Global Potassium Nitrate Market Size, Share, and COVID-19 Impact Analysis, By Raw Material (Potassium Chloride, Ammonium Nitrate, and Sodium Nitrate), By Formulation (Granular, Liquid, and Powder), By End-User (Agriculture, General Industries, Pharmaceutical Industry, Food Industry, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Potassium Nitrate Market Size Insights Forecasts to 2035

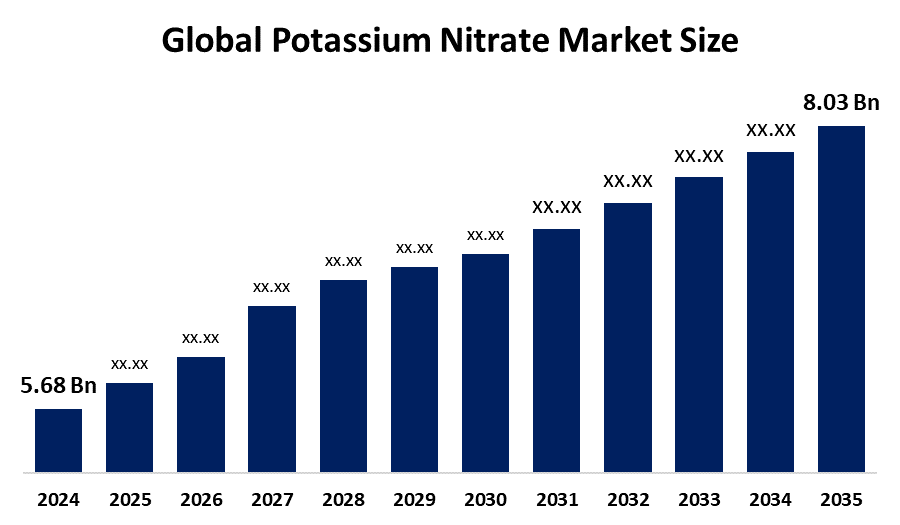

- The Global Potassium Nitrate Market Size Was Estimated at USD 5.68 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.2% from 2025 to 2035

- The Worldwide Potassium Nitrate Market Size is Expected to Reach USD 8.03 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Potassium Nitrate Market Size was worth around USD 5.68 Billion in 2024 and is predicted to Grow to around USD 8.03 Billion by 2035 with a compound annual growth rate (CAGR) of 3.2% from 2025 to 2035. The worldwide potassium nitrate market expansion results from increased demand for efficient water-soluble fertilizers used in precision agriculture, which enhance crop production. The market expansion receives additional support from its growing application as a food preservative and its industrial usage in glass production.

Market Overview

The global potassium nitrate market operates on a white, oxidising, crystalline compound that dissolves in water and provides essential nutrient properties without delivering chloride. The primary application of this product exists in agriculture as an effective fertilizer which supports the growth of fruits, vegetables and tobacco plants through fertigation and hydroponics systems. The food industry uses the product for meat curing, while industrial applications extend to glass manufacturing, solar energy storage and fireworks production. The market drivers include rising global demand for improved crop yields, increasing adoption of precision farming, and growing awareness of soil salinity.

In January 2026, in a boost to agriculture, India's Central Government has achieved record fertilizer availability for 2024-25, supplying 176.79 crore bags, exceeding the demand of 152.50 crore. The system provides potassium nitrate and potash-based products, which help farmers plan their planting while delivering subsidies through the Nutrient-Based Subsidy (NBS) program. The development of specialized eco-friendly fertilizer blends and their application in medical-grade tooth sensitivity treatments creates expanding business opportunities. SQM S.A., Haifa Group, Yara International ASA, Uralchem and ICL Group Ltd. control the market through their strategic production of high-purity products. The Asia-Pacific region dominates the market because it controls both production and consumption.

Report Coverage

This research report categorizes the potassium nitrate market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the potassium nitrate market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the potassium nitrate market.

Global Potassium Nitrate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.68 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.2% |

| 2035 Value Projection: | USD 8.03 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 97 |

| Segments covered: | By Raw Material, By Formulation and COVID-19 Impact Analysis |

| Companies covered:: | SQM S.A., Nutrien Ltd., Yara International ASA, Haifa Group, Uralchem Group, The Mosaic Company, Arab Potash Company, ICL Group Ltd, K+S AG, Migao Corporation, OCP Group, AG CHEMI GROUP, GFS Chemicals, Wentong Potassium Salt Group, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global potassium nitrate market exists because farmers need chloride-free water-soluble fertilisers, which provide high crop yields on their limited farmland. The market drivers for this industry include two factors, which are increased usage of fertigation and precision farming methods in Asia-Pacific countries and rising demand for specialized fertiliser mixtures, which farmers use to grow high-value fruits and vegetables. The market experiences substantial growth through various industrial uses, which include glass production and solar thermal energy storage, pharmaceutical development and food preservation in meat processing. The developing world experiences increased fertilizer demand because governments provide subsidies for better fertiliser products.

Restraining Factors

The global potassium nitrate market experiences two main constraints, which include high raw material expenses and strict environmental rules about nitrate pollution and expensive production processes. The market growth experiences obstacles because of three factors, which include supply chain disruptions, transportation problems and competition from lower-priced fertilizer products.

Market Segmentation

The potassium nitrate market share is classified into raw material, formulation and end-user.

- The potassium chloride segment dominated the market in 2024, approximately 53% and is projected to grow at a substantial CAGR during the forecast period.

Based on the raw material, the potassium nitrate market is divided into potassium chloride, ammonium nitrate, and sodium nitrate. Among these, the potassium chloride segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The potassium chloride segment dominated the market because it offers wide availability and maintains low production costs while delivering high potassium content. The market expansion results from its cost-effective nature and easy availability, which make it the preferred raw material for high-efficiency chloride-free fertilisers used in agriculture.

- The granular segment accounted for the largest share in 2024, approximately 41% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the formulation, the potassium nitrate market is divided into granular, liquid, and powder. Among these, the granular segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This segment holds the largest potassium nitrate market share due to its agricultural use, which meets high demand from both large-scale farmers and dryland farming operations. The product provides farmers with superior handling capabilities because it produces low dust emissions and delivers uniform nutrient distribution and compatibility with precision fertigation systems, which increases crop yields.

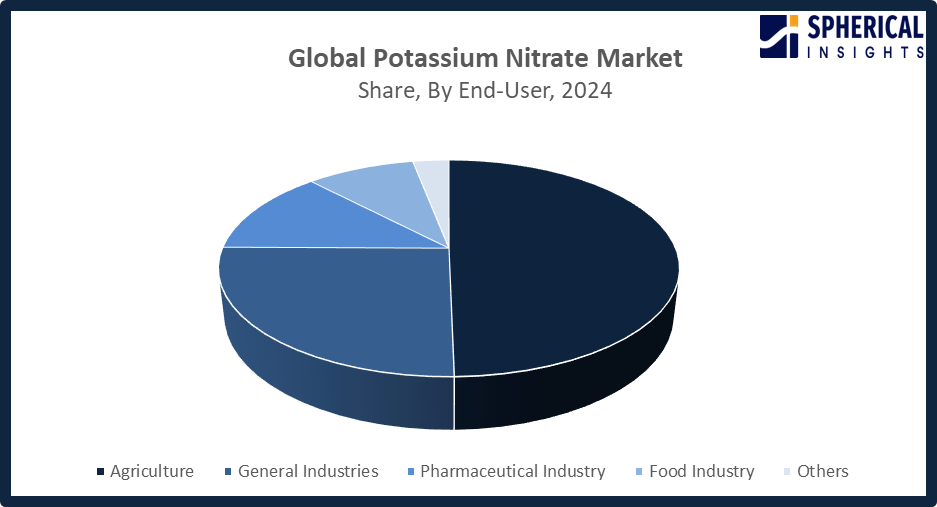

- The agriculture segment accounted for the highest market revenue in 2024, approximately 50% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-user, the potassium nitrate market is divided into agriculture, general industries, pharmaceutical industry, food industry, and others. Among these, the agriculture segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The agriculture segment market growth is owing to farmers increasingly demanding water-soluble fertilizers that enable high-yield crop production. The product serves specialized farming needs because it contains no chloride, while its consumption rises due to growing global populations and government support for modern agricultural methods.

Get more details on this report -

Regional Segment Analysis of the Potassium Nitrate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the potassium nitrate market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the potassium nitrate market over the predicted timeframe. The potassium nitrate market will experience a 43% share of its main growth from the Asia Pacific because agricultural needs in China, India and Japan require efficient fertilizers to support their food production expansion. The rapid adoption of fertigation and greenhouse techniques in Southeast Asia, combined with rising industrial applications, creates additional growth momentum. The 2026 Indian Union Budget supports this initiative through its plan to decrease fertilizer subsidies while supporting nutrient-based balanced fertilization (NBS) and promoting domestic sustainable production through import reductions. The new approach will increase farmer earnings by providing efficient potash-based solutions that fulfil growing nutrient requirements and strengthen the regional market share.

North America is expected to grow at a rapid CAGR in the potassium nitrate market during the forecast period. Precision agriculture and fertigation, as well as high-value crops, drive rapid market expansion for potassium nitrate in North America, expected to have 27% share, which operates from the US and Canada. The market shows strong demand for water-soluble fertilizers because they provide yield improvements and stress resistance benefits. The market expansion receives additional support from industrial applications, which use potassium nitrate in glass manufacturing and food preservation processes. The U.S. Department of Defense awarded $192.5 million to Goex/Estes Energetics and METSS Corporation in February 2024 to establish domestic production of critical chemicals, including potassium nitrate oxidizers under the Defence Production Act.

The European potassium nitrate market experiences growth because precision agriculture requires chloride-free fertilizers which Germany, France and Spain provide. The sustainable farming practice, which produces high crop yields, operates under this approach that tackles soil salinity problems. The European Union needs high-purity specialty products because its regulations have become more stringent. KEMAPCO and GIZ from Germany established a partnership in June 2023 to install emission-reduction technology, which will achieve 80% carbon emission reductions while supporting climate initiatives. The market experiences growth because more food preservatives are being used.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the potassium nitrate market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SQM S.A.

- Nutrien Ltd.

- Yara International ASA

- Haifa Group

- Uralchem Group

- The Mosaic Company

- Arab Potash Company

- ICL Group Ltd

- K+S AG

- Migao Corporation

- OCP Group

- AG CHEMI GROUP

- GFS Chemicals

- Wentong Potassium Salt Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, Uralchem JSC signed an MoU with Rashtriya Chemicals and Fertilizers Limited, National Fertilizers Limited, and Indian Potash Limited to establish a urea plant in Russia with 1.8-2 million tonnes annual capacity. The project will use ammonia from Togliattiazot JSC and Indian financing.

- In November 2025, The Mosaic Company completed the sale of its Taquari-Vassouras potash mine in Brazil to VL Mineracao Ltda. for $27 million. VL Mineracao assumed operations and $22 million in asset retirement obligations. Payments include $12 million upfront and contingent instalments.

- In October 2025, Chilean fertilizer producer Sociedad Quimica y Minera de Chile (SQM) reported lower potassium nitrate (NOP) production, totalling 127,900t in Q3, down 6% year on year. Nine-month output fell 4% to 394,700t. The company increased specialty blends production, reflecting a strategic shift toward higher-value plant nutrients.

- In October 2021, ICL Group Ltd announced plans to expand its commercial relationship with Haldor Topsoe through a long-term potassium nitrate (NOP) supply agreement. ICL aimed to begin marketing the product in early 2022 while maintaining existing supplier partnerships.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the potassium nitrate market based on the below-mentioned segments:

Global Potassium Nitrate Market, By Raw Material

- Potassium Chloride

- Ammonium Nitrate

- Sodium Nitrate

Global Potassium Nitrate Market, By Formulation

- Granular

- Liquid

- Powder

Global Potassium Nitrate Market, By Application

- Agriculture

- General Industries

- Pharmaceutical Industry

- Food Industry

- Others

Global Potassium Nitrate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the potassium nitrate market over the forecast period?The global potassium nitrate market is projected to expand at a CAGR of 3.2% during the forecast period.

-

2. What is the market size of the potassium nitrate market?The global potassium nitrate market size is expected to grow from USD 5.68 billion in 2024 to USD 8.03 billion by 2035, at a CAGR of 3.2% during the forecast period 2025-2035.

-

3. What is the global potassium nitrate market?The global potassium nitrate market refers to worldwide production, distribution, and consumption of potassium nitrate across agriculture, food, and other industries.

-

4. Which region holds the largest share of the potassium nitrate market?Asia Pacific is anticipated to hold the largest share of the potassium nitrate market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global potassium nitrate market?SQM S.A., Nutrien Ltd., Yara International ASA, Haifa Group, Uralchem Group, The Mosaic Company, Arab Potash Company, ICL Group Ltd, K+S AG, Migao Corporation, and Others.

-

6. What factors are driving the growth of the potassium nitrate market?The drivers include rising demand for high-efficiency, chloride-free specialty fertilizers in agriculture, expanding use in food preservation (meat curing), and increasing applications in pharmaceutical, glass, and fireworks manufacturing.

-

7. What are the market trends in the potassium nitrate market?Key trends include rising demand for high-efficiency, chloride-free fertilizers, increased use in precision agriculture, and growth in food, pharmaceutical, and solar applications.

-

8. What are the main challenges restricting wider adoption of the potassium nitrate market?The challenges restricting wider adoption of the potassium nitrate market include high production costs, strict environmental regulations on chemical usage, fluctuating raw material prices, logistical hurdles, and competition from cheaper alternative fertilizers.

-

9. Which are the major raw materials in the global potassium nitrate market?Major raw materials in the global potassium nitrate market include potassium chloride, sodium nitrate, ammonium nitrate, and nitric acid.

Need help to buy this report?