United States Satellite Communication Market Size, Share, and COVID-19 Impact Analysis, By Component (Equipment and Services), By Satellite Constellations (LEO, MEO, and GEO), and United States Satellite Communication Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited States Satellite Communication Market Insights Forecasts to 2035

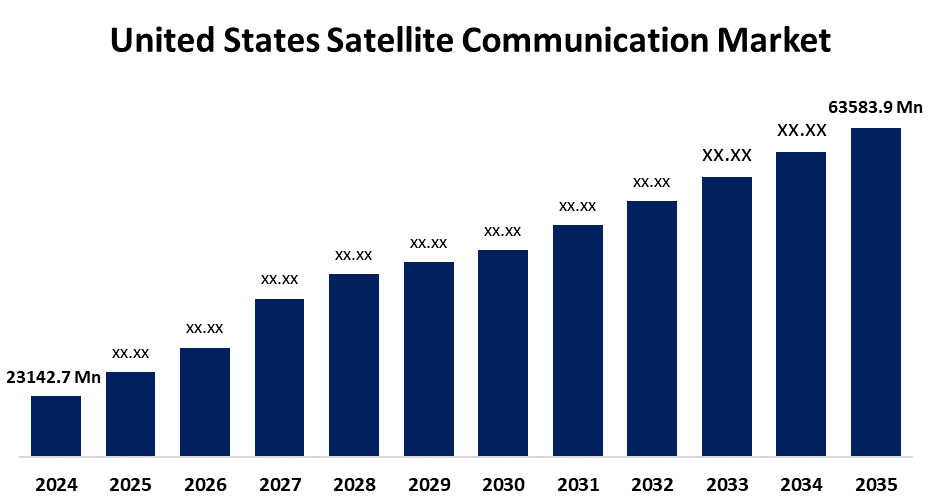

- The US Satellite Communication Market Size Was Estimated at USD 23142.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.62% from 2025 to 2035

- The US Satellite Communication Market Size is Expected to Reach USD 63583.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Satellite Communication Market is anticipated to reach USD 63583.9 million by 2035, growing at a CAGR of 9.62% from 2025 to 2035. The expansion of the United States satellite communication market is propelled by the rising need for high-throughput satellite systems, which offer substantially faster data rates and more capacity than conventional systems.

Market Overview

Satellite communication is the process of transmitting speech, data, video, and other types of information between remote parts of the planet by means of man-made satellites circling the earth. The commercial space sector is very influential on the US SATCOM market. As the private sector continues to engage in space exploration, satellite manufacturing, launch services, data transfer, and satellite-based communication become more prominent. The trend is spurring innovation in satellite services and technology, and industry competition. Companies building new satellite constellations for data analytics, telecommunication, earth observation, etc., are driving the growth of the SATCOM market. The Federal Communications Commission has focused on speeding up the satellite licensing process and expanding bandwidth for satellite communications. These legislative measures will lead to increased innovation, reduce market entry costs, and lead to new satellite systems. Several international accords and agreements are also impacting the reach and competitive posture of satellite operations and spectrum sales, thus generating increased revenues for the SATCOM market. The US coastal waters are the most at risk since they have open boundaries.

The U.S. Department of Defence has significantly increased its aid for commercial satellite integration. The Federal Communications Commission has advocated for licensing reforms that give national security screening top priority in satellite licensing in order to safeguard orbital operations and enhance regulatory integrity.

Report Coverage

This research report categorizes the market for the United States satellite communication market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States satellite communication market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States satellite communication market.

United States Satellite Communication Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 23142.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.62% |

| 2035 Value Projection: | USD 63583.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Component, By Satellite Constellations |

| Companies covered:: | Intelsat, EchoStar Corp Class A, Viasat Inc, L3Harris Technologies Inc, Inmarsat Global Limited, Iridium Communications Inc, Gilat Satellite Networks Ltd, Orbcomm Inc, Telesat, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States satellite communication market is boosted by technological progress, which is providing substantial support to the expansion and growth of the satellite communications industry. The technological advances that are impacting the industry are continuously proposing new ideas that are transforming the satellite communications industry through improvements to the reliability, efficiency, and overall performance of satellite communication systems. Technological advancements are one of the major driving forces for the development of the satellite communications industry. Various prerequisite technologies are evident in improving connectivity, increasing the uses, and re-imagining the potential solutions for occupying space in connected communication system.

Restraining Factors

The United States satellite communication market faces obstacles like the high costs associated with satellite communication services, for infrastructure, satellite development, launch, ongoing operation, etc. As the industry grows, taking measures and finding other ways to achieve similar results at lower costs will help provide greater access and develop continued innovation for the long-term growth of satellite communication services.

Market Segmentation

The United States satellite communication market share is classified into component and satellite constellations.

- The services segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States satellite communication market is segmented by component into equipment and services. Among these, the services segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven due to the increased market demand for satellite TV alongside the growth of the media and leisure sectors. The increased demand for satcom services is also supported by efforts to enable seamless transfer of data from data source sites to the end-user locations. Technology improvements are key to reductions in manufacturing costs, which will then result in reduced lease costs and can also support revenue growth in markets.

- The LEO segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the satellite constellations, the United States satellite communication market is segmented into LEO, MEO, and GEO. Among these, the LEO segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the demand for low earth orbiting satellites, for communications, to provide affordable internet access, significantly impacts market growth, and it is mainly due to the demand for internet, especially to gaps in underserved areas, or remote locations that have connectivity lacking or spasmodic or difficult to install, due to expensive costs compared to fixed line broadband systems.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States satellite communication market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Intelsat

- EchoStar Corp Class A

- Viasat Inc

- L3Harris Technologies Inc

- Inmarsat Global Limited

- Iridium Communications Inc

- Gilat Satellite Networks Ltd

- Orbcomm Inc

- Telesat

- Others

Recent Development

- In April 2025, SpinLaunch, a space technology company, announced a USD 12 million strategic investment from Kongsberg Defence & Aerospace to support the development and commercialization of its revolutionary Low-Earth Orbit (LEO) satellite broadband constellation, Meridian Space. This partnership highlights SpinLaunch’s commitment to delivering affordable and sustainable satellite communication services.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States satellite communication market based on the following segments:

United States Satellite Communication Market, By Component

- Equipment

- Services

United States Satellite Communication Market, By Satellite Constellations

- LEO

- MEO

- GEO

Need help to buy this report?