United Kingdom Defense Electronics Market Size, Share, By Vertical (Navigation, Communication, and Display, Electronic Warfare, Optronics, Radars, and C4ISR), By Electronic Warfare (Jammers, Self-protection EW Suites, Directed Energy Weapons, Directional Infrared Countermeasures, Antennas, IR Missile Warning Systems, & Others), United Kingdom Defense Electronics Market Insights, Industry Trend, Forecasts to 2035

Industry: Aerospace & DefenseUnited Kingdom Defense Electronics Market Size Insights Forecasts to 2035

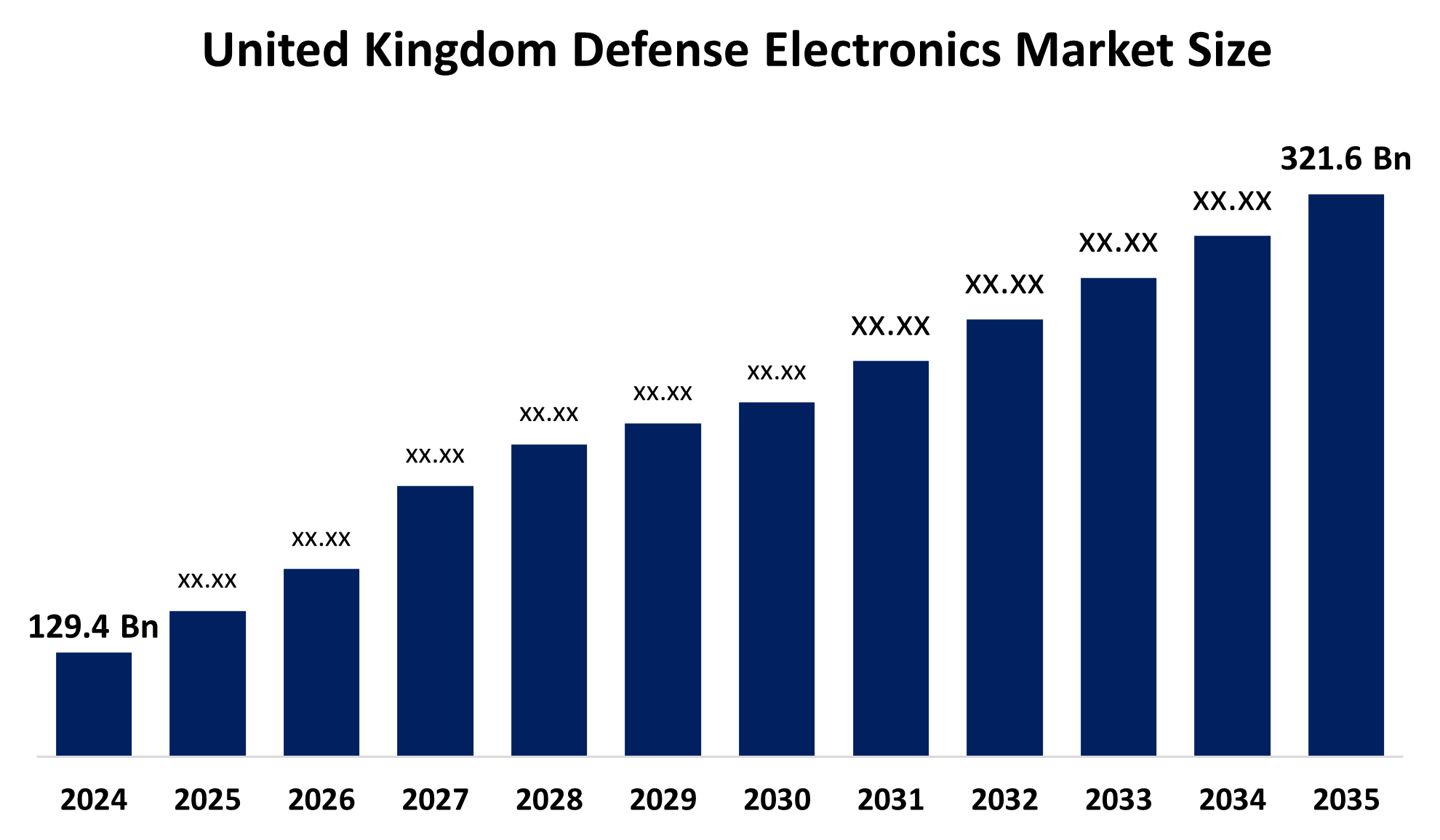

- United Kingdom Defense Electronics Market Size 2024: USD 129.4 Bn

- United Kingdom Defense Electronics Market Size 2035: USD 321.6 Bn

- United Kingdom Defense Electronics Market CAGR 2024: 8.61%

- United Kingdom Defense Electronics Market Segments: Vertical and Electronic Warfare

Get more details on this report -

The United Kingdom Defense Electronics Market Size includes the sophisticated systems for the military use, driven by the civil military integration and the huge government investments in the AI powered radars, EW, UAVs, smart C4ISR, cyber defense, and the directed energy weapons for land, sea, air and the space platforms, focusing on the technological self-reliance and advanced military capabilities. The United Kingdom’s defense electronic market is rapidly evolving market for the high tech electronic components and systems essential for modernizing its armed forces, which is emphasizing indigenous innovation and integration with the civilian tech.

The UK Defence Industrial Strategy aims to make the UK a leading tech-enabled defence power by 2035 and an engine for economic growth. It supports the defence electronics market through procurement reform, innovation acceleration, supply-chain resilience, and strengthened domestic capabilities in advanced electronic and digital defence technologies.

United Kingdom Defense Electronics Market Size offers the major future opportunities in the AI driven autonomous system like the robot dogs and drones, advanced Electronic warfare for jamming the protection, C4ISR computers, Intelligence, Surveillances, Reconnaissance’s, and the space based technology, which is driven by massive defense spending and the geopolitical tensions, focusing on indigenous innovation in sensors, cyber, and integrated system for naval, air, and ground platforms.

Market Dynamics of the United Kingdom Defense Electronics Market

The United Kingdom Defense Electronics Market Size is driven by the massive government investments in military modernization, rising geopolitical tension, strategic goals to become a world-class force, and rapid tech adoption like AI for advanced radar, EW, cyber and autonomous systems aiming for network centric warfare capabilities. United Kingdom’s sustained the significant budget growth fuels demand for cutting edge electronics aiming to transform the PLA into the high tech force. Protecting the increasingly connected military networks from the cyber-attacks spurs demand for the advanced cybersecurity solutions.

The United Kingdom Defense Electronics Market Size is restrained by the international export restrictions, supply chin vulnerabilities for the high end components, and challenges regarding the perceived quality and reliability of its military products in the global market. The increasing use of interconnected digital infrastructure in defense systems heighten the risk of the cyber-attacks, Ensuring the security of these sensitive networks from potential breaches is a critical and ongoing challenge

United Kingdom's defense electronics sector has a bright future because of its military modernization, information, and military-civil fusion. Secure communications, AI-driven signal processing, radar systems, and electronic warfare are all seeing growth prospects. In order to fulfil changing national defense and security objectives, the integration of technologies like AI, 5G, sophisticated sensors, and quantum communication will improve interoperability, reinforce system intelligence, and increase operational efficiency.

United Kingdom Defense Electronics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 129.4 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.61% |

| 2035 Value Projection: | USD 321.6 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Vertical, By Electronic Warfare |

| Companies covered:: | BAE Systems, Leonardo UK, Thales UK, QinetiQ, Ultra Electronics, Raytheon UK, Lockheed Martin UK, Northrop Grumman UK, L3Harris UK, Saab UK, Chemring Group, Teledyne e2v and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The United Kingdom defense electronics market share is classified into vertical and electronic warfare.

By Vertical

The United Kingdom Defense Electronics Market Size is divided by vertical into navigation, communication, and display, electronic warfare, optronics, radars, and C4ISR. Among these, the navigation and communication segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment is expanding because of increasing government investment, particularly in display technologies. Additionally, the demand for sophisticated military systems, such as better communication capabilities and real-time decision-making, helped to drive segment expansion.

By Electronic warfare

The United Kingdom Defense Electronics Market Size is divided by electronic warfare into jammers, self-protection EW suites, directed energy weapons, directional infrared countermeasures, antennas, IR missile warning systems, & others. Among these, the Self-protection EW Suites segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is due to the need to protect military assets from evolving threats, and supported by significant investments in technical innovation.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom Defense Electronics Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United Kingdom Defense Electronics Market

- BAE Systems

- Leonardo UK

- Thales UK

- QinetiQ

- Ultra Electronics

- Raytheon UK

- Lockheed Martin UK

- Northrop Grumman UK

- L3Harris UK

- Saab UK

- Chemring Group

- Teledyne e2v

Recent Developments in United Kingdom Defense Electronics Market

- In May 2025, the UK Ministry of Defence and QinetiQ advanced a £160 million programme to accelerate next-generation laser and radio-frequency directed energy weapons, including DragonFire, strengthening the UK defence electronics market through high-energy laser, power, and control system innovation.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom Defense Electronics Market Size based on the below-mentioned segments:

United Kingdom Defense Electronics Market, By Vertical

- Navigation

- Communication and Display

- Electronic Warfare

- Optronics

- Radars

- C4ISR

United Kingdom Defense Electronics Market, By Electronic Distribution

- Jammers

- Self-protection EW Suites

- Directed Energy Weapons

- Directional Infrared Countermeasures

- Antennas

- IR Missile Warning Systems

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the United Kingdom defense electronics market size?A: United Kingdom defense electronics market is expected to grow from USD 129.4 billion in 2024 to USD 321.6 billion by 2035, growing at a CAGR of 8.61% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the massive government investments in military modernization, rising geopolitical tension, strategic goals to become a world-class force, and rapid tech adoption like AI for advanced radar, EW, cyber and autonomous systems aiming for network centric warfare capabilities.

-

Q: What factors restrain the United Kingdom defense electronics market?A: Constraints include the international export restrictions, supply chin vulnerabilities for the high end components, and challenges regarding the perceived quality and reliability of its military products in the global market.

-

Q: How is the market segmented by vertical?A: The market is segmented into navigation, communication and display, electronic warfare, optronics, radars, C4ISR.

-

Q: Who are the key players in the United Kingdom defense electronics market?A: Key companies include BAE Systems, Leonardo UK, Thales UK, QinetiQ, Ultra Electronics, Raytheon UK, Lockheed Martin UK, Northrop Grumman UK, L3Harris UK, Saab UK, Chemring Group, Teledyne e2v.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?