North America Pumps Market Size, Share, and COVID-19 Impact Analysis, By Type (Centrifugal, Positive Displacement, Rotary, Reciprocating and Others), By End User (Agriculture, Water & Wastewater, Oil & Gas, Mining, Infrastructure Application and Others), and North America Pumps Market Size Insights, Industry Trends, Forecast to 2035

Industry: Machinery & EquipmentNorth America Pumps Market Size Insights Forecasts to 2035

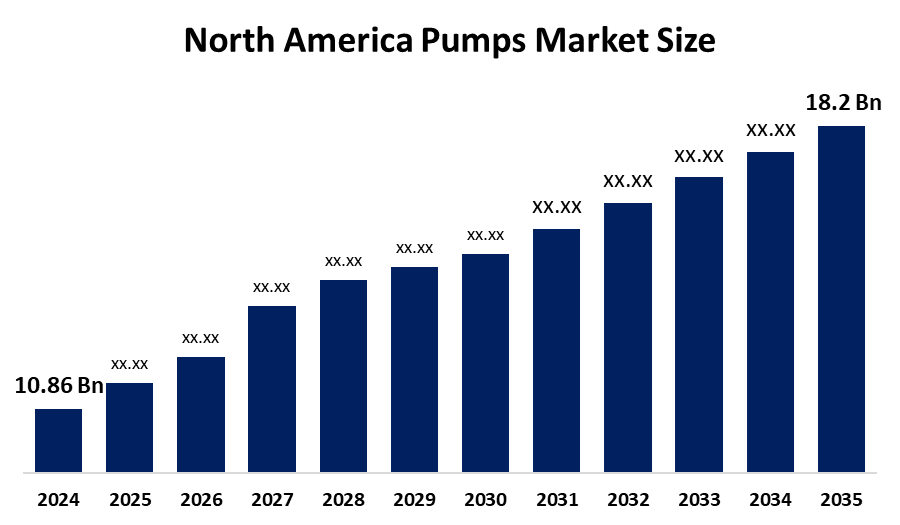

- The North America Pumps Market Size Was Estimated at USD 10.86 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.81% from 2025 to 2035

- The North America Pumps Market Size is Expected to Reach USD 18.2 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The North America Pumps Market Size is anticipated to reach USD 18.2 Billion by 2035, growing at a CAGR of 4.81% from 2025 to 2035. The market is driven by the growth of various industries such as oil and gas extraction, water and wastewater management, and electricity production. The market for pumps with high energy efficiency and the incorporation of IoT, along with automation technologies, into pump setups.

Market Overview

Pumps are the mechanical devices that are specifically engineered to transport fluids, either in the form of liquids, gases, or slurries, through mechanical force. such devices in various sectors like industrial, commercial and residential ones. The applications of pumps are water treatment, oil and gas drilling, chemical manufacturing, farming, and HVAC systems. The increasing spending on infrastructure combined with the imposition of tougher environmental regulations, has resulted in a huge rise in the need for energy-saving and durable pump solutions throughout the region.

The pump of Vaseline's new Vaseline Intensive Care packaging has received an evaluation by How2Recycle to be classified as widely recyclable in the U.S. and Canada. Unilever intends to have all of its rigid plastic packaging by the year 2030 made 100% reusable, recyclable, or compostable. The U.S. Department of Energy (DOE) is focusing on the creation of heat pumps that will work under the most severe weather conditions, and has recently awarded Rheem Manufacturing for being the top performer in the northern U.S. and Canada regions.

The Canadian economy has been supported by government initiatives to upgrade water infrastructure. U.S. federal authority decides to invest in the water infrastructure projects in the amount of $8.8 billion in the very first year of the new decade, choosing water treatment and distribution networks modernization as its priority. The rising activity in the shale gas regions and the setting up of LNG terminals in North America, particularly in the U.S. and Canada, are among the principal reasons influencing this situation.

Report Coverage

This research report categorizes the market for the North America Pumps Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America Pumps Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America Pumps Market Size.

North America Pumps Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 10.86 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.81% |

| 2035 Value Projection: | 18.2 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By End User |

| Companies covered:: | Iwaki America, Vaughan Chopper Pumps, SPX FLOW, Ingersoll Rand Inc, ITT Inc, Flowserve Corp, Xylem Inc, Grundfos Holding A/S, Sulzer AG, Pentair PLC, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Pumps Market in North America is driven by technological progress in the form of smart pump systems with embedded sensors and automation. The U.S. oil and gas industry is pouring more than $50 billion into new projects, which in turn drives the need for pumps in drilling, processing and transportation. The rapidly growing industrialization and urbanization in developing countries result in higher demand for efficient fluid handling systems in all industries including water treatment of oil and gas, chemicals, and power generation, as they require advanced pumps for sector support.

Restraining Factors

The pumps market in North America is restrained by operations of pumps are further complicated by high operational costs as well as strict energy efficiency and environmental regulations. The Department of Energy has set energy-efficient standards that U.S. pump manufacturers are required to follow, which has also resulted in increased R&D costs.

Market Segmentation

The North America Pumps Market Size share is categorised into type and end user.

- The centrifugal segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America Pumps Market Size is segmented by type into centrifugal, positive displacement, rotary, reciprocating and others. Among these, the centrifugal segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Centrifugal is the largest segment in terms of revenue share in 2025, with a share of 65.12%. This is due to their ability to handle low-viscosity fluids efficiently and to meet the high-volume requirements that are common in municipal and industrial water systems. They also have a lower total cost of ownership in terms of installation and maintenance compared to other types.

- The water & wastewater segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the North America Pumps Market Size is segmented into agriculture, water & wastewater, oil & gas, mining, infrastructure application and others. Among these, the water & wastewater segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The pumps market in 2024 accounted for 42.3%. The significant government measures like the U.S. government's investment of $111 billion for water infrastructure through the American Jobs Plan, which necessitates the refurbishment of old systems and construction of new treatment plants for adherence to stricter federal policies, including the EPA's 2024 PFAS rule, were among the main drivers.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the North America Pumps Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Iwaki America

- Vaughan Chopper Pumps

- SPX FLOW

- Ingersoll Rand Inc

- ITT Inc

- Flowserve Corp

- Xylem Inc

- Grundfos Holding A/S

- Sulzer AG

- Pentair PLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In November 2025, Unibloc Hygienic Technologie, a global provider of hygienic positive displacement pumps, launched its new Unibloc CleanPlus line of hygienic pumps for the cosmetic, pharmaceutical, and tanker truck industries that require durable, sanitary operations.

In May 2025, Lennox and Ariston Group announced a Joint Venture to launch water heaters in North America. This strategic partnership brings the trusted brands, distribution channels, and expansive customer network of Lennox with Ariston Group's advanced global and regional expertise in water heating technology, R&D, and manufacturing.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America Pumps Market Size based on the below-mentioned segments:

North America Pumps Market Size, By Type

- Centrifugal

- Positive Displacement

- Rotary

- Reciprocating

- Others

North America Pumps Market Size, By End User

- Agriculture

- Water & Wastewater

- Oil & Gas

- Mining

- Infrastructure Application

- Others

Frequently Asked Questions (FAQ)

-

What is the North America Pumps Market Size?The North America Pumps Market Size is expected to grow from USD 10.86 billion in 2024 to USD 18.2 billion by 2035, growing at a CAGR of 4.81% during the forecast period 2025-2035.

-

What is pumps, and its primary use?Pumps are the mechanical devices that are specifically engineered to transport fluids, either in the form of liquids, gases, or slurries, through mechanical force. such devices in various sectors like industrial, commercial and residential ones.

-

What are the key growth drivers of the market?Market growth is driven by technological progress in the form of smart pump systems with embedded sensors and automation. The U.S. oil and gas industry is pouring more than $50 billion into new projects, which in turn drives the need for pumps in drilling, processing and transportation.

-

What factors restrain the North America Pumps Market Size?The market is restrained by the operations of pumps are further complicated by high operational costs as well as strict energy efficiency and environmental regulations. The Department of Energy has set energy-efficient standards that U.S. pump manufacturers are required to follow, which has also resulted in increased R&D costs.

-

How is the market segmented by type?The market is segmented into centrifugal, positive displacement, rotary, reciprocating and others

-

Who are the key players in the North America Pumps Market Size?Key companies include Iwaki America, Vaughan Chopper Pumps, SPX FLOW, Ingersoll Rand Inc., ITT Inc., Flowserve Corp, Xylem Inc., Grundfos Holding A/S, Sulzer AG, and Pentair PLC.

Need help to buy this report?