Singapore Spinal Imaging Market Size, Share, and COVID-19 Impact Analysis, By Product (MRI, Computed Tomography, X-ray, Ultrasound, and Others), By Application (Spinal Infection, Vertebral Fractures, Spinal Cancer, Spinal Cord & Nerve Compression, and Others), By End Use (Hospitals, Diagnostic Imaging Centers, Ambulatory Care Centers, and Others), and Singapore Spinal Imaging Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareSingapore Spinal Imaging Market Insights Forecasts to 2035

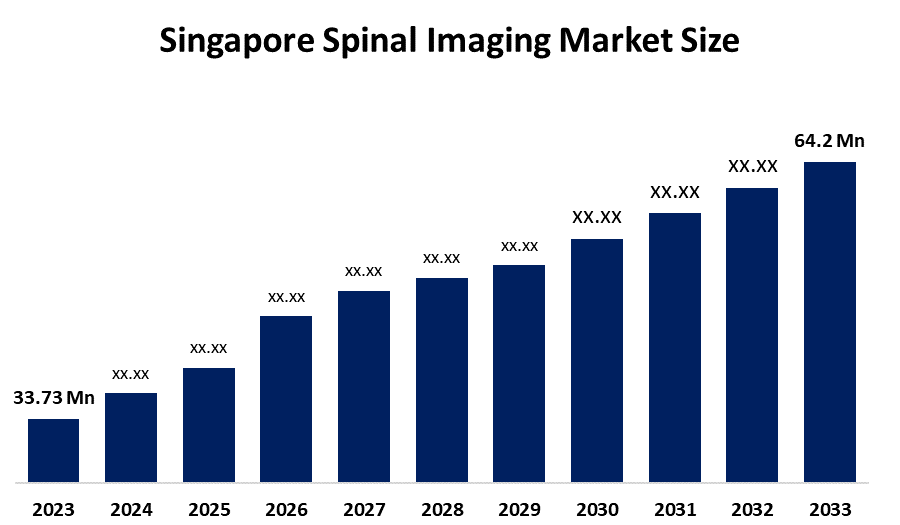

- The Singapore Spinal Imaging Market Size Was Estimated at USD 33.73 Million in 2024

- The Singapore Spinal Imaging Market Size is Expected to Grow at a CAGR of Around 6.03% from 2025 to 2035

- The Singapore Spinal Imaging Market Size is Expected to Reach USD 64.2 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Singapore Spinal Imaging Market size is anticipated to reach USD 64.2 million by 2035, growing at a CAGR of 6.03 from 2025 to 2035. The Singapore Spinal Imaging market is driven by the rising prevalence of cancer and chronic diseases, increasing demand for non-invasive diagnostics and personalized medicine, strong government support for biomedical RD, and continuous advancements in exosome research and analysis technologies.

Market Overview

The Singapore spinal imaging market is the market for diagnostic imaging devices that are utilized in the visualization of the spine to detect, diagnose, and monitor spinal disorders and injuries. The market covers the modalities like X-ray, CT scans, MRI, and ultrasound, which are used in applications of degenerative spine disease, trauma, tumors, infection, and congenital deformations in hospitals, diagnostic centers, and specialty clinics in Singapore.

Singapore’s adoption of the spinal imaging market, which is reflective of its population health needs, particularly an aging population. Nearly 25 of the residents will be 65+ years old by 2030; thus, the cases of degenerative spine disorders, chronic back pain, fractures due to osteoporosis, and spinal stenosis will definitely increase. As per statistics, musculoskeletal conditions have been the major reason for outpatient consultation. In addition, road accidents and sports-related injuries have also hugely contributed to the demand for early and accurate spinal diagnosis through MRI, CT, and X-ray systems.

The government plays a major role in the growth of the market by providing a strong backing through its high healthcare expenditure (more than 4 5 billion annually) and also through the renovation of its infrastructure. The RIE 2025 plan dedicates S28 billion to research and innovation, which, among others, includes healthcare imaging and AI-enabled diagnostics. Ongoing expenditures on public hospitals, preventive care, and cutting-edge diagnostic technologies in Singapore clearly demonstrate the significance and need for spinal imaging in the country's healthcare system and make the market a compelling, demand-driven opportunity.

Report Coverage

This research report categorizes the market for the Singapore spinal imaging market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore spinal imaging market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore spinal imaging market.

Singapore Spinal Imaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 33.73 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.03% |

| 2035 Value Projection: | USD 64.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product,By Application |

| Companies covered:: | Siemens Healthineers,GE HealthCare,Canon Medical Systems,Fujifilm Holdings Corporation,Hitachi Medical Systems,Carestream Health,Agfa-Gevaert Group,Esaote S.p.A,Samsung Medison,United Imaging Healthcare,Hologic, Inc And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Singapore spinal imaging market is driven by an aging population, rising prevalence of degenerative spine and musculoskeletal disorders, increasing cases of road, workplace, and sports-related spinal injuries, and growing demand for early and accurate diagnosis. Additionally, advanced healthcare infrastructure, government investment in diagnostic imaging, adoption of MRI and CT technologies, and use of AI-enabled imaging systems further support market growth.

Restraining Factors

The Singapore spinal imaging market is restrained by high costs of advanced imaging systems (MRI and CT), limited availability of skilled radiologists, and long waiting times in public hospitals. Additionally, strict regulatory requirements, radiation exposure concerns, and the high cost of maintenance and upgrades can slow market expansion.

Market Segmentation

The Singapore spinal imaging market share is classified into product, application, and end use.

- The MRI segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore spinal imaging market is segmented by product into MRI, computed tomography, x-ray, ultrasound, and others. Among these, the MRI segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The MRI segment is growing because of its high diagnostic accuracy, detailed soft-tissue imaging, and absence of radiation, making it preferred for spinal disorders, supported by rising demand for early diagnosis and investment in advanced imaging facilities in Singapore.

- The spinal cord & nerve compression segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Singapore spinal imaging market is segmented by application into spinal infection, vertebral fractures, spinal cancer, spinal cord nerve compression, and others. Among these, the spinal cord & nerve compression segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The spinal cord & nerve compression segment is growing because of the rising prevalence of degenerative spine conditions such as herniated discs, spinal stenosis, and spondylosis, especially among Singapore’s aging population. Increasing demand for early and precise diagnosis using MRI and CT scans to guide timely treatment further drives growth.

- The hospitals segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore spinal imaging market is segmented by end use into hospitals, diagnostic imaging centers, ambulatory care centers, and others. Among these, the hospitals segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The hospital segment is growing because hospitals handle a high volume of spinal trauma, degenerative disorders, and surgical cases, requiring advanced imaging for diagnosis and treatment planning. Availability of comprehensive imaging infrastructure, skilled specialists, and government investment in public hospitals in Singapore further supports segment growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore spinal imaging market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Siemens Healthineers

- GE HealthCare

- Philips Healthcare

- Canon Medical Systems

- Fujifilm Holdings Corporation

- Hitachi Medical Systems

- Carestream Health

- Agfa-Gevaert Group

- Esaote S.p.A.

- Samsung Medison

- United Imaging Healthcare

- Hologic, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In February 2025, AsiaMedic and Sunway officially launched the AsiaMedic Sunway Imaging Centre at Royal Square in Novena, Singapore, offering advanced diagnostic imaging services, including 3T MRI and CT scans, to enhance spinal and overall healthcare diagnosis capacity.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Singapore spinal imaging market based on the below-mentioned segments:

Singapore Spinal Imaging Market, By Product

- MRI

- Computed Tomography

- X-ray

- Ultrasound

- Others

Singapore Spinal Imaging Market, By Application

- Spinal Infection

- Vertebral Fractures

- Spinal Cancer

- Spinal cord & nerve compression

- Others

Singapore Spinal Imaging Market, By End Use

- Hospitals

- Diagnostic imaging centers

- Ambulatory care centers

- Others

Frequently Asked Questions (FAQ)

-

What is the Singapore spinal imaging market size in 2024?The Singapore spinal imaging market size was estimated at USD 33.73 million in 2024.

-

What is the projected market size of the Singapore spinal imaging market by 2035?The Singapore spinal imaging market size is expected to reach USD 64.2 million by 2035.

-

What is the CAGR of the Singapore spinal imaging market?The Singapore spinal imaging market size is expected to grow at a CAGR of around 6.03% from 2024 to 2035.

-

What are the key growth drivers of the Singapore spinal imaging market?The Singapore Spinal Imaging market is driven by the rising prevalence of cancer and chronic diseases, increasing demand for non-invasive diagnostics and personalized medicine, strong government support for biomedical R&D, and continuous advancements in exosome research and analysis technologies.

-

Which application segment dominated the market in 2024?The spinal cord & nerve compression segment dominated the market in 2024.

-

What segments are covered in the Singapore spinal imaging market report?The Singapore spinal imaging market is segmented on the basis of product, application, and end use.

-

Who are the key players in the Singapore spinal imaging market?Key companies include Siemens Healthineers, GE HealthCare, Philips Healthcare, Canon Medical Systems, Fujifilm Holdings Corporation, Hitachi Medical Systems, Carestream Health, Agfa-Gevaert Group, Esaote S.p.A., Samsung Medison, United Imaging Healthcare, Hologic, Inc. and others

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?