Global Nonylphenol Ethoxylates Market Size, Share, and COVID-19 Impact Analysis, By Application (Textiles, Paints and Coatings, Detergents and Cleaners, Emulsifiers, and Metalworking Fluids), By End User (Textile Manufacturing, Automotive, Construction, Household and Personal Care, and Industrial and Institutional Cleaning), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Nonylphenol Ethoxylates Market Size Insights Forecasts to 2035

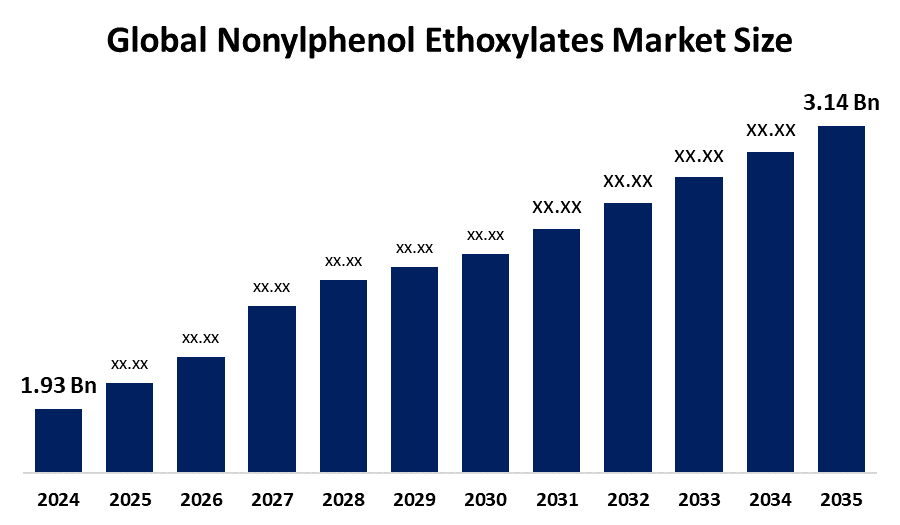

- The Global Nonylphenol Ethoxylates Market Size Was Valued at USD 1.93 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.52 % from 2025 to 2035

- The Worldwide Nonylphenol Ethoxylates Market Size is Expected to Reach USD 3.14 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Nonylphenol Ethoxylates Market Size was worth around USD 1.93 Billion in 2024 and is predicted to Grow to around USD 3.14 Billion by 2035 with a compound annual growth rate (CAGR) of 4.52 % from 2025 to 2035. The market for nonylphenol ethoxylates offers opportunities for creating biodegradable and environmentally friendly surfactant substitutes, growing applications in the industrial, textile, and detergent sectors, utilizing technological advancements, and meeting rising demand in developing nations brought on by urbanization and industrialization.

Market Overview

Nonylphenol Ethoxylates (NPEs) are nonionic surfactants that are generated from nonylphenol and are used extensively in the textile, paint, agrochemical, oilfield, and institutional and domestic cleaning industries as detergents, emulsifiers, wetting agents, and cleansers. They have superior emulsification, detergency, and surface tension-lowering capabilities, but they break down into nonylphenol (NP), an endocrine disruptor that is persistent, bioaccumulative, and extremely harmful to aquatic life. For instance, in June 2025, the Ministry of Environment launched new restrictions on importing detergents containing Nonylphenol (NP) and Nonylphenol Polyethylene Glycol Ether (NPEO), effective immediately, citing environmental and health risks, with implementation planned in two phases. The expansion of agricultural applications and the growing need for cleaning goods are the main factors driving the nonylphenol ethoxylates market growth. Additionally, the need for nonylphenol ethoxylates in a variety of industries, including textiles, agriculture, and personal hygiene products, is propelling the nonylphenol ethoxylates market expansion.

Report Coverage

This research report categorizes the nonylphenol ethoxylates market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the nonylphenol ethoxylates market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the nonylphenol ethoxylates market.

Global Nonylphenol Ethoxylates Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.93 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.52% |

| 2035 Value Projection: | USD 3.14 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 173 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Application, By End User and COVID-19 Impact Analysis |

| Companies covered:: | AkzoNobel N.V., BASF SE, Clariant AG, Dow Inc., Huntsman Corporation, India Glycols Limited, Kraton Corporation, Nouryon, Oxiteno, Sabic, Shree Vallabh Chemicals, Shubh Industries, Solvay SA, Stepan Company, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The nonylphenol ethoxylates market is expected to grow owing to its wide application as a wetting agent and emulsifier in textile manufacturing. The nonylphenol ethoxylates market will experience growth due to manufacturers' need to produce high-quality textiles, which require the use of nonylphenol ethoxylate. The Nonylphenol Ethoxylates (NPEs) market has its main growth driver in the increasing need for effective surfactants, which people use in both industrial settings and personal consumer products. The market demand for cleaning products and personal care items rises as developing countries experience increased industrial development, urban growth, and higher consumer spending.

Restraining Factors

The market for nonylphenol ethoxylates is restricted by strict environmental laws, rising health and environmental concerns, prohibitions on non-biodegradable surfactants, and consumer demand for safer, more environmentally friendly substitutes. These factors work together to restrict market expansion and hinder broad industrial adoption.

Market Segmentation

The nonylphenol ethoxylates market share is classified into application and end user.

- The detergents and cleaners segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the nonylphenol ethoxylates market is divided into textiles, paints and coatings, detergents and cleaners, emulsifiers, and metalworking fluids. Among these, the detergents and cleaners segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The detergents and cleansers, owing to their exceptional wetting, dispersion, and emulsifying qualities, improve cleaning effectiveness in both commercial and residential settings. Laundry detergents, dishwashing solutions, and home cleansers are just a few of the many goods in this category that mostly depend on surfactants to function at their best.

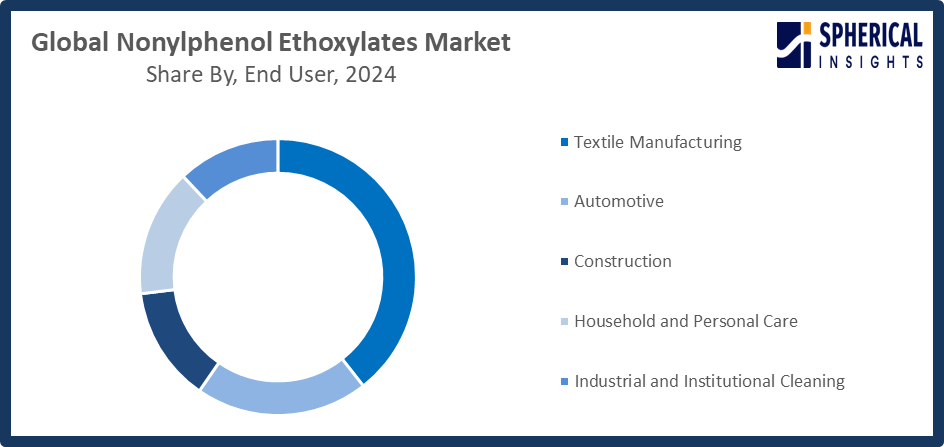

- The textile manufacturing segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the nonylphenol ethoxylates market is divided into textile manufacturing, automotive, construction, household and personal care, and industrial and institutional cleaning. Among these, the textile manufacturing segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The importance of textile manufacturing stems from the fact that nonylphenol ethoxylates are used in the creation of textiles and fabrics for their emulsifying and wetting qualities. Superior fabric quality and consistency are ensured by NPEs' improved wetting, emulsifying, and dispersion qualities, which also improve dyeing, finishing, and cleaning procedures.

Get more details on this report -

Regional Segment Analysis of the Nonylphenol Ethoxylates Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the nonylphenol ethoxylates market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the nonylphenol ethoxylates market over the predicted timeframe. The consumption of NPEs is greatly influenced by the region's robust textile, paint and coating, detergent, and personal care sectors. The rising demand from nations like China and India in the Asia-Pacific area. The biggest markets are found in nations like China and India, which have roughly 40% and 25% of the regional share, respectively. Taiwan's phased import bans on detergents containing NP/NPE beginning in December 2026 (with a 5% threshold) and June 2027 (with a 0.1% threshold) and China's Ministry of Ecology and Environment's April 2025 proposal to limit nonylphenol (NP) levels in wastewater discharge are still less onerous than those in Western markets.

North America is expected to grow at a rapid CAGR in the nonylphenol ethoxylates market during the forecast period. Growing industrial activity, especially in the textile, detergent, paint and coating, and personal care industries, is what is driving the region's growth. At over 60%, the United States has the highest market share, followed by Canada at about 25%. Strategic alliances between major firms and ongoing product development characterize the competitive environment. Under the TSCA, the U.S. Environmental Protection Agency (EPA) is still enforcing Significant New Use Rules (SNURs). Recent final SNUR batches produced in 2025 require aquatic toxicity limitations in addition to Significant New Use Notices for specific NP/NPE uses.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the nonylphenol ethoxylates market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AkzoNobel N.V.

- BASF SE

- Clariant AG

- Dow Inc.

- Huntsman Corporation

- India Glycols Limited

- Kraton Corporation

- Nouryon

- Oxiteno

- Sabic

- Shree Vallabh Chemicals

- Shubh Industries

- Solvay SA

- Stepan Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2022, the National Environment Agency of Singapore (NEA) launched a proposal to regulate five chemicals, including Amitrole, Nonylphenol, NPEs, Iprodione, Dechlorane Plus, and UV-328, aligning national legislation with the Stockholm and Rotterdam Conventions for controlled substances.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the nonylphenol ethoxylates market based on the below-mentioned segments:

Global Nonylphenol Ethoxylates Market, By Application

- Textiles

- Paints and Coatings

- Detergents and Cleaners

- Emulsifiers

- Metalworking Fluids

Global Nonylphenol Ethoxylates Market, By End User

- Textile Manufacturing

- Automotive

- Construction

- Household and Personal Care

- Industrial and Institutional Cleaning

Global Nonylphenol Ethoxylates Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the nonylphenol ethoxylates market over the forecast period?The global nonylphenol ethoxylates market is projected to expand at a CAGR of 4.52% during the forecast period.

-

2. What is the market size of the nonylphenol ethoxylates market?The global nonylphenol ethoxylates market size is expected to grow from USD 1.93 billion in 2024 to USD 3.14 billion by 2035, at a CAGR of 4.52 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the nonylphenol ethoxylates market?Asia Pacific is anticipated to hold the largest share of the nonylphenol ethoxylates market over the predicted timeframe.

-

4. Who are the top companies operating in the global nonylphenol ethoxylates market?AkzoNobel N.V., BASF SE, Clariant AG, Dow Inc., Huntsman Corporation, India Glycols Limited, Kraton Corporation, Nouryon, Oxiteno, Sabic, Shree Vallabh Chemicals, Shubh Industries, Solvay SA, Stepan Company, and Others.

-

5. What factors are driving the growth of the nonylphenol ethoxylates market?The nonylphenol ethoxylates market is driven by industrial demand, applications in textiles, detergents, paints, personal care, technological advancements, urbanization, rising consumer goods consumption, and increasing investment in sustainable surfactant alternatives.

-

6. What are the market trends in the nonylphenol ethoxylates market?The creation of environmentally acceptable substitutes, advancements in high-performance surfactants, growing uses in agrochemicals and water treatment, and an increase in regulatory compliance efforts worldwide are some of the major trends in the nonylphenol ethoxylates market.

-

7. What are the main challenges restricting the wider adoption of the nonylphenol ethoxylates market?Strict environmental laws, ecological and health concerns, prohibitions on non-biodegradable surfactants, growing consumer preference for safer substitutes, and the expensive expenses of research and sustainable product development all limit market expansion.

Need help to buy this report?