Global Oleic Acid Market Size, Share, and COVID-19 Impact Analysis, By Source (Plant-based and Animal-based), By Application (Emulsifiers/Stabilizers, Solvents/Carriers, Lubricity/Plasticizers, Surfactants/Soaps, and Others), By End Use (Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care, Industrial, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Oleic Acid Market Size Insights Forecasts to 2035

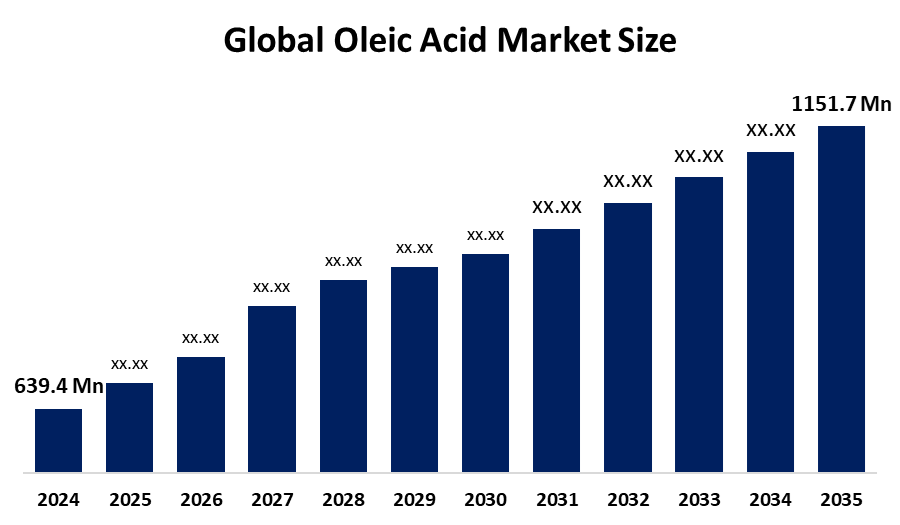

- The Global Oleic Acid Market Size Was Estimated at USD 639.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.5% from 2025 to 2035

- The Worldwide Oleic Acid Market Size is Expected to Reach USD 1151.7 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Oleic Acid Market Size was worth around USD 639.4 Million in 2024 and is predicted to Grow to around USD 1151.7 Million by 2035 with a compound annual growth rate (CAGR) of 5.5% from 2025 to 2035. The global Oleic Acid Market Size is expanding owing to increasing consumer demand for natural bio-based ingredients, which are used in cosmetics, personal care products and food items. The market is expanding because people are more health-conscious, and they prefer healthy cooking oils and sustainable, eco-friendly industrial lubricants.

Market Overview

The global Oleic Acid Market Size includes all activities that involve manufacturing and using oleic acid, which is a monounsaturated omega-9 fatty acid that comes from plant oils made from olive, sunflower, and soybean sources. Manufacturers use oleic acid in multiple industries because its properties allow it to function as an emollient, surfactant and stabilizer. The product is used in many different fields, including cosmetics and personal care products, pharmaceuticals, food and beverage production and industrial applications, which include lubricants and detergents and biodiesel manufacturing. The market expands because consumers increasingly want natural plant-based products, and they learn about the cardiovascular health advantages of oleic acid, and the food and personal care industries expand worldwide.

In December 2025, the EU Deforestation Regulation (EUDR) mandates that all palm-derived oleic acid imports need to have complete traceability through geolocation information to verify that the products originate from deforestation-free sources. The company faces penalties that can reach 4 % of its yearly European Union revenue because the business needs to maintain visible supply chain operations to enter markets. The market provides opportunities through high-purity oleic acid and specialty-grade oleic acid, and environmentally friendly processes that use sustainable materials and green chemistry methods. Cargill, BASF, Oleon Emery Oleochemicals, KLK Oleo, Godrej Industries and Croda International are the main market players who use their advanced extraction methods and worldwide distribution systems to meet the needs of both industrial customers and retail buyers.

Report Coverage

This research report categorizes the Oleic Acid Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Oleic Acid Market Size. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Oleic Acid Market Size.

Oleic Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 639.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.5% |

| 2035 Value Projection: | USD 1151.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Source, By Application |

| Companies covered:: | Cargill, Incorporated, KLK OLEO, Wilmar International Limited, Oleon NV, Godrej Industries, BASF SE, Emery Oleochemicals, IOI Group, Vantage Specialty Chemicals, AkzoNobel N.V., Eastman Chemical Company, Croda International, Kao Corporation, Adani Wilmar Ltd., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global Oleic Acid Market Size demonstrates expansion due to increasing demand for natural bio-based ingredients that the cosmetic and personal care and food sectors require, which has resulted in companies choosing plant-based feedstocks such as palm oil and sunflower oil. Personal care products experience market growth because of their function as a skin-conditioning emollient and surfactant for anti-ageing treatments. The food sector, particularly in the Asia-Pacific, drives demand due to increasing consumption of healthy cooking oils and processed food emulsifiers. The market expansion accelerates through factors such as regulatory support for green chemistry and the growing use of bio-lubricants, pharmaceuticals, and industrial surfactants.

Restraining Factors

The global Oleic Acid Market Size faces its main obstacles from the fluctuating costs of palm and soybean oil, the disruptions that interrupt supply chains, and the battle against lower-priced alternatives like stearic and lauric acids. The growth of the market faces obstacles from three environmental problems, such as deforestation, climate-related production challenges and the strict laws that control animal-based product usage.

Market Segmentation

The Oleic Acid Market Size share is classified into source, application, and end use.

- The plant-based segment dominated the market in 2024, approximately 85% and is projected to grow at a substantial CAGR during the forecast period.

Based on the source, the Oleic Acid Market Size is divided into plant-based and animal-based. Among these, the plant-based segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The plant-based segment is market-leading because consumers now prefer natural, sustainable, clean-label ingredients that appear in food, cosmetics and pharmaceuticals. The market for plant-based oleic acid products developed rapidly because people became more aware of their health and environmental advantages, regulatory bodies supported bio-based products, and non-GMO high-oleic oilseed feedstocks became more accessible.

- The surfactants/soaps segment accounted for the largest share in 2024, approximately 37% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the Oleic Acid Market Size is divided into emulsifiers/stabilizers, solvents/carriers, lubricity/plasticizers, surfactants/soaps, and others. Among these, the surfactants/soaps segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The surfactants and soaps segment growth is due to oleic acid’s wide use in detergents, personal care products, and industrial cleaners. The market for natural ingredients increases because people want bio-based biodegradable products, and they have better hygiene practices, and they prefer natural surfactants instead of synthetic ones.

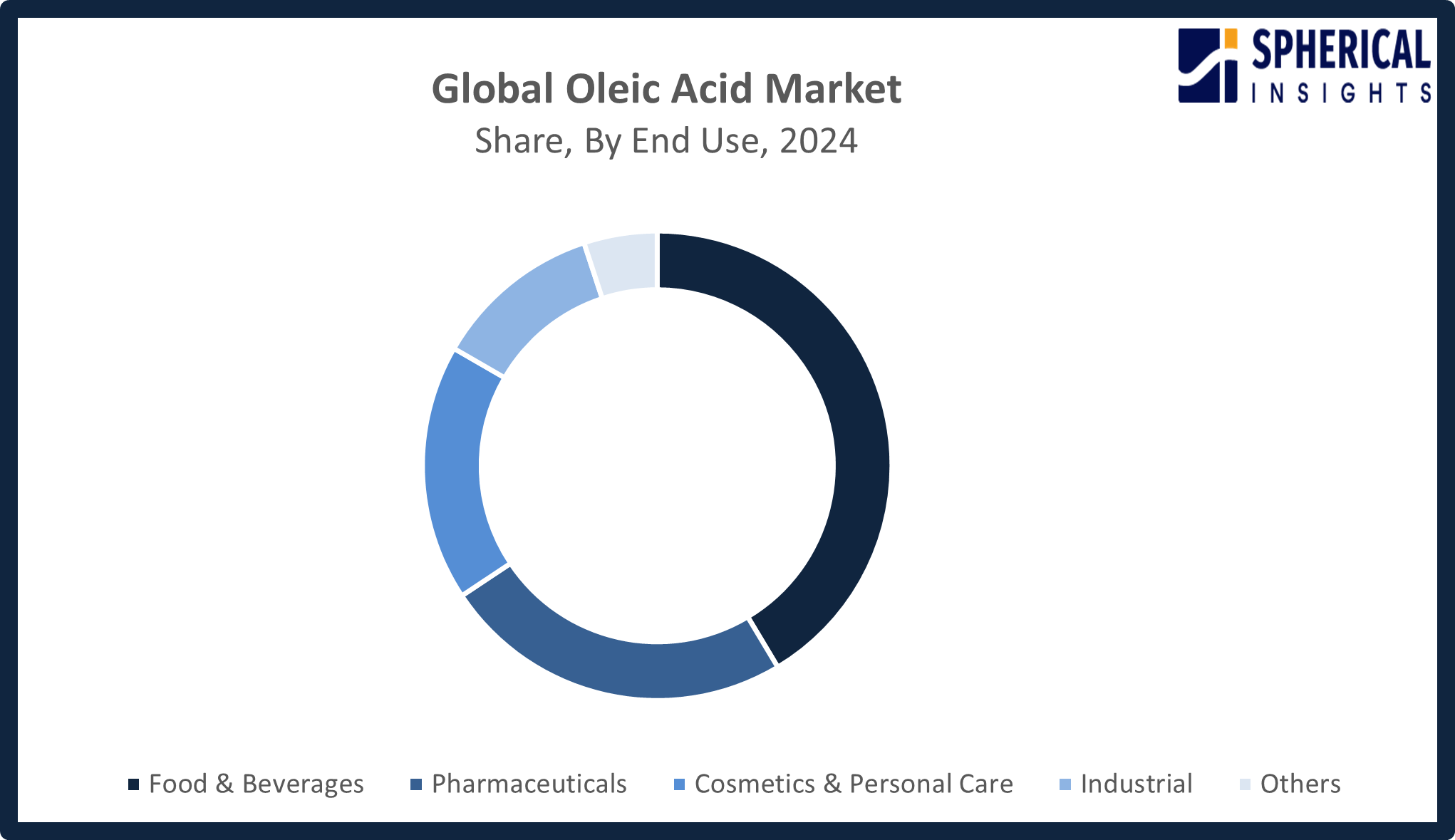

- The food & beverages segment accounted for the highest market revenue in 2024, approximately 41% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end use, the Oleic Acid Market Size is divided into food & beverages, pharmaceuticals, cosmetics & personal care, industrial, and others. Among these, the food & beverages segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The food and beverages segment market growth is due to rising demand for clean-label, plant-based ingredients and healthier fat alternatives. Oleic acid functions as an emulsifier and stabilizer and carrier oil in food processing. The segment growth accelerated because consumers learned about cardiovascular health advantages, packaged food consumption increased, and regulatory bodies supported natural ingredient use.

Get more details on this report -

Regional Segment Analysis of the Oleic Acid Market Size

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the Oleic Acid Market Size over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the Oleic Acid Market over the forecast period. The region is expected to account for approximately 43% of the global market, driven by abundant availability of raw materials, expanding food processing and personal care industries, and rising oleochemical production. Countries such as Indonesia and Malaysia benefit from extensive palm oil production facilities, while China and India generate strong demand from the food, pharmaceutical, and cosmetics sectors.

The region’s growth is further supported by rapid industrialization, increasing demand for plant-based products, and favorable government policies that encourage domestic production and export expansion. For instance, India launched the National Mission on Edible Oils–Oilseeds (NMEO–Oilseeds) in October 2024 to boost domestic oilseed production, strengthen processing infrastructure, reduce import dependence, and increase feedstock availability for oleic acid manufacturers.

North America is expected to grow at a rapid CAGR in the Oleic Acid Market Size during the forecast period. The North American Oleic Acid Market Size is expected to have a 25% share because consumers increasingly demand clean-label plant-based ingredients, which they use in food products, personal care items and pharmaceutical drugs. The United States leads this growth with strong R&D investment, advanced oleochemical manufacturing, and regulatory incentives supporting sustainable, bio-based chemicals. The cosmetics and industrial sectors and the food industry experience growth because users increasingly adopt natural emulsifiers, and they adopt biodegradable surfactants together with functional oils. The U.S. EPA proposed in 2026 to raise Renewable Fuel Standard quotas for 2026-2027, which will create a greater requirement for fat and oil feedstocks that will affect the global Oleic Acid Market Size.

The European market for oleic acid shows continuous expansion because consumers increasingly seek natural and sustainable clean-label ingredients for their food, cosmetics and pharmaceutical needs. Germany, France, and the UK lead the market because of their enforcement of strict regulations, their adoption of bio-based surfactants and their investments in green oleochemical technologies. The market grows because consumers now prefer products that use plant-based materials and have environmental benefits. The EU's RED III, which took effect in May 2025, established new renewable fuel requirements and more stringent sustainability regulations that mandated oleic acid exporters to use certified feedstocks that can be traced back to their origin.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Oleic Acid Market Size, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill, Incorporated

- KLK OLEO

- Wilmar International Limited

- Oleon NV

- Godrej Industries

- BASF SE

- Emery Oleochemicals

- IOI Group

- Vantage Specialty Chemicals

- AkzoNobel N.V.

- Eastman Chemical Company

- Croda International

- Kao Corporation

- Adani Wilmar Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2026, Indonesia plans to raise its biodiesel mandate from B40 to B50 by late 2026, driving higher demand for palm oil and related feedstocks. This move is expected to impact oleic acid availability and prices, supporting growth in the global oleochemical and biofuel markets.

- In February 2026, IOI Corporation Bhd announced plans to become the world’s largest vegetable oil-based fatty acid producer by acquiring Pan Century Edible Oils and Pan Century Oleochemicals for RM423 million. The Pasir Gudang complex offers 1 million TPA refinery capacity, creating a major vertically integrated palm oil and oleochemical hub.

- In September 2025, KLK OLEO showcased its sustainable, plant-based oleochemical solutions for the plastics industry. The company provides renewable-sourced oleochemicals and specialty chemicals that enhance plastic products, offering benefits from process optimization to improved part performance, supporting greener, more efficient manufacturing across the sector.

- In February 2025, Pioneer launched Plenish high oleic Enlist E3 soybeans for the U.S. 2025 season. Available in Z-Series varieties, these soybeans offer herbicide tolerance, industry-leading genetics, and higher yield potential, enabling farmers to boost per-acre profits while effectively managing weeds with the top-performing trait in soybeans.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Oleic Acid Market Size based on the below-mentioned segments:

Global Oleic Acid Market Size, By Source

- Plant-based

- Animal-based

Global Oleic Acid Market Size, By Application

- Emulsifiers/Stabilizers

- Solvents/Carriers

- Lubricity/Plasticizers

- Surfactants/Soaps

- Others

Global Oleic Acid Market Size, By End Use

- Food & Beverages

- Pharmaceuticals

- Cosmetics & Personal Care

- Industrial

- Others

Global Oleic Acid Market Size, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Oleic Acid Market Size over the forecast period?The global Oleic Acid Market Size is projected to expand at a CAGR of 5.5% during the forecast period.

-

2. What is the market size of the Oleic Acid Market Size?The global Oleic Acid Market Size is expected to grow from USD 639.4 million in 2024 to USD 1151.7 million by 2035, at a CAGR of 5.5% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Oleic Acid Market Size?Asia Pacific is anticipated to hold the largest share of the Oleic Acid Market Size over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global Oleic Acid Market Size?Cargill, Incorporated, KLK OLEO, Wilmar International Limited, Oleon NV, Godrej Industries, BASF SE, Emery Oleochemicals, IOI Group, Vantage Specialty Chemicals, AkzoNobel N.V., and Others.

-

5. What factors are driving the growth of the Oleic Acid Market Size?The drivers include booming demand for natural cosmetics/personal care, growth in functional food, rising use of bio-based lubricants, and expanding pharmaceutical applications, alongside strong demand for sustainable, plant-based ingredients.

-

6. What are the market trends in the Oleic Acid Market Size?Key trends include rising demand for plant-based, natural cosmetics/skincare, sustainable sourcing, high-purity pharmaceutical applications, and growth in bio-based lubricants.

-

7. What are the main challenges restricting wider adoption of the Oleic Acid Market Size?The challenges restricting wider Oleic Acid Market Size adoption include volatile raw material prices (palm/soybean oil), supply chain disruptions, intense competition from cheaper synthetic alternatives, and stringent regulatory compliance requirements.

Need help to buy this report?