Japan Palm Oil Market Size, Share, and COVID-19 Impact Analysis, By Nature (Organic and Conventional), By Product (Fractionated Palm Oil, Crude Palm Oil, and Palm Kernel Oil), and Japan Palm Oil Market Insights, Industry Trend, Forecasts to 2035

Industry: Specialty & Fine ChemicalsJapan Palm Oil Market Insights Forecasts to 2035

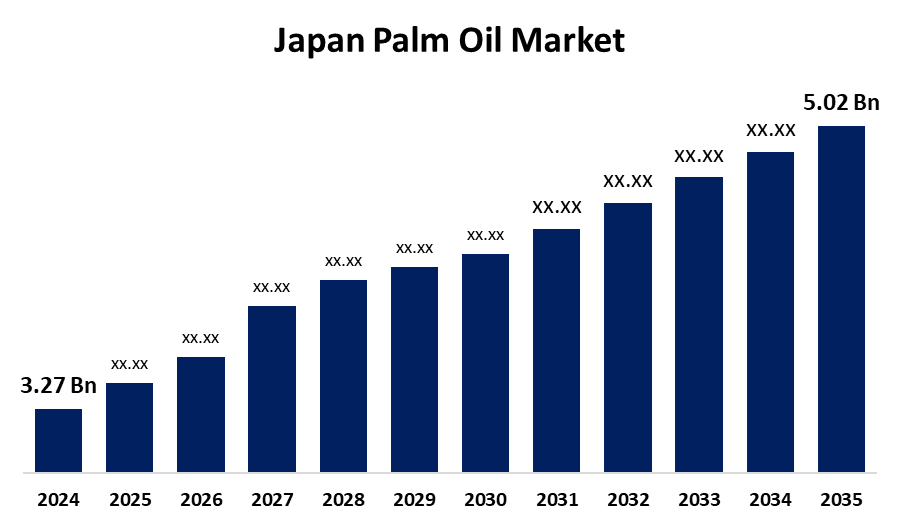

- The Japan Palm Oil Market Size Was Estimated at USD 3.27 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.97% from 2025 to 2035

- The Japan Palm Oil Market Size is Expected to Reach USD 5.02 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Palm Oil Market is anticipated to Reach USD 5.02 Billion by 2035, Growing at a CAGR of 3.97% from 2025 to 2035. The expansion of Japans palm oil market is being driven by rising demand for edible oils, growing application in cosmetics and personal care, and rising demand for processed foods.

Market Overview

Palm oil is an edible oil that is extracted from the fruit of oil palm trees. Palm oil is widely used in Japan across various industries such as food and beverages, personal care and cosmetics, biofuel and energy, and pharmaceuticals. The largest consumer of palm oil is the food and beverages industry. The palm oils versatility and natural taste make it a favorable ingredient in processed foods, baked goods, margarine, and confectionery. Palm oil is cost-effective than other vegetable oils. Japan has a fast lifestyle, and people are seeking processed and convenience food, driving the market for palm oil. The innovation in cultivation and extraction processes improves the efficacy and yield of the palm oil, which further fuels the market growth. The rising demand for sustainable and certified palm oil is a key trend in the market. The rising trend of natural and sustainable cosmetic products presents a significant opportunity for growth.

Report Coverage

This research report categorizes the market for the Japan palm oil market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan palm oil market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan palm oil market.

Japan Palm Oil Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.27 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 3.97% |

| 2035 Value Projection: | USD 5.02 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Nature, By Product |

| Companies covered:: | ADM, Olam International, Nisshin OilliO Group, Ltd., Itochu Corporation, Mitsui & Co., Ltd, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The integration of palm oil in the preparation of biofuel drives the Japanese palm oil market. The palm oil is available at low costs as compared to other vegetable oils, making it a staple in emerging markets. The palm oil has moisturizing, emulsifying, and stabilizing properties; hence, they are extensively used in the pharmaceutical, personal care, and cosmetic industries. Additionally, technological advancements play a significant role in the market growth.

Restraining Factors

One of the significant restraints for the palm oil industry is the fluctuation in the weather, which may disrupt the supply chain and impact the price. The palm oil contains high saturated fat, which limits the market expansion among health-conscious consumers.

Market Segmentation

The Japan palm oil market share is classified into nature and product.

- The conventional segment held a dominant share of the market in 2024 and is expected to grow at a rapid CAGR during the forecast period.

The Japan palm oil market is segmented by nature into organic and conventional. Among these, the conventional segment held a dominant share in 2024 and is expected to grow at a rapid CAGR during the forecast period. The conventional method is more cost-effective and popular in low-income areas with a high population. Conventional palm oil is cultivated by using fertilizers and pesticides.

- The fractionated palm oil segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan palm oil market is segmented by product into fractionated palm oil, crude palm oil, and palm kernel oil. Among these, the fractionated palm oil segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segmental growth is attributed to its easy accessibility and feasible prices. These are used in edible oils, like margarine/shortening, as well as in bread and cake-like pastry production.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the Japan palm oil market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ADM

- Olam International

- Nisshin OilliO Group, Ltd.

- Itochu Corporation

- Mitsui & Co., Ltd

- Other

Recent Developments

- In December 2024, Nissin Foods Holdings, the largest palm oil buyer in Japan, committed to building a traceable and sustainable palm oil supply chain. Nissin wants to work with Indonesian smallholder farmers for livelihood improvement and sustainable agriculture.

- In September 2024, Japan International Research Centre for Agricultural Sciences (JIRCAS) exhibited its study on the recycling technology of oil palm at the "Global Festa JAPAN 2024." The project aims to create high-value-added technology toward a sustainable palm industry with solutions to problems of environmental issues in the production of palm oil

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan palm oil market based on the below-mentioned segments:

Japan Palm Oil Market, By Nature

- Organic

- Conventional

Japan Palm Oil Market, By Product

- Fractionated Palm Oil

- Crude Palm Oil

- Palm Kernel Oil

Need help to buy this report?