Japan Greenhouse Horticulture Market Size, Share, By Greenhouse Type (Glass Greenhouse, Plastic Greenhouse, and Net House), End-Use (Commercial Horticulture, Home Gardening, and Research & Education), Japan Greenhouse Horticulture Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureJapan Greenhouse Horticulture Market Insights Forecasts to 2035

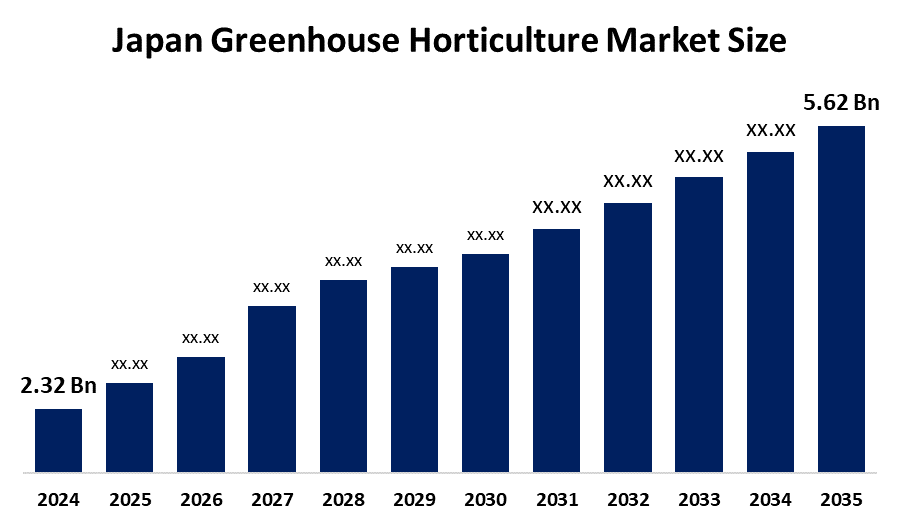

- Japan Greenhouse Horticulture Market Size 2024: USD 2.32 Billion

- Japan Greenhouse Horticulture Market Size 2035: USD 5.62 Billion

- Japan Greenhouse Horticulture Market CAGR 2024: 8.38%

- Japan Greenhouse Horticulture Market Segments: Greenhouse Type and End-use.

Get more details on this report -

The Greenhouse Horticulture Market In Japan Primarily Includes Growing Crops In A High-Tech Environment, Focused On High-End Vegetables, Fruit Trees, And Flower Production To Be Grown In A Greenhouse To Create An Ideal Growing Environment For The Selected Produce. The agricultural production of greenhouse horticulture in Japan has been done using highly developed, sophisticated environmental control systems to reduce the effects of the extreme weather conditions that can occur in Japan, such as those due to typhoons and heavy snowfalls. There is a growing trend toward using the Internet of Things (IoT) in Greenhouses to monitor the real-time data of CO2 levels, humidity, and light in a greenhouse. The market is transitioning from being just a means to extend the seasonality and create a perpetual harvest to being fully industrially productive all year. It has been reported that the output from Greenhouse Horticulture has reached the highest level per hectare of any other agricultural production located on the limited agricultural soil of Japan.

The Japanese government and private organizations are actively working to improve this industry through a variety of programs and projects. The Ministry of Agriculture, Forestry, and Fisheries (MAFF) has developed and implemented the "Next-Generation Greenhouse Horticulture" hubs in ten sites designed to achieve cost-effective production. Private-sector funding is growing rapidly as well, and through partnerships between large technology companies and agricultural cooperatives, there will be investment into "Plant Factories", as well as a wide variety of tech-driven cluster facilities. These investments are targeted at attracting young people into agriculture by eliminating physical labour through various forms of robotic automation, while simultaneously ensuring financial viability via government investments into energy-efficient heating systems.

Technological advancement is making a tremendous impact on Greenhouse Horticulture in Japan and is driving the utilization of climate computers utilizing Artificial Intelligence technology, which creates a new level of efficiency in greenhouse management by allowing for complete automation of climate control and the reduction of manual labor. Robotic harvesting technology is already being adopted, significantly decreasing the necessity for human labor. The development of new technologies like wood-biomass heating and the use of supplemental LED lighting provide means to develop lower carbon footprints as well as decreased energy costs. Similarly, as the industry expands within urban cities, hydroponics and aeroponics are becoming increasingly common as they promote precise nutrient and water management, both critical to providing sustainably grown produce in densely populated metropolitan areas such as Tokyo and Osaka.

Japan Greenhouse Horticulture Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.32 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.38% |

| 2035 Value Projection: | USD 5.62 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Greenhouse Type, By End-Use |

| Companies covered:: | Inochio Agri Corporation, Mitsubishi Mahindra Agricultural Machinery Co., Ltd., Kubota Corporation, Yanmar Holdings Co., Ltd., Japan Dome House Co., Ltd., Daisen Co., Ltd., Takii & Co., Ltd., Toyota Tsusho Corporation, Others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Greenhouse Horticulture Market:

The Japanese greenhouse market is driven by the necessity for food, and maximising the effectiveness of limited farmland is majorly important in Japan, in particular the development of advanced greenhouse systems that can produce 2-3 times greater yields than those generated through traditional, open-air agricultural systems. With only 11% of land available for farming, the demand for fresh fruits, vegetables, and herbs that are grown locally without chemical pesticides is growing, thus promoting the growth of controlled environment agriculture (CEA) to enable year-round production through guaranteed supply.

The Japanese greenhouse market is restrained by the high level of capital investment required to build and maintain technologically advanced greenhouses, which is a major obstacle to success for small-scale farmers. An additional issue is the high cost of heating a greenhouse during winter and cooling it during summer, which would reduce the profit margins for many small-scale farmers and hinder the adoption of more advanced automated systems.

Japan’s greenhouse market offers strong opportunities due to the need for food for dense populations in urban areas, which provides a large opportunity for the expansion of AI-integrated smart" vertical farming. Utilizing renewable energy sources, such as biomass and solar energy, will help lower the long-term operational costs of greenhouse systems while supporting Japan's national goal of becoming carbon neutral by 2050.

Market Segmentation

The Japan greenhouse horticulture market share is classified into greenhouse type and end-use.

By Greenhouse Type:

The Japanese greenhouse horticulture market is divided by greenhouse type into glass greenhouse, plastic greenhouse, and net house. Among these, the glass greenhouse segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Glass greenhouses are an ideal choice for large-scale horticultural companies seeking great production and quality because of their sturdy construction and long lifespan. They offer excellent light management and insulation, which help crops grow efficiently in a variety of environmental situations.

By End-use:

The Japanese greenhouse horticulture market is divided by end-use into commercial horticulture, home gardening, and research & education. Among these, the commercial horticulture segment accounted for the largest revenue share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Commercial horticulture is characterized by large-scale production and distribution of flowers, ornamental plants, and vegetables, generally catering to wholesaler and retailer demands.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan greenhouse horticulture market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Greenhouse Horticulture Market:

- Inochio Agri Corporation

- Mitsubishi Mahindra Agricultural Machinery Co., Ltd.

- Kubota Corporation

- Yanmar Holdings Co., Ltd.

- Japan Dome House Co., Ltd.

- Daisen Co., Ltd.

- Takii & Co., Ltd.

- Toyota Tsusho Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan greenhouse horticulture market based on the below-mentioned segments:

Japan Greenhouse Horticulture Market, By Greenhouse Type

- Glass Greenhouse

- Plastic Greenhouse

- Net House

Japan Greenhouse Horticulture Market, By End-use

- Commercial Horticulture

- Home Gardening

- Research and Education

Frequently Asked Questions (FAQ)

-

Q: What is the base year for the Japan greenhouse horticulture market?A: The base year for the Japan greenhouse horticulture market is 2024, with historical data covering the period from 2020 to 2023.

-

Q: What is the projected market size of Japan greenhouse horticulture by 2035?A: The market is expected to grow from USD 2.32 billion in 2024 to USD 5.62 billion by 2035.

-

Q: What is the expected CAGR of the Japan greenhouse horticulture market during the forecast period?A: The market is projected to grow at a CAGR of 8.38% during the forecast period 2025–2035.

-

Q: Which greenhouse type holds the largest market share in Japan?A: Glass greenhouses held the largest market share in 2024 due to their durability, efficient light management, and suitability for large-scale commercial production.

-

Q: What are the key growth drivers of the Japan greenhouse horticulture market?A: Key drivers include limited arable land, rising demand for year-round food production, adoption of IoT and AI-based greenhouse technologies, and strong government support.

-

Q: Who are the major players operating in the Japan greenhouse horticulture market?A: Major players include Inochio Agri Corporation, Kubota Corporation, Yanmar Holdings Co., Ltd., Mitsubishi Mahindra Agricultural Machinery Co., Ltd., and Toyota Tsusho Corporation.

Need help to buy this report?