Russia LED Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Panel Lights, Down Lights, Street Lights, Tube Lights, Bulbs, and Others), By Application (Commercial, Residential, Institutional, and Industrial), and Russia LED Market Insights, Industry Trend, Forecasts to 2035

Industry: Semiconductors & ElectronicsRussia LED Market Size Insights Forecasts to 2035

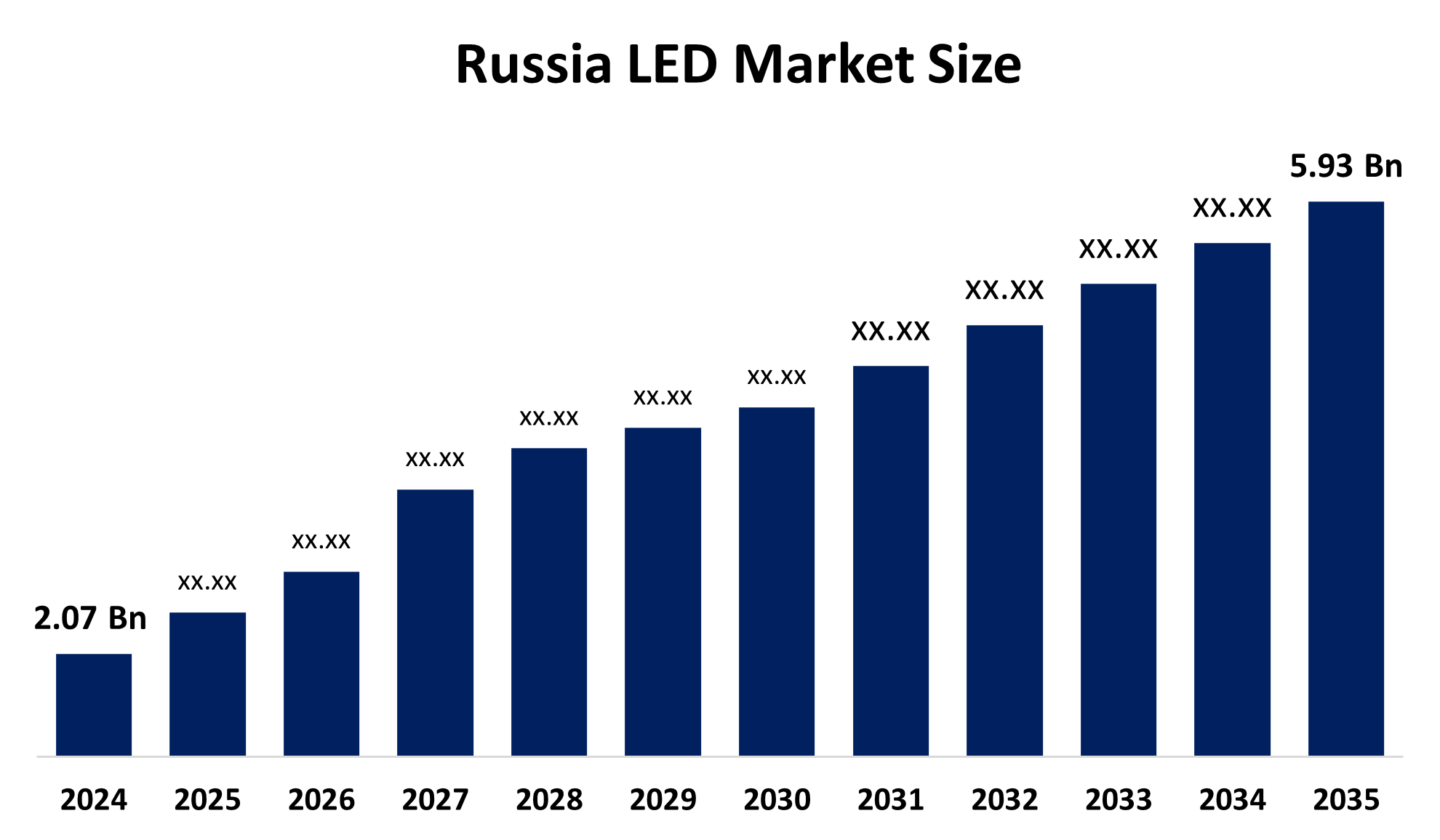

- The Russia LED Market Size Was Estimated at USD 2.07 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 10.04% from 2025 to 2035

- The Russia LED Market Size is Expected to Reach USD 5.93 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Russia LED Market Size is Anticipated to Reach USD 5.93 Billion by 2035, Growing at a CAGR of 10.04% from 2025 to 2035. The LED market in Russia is driven by the increasing need for energy saving lighting, the government's support of LED use through various measures, quick urbanization, smart city projects, infrastructure improvement, and the growing reliance on LEDs for indoor, commercial, industrial, and outdoor lighting among various applications.

Market Overview

The Russia LED Market Size encapsulates the entire lifetime of light-emitting diodes (LEDs) in the country, from the manufacturing and distribution to the use of the technology. The advantages of LEDs have made them the first choice for all types of lighting, including residential, commercial, industrial, automotive, and outdoor, and the main reason for their widespread application is power savings, along with their long life.

The government of Russia encourages the use of LED technology via the implementation of energy-efficiency regulations, setting up a minimum percentage of local LED materials in public purchasing, and giving the local products a 15% price advantage starting January 1, 2025, besides limiting certain imports in order to strengthen the domestic market. One of the results of these practices has been Ufa’s more than 100 million rubles saved through replacing conventional street lighting with LED. Such cities are the ones that benefit the most, as all these actions are aimed at promoting the large scale use of energy efficient LED installations throughout the country.

The Russia LED Market Size has witnessed considerable innovations and technology advancements in the local market. There is a competition among Russian LED companies to develop IoT connected and adaptive controlled lighting solutions for urban and industrial use that consume less power. One case in point is VARTON, which has introduced IONIK LED park lights to create better energy performance and ambiance in outdoor areas. Advanced LED solutions for infrastructure and sustainability goals, smart lighting, and IoT integration will be the main areas of future opportunities.

Report Coverage

This research report categorizes the market for the Russia LED market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia LED market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub segment of the Russia LED market.

Russia LED Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.07 billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.04% |

| 2035 Value Projection: | USD 5.93 billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Varton, Optogan, GS Group (GS LED), LED Effect, Arlight, Planeta Sid, LED Eco Dom, RW LIGHT, EMALED, DLED and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The LED market in Russia is driven by the demand for energy-efficient and long-lasting light sources. In addition, government support through energy conservation programs, smart city projects, and infrastructure modernization will apply to the whole country and even more so in urban areas where electric power is expensive. These factors, along with urbanization, conventional lighting switching over to LED, and rising electricity costs, are also making the market grow. Moreover, Russia is witnessing an ongoing market growth due to the introduction of smart LED's, Io T enabled lighting, and high-efficiency luminaries, along with their widespread applications.

Restraining Factors

The LED market in Russia is mostly constrained by the high initial installation costs, dependence on imported parts, lack of small-town residents' awareness of long term savings, and regulatory issues. These factors considerably slow down the adoption rate in the sectors of residential and small scale commercial.

Market Segmentation

The Russia LED market share is classified into product type and application.

- The street lights segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia LED Market Size is segmented by product type into panel lights, down lights, street lights, tube lights, bulbs, and others. Among these, the street lights segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because governments and municipalities are progressively substituting energy-efficient LED street lighting for traditional street lighting in order to meet urban modernization and smart city programs, reduce maintenance expenses, and lower electricity costs.

- The commercial segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia LED Market Size is segmented by application into commercial, residential, institutional, and industrial. Among these, the commercial segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is because large-scale installations lower electricity costs and maintenance, and there is a considerable demand for energy efficient lighting in businesses, retail establishments, shopping centers, and the hospitality industry. Adoption is further fueled by government energy efficiency regulations and the renovation of commercial infrastructure, giving this sector the highest revenue share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia LED Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Varton

- Optogan

- GS Group (GS LED)

- LED Effect

- Arlight

- Planeta Sid

- Led Eco Dom

- RW Light

- EMALED

- DLED

- Others

Key Target Audience

- Market Players

- Investors

- End users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value Added Resellers (VARs)

Recent Developments:

- In January 2025, Arlight showed new LED strips and the FITOLUX LED strips that are meant for the growing of plants.

- In August 2024, VARTON introduced the line of IONIK LED park lights, which are made with Russian made LEDs that provide an effective and beautiful lighting solution for the outdoors in cities.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia LED Market Size based on the below-mentioned segments:

Russia LED Market, By Product Type

- Panel Lights

- Down Lights

- Street Lights

- Tube Lights

- Bulbs

- Others

Russia LED Market, By Application

- Commercial

- Residential

- Institutional

- Industrial

Frequently Asked Questions (FAQ)

-

Q: What is the Russia LED market size?A: Russia LED market size is expected to grow from USD 2.07 billion in 2024 to USD 5.93 billion by 2035, growing at a CAGR of 10.04% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the demand for energy-efficient and long-lasting light sources. In addition, government support through energy conservation programs, smart city projects, and infrastructure modernization will apply to the whole country and even more so in urban areas where electric power is expensive.

-

Q: What factors restrain the Russia LED market?A: Constraints include the high initial installation costs, dependence on imported parts, lack of small-town residents' awareness of long-term savings, and regulatory issues.

-

Q: How is the market segmented by product type?A: The market is segmented into panel lights, down lights, street lights, tube lights, bulbs, and others.

-

Q: Who are the key players in the Russia LED market?A: Key companies include Varton, Optogan, GS Group (GS LED), LED‑Effect, Arlight, Planeta Sid, LedEcoDom, RW LIGHT, EMALED, DLED, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?