Germany Glass Packaging Market Size, Share, and COVID-19 Impact Analysis, By Product (Bottles/Containers, Jars, Vials, and Ampoules), By End-User (Pharmaceuticals, Personal Care, and Household Care), and Germany Glass Packaging Market Insights, Industry Trend, Forecasts to 2035.

Industry: Construction & ManufacturingGermany Glass Packaging Market Insights Forecasts to 2035

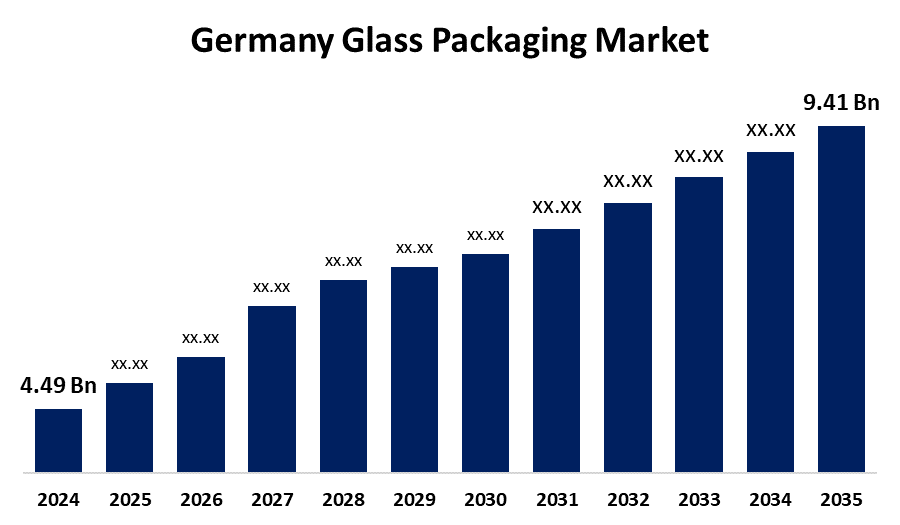

- The Germany Glass Packaging Market Size was estimated at USD 4.49 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.96% from 2025 to 2035

- The Germany Glass Packaging Market Size is Expected to Reach USD 9.41 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Germany Glass Packaging Market Size is Anticipated to reach USD 9.41 Billion By 2035, Growing at a CAGR of 6.96% from 2025 to 2035. The Germany glass packaging market is driven by growing demand from the beverage and drug industries, growing consumer inclination towards sustainable and recyclable materials, and tight environmental regulations. The robust recycling infrastructure of the country and emphasis on minimizing plastic consumption further reinforce the move towards environmentally friendly glass packaging solutions.

Market Overview

The Germany glass packaging market is the use of glass containers, like bottles, jars, and vials, to hold, guard, and preserve products. It is a common preference because it is durable, inert, and capable of maintaining the freshness and taste of the contents without chemical leaching. Glass packaging will become more popular as increasing numbers of industries seek out alternatives to using plastic packaging, especially as glass packaging options and recycling become lighter and more efficient. Furthermore, new production technologies are revolutionizing the glass packaging industry. Some of the major advancements are light-weight glass production with reduced material per unit but same strength, and utilizing hybrid or electric furnaces to lower energy consumption. Moreover, digital print technology allows for intricate graphics on glass surfaces, opening up possibilities for greater branding. These advancements allow producers to tackle environmental issues as well as satisfy growing demand economically. Additionally, lightweight glass packaging resolves environmental and logistical issues by reducing the weight of glass containers without compromising strength. The solution reduces shipping expenses, lowers carbon emissions, and is in line with Germany's sustainability objectives.

Report Coverage

This research report categorizes the market for Germany glass packaging market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany glass packaging market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany glass packaging market.

Germany Glass Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.49 Billion |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 6.96% |

| 2035 Value Projection: | USD 9.41 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | Gerresheimer AG, Ardagh Group S.A., O-I Glass Inc., Schott AG, O-I Glass, Verallia, Gerresheimer AG, Stoelzle Glass Group, Vidrala, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing environmental awareness and sustainability efforts will drive the German Glass Packaging Market. The high recycling rate reduces the environmental impact, thereby making glass a sought-after material among environmentally conscious consumers and companies. Furthermore, the strong food and drink production sector will significantly influence the Germany glass packaging market. Moreover, glass packaging is becoming increasingly popular in the pharmaceutical sector because of its sterility and inertness. The increasing prevalence of chronic illnesses in Germany, along with a growing population, has boosted demand for high-quality packaging of injectable drugs, vaccinations, and healthcare products. Glass has superior resistance to contamination, which makes it perfectly suited for delicate pharmaceutical applications.

Restraining Factors

The manufacture of glass is an energy-intensive process involving the use of high-temperature furnaces for melting raw materials such as silica sand, soda ash, and limestone. German energy expenses are among the highest in Europe owing to strict environmental regulations and a renewed emphasis on renewable energy shifts, which increase the cost of glass production and constrain the profit margins of producers.

Market Segmentation

The Germany glass packaging market share is classified into product and end-user.

- The bottles/containers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Germany glass packaging market is segmented by product into bottles/containers, jars, vials, and ampoules. Among these, the bottles/containers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by the high demand from the drinks sector, most notably for beer, wine, and spirits. Glass is also the first choice for retaining quality and taste, which matches consumers' preferences and stringent environmental policies. Furthermore, a highly developed industrial infrastructure and extensive use in food, cosmetics, and drugs. Glass packaging is also linked to high quality, improving the appeal to consumers.

- The pharmaceuticals segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Germany glass packaging market is segmented by end-user into pharmaceuticals, personal care, and household care. Among these, the pharmaceuticals segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to the nation's robust pharmaceutical production capability and rigid regulatory requirements. Glass is utilized due to its inert, non-reactive nature, which makes it the best choice for containing sensitive drugs, notably injectables. The expanding need for vaccines and chronic conditions has resulted in a rise in the utilization of glass ampoules and vials.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany glass packaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Gerresheimer AG

- Ardagh Group S.A.

- O-I Glass Inc.

- Schott AG

- O-I Glass

- Verallia

- Gerresheimer AG

- Stoelzle Glass Group

- Vidrala

- Others

Recent Developments:

- In April 2024, SCHOTT was committed to being the world's first climate-neutral specialty glass producer by 2030 and a leader in the circular economy. It launched pilot recycling projects to investigate the reuse of glass-ceramic and pharma packaging. In the absence of legal frameworks, SCHOTT attempted to demonstrate the technical feasibility and effectiveness of large-scale recycling.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany glass packaging market based on the below-mentioned segments

Germany Glass Packaging Market, By Product

- Bottles/Containers

- Jars

- Vials

- Ampoules

Germany Glass Packaging Market, By End-User

- Pharmaceuticals

- Personal Care

- Household Care

Need help to buy this report?