Global Artificial Intelligence in Fintech Market Size, Share, and COVID-19 Impact Analysis, By Components (Solutions and Services), By Application (Virtual Assistant, Business Analytics and Reporting, Customer Behavioural Analytics, Fraud Detection, Quantitative and Asset Management, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Information & TechnologyGlobal Artificial Intelligence in Fintech Market Size Insights Forecasts to 2035

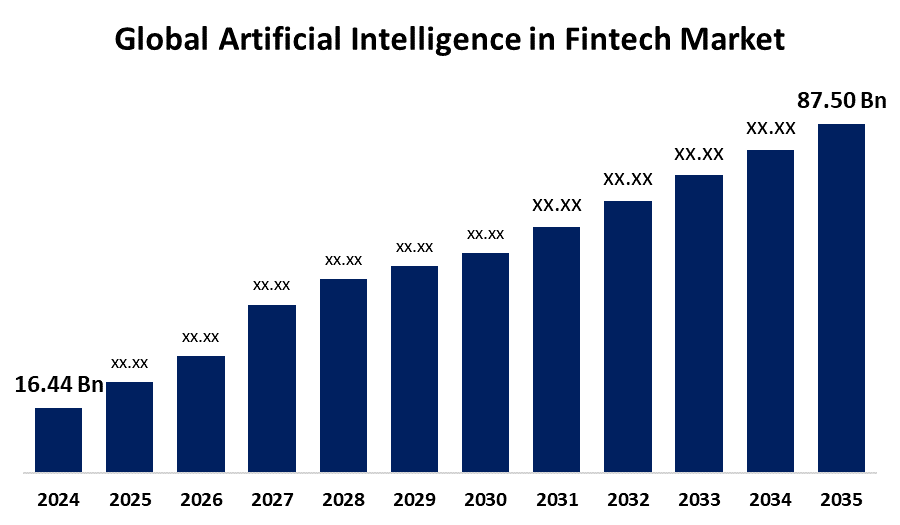

- The Global Artificial Intelligence in Fintech Market Size Was Estimated at USD 16.44 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 16.42% from 2025 to 2035

- The Worldwide Artificial Intelligence in Fintech Market Size is Expected to Reach USD 87.50 Billion by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Artificial Intelligence in Fintech Market Size was worth around USD 16.44 Billion in 2024 and is predicted to Grow to around USD 87.50 Billion by 2035 with a compound annual growth rate (CAGR) of 16.42% from 2025 to 2035. Improved automation, better fraud detection, customized financial services, higher operational efficiency, sophisticated risk management, and greater financial inclusion are some of the opportunities in the artificial intelligence in fintech market.

Global Artificial Intelligence in Fintech Market Forecast and Revenue Outlook

- 2024 Market Size: USD 16.44 Billion

- 2035 Projected Market Size: USD 87.50 Billion

- CAGR (2025-2035): 16.42%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market Overview

The use of machine-based systems that mimic human intelligence to carry out cognitively demanding tasks, like data analysis, decision-making, and predictive modeling, inside financial technology ecosystems is known artificial intelligence in fintech market. According to the U.S. Government Accountability Office (GAO), artificial intelligence (AI) refers to the use of machines to perform tasks that traditionally required human intelligence, such as automated trading, credit underwriting, and improved customer service in banking and payments. Fintech, or financial technology, is the application of contemporary technology to financial services to improve or automate investment and banking operations. The widespread use of AI in financial institutions to identify and stop fraud via online banking channels is one of the main factors driving the expansion of the artificial intelligence in fintech market. The need for individualized services, regulatory backing, and technology developments is what propels AI in Fintech, allowing for fraud detection, compliance automation, and artificial intelligence in fintech market.

Key Market Insights

- North America is expected to account for the largest share in the artificial intelligence in fintech market during the forecast period.

- In terms of Components, the solutions segment is projected to lead the artificial intelligence in fintech market throughout the forecast period

- In terms of application, the business analytics and reporting segment captured the largest portion of the market

Artificial Intelligence in Fintech Market Trends

- Growing Adoption of AI-Powered Chatbots: Using virtual assistants that are available around the clock to improve customer service and assistance.

- Personalized financial services: AI-powered customized credit packages, savings plans, and investment advice based on customer data and behavior.

- Voice Recognition & Biometric Security: Using AI-based identity verification systems to improve security and authentication.

- Robo-advisors driven by AI: automating financial planning and portfolio management for both individual and institutional clients.

Report Coverage

This research report categorizes the artificial intelligence in fintech market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the artificial intelligence in fintech market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the artificial intelligence in fintech market.

Global Artificial Intelligence in Fintech Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 16.44 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 16.42% |

| 2035 Value Projection: | USD 87.50 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Components, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Oracle, Microsoft, Affirm, Inc., Google LLC, Salesforce, Inc., Instructure, Inc., Amelia U.S. LLC, Narrative Science, Upstart Network, Inc., Inbenta Technologies, Amazon Web Services, ComplyAdvantage.com, Nuance Communications, Inc., International Business Machines Corp., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving factors

The development of real-time payment rails, open-banking regulations that provide detailed client data, and cloud-native AI technologies that reduce operating expenses for mid-tier banks are all driving growth in artificial intelligence in fintech market. AI adoption in robo-advisory and customer service automation is driven by consumer desire for individualized financial services, improving user experience and efficiency. AI integration improves financial systems' scalability and agility while also facilitating wider service accessibility, which advances financial inclusion. Cost-cutting developments in cloud computing and machine learning allow financial companies to easily use AI. All of these elements work together to drive the artificial intelligence in fintech market.

Restraining Factor

The artificial intelligence in fintech market is restricted by challenges with data protection, high installation and maintenance costs, difficulties with regulations and compliance, and a lack of qualified personnel which can create, implement, and oversee AI systems.

Market Segmentation

The global artificial intelligence in fintech market is divided into components and application.

Global Artificial Intelligence in Fintech Market, By Components:

- The solutions segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on components, the global artificial intelligence in fintech market is segmented into solutions and services. Among these, the solutions segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The solutions offered by certain companies help businesses perform things like identifying and preventing financial fraud, improving customer relationships through multichannel customer experience solutions, and expanding retail banking operations using next-best-action software.

The services segment in the artificial intelligence in fintech market is expected to grow at the fastest CAGR over the forecast period. The managed service's assistance in managing AI-enabled financial apps is likely to contribute to its rapid growth. Fintech companies are utilizing AI to offer expert services that are anticipated to propel the market's growth.

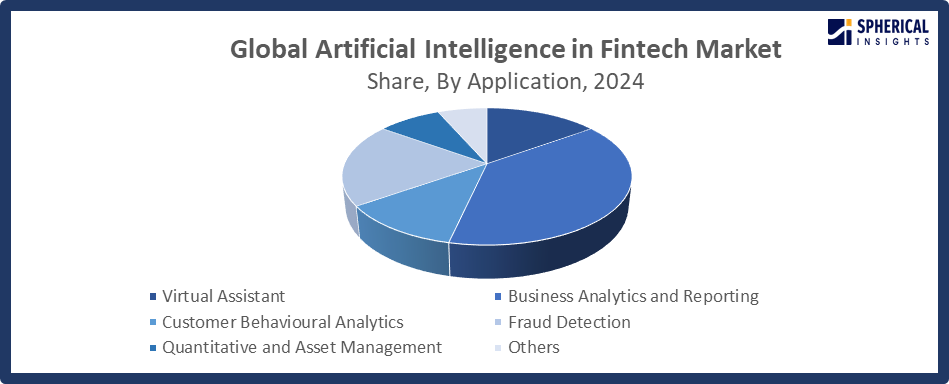

Global Artificial Intelligence in Fintech Market, By Application:

- The business analytics and reporting segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on application, the global artificial intelligence in fintech market is segmented into virtual assistant, business analytics and reporting, customer behavioural analytics, fraud detection, quantitative and asset management, and others. Among these, the business analytics and reporting segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Business analytics and reporting support customer behavior analysis as well as regulatory and compliance management. Increased revenue, better decision-making, and improved operational efficiency are some of the reasons for the segment's growth.

Get more details on this report -

The fraud detection segment in the artificial intelligence in fintech market is expected to grow at the fastest CAGR over the forecast period. The expansion of the fraud detection market is mostly being driven by growing financial crime concerns and the need for cutting-edge AI-based solutions that offer improved security, real-time monitoring, and efficient fraud prevention in the financial industry.

Regional Segment Analysis of the Global Artificial Intelligence in Fintech Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America Artificial Intelligence in Fintech Market Trends

Get more details on this report -

North America is expected to hold the largest share of the global artificial intelligence in fintech market over the forecast period.

North America can be ascribed to the sophisticated economies of the United States and Canada, placing a high priority on technologies produced from research and development. The most competitive and rapidly evolving AI technology in fintech is found in these regions. North America remains an innovation hub due to sustained public-private investment, which feeds international best practices back into the Fintech AI sector. The region's supremacy is further reinforced by the existence of top fintech and AI businesses, broad digital adoption, and regulatory backing.

U.S Artificial Intelligence in Fintech Market Trends

The advanced technological infrastructure, robust government support, and substantial investment levels from both the public and private sectors are driving the notable expansion of the U.S. artificial intelligence in the fintech market. The U.S. Government Accountability Office (GAO) reports that in 2023, federal funding in AI-related projects totaled more than $1.5 billion, fostering innovation and adoption in a variety of sectors, including financial technology.

Canada Artificial Intelligence in Fintech Market Trends

In Canada's Fintech industry, artificial intelligence (AI) refers to machine learning-based solutions that improve accessibility and efficiency in financial matters through risk assessment, personalized banking, and fraud detection. With the help of a robust innovation ecosystem, government funding programs, and a cooperative research environment, Canada's artificial intelligence in the fintech business is growing gradually.

Asia Pacific Artificial Intelligence in Fintech Market Trends

Asia Pacific is expected to grow at the fastest CAGR in the artificial intelligence in fintech market during the forecast period.

In the Asia Pacific Fintech sector, artificial intelligence (AI) incorporates sophisticated algorithms for credit scoring, fraud detection, tailored advice, and regulatory compliance, transforming financial efficiency and inclusion in a range of economies. Numerous potential for the progress of AI in the fintech industry are created by the rapid rise of domestic firms with supportive government measures. AI-driven fintech is encouraged by India's National Strategy for Artificial Intelligence (2018) and India AI Mission (2024), with 90% of financial institutions giving AI top priority for innovation and 18% being at the forefront of risk management implementation.

China Artificial Intelligence in Fintech Market Trends

China's Fintech artificial intelligence market is expanding quickly due to robust government programs, abundant data, and large investments from leading tech companies. Financial services are changing as a result of AI's incorporation into digital payments, credit rating, and fraud detection. China continues to dominate the world's fintech industry in AI innovation and adoption due to benevolent regulatory frameworks.

Japan Artificial Intelligence in Fintech Market Trends

The Fintech market for artificial intelligence in Japan is expanding gradually, due to developments in robotics, machine learning, and government-led digital transformation projects. AI is being used by financial organizations to improve fraud prevention, risk assessment, and customer service. Its focus on technological accuracy, Japan is a major force in the Asia-Pacific fintech market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global artificial intelligence in fintech market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players In The Artificial Intelligence in Fintech Market Include

- Oracle

- Microsoft

- Affirm, Inc.

- Google LLC

- Salesforce, Inc.

- Instructure, Inc.

- Amelia U.S. LLC

- Narrative Science

- Upstart Network, Inc.

- Inbenta Technologies

- Amazon Web Services

- ComplyAdvantage.com

- Nuance Communications, Inc.

- International Business Machines Corp.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In September 2025, the UK Financial Conduct Authority (FCA) launched the ‘Supercharged Sandbox’ to support companies in the rapidly evolving artificial intelligence (AI) sector, enhancing innovation and regulatory collaboration in the fintech industry, as highlighted by the FCA’s chief data, information, and intelligence officer.

- In April 2025, The Financial Technology Report announced The Top 25 FinTech AI Companies of 2025, highlighting AI’s transformative impact in financial services. This year marks a shift from innovation to measurable results, improving operational efficiency, addressing cyber threats, and promoting equitable credit access.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the artificial intelligence in fintech market based on the following segments:

Global Artificial Intelligence in Fintech Market, By Components

- Solutions

- Services

Global Artificial Intelligence in Fintech Market, By Application

- Virtual Assistant

- Business Analytics and Reporting

- Customer Behavioural Analytics

- Fraud Detection

- Quantitative and Asset Management

- Others

Global Artificial Intelligence in Fintech Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the artificial intelligence in fintech market over the forecast period?The global artificial intelligence in fintech market is projected to expand at a CAGR of 16.42% during the forecast period.

-

2. What is the market size of the artificial intelligence in fintech market?The global artificial intelligence in fintech market size is expected to grow from USD 16.44 billion in 2024 to USD 87.50 billion by 2035, at a CAGR 16.42% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the artificial intelligence in fintech market?North America is anticipated to hold the largest share of the artificial intelligence in fintech market over the predicted timeframe.

-

4. Who are the top companies operating in the global artificial intelligence in fintech market?Oracle, Microsoft, Affirm, Inc., Google LLC, Salesforce, Inc., Instructure, Inc., Amelia U.S. LLC, Narrative Science, Upstart Network, Inc., Inbenta Technologies, Amazon Web Services, ComplyAdvantage.com, Nuance Communications, Inc., International Business Machines Corp., and others.

-

5. What factors are driving the growth of the artificial intelligence in fintech market?The growth of the artificial intelligence in fintech market is driven by increasing digitalization, demand for personalized financial services, real-time data analytics, fraud prevention solutions, and the need for enhanced operational efficiency.

-

6. What are market trends in the artificial intelligence in fintech market?Predictive analytics, robo-advisors, automated underwriting, biometric security solutions, chatbots driven by AI, and the incorporation of generative AI models for fraud detection and personalized client experiences are some of the major market trends.

-

7. What are the main challenges restricting wider adoption of the artificial intelligence in fintech market?The lack of qualified personnel capable of creating and overseeing cutting-edge AI technology is one of the main obstacles, along with issues with data protection, high implementation costs, complicated regulations, and restricted interoperability of legacy systems.

Need help to buy this report?