India Aniline Market Size, Share, By Derivative (Sulphur Derivatives Of Aniline, N-Alkyl Aniline Derivatives, C-Alkyl Aniline Derivatives, And Others), By End User (Chemical, Petrochemical, Oil & Gas, Energy Power, Pharmaceutical, Automotive, And Others), And India Aniline Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Aniline Market Insights Forecasts to 2035

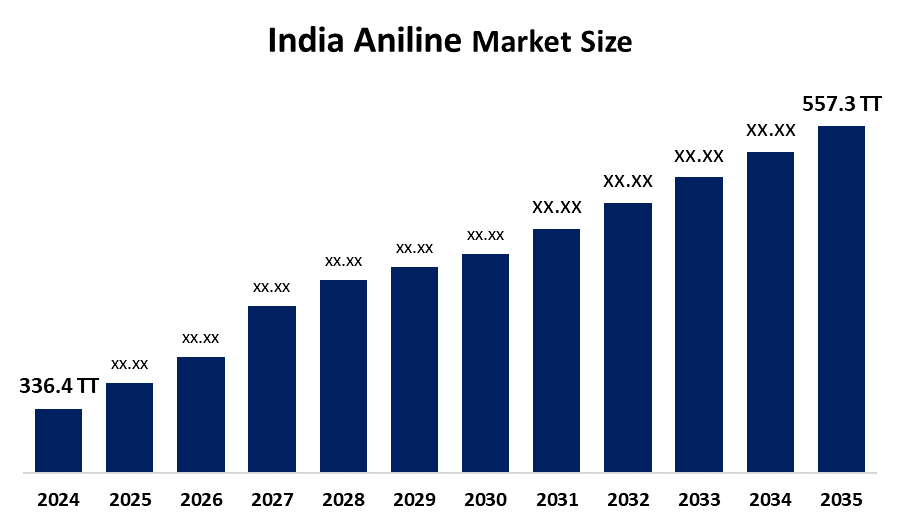

- India Aniline Market 2024: 336.4 Thousand Tonnes

- India Aniline Market Size 2035: 557.3 Thousand Tonnes

- India Aniline Market CAGR 2024: 4.7%

- India Aniline Market Segments: Derivative and End User

Get more details on this report -

The India Aniline Market Size India n-heptane market encompasses all stages of production, distribution, and use of aniline, widely regarded as a key chemical intermediate in modern industrial chemistry. Most aniline is manufactured through catalytic hydrogenation of nitrobenzene and is used as a building block for a wide variety of downstream products to be incorporated into various applications such as polyurethane foam, dye, rubber processing chemicals, pharmaceutical intermediates, and agri-chemical derivatives. Aniline is the backbone of India’s burgeoning manufacturing ecosystem, and it enables the use of a variety of materials including automotive interiors, insulation and other building materials, and colorants and specialty pharmaceuticals.

The aniline in India are backed by government support, including the Make in India and the Production-Linked Incentive (PLI) schemes, focused on chemicals and related intermediates have been designed to reduce import dependency, encourage domestic production, and build value chain resilience, directly enhancing demand for intermediates like aniline by making local manufacturing more cost-competitive and technologically up-to-date.

As technology advances, India’s aniline providers are now using various forms of modernized chemical nitration and hydrogenation processes, such as energy-efficient chemical processing reactors, automated chemical manufacturing processes, and sufficient safety equipment, in an effort to comply with internationally accepted standards and to minimize the production of hazardous waste recycling byproducts. Manufacturers are also beginning to utilize environmental compliance technologies and more environmentally friendly solvents, which have a positive impact not only on product quality but also on the global competitiveness of Indian chemical manufacturers. Research institutions and chemical firms typically work together to support advancements in the aniline market.

Market Dynamics of the India Aniline Market:

The India Aniline Market Size is driven by the strong and diversified demand from dyes and pigments industry, rapid expansion of the rubber and automotive sectors, increased pharmaceutical industry’s use of aniline intermediates, growing agrochemical sector contribute to rising consumption of aniline, strong government policy support for domestic chemical manufacturing, rise of import substitution also enhances overall market demand.

The India Aniline Market Size is restrained by the environmental and health challenges, inherent toxicity, stringent compliance with safety and emission standards, increased operational costs for producers, complex regulatory pressures, and import dependency for certain chemical feedstocks challenges.

The future of India Aniline Market Size is bright and promising, with versatile opportunities emerging from development of new end-use markets, including pharmaceuticals, agrochemicals, specialty fibers, and high-performance materials, has caused an increase in the demand for aniline derivatives. Additionally, the Indian government has implemented import substitution policies to support the development of domestic capacity. Improvement in the production of chemicals using sustainable methods and bio-based feedstocks increase the global demand for green chemistry. This level of innovation could facilitate new opportunity to manufacturer as well as improve the export competitiveness of Indian aniline producers in the global marketplace.

India Aniline Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 336.4 Thousand Tonnes |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 4.7% |

| 2035 Value Projection: | 557.3 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Derivative, By End User |

| Companies covered:: | Gujarat Narmada Valley Fertilizers & Chemicals Limited R K Synthesis Limited Hindustan Organic Chemicals Limited Aarti Industries Limited Industrial Solvents & Chemicals Pvt. Ltd. Valiant Organics Limited Panoli Intermediates Pvt. Ltd. Kutch Chemical Industries Limited Alchemie Finechem Pvt Ltd. Others Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The India Aniline Market share is classified into derivative and end user.

By Derivative:

The India Aniline Market Size is divided by derivative into sulphur derivative of aniline, n-alkyl aniline derivatives, c-alkyl aniline derivatives, and others. Among these, the sulphur derivative of aniline held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Robust demand from textile, rubber, and pharmaceutical industries, known for consistent purity, reliable, and offer superior performance in specialized applications all contribute to the sulphur derivative of aniline segment's largest share and higher spending on aniline when compared to other derivative.

By End User:

The India Aniline Market Size is divided by end user into chemical, petrochemical, oil & gas, energy power, pharmaceutical, automotive, and others. Among these, the pharmaceutical segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The edible oil extraction segment dominates because of massive growth in healthcare and drug formulations, high purity requirements, rapid growth rate with increase in R&D and manufacturing investments, and well established infrastructure in India.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India Aniline Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Aniline Market:

- Gujarat Narmada Valley Fertilizers & Chemicals Limited

- R K Synthesis Limited

- Hindustan Organic Chemicals Limited

- Aarti Industries Limited

- Industrial Solvents & Chemicals Pvt. Ltd.

- Valiant Organics Limited

- Panoli Intermediates Pvt. Ltd.

- Kutch Chemical Industries Limited

- Alchemie Finechem Pvt Ltd.

- Others

Recent Developments in India Aniline Market:

In February 2024, Coventry has driven technological advancements in the Indian market context by opening the world’s first bio-based aniline manufacturing facility, focused on renewable feedstock to reduce carbon footprints in plastics, relevant to local sustainability trends.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India aniline market based on the below-mentioned segments:

India Aniline Market, By Derivative

- Food Grade

- Industrial Grade

- Pharmaceutical Grade

India Aniline Market, By End User

- Chemical

- Petrochemical

- Oil & Gas

- Energy Power

- Pharmaceutical

- Automotive

- Others

Frequently Asked Questions (FAQ)

-

What is the India aniline market size?India aniline market is expected to grow from 336.4 thousand tonnes in 2024 to 557.3 thousand tonnes by 2035, growing at a CAGR of 4.7% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the strong and diversified demand from dyes and pigments industry, rapid expansion of the rubber and automotive sectors, increased pharmaceutical industry’s use of aniline intermediates, growing agrochemical sector contribute to rising consumption of aniline, strong government policy support for domestic chemical manufacturing, rise of import substitution also enhances overall market demand

-

What factors restrain the India aniline market?Constraints include the environmental and health challenges, inherent toxicity, stringent compliance with safety and emission standards, increased operational costs for producers, complex regulatory pressures, and import dependency for certain chemical feedstocks challenges

-

How is the market segmented by derivative?The market is segmented into sulphur derivative of aniline, n-alkyl aniline derivatives, c-alkyl aniline derivatives, and others.

-

Who are the key players in the India aniline market?Key companies include Gujarat Narmada Valley Fertilizers & Chemicals Limited, R K Synthesis Limited, Hindustan Organic Chemicals Limited, Aarti Industries Limited, Industrial Solvents & Chemicals Pvt. Ltd., Valiant Organics Limited, Panoli Intermediates Pvt. Ltd., Kutch Chemical Industries Limited, Alchemie Finechem Pvt Ltd., and Others

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?