France Polyisobutylene Market Size, Share, and COVID-19 Impact Analysis, By Product (High Molecular Weight, Medium Molecular Weight, and Low Molecular Weight), By End-use (Lubricant Additives, Adhesives & Sealants, and Automotive Rubber Components), and France Polyisobutylene Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsFrance Polyisobutylene Market Insights Forecasts to 2035

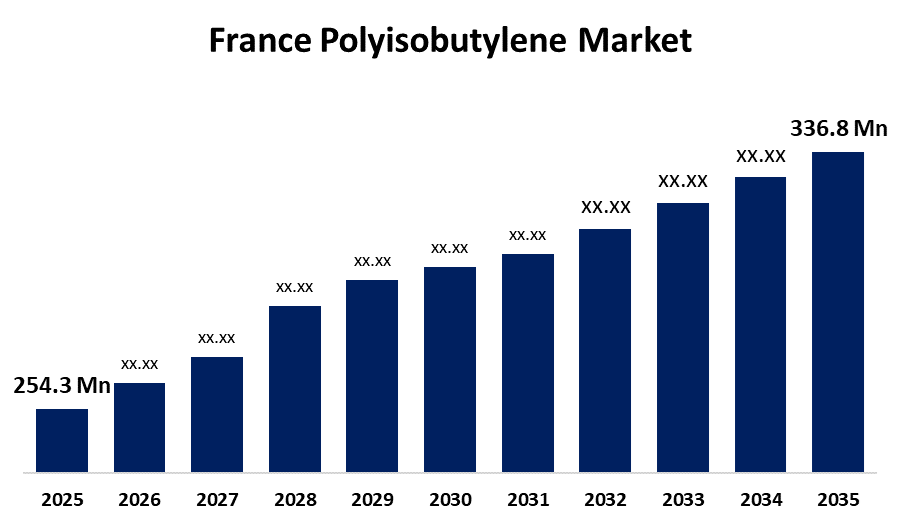

- The France Polyisobutylene Market Size was Estimated at USD 254.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.59% from 2025 to 2035

- The France Polyisobutylene Market Size is Expected to Reach USD 336.8 Million by 2035

Get more details on this report -

According to a Research Report Published By Spherical Insights & Consulting, the France Polyisobutylene Market Size is Anticipated to Reach USD 336.8 Million By 2035, Growing at a CAGR of 2.59% from 2025 to 2035. One of the main factors driving the market has been the automotive industry's steady growth as a result of rising consumer disposable income levels and urbanization.

Market Overview

The polyisobutylene (PIB) industry comprises the manufacture, distribution, and consumption of PIB, an elastomer or synthetic rubber which is manufactured by the polymerization of isobutylene. PIB possesses certain characteristic properties, that is, high molecular weight, low reactivity, as well as satisfactory adhesion and water resistance, because of which it finds many uses. The steady expansion of the automobile sector due to increased consumer disposable incomes and urbanization has been a major driving force for the market. PIB has extensive uses in engine oils, fuel additives, and lubricants, where it enhances performance by thickening viscosity, reducing friction, and extending the life of engine components. National demand for cleaner, fuel-efficient vehicles is increasing the use of high-performance lubricants, thus spurring the use of PIB. Continuous research in the chemical and petrochemical industries has also compelled industry players to increase product-launch frequencies since polyisobutylene plays an important role in shaping the demand for first-rate chemical compositions.

Report Coverage

This research report categorizes the market for the France polyisobutylene market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France polyisobutylene market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France polyisobutylene market.

France Polyisobutylene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 254.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.59% |

| 2035 Value Projection: | USD 336.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By End-use. |

| Companies covered:: | BASF SE, Group of Companies «Titan», INEOS, Braskem, ENEOS Corporation, Kothari Petrochemicals Limited, TPC Group, and Other Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is driven by the polyisobutylene assists in augmenting the functionality of fuel additives, lubricants, and coatings, allowing vehicles to satisfy these requirements. In addition to this, the expanding demand for environmentally friendly, biodegradable lubricants, sealants, and packaging makes PIB one of the leading choices in environmentally friendly formulations and supports the attention to decreasing ecological footprint and adhering to the principles of a circular economy. In advanced technology fields like aerospace, PIB is applied in advanced applications like lubricants, coatings, and sealants. Polyisobutylene finds broad application in drilling fluids for oil and gas exploration offshore because it has the capability of staying stable even under harsh conditions.

Restraining Factors

The polyisobutylene (PIB) industry is confronted by a number of challenges, such as competition from substitute materials, environmental regulations, and raw material price volatility. The manufacture of PIB, being a synthetic polymer, also has the potential to cause harm to the environment. Such challenges affect the profitability of PIB producers and may also impede market growth.

Market Segmentation

The France polyisobutylene market share is classified into product and end-use.

- The high molecular weight segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France polyisobutylene market is segmented by product into high molecular weight, medium molecular weight, and low molecular weight. Among these, the high molecular weight segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This special type of polyisobutylene exhibits higher viscosity, elasticity, and stability. The need for high molecular weight polyisobutylene (HMW PIB) is necessitated by unique industry requirements, such as those that demand the application of high-performance materials with superior chemical resistance, hardness, and versatility.

- The lubricant additives segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France polyisobutylene market is segmented by end-use into lubricant additives, adhesives & sealants, and automotive rubber components. Among these, the lubricant additives segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The ongoing expansion of the automobile industry and ensuing demand for high-performance engine oils are favorable for market growth. Polyisobutylene (PIB), especially the high molecular weight (HMW) type, is extensively used to formulate lubricant additives because of its distinctive characteristics like high viscosity, oxidation stability, and shear stability.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France polyisobutylene market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Group of Companies «Titan»

- INEOS

- Braskem

- ENEOS Corporation

- Kothari Petrochemicals Limited

- TPC Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Polyisobutylene Market based on the below-mentioned segments:

France Polyisobutylene Market, By Product

- High Molecular Weight

- Medium Molecular Weight

- Low Molecular Weight

France Polyisobutylene Market, By End-use

- Lubricant Additives

- Adhesives & Sealants

- Automotive Rubber Components

Need help to buy this report?