Global Pharmaceutical Packaging Market Size By Material (Plastics & Polymers, Paper & Paperboard, Glass, Aluminum Foil), By Product (Primary, Secondary, Tertiary), By End-use (Pharma Manufacturing, Contract Packaging, Retail Pharmacy, Institutional Pharmacy), By Region, And Segment Forecasts, By Geographic Scope And Forecast 2022 - 2032

Industry: Advanced MaterialsGlobal Pharmaceutical Packaging Market Insights Forecasts to 2032

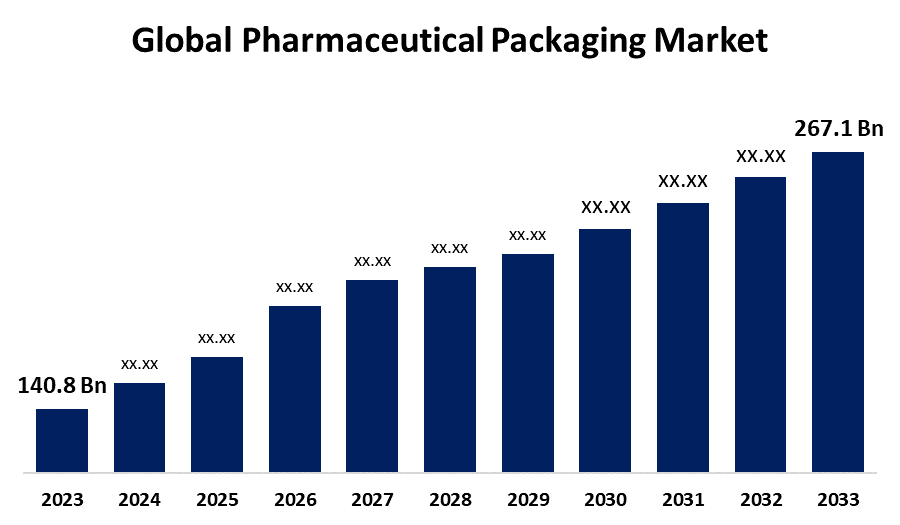

- The Global Pharmaceutical Packaging Market Size was valued at USD 140.8 Billion in 2022

- The Market Size is growing at a CAGR of 10.4% from 2022 to 2032

- The Global Pharmaceutical Packaging Market Size is expected to reach USD 267.1 Billion by 2032

- Asia Pacific Market is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Pharmaceutical Packaging Market Size is expected to reach USD 267.1 Billion by 2032, at a CAGR of 10.4% during the forecast period of 2022–2032.

Medicinal products frequently react negatively to light, moisture, and temperature. The stability and effectiveness of the medications are preserved by the protective barrier provided by packaging materials, such as molded pulp trays and containers. It is crucial to guarantee the safety of pharmaceutical items. Tamper-evident molded pulp trays and blister packs are examples of packaging methods that help prevent contamination and unwanted access. Customized solutions are frequently needed by the pharmaceutical packaging market to meet the needs of certain drug formulations and dosage formats. Because of its versatility, molded pulp can be used to create customized packaging that satisfies the particular needs of medicinal items.

Pharmaceutical Packaging Market Value Chain Analysis

The process starts with the raw ingredients, which include metal, plastic, glass, and molded pulp packaging materials. For pharmaceutical goods to be safe and pure, these components have to meet regulatory requirements. The manufacturing process uses the raw materials to create a variety of packaging, including bottles, vials, blister packs, and, in this case, molded pulp trays. At this point, accuracy and consistency are essential to meeting the demanding standards of the pharmaceutical sector. Packaging design plays a crucial role in providing consumers and healthcare professionals with important information. Printing and labeling make sure that every item is uniquely identified and has all the information that it needs, like barcodes, expiration dates, and dosing guidelines. Pharmaceutical items are packaged and then supplied via a convoluted network to pharmacies, distributors, and finally end users.

Pharmaceutical Packaging Market Opportunity Analysis

Utilizing cutting-edge materials and technologies—like RFID (Radio-Frequency Identification) and smart packaging offers a chance to improve patient adherence, security, and traceability. Customized packaging options are becoming more and more popular as specialized medications and personalized medicine gain traction. Safe transport and administration of specialized pharmaceuticals are ensured by packaging specifically designed to meet their needs. The growing emphasis on sustainability in the pharmaceutical industry presents a chance for environmentally friendly packaging options. As it is renewable and biodegradable, molded pulp might be essential to achieving sustainability objectives.The ongoing problem of fake medications presents a chance for packaging developments with anti-counterfeiting characteristics. These could include characteristics that detect tampering, such as holographic labeling. The pharmaceutical sector is growing on a worldwide scale. Packaging firms now have the chance to offer solutions that meet various regulatory standards as well as cultural preferences across various locations.

Global Pharmaceutical Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 140.8 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 10.4% |

| 2032 Value Projection: | USD 267.1 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Material, By Product, By End-Use, By Region, By Geographic Scope |

| Companies covered:: | Becton, Dickinson and Company, Amcor Plc, AptarGroup, Inc., Gerresheimer AG, Drug Plastics Group, Schott AG, West Pharmaceutical Services Inc., Owens Illinois Inc., Berry Global, Inc, SGD S.A., WestRock Company and Other Key Vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Pharmaceutical Packaging Market Dynamics

Growth of the pharmaceutical sector

The aging and growing global population is driving up demand for pharmaceuticals to meet a range of healthcare requirements. An rise in production and packaging needs is a direct result of this demand spike. Biologics and biosimilars are among the biopharmaceuticals that the pharmaceutical industry is seeing a move towards. Packaging improvements can be leveraged from the complex and delicate pharmaceuticals, which often require specific packaging to retain their potency. Because of the pharmaceutical industry's globalization, goods must adhere to a wide range of cultural norms and legal requirements. The demand for innovative and adaptive packaging solutions is fueled by the complexity of distribution and compliance regulations. Pharmaceutical sales are increasingly being conducted online, and this, together with the move to direct-to-consumer business models, presents potential for packaging solutions that are optimized for online distribution, including safe and intuitive designs.

Restraints & Challenges

Packing has hurdles in the deployment of serialization, particularly with the growth of track-and-trace rules. Sophisticated technology and painstaking planning are needed to guarantee that every unit has a unique identification. Packaging solutions with cutting-edge anti-counterfeiting characteristics are required due to the ongoing problem of counterfeit medications. It's a constant struggle to design packaging that is both easily verified and secure. The necessity for sophisticated and secure packaging frequently collides with the demand for affordable solutions. It's never easy to strike a balance between price and adherence to legal requirements. The rise in biopharmaceuticals poses new difficulties for the packaging of delicate and complicated medications. It is crucial to guarantee the integrity and stability of biologics while they are being stored and transported.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Pharmaceutical Packaging Market from 2023 to 2032. There is an increasing need for specialized packaging solutions in North America due to the increased prevalence of biopharmaceuticals, which includes biologics and biosimilars. For these medications to remain stable and effective, special primary packaging is frequently needed. Packaging design is influenced by North America's emphasis on medication regimen compliance and patient safety. Important factors to take into account are tamper-evident features, child-resistant packaging, and user-friendly designs. The demand for specialized packaging solutions for experimental medications is driven by the fact that North America is a hub for clinical trials. This covers trial drug packaging that guarantees the trial drug's integrity and traceability.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. Asia Pacific is a major hub for the production and use of pharmaceuticals. The need for packaging solutions is driven by the expanding pharmaceutical industry, which is fueled by factors such as population growth, rising healthcare costs, and rising middle-class income. A number of Asia-Pacific nations, including China and India, are regarded as developing markets for pharmaceuticals. Packaging firms have the opportunity to meet the growing demand for pharmaceutical products due to the rapid growth of these industries. Online sales and e-commerce, particularly in the pharmaceutical industry, have increased dramatically throughout the Asia Pacific area. Packaging needs are impacted by this move to digital channels, necessitating the use of solutions appropriate for online distribution.

Segmentation Analysis

Insights by Material

The Plastic and Polymers segment accounted for the largest market share over the forecast period 2023 to 2032. For adaptability, plastic and polymers provide a plethora of alternatives. Their moldability allows for a wide range of sizes and forms to be created, giving designers more options when creating packaging for various kinds of prescription drugs. Because plastic and polymer packaging is lightweight, it is a great option for distribution and transit. This can lessen the total environmental effect and help save money on logistics. Pharmaceutical items are well-protected by plastic and polymers. They can protect pharmaceuticals from light, moisture, and other external elements while maintaining their stability and integrity. Packaging made of plastic and polymers is frequently more affordable than packaging made of other materials. For pharmaceutical businesses trying to cut costs without sacrificing quality standards, this is an important consideration.

Insights by Product

Primary segment is witnessing the fastest market growth over the forecast period 2023 to 2032. Specialized primary packaging is frequently needed for the production of novel and inventive pharmaceuticals in order to guarantee the stability and effectiveness of the medication. The need for specialized primary packaging solutions is increasing as the pharmaceutical industry innovates more. Specialized primary packaging is becoming more and more necessary as biopharmaceuticals and specialty medications become more popular. These drugs frequently have distinct handling and storage needs. This comprises ampoules, syringes, vials, and other containers made specifically to keep these delicate mixtures safe. The importance of primary packaging in patient-centric healthcare is becoming more and more apparent. This trend is fueled in part by packaging improvements that improve patient adherence, like blister packs with clearly marked dosing instructions. Pre-filled syringes and auto-injectors are two primary packing options that are becoming more and more popular since they make medicine administration simple and accurate.

Insights by End Use

The Pharma manufacturing segment accounted for the largest market share over the forecast period 2023 to 2032. The growth of the pharmaceutical manufacturing industry raises the need for packaging materials because it increases drug production. In order to keep up with the demands of expanding pharmaceutical production, packaging businesses need to expand. Specialized packaging solutions are needed to support the development of complicated medication formulations and the growth of biopharmaceuticals. Primary and secondary packaging made to preserve the integrity and stability of these delicate goods falls under this category. Demand for packaging is rising as a result of pharmaceutical manufacturing expanding into developing nations. In these growing markets, packaging companies may need to adjust to new legal requirements and consumer preferences. Packaging innovation is fueled by the pharmaceutical manufacturing sector's adoption of serialization and track-and-trace technology to adhere to regulatory standards.

Recent Market Developments

- In February 2023, the Clinical Trial Kit, Gerresheimer's newest product, was introduced at the Pharmapack conference in Paris.

- In April 2022, Amcor expanded their line of pharmaceutical packaging with new High Shield laminates that are more environmentally friendly.

Competitive Landscape

Major players in the market

- Becton

- Dickinson and Company

- Amcor Plc

- AptarGroup, Inc.

- Gerresheimer AG

- Drug Plastics Group

- Schott AG

- West Pharmaceutical Services Inc.

- Owens Illinois Inc.

- Berry Global, Inc

- SGD S.A.

- WestRock Company

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Pharmaceutical Packaging Market, Material Analysis

- Plastics & Polymers

- Paper & Paperboard

- Glass

- Aluminum Foil

Pharmaceutical Packaging Market, Product Analysis

- Primary

- Secondary

- Tertiary

Pharmaceutical Packaging Market, End Use Analysis

- Pharma Manufacturing

- Contract Packaging

- Retail Pharmacy

- Institutional Pharmacy

Pharmaceutical Packaging Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Pharmaceutical Packaging Market?The Global Pharmaceutical Packaging Market is expected to grow from USD 140.8 Billion in 2023 to USD 267.1 Billion by 2032, at a CAGR of 10.4% during the forecast period 2023-2032.

-

2. Who are the key market players of the Pharmaceutical Packaging Market?Some of the key market players of market are Becton, Dickinson and Company, Amcor Plc, AptarGroup, Inc., Gerresheimer AG, Drug Plastics Group, Schott AG, West Pharmaceutical Services Inc., Owens Illinois Inc., Berry Global, Inc, SGD S.A., WestRock Company.

-

3. Which segment holds the largest market share?Plastics and polymers segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Pharmaceutical Packaging Market?North America is dominating the Pharmaceutical Packaging Market with the highest market share.

Need help to buy this report?