Global Oxygen Cylinders and Concentrators Market Size, Share, and COVID-19 Impact Analysis, By Type (Portable and Fixed), By End-use (Healthcare, Pharmaceutical & Biotechnology, Manufacturing, and Aerospace & Automotive), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Oxygen Cylinders And Concentrators Market Insights Forecasts To 2035

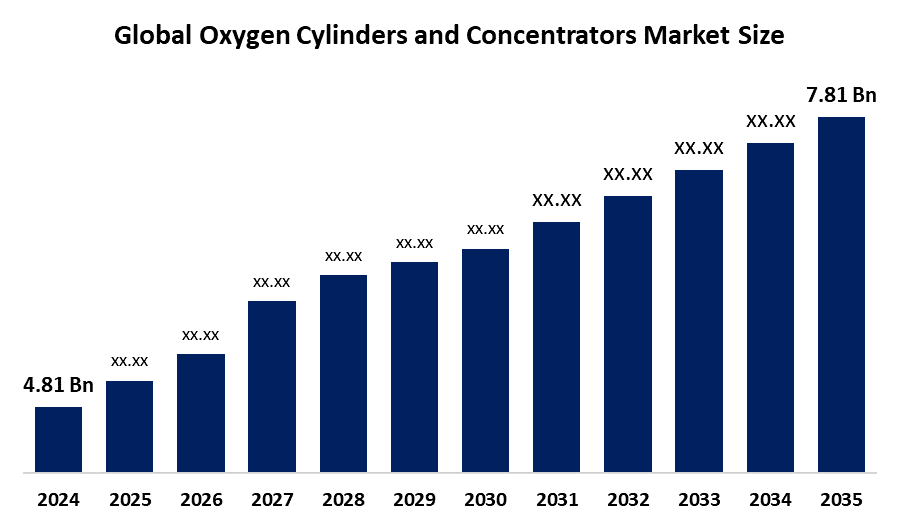

- The Global Oxygen Cylinders And Concentrators Market Size Was Estimated At USD 4.81 Billion In 2024

- The Market Size Is Expected To Grow At A CAGR Of Around 4.5% From 2025 To 2035

- The Worldwide Oxygen Cylinders And Concentrators Market Size Is Expected To Reach USD 7.81 Billion By 2035

- Asia Pacific Is Expected To Grow The Fastest During The Forecast Period.

Get more details on this report -

According To A Research Report Published By Spherical Insights And Consulting, The Global Oxygen Cylinders And Concentrators Market Size Was Worth Around USD 4.81 Billion In 2024 And Is Predicted To Grow To Around USD 7.81 Billion By 2035 With A Compound Annual Growth Rate (CAGR) Of 4.5% From 2025 To 2035. The worldwide oxygen cylinders and concentrators market is experiencing growth in terms of increased incidence of chronic respiratory disorders such as COPD and asthma among the elderly demographic, along with increased demand for home healthcare services and advances in smart and friendly devices.

Market Overview

The Global Oxygen Cylinders And Concentrators Market Size Can Be Defined As The Market Comprising Companies That Manufacture And Trade Equipment For The Storage And Distribution Of Medical-Grade Oxygen In Instances Where A Patient's Blood May Be Lacking In This Gas. The equipment has many applications in healthcare institutions worldwide, such as ambulances, clinics, homes, and health institutions, where patients may be suffering from COPD, asthma, pneumonia, COVID-19, and other illnesses affecting the respiratory system. The primary factor driving market growth is the rising number of patients afflicted with respiratory illnesses.

In December 2024, the Health Ministry in Timor-Leste launched the nation’s first National Oxygen & Pulse Oximetry Scale-Up Strategy and dedicated a PSA oxygen generation plant with the advanced WHO support. It was a result of the need to establish a sustainable and autonomous oxygen-dependent network following the shortages caused by COVID-19. Emerging markets such as those in developing economies are leveraged because of the developing healthcare infrastructures and favorable reimbursement scales, and disease awareness about oxygen therapy. Top manufacturers in the Portable Oxygen Concentrator industry are Philips Healthcare, Invacare Corporation, Chart Industries Inc., Linde PLC, and Air Liquide, with a focus on R&D and advancement and worldwide expansion to expand customer bases and competitive positioning in the global markets, followed by Drive DeVilbiss Healthcare and Inogen Inc., among others.

Report Coverage

This Research Report Categorizes The Oxygen Cylinders And Concentrators Market Size Based On Various Segments And Regions, Forecasts Revenue Growth, And Analyzes Trends In Each Submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the oxygen cylinders and concentrators market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the oxygen cylinders and concentrators market.

Global Oxygen Cylinders and Concentrators Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.81 Billion |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 4.5% |

| 2023 Value Projection: | USD 7.81 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Region |

| Companies covered:: | Philips Healthcare, Invacare Corporation, Nidek Medical Products, Chart Industries Inc., Inogen, Inc., GCE Group, Linde PLC, ResMed, Yuyue Medical, O2 Concepts LLC, Teijin Limited, OxyGo, LLC., Air Liquide, Precision Medical, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Oxygen Cylinders-Concentrators Market Size Is Propelled By The Rising Incidence Of Respiratory Disorders, Including COPD, Asthma, Pneumonia, And Sleep Apnoea, As Well As The Geriatric Population Worldwide. Increased hospitalizations, emergency care requirements, and long-term oxygen therapy requirements further fuel this market. The COVID-19 pandemic led to a rise in awareness regarding oxygen supply, leaving a long-term market demand. The introduction of portable and lightweight concentrators due to technological advances will further improve convenience for the patient, thereby increasing adoption in homecare. Besides, the growth of the market is driven by expanding healthcare access across emerging economies, improved reimbursement policies, and other factors, such as growing utilization of oxygen in industrial, medical, and disaster-response applications.

Restraining Factors

High Equipment And Maintenance Costs, Limited Access In Low-Income Regions To Oxygen Concentrators, And Inadequate Health Infrastructure Are The Major Factors That Restrain The Growth Of The Global Oxygen Cylinders And Concentrators Market Size. Other adversities arising from this market include several regulatory complications, problems related to the safety of storage and transportation of oxygen, dependency of concentrators on electricity, and shortage of trained personnel.

Market Segmentation

The oxygen cylinders and concentrators market share is classified into type and end-use.

- The fixed segment dominated the market in 2024, approximately 65% and is projected to grow at a substantial CAGR during the forecast period.

Based On The Type, The Oxygen Cylinders And Concentrators Market Size Is Divided Into Portable And Fixed. Among These, The Fixed Segment Dominated The Market In 2024 And Is Projected To Grow At A Substantial CAGR During The Forecast Period. The fixed segment dominated market growth due to its consistent demand across hospitals, clinics, and home healthcare settings. Due to stability, wide adoption, and its integral role in critical and chronic care, a wide array of options from stationary and portable cylinders to continuous or pulse dose concentrators have driven steady revenue and reinforced its leading position in the oxygen delivery market.

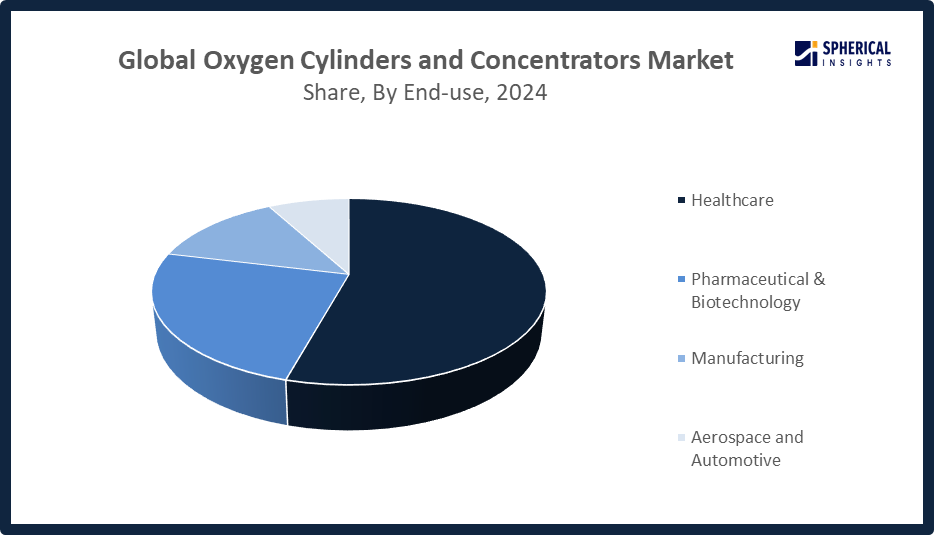

- The healthcare segment accounted for the highest market revenue in 2024, approximately 54% and is anticipated to grow at a significant CAGR during the forecast period.

Based On The End-Use, The Oxygen Cylinders And Concentrators Market Size Is Divided Into Healthcare, Pharmaceutical & Biotechnology, Manufacturing, And Aerospace & Automotive. Among these, the healthcare segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The healthcare segment is led due to an ever-growing prevalence of respiratory diseases, an increasing rate of hospitalization, and an ever-growing requirement for long-term oxygen therapies. Home healthcare service expansion, technological integration in portable oxygen concentrators, and government moves toward better accessibility in medical oxygen facilitated the adoption in recent times, thereby making healthcare the leading end-user segment in the global market for oxygen delivery.

Get more details on this report -

Regional Segment Analysis of the Oxygen Cylinders and Concentrators Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the oxygen cylinders and concentrators market over the predicted timeframe.

Get more details on this report -

North America Is Anticipated To Hold The Largest Share Of The Oxygen Cylinders And Concentrators Market Size Over The Predicted Timeframe. It is expected that North America will hold the 40% share of the oxygen cylinders and concentrators market, owing to advanced healthcare infrastructure, a high prevalence of chronic respiratory diseases, and strong adoption of home healthcare. The United States, the main growth driver, initiates oxygen therapy as a common symptom management approach for COPD and complications of COVID-19, with favorable reimbursement and well-developed distribution networks, while Canada further invests in augmenting hospital infrastructure and portable technologies. Technological advancement-lightweight concentrators-thereby furthers domination. Urgent Gaps in Neonatal Care: Globally, The Lancet Global Health Oxygen Commission has emphasized the need to address urgent gaps in neonatal care for universal access to pulse oximetry and medical oxygen in August 2025, as 5.4 million neonates require oxygen annually for acute hypoxemia.

Asia Pacific Is Expected To Grow At A Rapid CAGR In The Oxygen Cylinders And Concentrators Market Size During The Forecast Period. Rising cases of respiratory diseases, an aging population, and increasing healthcare infrastructure have made the Asia Pacific region projected to have a 22% market share in the oxygen cylinders and concentrators market. Growth is driven by India and China, in turn supported by increasing awareness of home healthcare, government initiatives, and increased capacity at hospitals. Factors driving the market’s growth include fast urbanization and growth in healthcare expenditure. Portable oxygen concentrators have significantly contributed to the growing demand for oxygen. In the wake of the COVID pandemic, the Indian Health Ministry launched the training of 200 master trainers in collaboration with AIIMS to educate hospital staff on the need for oxygen conservation. In this regard, the Indian government launched the training program in May 2025.

The EU Oxygen Cylinders & Concentrators Market Size Is Driven By The Absence Of Oxygen Among The Most Common Respiratory Disorders, The Elderly Population, And The Developed Healthcare Infrastructure. Germany is the largest market in the EU, backed by its advanced healthcare infrastructure, increased adoption of home oxygen therapy, and effective healthcare reimbursements. Rising awareness related to the management of chronic respiratory disorders, innovative technologies for portable oxygen concentrators, and developed healthcare services from the government are some of the factors adding to the growth of the EU oxygen cylinders & concentrators market.

Competitive Analysis:

The Report Offers The Appropriate Analysis Of The Key Organizations/Companies Involved Within The Oxygen Cylinders And Concentrators Market Size, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Philips Healthcare

- Invacare Corporation

- Nidek Medical Products

- Chart Industries Inc.

- Inogen, Inc.

- GCE Group

- Linde PLC

- ResMed

- Yuyue Medical

- O2 Concepts LLC

- Teijin Limited

- OxyGo, LLC.

- Air Liquide

- Precision Medical

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2025, O2 Concepts received MDR certification, approving its Oxlife Liberty and Oxlife Independence portable oxygen concentrators with DNA Technology for sale across EU countries. The certification ensures compliance with EU Regulation 2017/745, enhancing safety, performance, and post-market surveillance for medical devices.

- In June 2025, Inogen, Inc. launched the Voxi 5, a new stationary oxygen concentrator for long-term care patients in the U.S. The device complements Inogen’s portable concentrator line, enhancing access to high-quality oxygen therapy, expanding market potential, and leveraging existing home care sales channels.

- In May 2025, the Government of Kenya launched the Medical Oxygen Roadmap 2025-2030 to ensure sustainable and equitable access to medical oxygen. The initiative focuses on expanding production capacity, strengthening storage and delivery systems, training personnel, and integrating oxygen services into routine and emergency healthcare nationwide.

- In May 2025, AirSep launched Centrox-CR, a new oxygen cylinder refilling station. Available in medical 510(k) cleared and industrial versions, it delivers 93% pure oxygen using PSA technology, supporting both medical and industrial applications.

- In September 2024, Oxymed launched the P2 portable oxygen concentrator in India. Weighing 1.98 kg, it delivers 90-95% pure oxygen, features five pulse flow settings, a long-lasting battery, and a 2.8-inch LCD screen, offering an effective solution for patients with chronic respiratory conditions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the oxygen cylinders and concentrators market based on the below-mentioned segments:

Global Oxygen Cylinders and Concentrators Market, By Type

- Portable

- Fixed

Global Oxygen Cylinders and Concentrators Market, By End-use

- Healthcare

- Pharmaceutical & Biotechnology

- Manufacturing

- Aerospace & Automotive

Global Oxygen Cylinders and Concentrators Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the oxygen cylinders and concentrators market over the forecast period?The global oxygen cylinders and concentrators market is projected to expand at a CAGR of 4.5% during the forecast period.

-

2. What is the oxygen cylinders and concentrators market?The oxygen cylinders and concentrators market involves manufacturing and supplying devices that deliver medical oxygen to patients with respiratory conditions.

-

3. What is the market size of the oxygen cylinders and concentrators market?The global oxygen cylinders and concentrators market size is expected to grow from USD 4.81 billion in 2024 to USD 7.81 billion by 2035, at a CAGR of 4.5% during the forecast period 2025-2035.

-

4. Which region holds the largest share of the oxygen cylinders and concentrators market?North America is anticipated to hold the largest share of the oxygen cylinders and concentrators market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global oxygen cylinders and concentrators market?Philips Healthcare, Invacare Corporation, Nidek Medical Products, Chart Industries Inc., Inogen, Inc., GCE Group, Linde PLC, ResMed, Yuyue Medical, O2 Concepts LLC, and Others.

-

6. What factors are driving the growth of the oxygen cylinders and concentrators market?The market is driven by rising respiratory diseases, aging populations, increasing hospital and home care oxygen demand, COVID-19 awareness, technological advancements in portable concentrators, and expanding healthcare infrastructure worldwide.

-

7. What are the market trends in the oxygen cylinders and concentrators market?Key trends include portable concentrators, home healthcare adoption, technological innovations, rising chronic respiratory diseases, and increased government initiatives improving oxygen access globally.

-

8. What are the main challenges restricting the wider adoption of the oxygen cylinders and concentrators market?The main challenges restricting the wider adoption of the oxygen cylinders and concentrators market include high costs and limited reimbursement, infrastructure and logistical issues, complex regulatory hurdles, and social and psychological barriers.

Need help to buy this report?