Italy Construction Market Size, Share, and COVID-19 Impact Analysis, By Sector (Residential, Commercial, and Infrastructure), By Construction Type (New Construction and Renovation), By Construction Method (Conventional On-Site and Modern Methods of Construction), and Italy Construction Market Insights, Industry Trend, Forecasts to 2035

Industry: Construction & ManufacturingItaly Construction Market Insights Forecasts to 2035

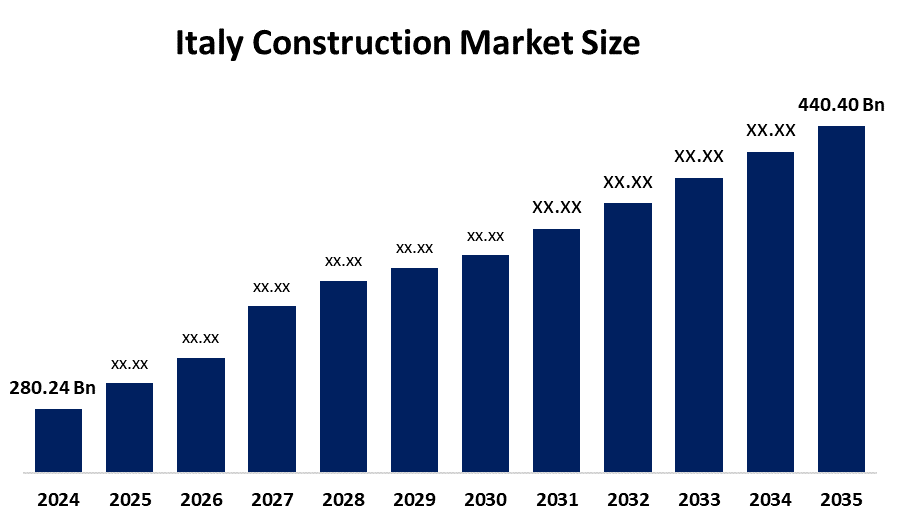

- The Italy Construction Market Size Was Estimated at USD 280.24 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.2% from 2025 to 2035

- The Italy Construction Market Size is Expected to Reach USD 440.40 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Italy Construction Market Size is anticipated to reach USD 440.40 Billion by 2035, Growing at a CAGR of 4.2% from 2025 to 2035. The Italy construction market is driven by government infrastructure investments, EU recovery funds, urban regeneration projects, rising residential renovation demand, energy-efficient building incentives, and growing public–private partnerships supporting transport, housing, and sustainable construction development across the country.

Market Overview

The Italy construction market refers to the combined segments of the industry that build and renovate buildings and infrastructure in Italy. It includes housing, commercial, industrial, and public infrastructure such as roads, bridges, and utilities. Various players are involved, such as building companies, subcontractors, material suppliers, and engineering service providers. Besides, market growth is attributed to factors such as EU recovery funding, government infrastructure programs, an increase in renovation and retrofitting works, a focus on energy-efficient buildings, urban redevelopment, and higher investments in transport, housing, and green construction.

The Italian construction market is being shaped by significant trends such as increased government infrastructure investments, which boost the expansion and modernization of roads, bridges, railways, airports, and public utilities to strengthen national connectivity and promote economic development. A second trend is the increasing focus on renovation and energy efficiency, which is mainly due to the country's old building stock and the availability of incentives for energy-efficient upgrading and seismic retrofitting of residential and commercial buildings. Moreover, the penetration of the latest construction technologies is revolutionizing the industry. Tools like Building Information Modeling (BIM), prefabrication, modular construction, drones, and robotics are not only facilitating better project planning but also helping to cut costs, improve safety on sites, and speed work overall, thus shortening construction timelines.

Technology and opportunity are almost inseparable concepts in the Italy construction market. High-tech solutions like Building Information Modeling (BIM), prefabrication, modular construction, drones, and digital project management tools are continuously raising levels of efficiency, precision, and safety. Such technical progress opens up good chances in areas of smart infrastructure, sustainable construction, energy, and efficient renovation projects. Besides, a rising demand for eco-friendly buildings, quicker project completion, and cost-cutting measures are some of the reasons why companies want to adopt the latest construction technologies, thus paving the way for a sustained market expansion.

Report Coverage

This research report categorizes the market for the Italy construction market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy construction market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy construction market.

Italy Construction Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 280.24 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 4.2% |

| 2035 Value Projection: | USD 440.40 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Webuild S.p.A., Saipem S.p.A., Impresa Pizzarotti & C. S.p.A., Astaldi Group, Mapei S.p.A., Maccaferri, Buzzi Unicem S.p.A., Italcementi S.p.A., Saint-Gobain (Italy operations), Others, and key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Italy construction market is driven by strong government support through infrastructure development programs and EU recovery funds aimed at modernizing transport networks, public utilities, and urban areas. Rising demand for residential renovation and retrofitting, due to an aging building stock and energy-efficiency regulations, further supports market growth. Incentives and tax benefits for sustainable and seismic-resistant buildings encourage private investment. Additionally, increasing urbanization, smart city initiatives, and the adoption of advanced construction technologies are improving productivity, reducing costs, and boosting overall construction activity across Italy.

Restraining Factors

The Italy construction market faces restraints such as high construction and raw material costs, skilled labor shortages, and complex regulatory and permitting processes. Project delays caused by bureaucratic approvals and rising interest rates also limit private investments, slowing the pace of new construction and infrastructure development.

Market Segmentation

The Italy construction market share is classified into sector, construction type, and construction method.

- The infrastructure segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy construction market is segmented by sector into residential, commercial, and infrastructure. Among these, the infrastructure segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The infrastructure segment dominates the market due to strong government spending and long-term public investment programs. Major projects in roads, bridges, railways, airports, and energy utilities are supported by EU recovery and resilience funds. These projects are large in scale, high in value, and spread over multiple years, ensuring consistent demand. Additionally, infrastructure development is critical for improving national connectivity, economic growth, and regional development, making it a priority over residential and commercial construction.

- The renovation segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy construction market is segmented by construction type into new construction and renovation. Among these, the renovation segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The renovation segment dominates the market because the country has a significant number of aging buildings needing modernization, energy-efficient upgrades, and seismic retrofitting. Government initiatives, including incentives like the Superbonus 110%, encourage extensive renovation of residential and commercial properties. Additionally, growing awareness of sustainability and green building practices drives demand for retrofitting and energy-efficient improvements. These factors create steady and widespread opportunities in the renovation segment, making it more prominent than new construction in terms of market activity and investment.

- The conventional on-site segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy construction market is segmented by construction method into conventional on-site and modern methods of construction. Among these, the conventional on-site segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The conventional on-site construction segment dominates the market because most projects, particularly renovations of aging buildings and large-scale infrastructure, require traditional construction techniques. Established industry practices, skilled labor availability, and the complexity of retrofitting historic and residential structures make on-site methods more practical. Although modern methods of construction, such as prefabrication and modular techniques, are gaining attention for efficiency and cost savings, their adoption remains limited, keeping conventional on-site construction as the primary method in the Italian market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Italy construction market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Webuild S.p.A.

- Saipem S.p.A.

- Impresa Pizzarotti & C. S.p.A.

- Astaldi Group

- Mapei S.p.A.

- Maccaferri

- Buzzi Unicem S.p.A.

- Italcementi S.p.A.

- Saint-Gobain (Italy operations)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Italy, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Italy construction market based on the below-mentioned segments:

Italy Construction Market, By Sector

- Residential

- Commercial

- Infrastructure

Italy Construction Market, By Construction Type

- New Construction

- Renovation

Italy Construction Market, By Construction Method

- Conventional On-Site

- Modern Methods of Construction

Frequently Asked Questions (FAQ)

-

1.What does the Italy construction market cover?It encompasses all activities related to building, upgrading, and maintaining residential, commercial, and infrastructure projects, including roads, bridges, housing, industrial facilities, and urban development, involving both private and public investments.

-

2.What drives growth in the Italy construction market?Growth is fueled by large-scale government infrastructure programs, incentives for energy-efficient renovations, urban regeneration projects, rising demand for modern housing, and the adoption of innovative construction technologies.

-

3.Which sector leads the Italy construction market?The infrastructure sector leads due to significant investments in highways, railways, airports, and utilities, which generate high-value projects and sustained construction activity.

-

4.What construction type is most prominent?Renovation dominates because of Italy’s aging building stock, government tax incentives like Superbonus 110%, and the push for energy-efficient and seismic-resilient buildings.

-

5.Which construction method is most commonly used?Traditional on-site construction remains prevalent, especially for retrofitting and complex infrastructure, though modular and prefabricated techniques are slowly gaining ground.

-

6.What are the latest trends in this market?Trends include government infrastructure investments, focus on energy-efficient renovations, and integration of modern technologies such as BIM, robotics, drones, and modular construction.

-

7.What opportunities exist for growth?Opportunities arise in sustainable building projects, energy-efficient retrofitting, smart city infrastructure, and faster construction using advanced technologies, creating efficiency and cost-saving benefits.

-

1.What does the Italy construction market cover?It encompasses all activities related to building, upgrading, and maintaining residential, commercial, and infrastructure projects, including roads, bridges, housing, industrial facilities, and urban development, involving both private and public investments.

-

2.What drives growth in the Italy construction market?Growth is fueled by large-scale government infrastructure programs, incentives for energy-efficient renovations, urban regeneration projects, rising demand for modern housing, and the adoption of innovative construction technologies.

-

3.Which sector leads the Italy construction market?The infrastructure sector leads due to significant investments in highways, railways, airports, and utilities, which generate high-value projects and sustained construction activity.

-

4.What construction type is most prominent?Renovation dominates because of Italy’s aging building stock, government tax incentives like Superbonus 110%, and the push for energy-efficient and seismic-resilient buildings.

-

5.Which construction method is most commonly used?Traditional on-site construction remains prevalent, especially for retrofitting and complex infrastructure, though modular and prefabricated techniques are slowly gaining ground.

-

6.What are the latest trends in this market?Trends include government infrastructure investments, focus on energy-efficient renovations, and integration of modern technologies such as BIM, robotics, drones, and modular construction.

-

7.What opportunities exist for growth?Opportunities arise in sustainable building projects, energy-efficient retrofitting, smart city infrastructure, and faster construction using advanced technologies, creating efficiency and cost-saving benefits.

Need help to buy this report?