Russia Drone Services Market Size, Share, and COVID-19 Impact Analysis, By Service (Surveying, Delivery, Monitoring, and Photography), By Industry (Construction, Energy, Logistics, and Agriculture), and Russia Drone Services Market Insights, Industry Trend, Forecasts to 2035

Industry: Aerospace & DefenseRussia Drone Services Market Size Insights Forecasts to 2035

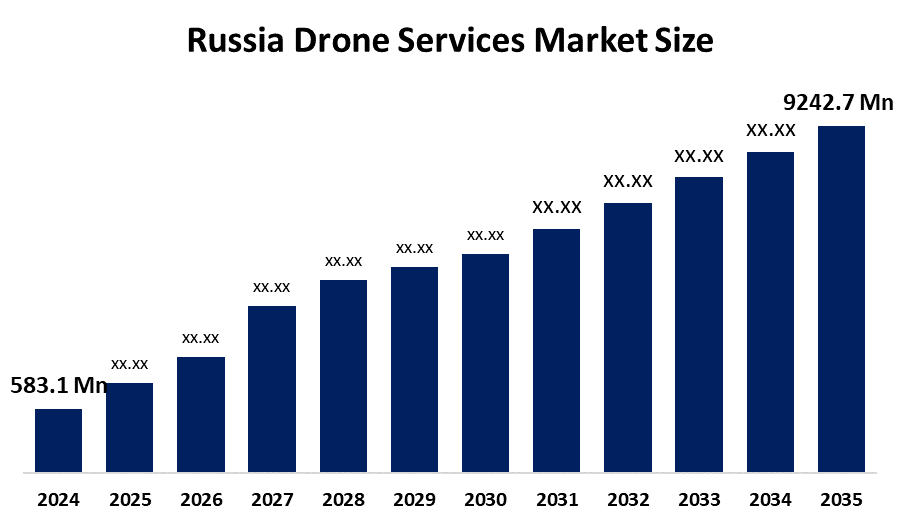

- The Russia Drone Services Market Size Was Estimated at USD 583.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 28.56% from 2025 to 2035

- The Russia Drone Services Market Size is Expected to Reach USD 9242.7 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Russia Drone Services Market Size is anticipated to Reach USD 9242.7 Million by 2035, Growing at a CAGR of 28.56% from 2025 to 2035. The drone services market in Russia is driven by the need for affordable aerial data, government support for UAV localization, growing use in defense, agricultural, energy, and infrastructure inspection, and developments in autonomous and AI-enabled drone technology.

Market Overview

Drone services in Russia cover both commercial and government-sourced UAV services that allow for operational support, data collection, and monitoring purposes. Additionally, major applications of the Russian drone market include aerial mapping, oil & gas/energy infrastructure inspection, agricultural crop inspections, construction site inspections, logistics support, monitoring activities for environmental protection, managing disasters, and surveillance for security in remote and widespread areas of Russia.

The financial support for UAV development in Russia comes from the National Project "Unmanned Aviation Systems," for which 7.11 billion RUB is allocated for civil UAV orders in 2024-25, and raised state demand for 2,500+ UAVs worth 7 billion RUB in 2026 are going to be the main items of the budget. Under the conditions of Russian origin, local manufacturers are benefited by subsidies of up to 2 million RUB per drone. Export promotion support programs are being put in place to reduce the costs of foreign certification and entering the market.

Russian UAV manufacturers are already in the process of developing a number of new technologies, like autonomous flight, AI-based aerial analytics, and hybrid powerplants for boosting the endurance of drones and precision mapping. For instance, ZALA Aero has extended its heavy-lift UAV services to cover industrial inspection and logistics, while Kronstadt Group has developed navigation systems for BVLOS operations. The future holds a lot of opportunities, including the use of drones for transporting people in smart cities, BVLOS commercial delivery, AI-driven monitoring, and defense-dual-use services in the areas of energy, agriculture, and infrastructure.

Report Coverage

This research report categorizes the market for the Russia drone services market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia drone services market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia drone services market.

Russia Drone Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 583.1 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 28.56% |

| 2035 Value Projection: | USD 9242.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 145 |

| Tables, Charts & Figures: | 152 |

| Segments covered: | By Service, By Industry and COVID-19 Impact Analysis |

| Companies covered:: | ZALA Aero Group, Geoskan Group of Companies, Kronshtadt Group, Aerodin, BP-Technologies, Albatross LLC, Unmanned Systems Group, JSC NPP Radar MMC, Enix / Eleron, Special Technology Center (STC), and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The drone services market in Russia is driven by the demand for aerial surveillance, border security, and the modernization of defense, which has resulted in the drone services market in Russia, which is further aided by government investments. The inspection of oil & gas pipelines, mining, agriculture, and infrastructure monitoring applications are becoming very common, which is leading to drone usage more and more. The technology advances in AI-powered analysis, autonomous flying, and high-quality imaging are making operations smart. Besides, the vast areas and inaccessible places in Russia are causing the usage of drones for logistics, mapping, environmental monitoring, and disaster management, thus, the market growth is supported.

Restraining Factors

The drone services market in Russia is mostly constrained by the strict airspace regulations that are strict, the obtaining of licenses, and the restriction of operations. Moreover, the limited access to high-tech components because of trade sanctions, the very high initial costs, concerns over cybersecurity, and the lack of infrastructure hamper the commercial adoption on a large scale.

Market Segmentation

The Russia drone services market share is classified into service and industry.

- The surveying segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia drone services market is segmented by service into surveying, delivery, monitoring, and photography. Among these, the surveying segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The widespread usage of drones in mining, construction, oil and gas exploration, and major infrastructure projects is what propels this domination. The demand for precise aerial mapping, geospatial data collecting, and land surveying has increased due to Russia's large and isolated terrain; drones provide cost-effectiveness, faster data acquisition, and enhanced safety when compared to conventional methods.

- The energy segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Russia drone services market is segmented by industry into construction, energy, logistics, and agriculture. Among these, the energy segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The widespread usage of drones for monitoring and inspecting offshore assets, refineries, electricity transmission lines, and oil and gas pipelines is the main factor behind this domination. Russia's extensive energy infrastructure, which is dispersed over harsh and inaccessible areas, is increasing reliance on drones for real-time data collecting, maintenance planning, and cost-effective, safe, and efficient surveillance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia drone services market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ZALA Aero Group

- Geoskan Group of Companies

- Kronshtadt Group

- Aerodin

- BP-Technologies

- Albatross LLC

- Unmanned Systems Group

- JSC NPP Radar MMC

- Enix / Eleron

- Special Technology Center (STC)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, the Ministry of Industry and Trade unveiled a new strategy for UAV development until 2035, which included the aim of raising along with the domestic drone production and market share.

- In August 2025, ICL Services started the digital delivery platform “DronExpress” for controlling drone-based goods deliveries, which offers enhancements in route planning and operational monitoring.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia drone services market based on the below-mentioned segments:

Russia Drone Services Market, By Service

- Surveying

- Delivery

- Monitoring

- Photography

Russia Drone Services Market, By Industry

- Construction

- Energy

- Logistics

- Agriculture

Frequently Asked Questions (FAQ)

-

Q: What is the Russia drone services market size?A: Russia drone services market size is expected to grow from USD 583.1 million in 2024 to USD 9242.7 million by 2035, growing at a CAGR of 28.56% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the demand for aerial surveillance, border security, and the modernization of defense, which has resulted in the drone services market in Russia, which is further aided by government investments. The inspection of oil & gas pipelines, mining, agriculture, and infrastructure monitoring applications are becoming very common, which is leading to drone usage more and more.

-

Q: What factors restrain the Russia drone services market?A: Constraints include the strict airspace regulations that are strict, the obtaining of licenses, and the restriction of operations.

-

Q: How is the market segmented by service?A: The market is segmented into surveying, delivery, monitoring, and photography.

-

Q: Who are the key players in the Russia drone services market?A: Key companies include ZALA Aero Group, Geoskan Group of Companies, Kronshtadt Group, Aerodin, BP-Technologies, Albatross LLC, Unmanned Systems Group, JSC NPP Radar MMC, Enix / Eleron, Special Technology Center (STC), and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?