Global Paraphenylenediamine Market Size, Share, and COVID-19 Impact Analysis, By Product (PPD AD, PPD AD Molten, PPD AD Ultra-Pure, and Others), By Application (Rubber Chemicals, Hair Dyes, Textile Dyes and Pigments, Synthetic Fibers, Polyurethane, Photographic Developing, Printing Inks, Oils and Gasoline, and Others), By End-use (Personal Care and Cosmetics, Textile Industry, Oil and Gas, Rubber and Plastic Industry, Chemical and Pharmaceutical, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Chemicals & MaterialsGlobal Paraphenylenediamine Market Insights Forecasts to 2035

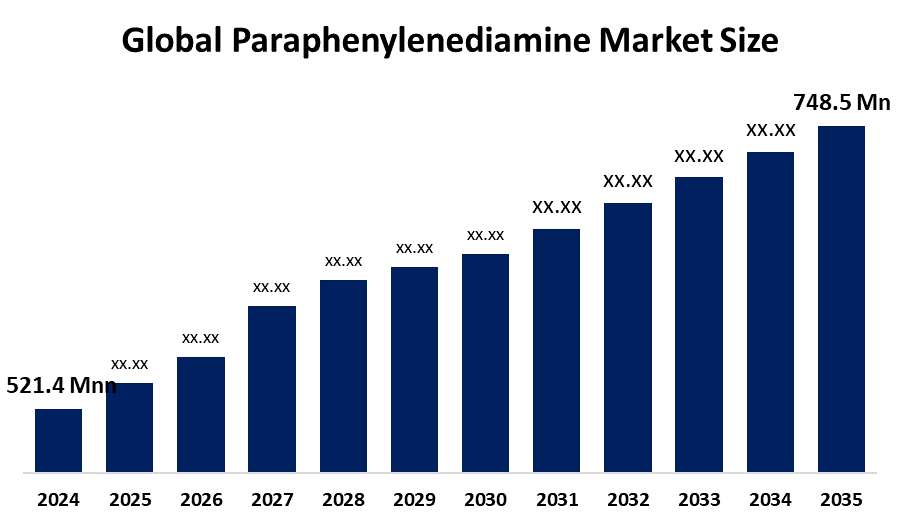

- The Global Paraphenylenediamine Market Size Was Valued at USD 521.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.3% from 2025 to 2035

- The Worldwide Paraphenylenediamine Market Size is Expected to Reach USD 748.5 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Paraphenylenediamine Market Size Was Worth Around USD 521.4 Million in 2024 And is predicted to grow to Around USD 748.5 Million by 2035 with a compound annual growth rate (CAGR) of 4.3% from 2025 to 2035. The global demand for paraphenylenediamine (PPD) products has created market growth because personal care products require more hair dyes, and Asia Pacific countries are increasing their textile production while using PPD as a rubber antioxidant. Rising demand for durable, high-performance materials such as aramid fibers further drives expansion.

Market Overview

Paraphenylenediamine (PPD) exists as a white-to-greyish solid because it contains aromatic amine groups, which originate from aniline and serve as a fundamental component of permanent hair dyes and oxidative dyes, whose market value has grown substantially. The material serves two primary functions, which include providing permanent dark hair colour to personal care products and serving as industrial materials that function as rubber manufacturing antioxidants and textile dyes, aramid fibre polymers (Kevlar) and printing inks. The cosmetic industry continues to experience rapid growth, while fashion textiles with bright colors and automotive production in the Asia Pacific region increase, which serve as the major forces driving market growth.

The U.S. Environmental Protection Agency (EPA) issued an Advanced Notice of Proposed Rulemaking (ANPRM) through TSCA Section 6, which evaluates the risk of 6PPD and 6PPD-quinone, its by-product on January 2025. The move follows a 2023 tribal petition requesting restrictions on 6PPD in tires. Stakeholders must provide their input to the ANPRM so that regulatory agencies can decide how to create their future rules. The market needs safer hypoallergenic bio-based product alternatives that can reduce health risks. High-performance aramid polymers have seen increased demand. The major global players who dominate the market include LANXESS, Aarti Industries Ltd., DuPont, Chizhou Fangda Technology Co. Ltd., BASF SE and Anhui Xianglong Chemical Co. Ltd. The Asia-Pacific region takes the lead in both production and consumption.

Report Coverage

This research report categorizes the paraphenylenediamine market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the paraphenylenediamine market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the paraphenylenediamine market.

The rubber chemicals segment accounted for the largest share in 2024, approximately 30% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the paraphenylenediamine market is divided into rubber chemicals, hair dyes, textile dyes and pigments, synthetic fibers, polyurethane, photographic developing, printing inks, oils and gasoline, and others. Among these, the rubber chemicals segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The market for this segment shows strong expansion due to the industrial and automotive sectors' need for better rubber compounds, which drives demand. PPD provides a common solution that tire manufacturers and industrial component producers use to improve the elasticity, strength and durability of their rubber products. The material functions as a crucial component that rubber industries use because it extends product lifespan while boosting performance throughout all rubber-based industries worldwide.

Global Paraphenylenediamine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 521.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.3% |

| 2035 Value Projection: | USD 748.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product , By End-use |

| Companies covered:: | DuPont de Nemours, Inc., LANXESS AG, BASF SE, Chizhou Fangda Technology Co., Ltd., Aarti Industries Ltd., BOCSCI Inc., Sumitomo Chemical Co., Ltd., Huntsman Corporation, AkzoNobel N.V., CHEMOS GmbH and Co. KG, TBI CORPORATION LTD., Anhui Xianglong Chemical Co., Ltd., Jay Organics Pvt. Ltd., Zhejiang Longsheng Group Co. Ltd., Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global paraphenylenediamine (PPD) market experiences its primary growth through the personal care and cosmetics industry expansion, which leads to permanent hair dye demand that constitutes more than 50% of market usage. Another major factor is the robust growth of the textile industry in emerging economies (Asia Pacific) for durable, dark-colored fabrics. The automotive and aerospace sectors create higher PPD demand because manufacturers require PPD to produce rubber antioxidants and advanced aramid fibers. Urban areas develop PPD-based products because people gain more money and follow current fashion trends.

Restraining Factors

The global paraphenylenediamine (PPD) market faces multiple restraining factors, which include the EU North America regulations that enforce concentration limits to protect against toxic and skin irritation effects. Market growth faces obstacles from three factors, which include rising consumer demand for natural products, fluctuating raw material costs and expensive research needed to develop safe alternatives.

Market Segmentation

The paraphenylenediamine market share is classified into product, application, and end-use.

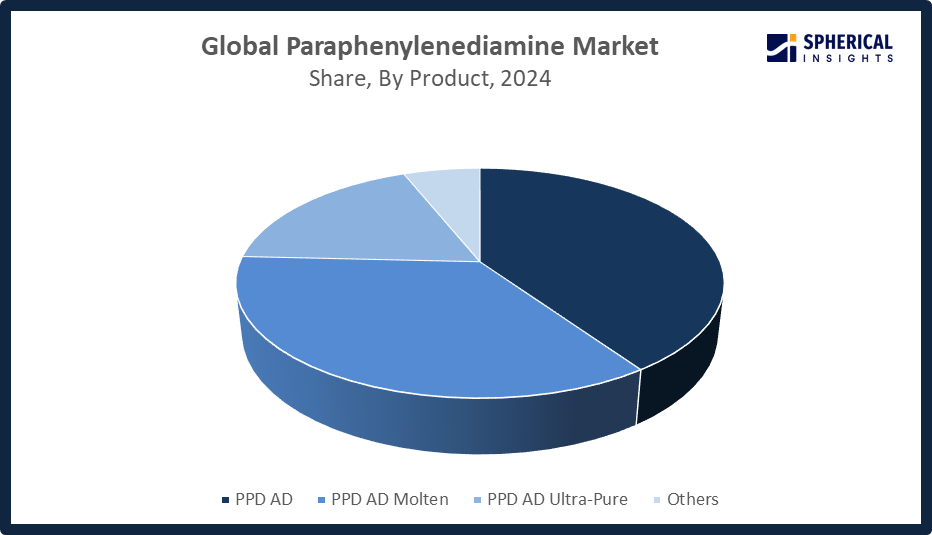

- The PPD AD segment dominated the market in 2024, approximately 40% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product, the paraphenylenediamine market is divided into PPD AD, PPD AD molten, PPD AD ultra-pure, and others. Among these, the PPD AD segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment market grows owing to it provides products with exceptional purity and performance capabilities and multiple industrial uses. The product serves as a standard material in the rubber chemical industry, hair dye production and textile dye manufacturing because of its improved stability and operational effectiveness. The company maintains a strong international market leadership position because personal care products, automotive items, and textile products create rising demand, and its manufacturing capabilities continue to grow.

- The personal care & cosmetics segment accounted for the highest market revenue in 2024, approximately 37% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the paraphenylenediamine market is divided into personal care & cosmetics, textile industry, oil & gas, rubber & plastic industry, chemical & pharmaceutical, and others. Among these, the personal care & cosmetics segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The personal care and cosmetics industry drove market growth because people increasingly demanded hair dyes and coloring products from this segment. PPD and its derivatives provide long-lasting, vibrant coloration, meeting consumer expectations. The combination of fashion trends, rising disposable incomes, and growing personal grooming habits in emerging markets strengthens PPD's status as a vital ingredient for hair care products used worldwide.

Get more details on this report -

- The rubber chemicals segment accounted for the largest share in 2024, approximately 30% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the paraphenylenediamine market is divided into rubber chemicals, hair dyes, textile dyes and pigments, synthetic fibers, polyurethane, photographic developing, printing inks, oils and gasoline, and others. Among these, the rubber chemicals segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The market for this segment shows strong expansion due to the industrial and automotive sectors' need for better rubber compounds, which drives demand. PPD provides a common solution that tire manufacturers and industrial component producers use to improve the elasticity, strength and durability of their rubber products. The material functions as a crucial component that rubber industries use because it extends product lifespan while boosting performance throughout all rubber-based industries worldwide.

- The personal care & cosmetics segment accounted for the highest market revenue in 2024, approximately 37% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the paraphenylenediamine market is divided into personal care & cosmetics, textile industry, oil & gas, rubber & plastic industry, chemical & pharmaceutical, and others. Among these, the personal care & cosmetics segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The personal care and cosmetics industry drove market growth because people increasingly demanded hair dyes and coloring products from this segment. PPD and its derivatives provide long-lasting, vibrant coloration, meeting consumer expectations. The combination of fashion trends, rising disposable incomes, and growing personalgrooming habits in emerging markets strengthens PPD's status as a vital ingredient for hair care products used worldwide.

Regional Segment Analysis of the Paraphenylenediamine Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the paraphenylenediamine market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the paraphenylenediamine market over the predicted timeframe. The paraphenylenediamine market in the Asia Pacific will become its 48% share of the market because the region has both a strong industrial base and increasing consumer demand. The textile industry and rubber industry, and the cosmetics industry in China and India create high demand for PPD because they use it in dyes, hair colorants and rubber additives. The country benefits from competitive manufacturing costs because of its high availability of raw materials, its fast-growing urban areas, and its increasing disposable incomes. The Hazardous Chemicals Safety Law of China, which will take effect in May 2026, requires chemical manufacturers to obtain stricter licensing and safety permits and transport controls, while they must provide better reporting standards, which will impact supply chains and domestic production and export of specialty amines like PPD.

North America is expected to grow at a rapid CAGR in the paraphenylenediamine market during the forecast period. The paraphenylenediamine market in North America will experience a 22% share of rapid growth due to rising demand from the United States and Canada, which have established cosmetics, textile and specialty chemical sectors that use PPD. The industry experiences growth because of technological advancements, which create new high-performance dyes and industrial application formulations. The industry requires high-purity PPD grades because strict quality and safety regulations demand such products. Canada will implement its Prohibition of Certain Toxic Substances Regulations on June 30 2026, which will ban specific toxic substances that pose aromatic amine-related risks, which are similar to those presented by PPD derivatives

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the paraphenylenediamine market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DuPont de Nemours, Inc.

- LANXESS AG

- BASF SE

- Chizhou Fangda Technology Co., Ltd.

- Aarti Industries Ltd.

- BOCSCI Inc.

- Sumitomo Chemical Co., Ltd.

- Huntsman Corporation

- AkzoNobel N.V.

- CHEMOS GmbH and Co. KG

- TBI CORPORATION LTD.

- Anhui Xianglong Chemical Co., Ltd.

- Jay Organics Pvt. Ltd.

- Zhejiang Longsheng Group Co. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2026, Vietnam enacted its new Law on Chemicals, introducing stricter lifecycle management, list-based controls, and mandatory GHS-aligned hazard classification. The regulation strengthens registration, import-export compliance, and hazardous chemical reporting requirements, potentially impacting para-phenylenediamine (PPD) and related intermediates if included under controlled chemical lists.

- In September 2025, Aarti Drugs Limited began commercial production at its new Sayakha, Gujarat facility, with a 60 MT/day capacity. Producing dimethylamine, monomethylamine, trimethylamine, and derivatives, the Rs. 220 crore plant aims to strengthen domestic supply, reduce raw material dependence, enhance reliability, and support future export potential.

- In June 2025, BASF launched its new world-scale hexamethylenediamine (HMD) plant in Chalampe, France, boosting annual capacity to 260,000 metric tons. This investment reinforces BASF’s commitment to European chemical production, supports regional growth, and aligns with its “Winning Ways” strategy to ensure long-term competitiveness.

- In March 2025, LANXESS will showcase its tire industry portfolio at Tire Technology Expo in Hannover, Germany. Its innovative, sustainable rubber additives aim to enhance manufacturing efficiency, reduce environmental impact, and support production of more durable, high-performance, and eco-friendly modern tires.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the paraphenylenediamine market based on the below-mentioned segments:

Global Paraphenylenediamine Market, By Product

- PPD AD

- PPD AD Molten

- PPD AD Ultra-Pure

- Others

Global Paraphenylenediamine Market, By Application

- Rubber Chemicals

- Hair Dyes

- Textile Dyes and Pigments

- Synthetic Fibers

- Polyurethane

- Photographic Developing

- Printing Inks

- Oils and Gasoline

- Others

Global Paraphenylenediamine Market, By End-use

- Personal Care & Cosmetics

- Textile Industry

- Oil & Gas

- Rubber & Plastic Industry

- Chemical & Pharmaceutical

- Others

Global Paraphenylenediamine Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the paraphenylenediamine market over the forecast period?The global paraphenylenediamine market is projected to expand at a CAGR of 4.3% during the forecast period.

-

2. What is the global paraphenylenediamine market?The global paraphenylenediamine market refers to the worldwide trade of PPD, used in hair dyes, rubber, and textile chemicals.

-

3. What is the market size of the paraphenylenediamine market?The global paraphenylenediamine market size is expected to grow from USD 521.4 million in 2024 to USD 828.7 million by 2035, at a CAGR of 4.3% during the forecast period 2025-2035.

-

4. Which region holds the largest share of the paraphenylenediamine market?Asia Pacific is anticipated to hold the largest share of the paraphenylenediamine market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global paraphenylenediamine market?DuPont de Nemours, Inc., LANXESS AG, BASF SE, Chizhou Fangda Technology Co. Ltd., Aarti Industries Ltd., BOCSCI Inc., Sumitomo Chemical Co., Ltd., Huntsman Corporation, AkzoNobel N.V., CHEMOS GmbH and Co. KG, and Others.

-

6. What factors are driving the growth of the paraphenylenediamine market?Growth in the paraphenylenediamine (PPD) market is driven by rising demand for permanent hair dyes, increased usage of rubber antioxidants, expanding textile production in the Asia-Pacific, and high-performance aramid fiber applications.

-

7. What are the market trends in the paraphenylenediamine market?Key trends include rising demand in cosmetics and rubber applications, stricter safety regulations, a shift to high‑purity grades, and growth in Asia‑Pacific markets.

-

8. What are the main challenges restricting wider adoption of the paraphenylenediamine market?Major challenges restricting the paraphenylenediamine (PPD) market include severe health concerns (skin allergies, toxicity), stringent environmental regulations, growing consumer demand for natural alternatives, and raw material price volatility.

Need help to buy this report?