Global Tertiary Butyl Alcohol Market Size, Share, and COVID-19 Impact Analysis, By Type (Industrial Grade, and Reagent Grade), By End User (Chemicals, Pharmaceuticals, Cosmetics and Personal Care, Food and Beverage, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Tertiary Butyl Alcohol Market Size Insights Forecasts to 2035

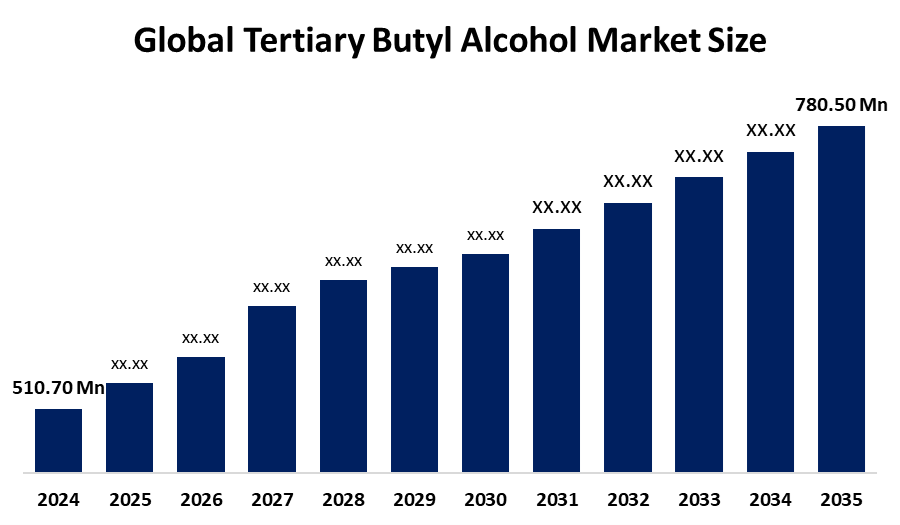

- The Global Tertiary Butyl Alcohol Market Size Was Estimated at USD 510.70 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.93 % from 2025 to 2035

- The Worldwide Tertiary Butyl Alcohol Market Size is Expected to Reach USD 780.50 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Tertiary Butyl Alcohol Market Size was valued at around USD 510.70 Million in 2024 and is predicted to grow to around USD 780.50 Million by 2035 with a compound annual growth rate (CAGR) of 3.93 % from 2025 to 2035. The growing demand for fuel additives, expansion of solvent types, use of pharmaceutical intermediates, growth in chemical manufacturing, advances in bio-based production, and increasing industrialization in emerging nations are all potential opportunities in the tertiary butyl alcohol market.

Market Overview

The global production, distribution, and consumption of tert-butanol, a branched alcohol that is mostly obtained from isobutylene hydration or, more indirectly, as a co-product with propylene oxide, contribute to the tertiary butyl alcohol (TBA) market. The complete supply chain, from producers and suppliers to the final consumers of different industries like chemicals, pharmaceuticals, fuels, and coatings, comprises the market participants. Recent announcements and launches by the government highlight the evolution of regulations. To improve fiscal monitoring of industrial emissions, the U.S. EPA issued a Superfund tax determination in September 2025 that included tert-butanol in taxable chemical listings. In order to mitigate groundwater contamination caused by MTBE degradation, California's Regional Water Quality Control Board implemented TBA discharge limitations (4 mg/L) under new NPDES permits in November 2025. The global market is mostly driven by the growing use of tertiary butyl alcohol as a chemical intermediate. The increasing demand for fuel additives is one of the main motivators. Oxygenated gasoline additives like MTBE and ETBE, which raise octane levels, decrease hazardous emissions, and increase fuel efficiency, are produced using TBA.

Report Coverage

This research report categorizes the tertiary butyl alcohol market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the tertiary butyl alcohol market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the tertiary butyl alcohol market.

Driving Factors

The demand for TBA is rising as a result of growing environmental concerns and strict emission restrictions that promote the use of cleaner and more effective fuel compositions. Chemical intermediate consumption has expanded due to rapid industrialization, particularly in emerging nations, which has directly boosted tertiary butyl alcohol market growth. Demand in the market is also being driven by the growing use of TBA in paints, coatings, and resins. It can be used in industrial paints and varnishes, supporting applications in the automotive and construction industries, owing to its exceptional solvency qualities. The growing pharmaceutical and chemical industries are another important factor.

Restraining Factors

The market for tertiary butyl alcohol is restricted by a number of problems, including fluctuating raw material costs, health and environmental issues, stringent regulations, the availability of substitute solvents and additives, difficulties with storage and shipping, and the waning use of MTBE in some areas.

Tertiary Butyl Alcohol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 510.70 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 3.93% |

| 2035 Value Projection: | 780.50 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End User |

| Companies covered:: | Indorama Ventures, LOTTE Chemical Corporation, LyondellBasell Industries Holdings B.V., Shandong Hengyuan Petrochemical Company Limited, Shandong Qilu Petrochemical Engineering Co. Ltd, Sisco Research Laboratories Pvt. Ltd., TASCO Chemical Corporation, Tokyo Chemical Industry Co., Ltd., ZiBo Haizheng Chemical Co., Ltd., Zibo Qixiang Tengda Chemical Co., Ltd., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The tertiary butyl alcohol market share is classified into type and end user.

- The industrial grade segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the tertiary butyl alcohol market is divided into industrial grade and reagent grade. Among these, the industrial grade segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The industrial-grade TBA is affordable and suitable for high-volume applications. It is widely utilized in fuel additive synthesis, paints, varnishes, resins, and large-scale chemical manufacturing. The use of industrial-grade TBA has been greatly increased by the rising demand for fuel additives like MTBE and ETBE, which raise octane ratings and lower emissions.

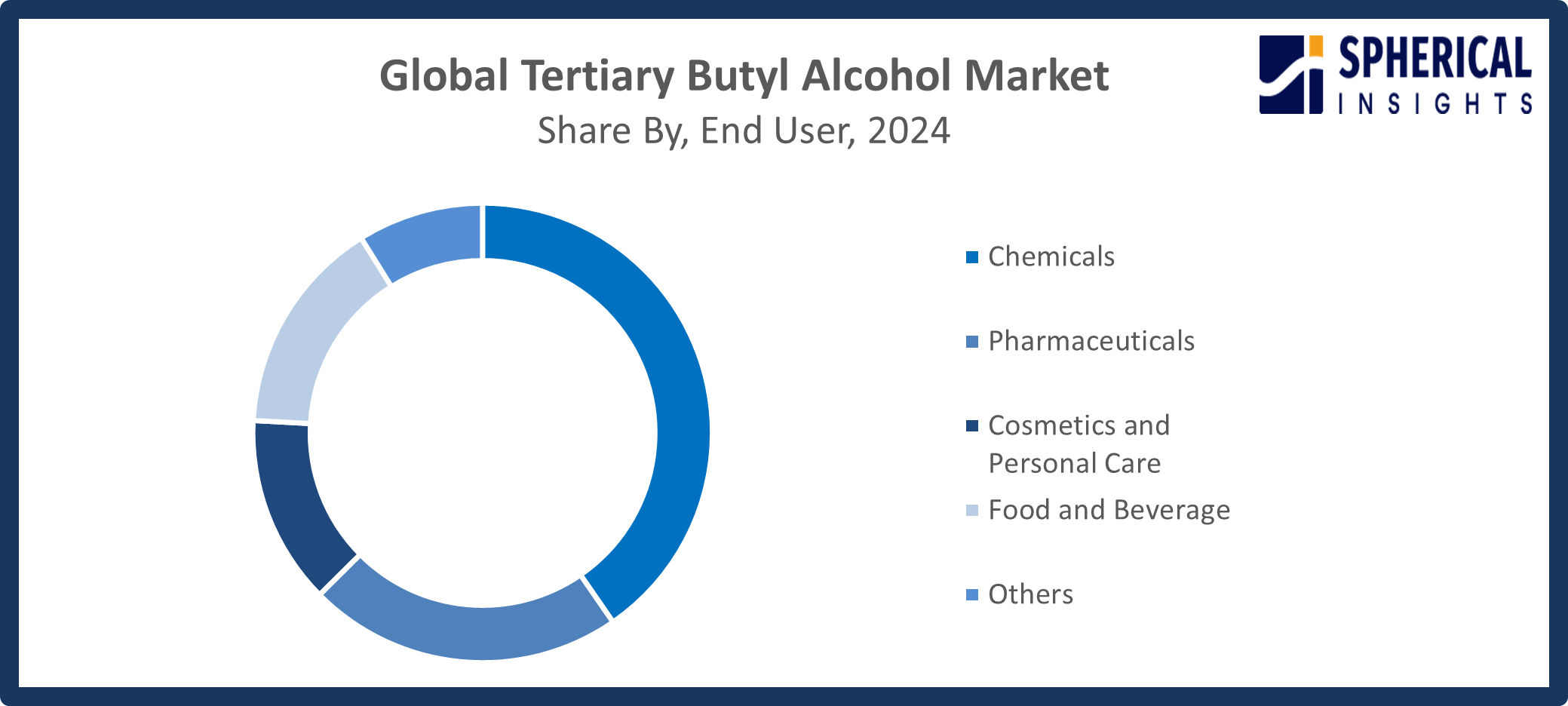

- The chemicals segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the tertiary butyl alcohol market is divided into chemicals, pharmaceuticals, cosmetics and personal care, food and beverage, and others. Among these, the chemicals segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. TBA's widespread use as a chemical intermediary in the manufacturing of oxygenated gasoline additives like MTBE and ETBE, as well as its application in the synthesis of specialized chemicals, solvents, and industrial resins, is what drives the chemicals industry. The market for high-performance chemical products has been further bolstered by the increasing industrialization of emerging economies.

Get more details on this report -

Regional Segment Analysis of the Tertiary Butyl Alcohol Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the tertiary butyl alcohol market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the tertiary butyl alcohol market over the predicted timeframe. A strong chemical industrial base is advantageous to the Asia Pacific area, especially in nations like China, India, Japan, and South Korea. Additionally, the region's ongoing need for tertiary butyl alcohol in a variety of types, including adhesives and medications, is fueled by expanding infrastructure construction and rising consumer goods demand. Japan's Ministry of Economy, Trade, and Industry reiterated its mission to produce 824 million liters of bioethanol per year through 2025 in December 2025, increasing the demand for ETBE through TBA hydration procedures. As trade policy changes, Indonesia's complete B35 biodiesel rollout, which has been in effect since 2024, indirectly increases the requirement for oxygenate.

North America is expected to grow at a rapid CAGR in the tertiary butyl alcohol market during the forecast period. The region's developed automobile sector encourages the use of TBA-based fuel additives to improve fuel economy and meet strict emission regulations. Growing R&D efforts in medicines and specialty chemicals further bolster industry expansion. Furthermore, increasing investments in the manufacturing of bio-based and sustainable chemicals are opening up new potential prospects. Partial waivers for 2025 cellulosic biofuels were described in a Federal Register notice dated September 18, 2025. The announcement recalibrated the criteria to 1.09 billion gallons and gave priority to advanced feedstocks that use TBA derivatives.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the tertiary butyl alcohol market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Indorama Ventures

- LOTTE Chemical Corporation

- LyondellBasell Industries Holdings B.V.

- Shandong Hengyuan Petrochemical Company Limited

- Shandong Qilu Petrochemical Engineering Co. Ltd

- Sisco Research Laboratories Pvt. Ltd.

- TASCO Chemical Corporation

- Tokyo Chemical Industry Co., Ltd.

- ZiBo Haizheng Chemical Co., Ltd.

- Zibo Qixiang Tengda Chemical Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2025, Kuwait and China launched a joint petrochemical initiative, including Tertiary Butyl Alcohol production units, boosting global supply, innovation, and industrial growth in high-value chemical markets.

- In February 2025, SABIC announced its 2024 results and a major MTBE project in Saudi Arabia, enhancing Tertiary Butyl Alcohol utilization for high-octane fuel production globally.

- In November 2024, Nouryon launched a major organic peroxide capacity expansion in Ningbo, China, increasing demand for Tertiary Butyl Alcohol to support polymer-enhancing chemical production in the Asia Pacific.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the tertiary butyl alcohol market based on the below-mentioned segments:

Global Tertiary Butyl Alcohol Market Size, By Type

- Industrial Grade

- Reagent Grade

Global Tertiary Butyl Alcohol Market Size, By End User

- Chemicals

- Pharmaceuticals

- Cosmetics and Personal Care

- Food and Beverage

- Others

Global Tertiary Butyl Alcohol Market Size, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the tertiary butyl alcohol market over the forecast period?The Global Tertiary Butyl Alcohol Market Size is projected to expand at a CAGR of 3.93% during the forecast period.

-

2. What is the market size of the tertiary butyl alcohol market?The Global Tertiary Butyl Alcohol Market Size is expected to grow from USD 510.70 million in 2024 to USD 780.50 million by 2035, at a CAGR of 3.93 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the tertiary butyl alcohol market?Asia Pacific is anticipated to hold the largest share of the tertiary butyl alcohol market over the predicted timeframe.

-

4. Who are the top companies operating in the Global Tertiary Butyl Alcohol Market Size?Indorama Ventures, LOTTE Chemical Corporation, LyondellBasell Industries Holdings B.V., Shandong Hengyuan Petrochemical Company Limited, Shandong Qilu Petrochemical Engineering Co. Ltd, Sisco Research Laboratories Pvt. Ltd., TASCO Chemical Corporation, Tokyo Chemical Industry Co., Ltd., ZiBo Haizheng Chemical Co., Ltd., Zibo Qixiang Tengda Chemical Co., Ltd., and Others.

-

5. What factors are driving the growth of the tertiary butyl alcohol market?The market for tertiary butyl alcohol is driven by the growing need for gasoline additives, the growth of the chemical and pharmaceutical sectors, the expansion of solvent types, the expansion of industry in emerging nations, and environmental legislation that support cleaner fuels.

-

6. What are the market trends in the tertiary butyl alcohol market?The increased usage of bio-based TBA in paints and coatings, production technological developments, increased demand for MTBE and ETBE, and strategic expansions by top chemical producers are some of the key industry trends.

-

7. What are the main challenges restricting the wider adoption of the tertiary butyl alcohol market?The availability of substitute solvents and additives, health concerns, severe environmental and safety laws, unstable raw material prices, and limited acceptance in some areas due to decreased MTBE consumption all restrict market growth.

Need help to buy this report?