United State Automotive Metal Market Size, Share, and COVID-19 Impact Analysis, By Type (Mild Steel, Alloy Steel, High Strength Steel, and Advanced High Strength), By End User (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles), and U.S. Automotive Metal Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationUnited State Automotive Metal Market Insights Forecasts to 2035

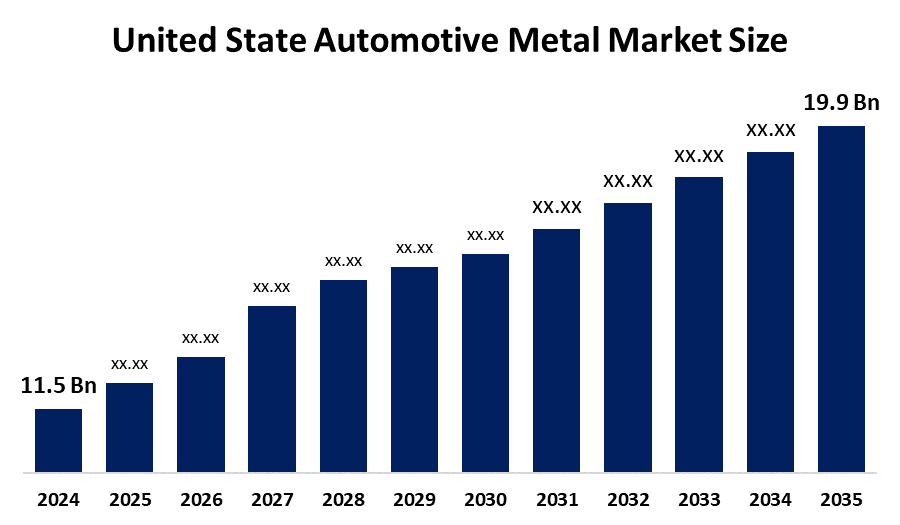

- The United State Automotive Metal Market Size Was Estimated at USD 11.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.11 % from 2025 to 2035

- The United State Automotive Metal Market Size is Expected to Reach USD 19.9 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United State Automotive Metal Market Size is anticipated to reach USD 19.9 Billion by 2035, growing at a CAGR of 5.11% from 2025 to 2035. The U.S. automotive metal market is driven by rising vehicle production, demand for lightweight materials to improve fuel efficiency, advancements in metal forming technologies, the growth of electric vehicles, and the increasing use of high-strength steel and aluminium.

Market Overview

The U.S. automotive metal market refers to the industry involved in producing, processing, and supplying metals such as steel, aluminum, magnesium, and copper used in vehicle manufacturing. These metals are essential for making car bodies, engines, chassis, and other structural components. The market focuses on improving vehicle performance, fuel efficiency, and safety through lightweight and durable materials. It is influenced by trends like electric vehicle adoption, sustainability goals, and advancements in metal forming technologies. The automobile industry in the United States is evolving, with more small SUVs being produced and more magnesium being used in component manufacturing instead of steel. Government programs and ARPA-E financing for low-cost aluminum and titanium manufacturing boost demand for lightweight, high-performance vehicle metals. The rising trend towards automation and smart manufacturing is expected to enhance production efficacy, which provides a notable opportunity for this market.

Report Coverage

This research report categorizes the market for the U.S. automotive metal market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. automotive metal market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. automotive metal market.

United State Automotive Metal Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 11.5 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.11% |

| 2035 Value Projection: | USD 19.9 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 217 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type and By End User |

| Companies covered:: | Alcoa Corporation, ATI, Kaiser Aluminum, Novelis, United States Steel Corporation, Allegheny Technologies, ArcelorMittal, Hyundai Steel Co., Ltd., Kaiser Aluminum, Novelis, ThyssenKrupp AG, and voestalpine AG. |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The rising demand for lightweight and high-performance materials in modern vehicles is one of the major contributors to this market. The growing emphasis on fuel efficiency, emissions reduction, and sustainability encourages the usage of aluminum, magnesium, and high-strength steel, is further propels the market growth. Advancements in metal forming and alloy development enhance vehicle safety, durability, and design flexibility. Rising customer demand for eco-friendly and efficient automobiles, as well as metal recycling, continues to fuel the market's expansion and competition.

Restraining Factors

The production of advanced lightweight alloys has a complex process and a high energy requirement, which further raises the manufacturing costs as compared to conventional steels, which further limit the market expansion. Additionally, competition from alternative materials restricts the market growth.

Market Segmentation

The U.S. automotive metal market share is classified into type and end user.

- The mild steel segment held a dominant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The U.S. automotive metal market is segmented by type into mild steel, alloy steel, high-strength steel, and advanced high-strength. Among these, the mild steel segment held a dominant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed to its cost-effectiveness and widespread use in structural automotive components. Its strength and recyclability make it a popular material for mass-produced vehicles, particularly in markets where consumers prioritise cost efficiency and environmental sustainability.

- The passenger cars segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The U.S. automotive metal market is segmented by end user into passenger cars, light commercial vehicles, and heavy commercial vehicles. Among these, the passenger cars segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. High production volumes, increased customer demand for fuel economy, and continued material innovation in mass-market and luxury car categories significantly contribute to this segmental growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. automotive metal market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Alcoa Corporation

- ATI

- Kaiser Aluminum

- Novelis

- United States Steel Corporation

- Allegheny Technologies

- ArcelorMittal

- Hyundai Steel Co., Ltd.

- Kaiser Aluminum

- Novelis

- ThyssenKrupp AG

- voestalpine AG.

Recent Developments

- In January 2025, American Axle & Manufacturing acquired UK-based Dowlais to strengthen its electric vehicle market presence. The merger, giving Dowlais 49% ownership, was expected to generate USD 300 Million in annual savings.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the U.S., regional, and country levels from 2020 to 2035. Spherical Insights has segmented the U.S. automotive metal market based on the below-mentioned segments:

U.S. Automotive Metal Market, By Type

- Mild Steel

- Alloy Steel

- High Strength Steel

- Advanced High Strength

U.S. Automotive Metal Market, By End User

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Need help to buy this report?