Global Stainless Steel Flat Market Size, Share, and COVID-19 Impact Analysis, By Type (Hot Rolled, Cold Rolled, Coils, Sheets, Plates, and Strips), By Application (Manufacturing, Construction, Automotive, and Industrial Equipment), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Stainless Steel Flat Market Size Insights Forecasts to 2035

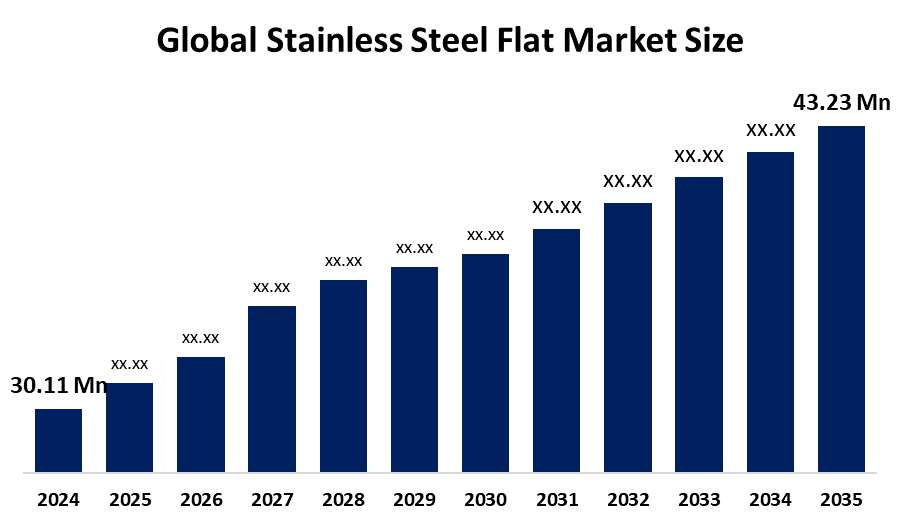

- The Global Stainless Steel Flat Market Size Was Estimated at USD 30.11 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.34% from 2025 to 2035

- The Worldwide Stainless Steel Flat Market Size is Expected to Reach USD 43.23 Million by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Stainless Steel Flat Market Size was worth around USD 30.11 Million in 2024 and is predicted to Grow to around USD 43.23 Million by 2035 with a compound annual growth rate (CAGR) of 3.34% from 2025 to 2035. The global stainless steel flat market is experiencing growth, which includes increasing infrastructure development, the expansion of automotive and appliance industries and the rising need for materials that resist corrosion and offer long-lasting durability, technological innovations and the environmental benefits of stainless steel, which can be recycled and reused.

Market Overview

The global stainless steel flat market includes all activities related to manufacturing, trading and using flat-rolled stainless steel products, which are produced in standard grades that include 304 and 316 and duplex. The construction industry, the automotive sector, the aerospace industry, the household appliance market, and the industrial equipment sector use these products due to their ability to resist corrosion, their long-lasting nature and their visual attractiveness. Market growth is driven by urbanisation, increasing automotive and infrastructure needs, and growing use of technology in food processing and medical facilities.

The Indian government introduced its third round of the Production-Linked Incentive (PLI) scheme for Specialty Steel in November 2025 through Union Minister H.D. Kumaraswamy. The program has a budget of Rs 6,322 crore, which aims to increase stainless steel output while decreasing import levels and establishing domestic manufacturing capabilities, according to Aatmanirbhar Bharat. The program supports 22 steel sub-categories, which provide incentive rates between 4% and 15% and has received investments totalling Rs 43,874 crore. The transition to high-grade stainless steel, which delivers value-added features while minimizing emissions, presents business opportunities because emerging markets expand and sustainable production technologies are developed. The market receives advantages because government policies provide support, while trade incentives exist, and consumers increasingly choose materials that offer high durability and corrosion resistance.

Report Coverage

This research report categorizes the stainless steel flat market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the stainless steel flat market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the stainless steel flat market.

Global Stainless Steel Flat Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 30.11 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.34% |

| 2035 Value Projection: | USD 43.23 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 176 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Acerinox S.A., POSCO, ArcelorMittal S.A., Jindal Stainless Limited, Outokumpu Oyj, Aperam S.A., Baosteel Group/Baowu, Yieh United Steel Corp., JFE Steel Corporation, AK Steel Corporation, Baosteel Stainless Ltd, Nippon Steel Corporation, ThyssenKrupp Stainless GmbH, Taiyuan Iron and Steel Group Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The stainless steel flat market which operates worldwide receives its main driving force from urbanization and infrastructure development activities which create a rising need for durable materials that resist corrosion and will be used in roofing and cladding and building structural elements. Automotive manufacturers require high-strength lightweight materials which provide heat resistance for their exhaust systems and electric vehicle (EV) battery housings. The material drives sustainable development because it can be recycled completely which results in its growing use in green building projects. Asian Pacific emerging economies have started to boost their production and consumption activities to meet the needs of their industrial production and consumer products.

Restraining Factors

The worldwide stainless steel flat market faces key challenges which include high price fluctuations of nickel and chromium raw materials which create manufacturing cost challenges for producers. Market growth is restricted because of three factors which include rising trade protectionism through tariffs and strict environmental regulations and competition from lightweight and affordable aluminum products which impact Western producers.

Market Segmentation

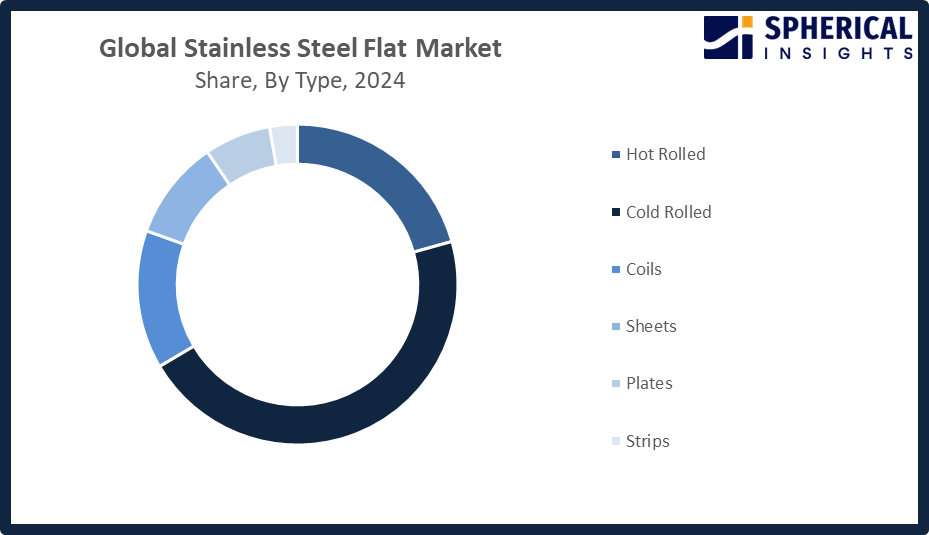

The stainless steel flat market share is classified into type and application.

- The cold rolled segment dominated the market in 2024, approximately 45% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the stainless steel flat market is divided into hot rolled, cold rolled, coils, sheets, plates, and strips. Among these, the cold rolled segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The cold-rolled segment dominated stainless steel flat market growth due to it offered superior surface finish, precise dimensions and high strength. Its versatility makes it suitable for use in automotive, construction and appliance applications. The segment maintained its market leadership because demand for high-quality products increased and customers started using the products more frequently in infrastructure and manufacturing operations.

Get more details on this report -

- The construction segment accounted for the highest market revenue in 2024, approximately 40% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the stainless steel flat market is divided into manufacturing, construction, automotive, and industrial equipment. Among these, the construction segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The construction segment worked as the primary driver for stainless steel flat market growth because urbanization efforts, infrastructure projects and the need for long-lasting corrosion-resistant materials created demand for stainless steel flats. Stainless steel flats are widely used in residential, commercial, and industrial projects for structural, architectural, and facade applications, making construction the primary growth driver in both emerging and developed markets.

Regional Segment Analysis of the Stainless Steel Flat Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the stainless steel flat market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the stainless steel flat market over the predicted timeframe. The stainless steel flat market is expected to have a 53% share of the Asia Pacific region due to its industrial growth, urban development, and infrastructure building activities. China controls the region because of its extensive construction industry, its powerful manufacturing sector and its significant stainless steel production capabilities. India follows behind because its government infrastructure projects are increasing, while its automobile production is expanding, and its citizens are buying more goods. Japan and South Korea operate high-value manufacturing facilities, which include their automotive and electronics sectors that need precision-grade stainless steel flats. The Indian Union Budget FY26, which came into effect in February 2025, enabled the stainless steel sector to grow through tariff cuts on flat-rolled stainless steel, which dropped from 22.5% to 15% and through import exemptions on vital minerals, which helped India to establish stronger market dominance in the region.

North America is expected to grow at a rapid CAGR in the stainless steel flat market during the forecast period. North America will experience a 18% market share rapid growth in the stainless steel flat market because of increasing investments for modernizing infrastructure, developing renewable energy sources and building advanced manufacturing facilities. The United States leads regional growth, supported by strong demand from construction, automotive, aerospace, and industrial equipment sectors, along with the reshoring of manufacturing activities. The market growth throughout the region receives acceleration from two factors, which include the rising use of low-emission stainless steel that performs well and the existence of trade regulations and technological progress.

Europe's stainless steel flat market expansion connects with the increasing need for sustainable high-grade steel materials, which the construction, automotive and industrial sectors require. Germany leads with its strong automotive and engineering base, while Italy and Spain drive growth through construction activity and stainless steel processing hubs. The Italian government authorized a €35 million support measure in December 2025, which it included in its 2026 budget to support low-emission stainless steel production that uses scrap metal, which will benefit Acciai Speciali Terni and strengthen Europe's commitment to recycled energy-efficient steel production.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the stainless steel flat market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Acerinox S.A.

- POSCO

- ArcelorMittal S.A.

- Jindal Stainless Limited

- Outokumpu Oyj

- Aperam S.A.

- Baosteel Group/Baowu

- Yieh United Steel Corp.

- JFE Steel Corporation

- AK Steel Corporation

- Baosteel Stainless Ltd

- Nippon Steel Corporation

- ThyssenKrupp Stainless GmbH

- Taiyuan Iron and Steel Group Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, South Korea's POSCO and Chinas Tsingshan Holding Group signed an agreement to build a 2 million ton stainless steel plant in Morowali Industrial Park, Sulawesi, Indonesia, POSCO will hold a 44.1% stake and Tsingshan 55.88%, jointly managing construction and operations to strengthen their Southeast Asia presence.

- In August 2025, Indias DGTR proposed a 12% safeguard duty on select steel imports for three years to protect domestic producers, following a provisional duty from April. The move targets flat steel products and has sparked debate between steel makers and MSMEs over potential cost and competitiveness impacts, pending CBIC approval.

- In June 2025, Chinas Baosteel maintained flat product prices for July, marking the fourth consecutive month of stability, except for a February increase. Weak steel prices and the July off-season limit hikes. The decision is expected to influence East Asian steel mills' upcoming monthly quotations, keeping regional prices stable or slightly lower.

- In March 2024, JFE Steel and Hitachi launched a joint solution for steel companies in Japan and abroad. Combining Hitachis Al driven cold rolling flatness control system with JFE Steels consulting programs, the service optimizes steel sheet flattening processes, leveraging advanced technology and operational expertise to meet customer needs efficiently.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the stainless steel flat market based on the below-mentioned segments:

Global Stainless Steel Flat Market, By Type

- Hot Rolled

- Cold Rolled

- Coils

- Sheets

- Plates

- Strips

Global Stainless Steel Flat Market, By Application

- Manufacturing

- Construction

- Automotive

- Industrial Equipment

Global Stainless Steel Flat Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the stainless steel flat market over the forecast period?The global stainless steel flat market is projected to expand at a CAGR of 3.34% during the forecast period.

-

2. What is the market size of the stainless steel flat market?The global stainless steel flat market size is expected to grow from USD 30.11 million in 2024 to USD 43.23 million by 2035, at a CAGR of 3.34% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the stainless steel flat market?Asia Pacific is anticipated to hold the largest share of the stainless steel flat market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global stainless steel flat market?Acerinox S.A., POSCO, ArcelorMittal S.A., Jindal Stainless Limited, Outokumpu Oyj, Aperam S.A., Baosteel Group/Baowu, Yieh United Steel Corp., JFE Steel Corporation, AK Steel Corporation, Baosteel Stainless Ltd, and Others.

-

5. What factors are driving the growth of the stainless steel flat market?Rapid growth in the stainless steel flat market is driven by booming infrastructure development in emerging economies, rising automotive production (especially EVs), increasing demand for sustainable/recyclable materials, and technological advancements in manufacturing.

-

6. What are the market trends in the stainless steel flat market?Key trends include rising sustainability, high-recycled content, strong Asian demand, EV growth, and increased adoption of high-performance duplex grades and 300-series.

-

7. What are the main challenges restricting wider adoption of the stainless steel flat market?Key challenges restricting wider adoption of stainless steel flat products include high, volatile raw material prices (nickel/chromium), intense competition from cheaper substitutes like aluminum, and high initial costs, alongside stringent environmental regulations.

Need help to buy this report?