson & Johnson

- Teva Pharmaceuticals Industries Ltd.

- Hisamitsu Pharmaceutical Co., Inc.

- Endo International plc

- GlaxoSmithKline plc

- Novartis AG

- Amneal Pharmaceuticals LLC

- Teikoku Pharma USA, Inc.

- Purdue Pharma L.P.

- 3M Company

- Sanofi S.A.

- Noven Pharmaceuticals, Inc.

- Corium LLC

- Abbott Laboratories

- Others

Recent Developments in United States Pain Patch Market:

- In March 2025, AposHealth launched the Apos System, a non-invasive, foot-worn medical device aimed at reducing chronic knee pain caused by osteoarthritis through a biomechanical approach.

- In January 2025, the FDA approved Vertex Pharmaceuticals novel non-opioid drug, Journavx 50 mg oral tablets, to treat moderate to severe acute pain in adults. This was the first new class of pain medication approved by the FDA in over two decades and works by selectively inhibiting NaV1.8 sodium channels in pain-sensing nerves, offering an alternative without the risk of addiction associated with opioids.

- In January 2025, Tris Pharma announced positive topline data from a phase 3 trial for its non-opioid pain medication, cebranopadol, indication potential for a future product launch.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States Pain Patch Market Size based on the below-mentioned segments:

United States Pain Patch Market, By Product Type

- Heat Patch

- Cold Patch

- Medicated Patch

- Herbal Patch

- Transdermal Patch

United States Pain Patch Market, By Distribution Channel

- Online

- Offline

- Pharmacies

- Supermarkets

- Specialty Stores

United States Pain Patch Market, By Application

- Chronic Pain Relief

- Acute Pain Relief

- Muscle Pain Relief

- Joint Pain Relief

- Post-Operative Pain Relief

Frequently Asked Questions (FAQ)

-

Q: What is the US pain patch market size?A: US pain patch market is expected to grow from USD 1798.4 million in 2024 to USD 3309.7 million by 2035, growing at a CAGR of 5.7% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increasing prevalence of chronic pain conditions, particularly among the aging population, growing preference for non-opioid and non-invasive pain management solutions, rising cases of musculoskeletal disorders, arthritis, sports injuries, and post-surgical pain, demand for convenient and targeted pain relief options, improved patient awareness and easier access to over-the-counter pain patches support wider adoption.

-

Q: What factors restrain the US pain patch market?A: Constraints include the limitations in drug loading capacity compared to systemic therapies, potential skin irritation or allergies, slower onset of action for some patches, and stringent regulatory requirements that can slow product approvals and increase compliance costs.

-

Q: How is the market segmented by product type?A: The market is segmented into heat patch, cold patch, medicated patch, herbal patch, and transdermal patch.

-

Q: Who are the key players in the US pain patch market?A: Key companies include Viatris Inc., Johnson & Johnson, Teva Pharmaceuticals Industries Ltd., Hisamitsu Pharmaceutical Co., Inc., Endo International plc, GlaxoSmithKline plc, Novartis AG, Amneal Pharmaceuticals LLC, Teikoku Pharma USA, Inc., Purdue Pharma L.P., 3M Company, Sanofi S.A., Noven Pharmaceuticals, Inc., Corium LLC, Abbott Laboratories, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?