Spain Plastic Recycling Market Size, Share, By Recycling Process (Mechanical Recycling, Chemical Recycling, And Biodegradable), By Application (Packaging, Building & Construction, Automotive & Transportation, Electrical & Electronics, Textiles, And Others), And Spain Plastic Recycling Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsSpain Plastic Recycling Market Size Insights Forecasts to 2035

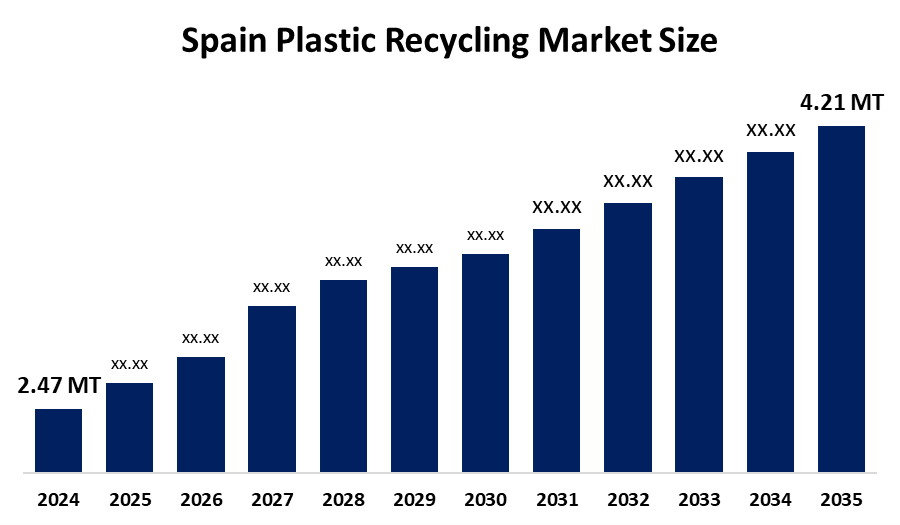

- Spain Plastic Recycling Market Size 2024: 2.47 Million Tonnes

- Spain Plastic Recycling Market Size 2035: 4.21 Million Tonnes

- Spain Plastic Recycling Market Size CAGR 2024: 4.97%

- Spain Plastic Recycling Market Size Segments: Recycling Process and Application

Get more details on this report -

Spain Plastic Recycling Market Size includes all the economic activities related to collecting, sorting, processing, and reusing plastic waste that has been created from residential, commercial, or industrial sources throughout Spain. The Plastic Recycling Market Size involves both mechanical and chemical processes to recycle plastic waste into raw materials that can be developed into finished goods such as construction materials, packages, clothing, etc. Environmental consciousness and increased regulation are driving demand for plastic recycling, and spurring the desire to create a circular economy with plastic products that will not be sent into landfills but will continue to be used.

The plastic recycling in Spain are backed by government support, including the PERTE de Economía Circular under the Spanish government, o support projects that improve plastic waste management, recycling technologies, eco-design, and digital innovation in the plastics sector. Spain’s Ecoembes, the organization coordinating the recycling of household packaging, reported that over 1.56 million tonnes of domestic packaging waste were managed and recycled, with nearly 590,000 tonnes being plastic packaging, reflecting growing public participation in plastic recycling.

As technology advances, Spanish plastic recycling providers are now using automation, artificial intelligence and improved sorting systems have created more precise and efficient means of separating types of plastics. For instance, installing AI-equipped robotic technology has allowed facilities to reclaim over 100,000 kilograms of recyclable materials each year providing higher recovery rates for recyclables, but less contamination, as well as decreased operational costs.

Spain Plastic Recycling Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 2.47 Million Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.97% |

| 2035 Value Projection: | 4.21 Million Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Recycling Process, By Application |

| Companies covered:: | Sp-Berner, Clear Pet S.L., Recycled Polymers Europe, Veolia, Alpla Group, Amcor Group GmbH, AIRESA S.L.U., Sostenplas, Loginplast S.L., Manc Recyclaplast, Berry Global Inc., Urola Packaging, Caiba Packaging, Gerresheimer AG, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Spain Plastic Recycling Market Size:

The Spain Plastic Recycling Market Size is driven by the urbanization, stringent regulatory frameworks, increased plastic recycling technologies, higher recycling rates and reduction of single-use plastics, increased corporate responsibility under Extended Producer Responsibility (EPR) schemes, rising environmental awareness among consumers and businesses, rising investment in recycling infrastructure and innovation.

The Spain Plastic Recycling Market Size is restrained by the complicate sorting and recycling processes, reducing efficiency and profitability, limitations in recycling capacity for certain plastics, inconsistencies in data reporting and measurement of recycling rates, and high cost of adopting advanced recycling technologies.

The future of Spain Plastic Recycling Market Size is bright and promising, with versatile opportunities emerging from growing need for high quality recycled plastic in many industries to reduce their waste. With the development of new methods of chemically recycling plastic, there is an opportunity to recycle more types of plastics that were previously hard or impossible to recycle using the mechanical process. In addition to this there has been an increase in financial incentives and public funding for projects that promote the circular economy, combined with an increase in consumer demand for more eco-friendly products, will provide an environment conducive for new business models and the expansion of innovative recycling value chains and enhance Spain's overall capacity to lead in the area of high quality, low energy and high value plastic recycling.

Market Segmentation

The Spain Plastic Recycling Market Size share is classified into recycling process and application.

By Recycling Process:

The Spain Plastic Recycling Market Size is divided by recycling process into mechanical recycling, chemical recycling, and biodegradable. Among these, the polyethylene terephthalate segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. established infrastructure, cost-effectiveness, high efficiency plastics, well established infrastructure, lower environmental impact, and demand for sustainable materials in packaging drive its adoption, all contribute to the mechanical recycling segment's largest share and higher spending on plastic recycling when compared to other recycling process.

By Application:

The Spain Plastic Recycling Market Size is divided by application into packaging, building & construction, automotive & transportation, electrical & electronics, textiles, and others. Among these, the packaging segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The packaging segment dominates because of high volume of single-use plastics from the food sectors, strict government regulations, and growing consumer demand for sustainable and circular packaging solutions in Spain.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Spain Plastic Recycling Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Spain Plastic Recycling Market Size:

- Sp-Berner

- Clear Pet S.L.

- Recycled Polymers Europe

- Veolia

- Alpla Group

- Amcor Group GmbH

- AIRESA S.L.U.

- Sostenplas

- Loginplast S.L.

- Manc Recyclaplast

- Berry Global Inc.

- Urola Packaging

- Caiba Packaging

- Gerresheimer AG

- Others

Recent Developments in Spain Plastic Recycling Market Size:

In October 2025, EsPlasticos launched “Spain’s first Plastics Industry Strategy,” a roadmap designed to improve the sectors competitiveness, increase recycling rates, and promote circular economy measures.

In April 2025, GCR Group opened a new state-of-the-art polyolefins recycling plant, boosting a capacity to process over 100,000 tonnes of post-consumer and 30,000 tonnes of pre-consumer plastic annually.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Spain, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Spain Plastic Recycling Market Size based on the below-mentioned segments:

Spain Plastic Recycling Market Size, By Recycling Process

- Mechanical Recycling

- Chemical Recycling

- Biodegradable

Spain Plastic Recycling Market Size, By Application

- Packaging

- Building & Construction

- Automotive & Transportation

- Electrical & Electronics

- Textiles

- Others

Frequently Asked Questions (FAQ)

-

What is the Spain Plastic Recycling Market Size?Spain Plastic Recycling Market Size is expected to grow from 2.47 million tonnes in 2024 to 4.21 million tonnes by 2035, growing at a CAGR of 4.97% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the urbanization, stringent regulatory frameworks, increased plastic recycling technologies, higher recycling rates and reduction of single-use plastics, increased corporate responsibility under Extended Producer Responsibility (EPR) schemes, rising environmental awareness among consumers and businesses, rising investment in recycling infrastructure and innovation.

-

What factors restrain the Spain Plastic Recycling Market Size?Constraints include the complicate sorting and recycling processes, reducing efficiency and profitability, limitations in recycling capacity for certain plastics, inconsistencies in data reporting and measurement of recycling rates, and high cost of adopting advanced recycling technologies.

-

How is the market segmented by recycling process?The market is segmented into mechanical recycling, chemical recycling, and biodegradable.

-

Who are the key players in the Spain Plastic Recycling Market Size?Key companies include Sp-Berner, Clear Pet S.L., Recycled Polymers Europe, Veolia, Alpla Group, Amcor Group GmbH, AIRESA S.L.U., Sostenplas, Loginplast S.L., Manc Recyclaplast, Berry Global Inc., Urola Packaging, Caiba Packaging, Gerresheimer AG, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?