Asia Pacific Ophthalmic Drugs Market Size, Share, and COVID-19 Impact Analysis, By Class (Anti-allergy, Anti-inflammatory, Non-steroidal drugs, Steroidal drugs, Anti-VEGF Agents, Anti-glaucoma, and Others), By Disease (Dry eye, Allergies, Glaucoma, Infection, Retinal Disorders, Uveitis, and Others), and Asia Pacific Ophthalmic Drugs Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareAsia Pacific Ophthalmic Drugs Market Size Insights Forecasts to 2035

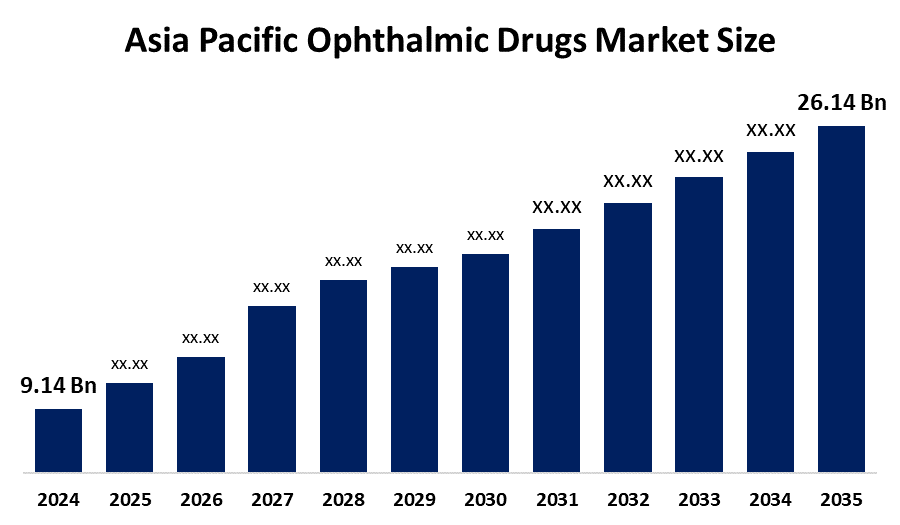

- The Asia Pacific Ophthalmic Drugs Market Size Was Estimated at USD 9.14 Billion in 2024.

- The Market Size is Expected to Grow at a CAGR of 10.02 % between 2025 and 2035.

- The Asia Pacific Ophthalmic Drugs Market Size is Anticipated to Reach USD 26.14 Billion by 2035.

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Asia Pacific Ophthalmic Drugs Market Size is anticipated to Hold USD 26.14 Billion by 2035, Growing at a CAGR of 10.02 % from 2025 to 2035. The Asia Pacific ophthalmic drugs market offers strong opportunities driven by rising cases of glaucoma, cataracts, and dry eye disease, along with rapid healthcare modernization, increased access to eye care, expanding elderly populations, and accelerated adoption of innovative biologics and targeted ocular therapies.

Market Overview

The Asia Pacific ophthalmic drugs market is experiencing strong growth driven by rising cases of eye disorders such as glaucoma, dry eye disease, cataracts, and diabetic retinopathy. Rapid population ageing, increasing screen exposure, and higher prevalence of diabetes are contributing to escalating demand for advanced ophthalmic treatments. Countries like China, India, and Japan are witnessing expanding healthcare infrastructure and increased spending on eye care services. Pharmaceutical companies are also launching innovative formulations, including sustained-release eye drops, biologics, and combination therapies. Growing awareness about early diagnosis, government-led vision care programs, and increasing access to ophthalmologists further support market expansion. Additionally, technological advancements in drug delivery systems are enhancing treatment efficacy and improving patient compliance, driving sustained market growth across the region.

Report Coverage

This research report categorizes the market for the Asia Pacific ophthalmic drugs market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific ophthalmic drugs market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific ophthalmic drugs market.

Asia Pacific Ophthalmic Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 9.14 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.02% |

| 2035 Value Projection: | USD 26.14 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 285 |

| Tables, Charts & Figures: | 133 |

| Segments covered: | By Class, By Disease and COVID-19 Impact Analysis |

| Companies covered:: | AbbVie Inc., Merck & Co., Inc., Alcon, Pfizer Inc., Novartis AG, Bayer AG, Lupin, Sun Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories Ltd., Santen Pharmaceutical Co., Ltd., Zhaoke Ophthalmology, and Arctic Vision Hong Kong Biotech Ltd. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Key factors driving the Asia Pacific ophthalmic drugs market include the rising burden of chronic eye disorders, driven by aging populations and lifestyle changes such as excessive screen exposure. Growing awareness of preventive eye care, coupled with improved access to ophthalmologists and diagnostic technologies, supports higher treatment uptake. Advancements in drug formulations, including biologics, sustained-release therapies, and combination drugs, are enhancing patient compliance and outcomes. Expanding healthcare infrastructure, along with government initiatives to strengthen eye care services, further accelerates market growth across the region.

Restraining Factors

Market growth is restrained by high treatment costs, limited access to advanced ophthalmic drugs in rural areas, and regulatory delays in approving novel therapies. Shortage of specialized ophthalmologists and competition from low-cost generics also challenge wider adoption of premium eye care treatments.

Market Segmentation

The Asia Pacific ophthalmic drugs market share is classified into class and disease.

Get more details on this report -

- The anti-glaucoma segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific ophthalmic drugs market is segmented by class into anti-allergy, anti-inflammatory, non-steroidal drugs, steroidal drugs, anti-VEGF agents, anti-glaucoma, and others. Among these, the anti-glaucoma segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is driven by the rising prevalence of glaucoma across aging populations in countries such as Japan, China, and South Korea, alongside increasing awareness and early diagnosis. Additionally, expanding access to advanced eye-care services, improved therapeutic formulations, and government-supported screening programs are strengthening demand. The growing shift toward combination therapies and sustained-release drug solutions further supports the robust outlook for this segment.

- The dry eye segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific ophthalmic drugs market is segmented by disease into dry eye, allergies, glaucoma, infection, retinal disorders, uveitis, and others. Among these, the dry eye segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because dry eye cases are rapidly increasing across the Asia Pacific region due to rising screen time, prolonged digital device usage, aging demographics, and environmental pollution. Additionally, growing awareness, improved diagnostic capabilities, and higher availability of advanced formulations including artificial tears, lipid-based drops, and prescription therapies—are further supporting segment growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific ophthalmic drugs market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AbbVie Inc.

- Merck & Co., Inc.

- Alcon

- Pfizer Inc.

- Novartis AG

- Bayer AG

- Lupin

- Sun Pharmaceutical Industries Ltd.

- Dr. Reddy’s Laboratories Ltd.

- Santen Pharmaceutical Co., Ltd.

- Zhaoke Ophthalmology

- Arctic Vision Hong Kong Biotech Ltd.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific ophthalmic drugs market based on the following segments:

Asia Pacific Ophthalmic Drugs Market, By Class

- Anti-allergy

- Anti-inflammatory

- Non-steroidal drugs

- Steroidal drugs

- Anti-VEGF Agents

- Anti-glaucoma

- Others

Asia Pacific Ophthalmic Drugs Market, By Disease

- Dry eye

- Allergies

- Glaucoma

- Infection

- Retinal Disorders

- Uveitis

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Asia Pacific ophthalmic drugs market size?A: Asia Pacific ophthalmic drugs market size is expected to grow from USD 9.14 Billion in 2024 to USD 26.14 Billion by 2035, growing at a CAGR of 10.02 % during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Key factors driving the Asia Pacific ophthalmic drugs market include the rising burden of chronic eye disorders, driven by aging populations and lifestyle changes such as excessive screen exposure.

-

Q: What factors restrain the Asia Pacific ophthalmic drugs market?A: Shortage of specialized ophthalmologists and competition from low-cost generics also challenge wider adoption of premium eye care treatments.

-

Q: How is the market segmented by class?A: The market is segmented into anti-allergy, anti-inflammatory, non-steroidal drugs, steroidal drugs, anti-VEGF agents, anti-glaucoma, and others.

-

Q: Who are the key players in the Asia Pacific ophthalmic drugs market?A: Key companies include AbbVie Inc., Merck & Co., Inc., Alcon, Pfizer Inc., Novartis AG, Bayer AG, Lupin, Sun Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories Ltd., Santen Pharmaceutical Co., Ltd., Zhaoke Ophthalmology, and Arctic Vision Hong Kong Biotech Ltd.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?