United States Aquaponics Market Size, Share, and COVID-19 Impact Analysis, By Equipment (Pumps & Valves, Grow Light, Aeration Systems, Water Heaters, and Others), By Component (Rearing Tank, Settling Basin, Bio-Filters, Sump Tank, and Others), and United States Aquaponics Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited States Aquaponics Market Size Insights Forecasts to 2035

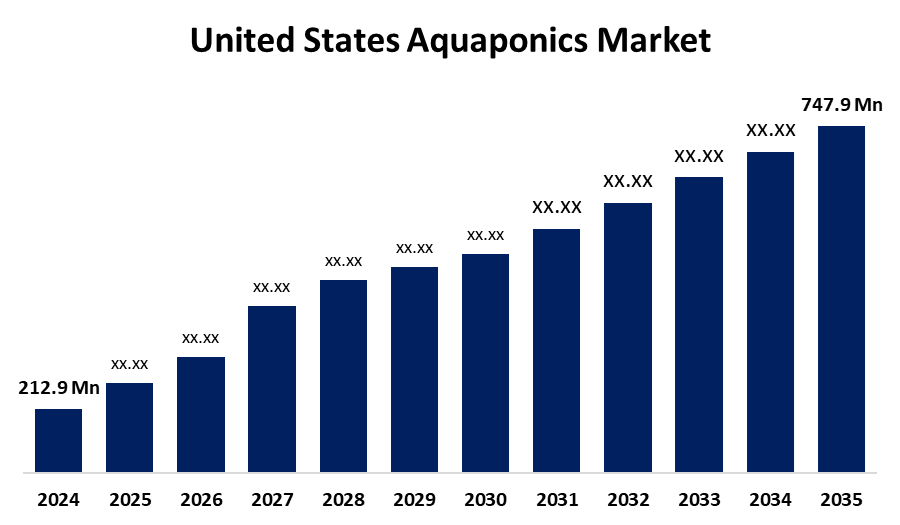

- The US Aquaponics Market Size Was Estimated at USD 212.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.10% from 2025 to 2035

- The US Aquaponics Market Size is Expected to Reach USD 747.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Aquaponics Market Size is anticipated to reach USD 747.9 million by 2035, growing at a CAGR of 12.10% from 2025 to 2035. The expansion of the United States' aquaponics market is propelled by a strong demand for organic produce, and the organic movement is predicted to continue to grow.

Market Overview

Aquaponics is a sustainable agricultural system that blends hydroponics and aquaculture, which is the production of fish or other aquatic creatures. It is expected that the positive environmental impacts of aquaponics will assist the target market in expanding. Customers who buy products from AQUAPO structures may be sure that, in addition to eating fresh food, up to 90% of the resources are being used in the production process, unlike traditional farming and food sourcing. The need for aquaponics systems will grow as a consequence of population growth and restrictions on land and water. As the urbanization phase of the human race expands vertically, urban farming and vertical farming are trending; therefore, aquaponics has great possibilities and advantages as producers can generate fresh produce while not needing as much space and start-up resources. There are many opportunities to grow via rooftop and indoor urban gardens, from outlets to farms. Moreover, sustainable living, urban self-sustainability are increasingly accepted, further supporting the already trending urban vertical farming concept. Aquaponic systems could also provide solutions in food deserts, where it is difficult to grow food.

The U.S. government actively promotes aquaponics through a number of programs designed to improve economic growth, food security, and sustainability. Through the USDA's Urban Agriculture and Innovative Production (UAIP) grant program, local food production and community education have been promoted through initiatives like the Choctaw Nation's aquaponics system in Oklahoma.

Report Coverage

This research report categorizes the market for the United States auaponics market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States aquaponics market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States aquaponics market.

United States Aquaponics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 212.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 12.10% |

| 2035 Value Projection: | USD 747.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 148 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Equipment, By Component and COVID-19 Impact Analysis |

| Companies covered:: | Greenlife Aquaponics, Bella Vita Farm, The Aquaponic Source, Nelson and Pade, Hydrofarm Holdings Group Inc Ordinary Shares, Symbiotic Aquaponic, Springworks Farm, AquaSprouts Inc., and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States aquaponics market is boosted by health-conscious consumers who are more interested in fresh food free of pesticides, and aquaponics produces organic food without the use of chemicals or artificial fertilisers, which appeals to consumers who care about the environment. The emerging move toward farm-to-table dining experiences and organic retail further adds to this demand. The general population is becoming more aware of the risks to health of eating food that has high chemical levels, which is expanding the market. When prices are higher for organic products, aquaponic farms make a significant profit.

Restraining Factors

The United States aquaponics market faces obstacles, like the buildings and equipment are costly to start aquaponics, particularly if it is a large farm. Even if they are only small-scale farmers, they will still have to potentially invest in tanks, pumps, lighting, and monitoring systems that could delay or prevent entry into this market.

Market Segmentation

The United States aquaponics market share is classified into equipment and component.

- The pumps & valves segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States aquaponics market is segmented by equipment into pumps & valves, grow light, aeration systems, water heaters, and others. Among these, the pumps & valves segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven as pumps are responsible for the movement of water, and they also ensure the delivery of nutrients and oxygen by the system. The systems incorporate both inline and submersible types of pumps. Valves will also be utilized in addition to the pumps to control and regulate the flow of water in the system.

- The rearing tank segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the component, the United States aquaponics market is segmented into rearing tank, settling basin, bio-filters, sump tank, and others. Among these, the rearing tank segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled as it can use a variety of types of raising tanks. For home-based units, even a small aquarium can be used. There is a large variety of types of rearing tanks or fish tanks, including glass, plastic, stock tanks, or totes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States aquaponics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Greenlife Aquaponics

- Bella Vita Farm

- The Aquaponic Source

- Nelson and Pade

- Hydrofarm Holdings Group Inc Ordinary Shares

- Symbiotic Aquaponic

- Springworks Farm

- AquaSprouts Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States aquaponics market based on the following segments:

United States Aquaponics Market, By Equipment

- Pumps & Valves

- Grow Light

- Aeration Systems

- Water Heaters

- Others

United States Aquaponics Market, By Component

- Rearing Tank

- Settling Basin

- Bio-Filters

- Sump Tank

- Others

Need help to buy this report?