Global Nonylphenol Market Size, Share, and COVID-19 Impact Analysis, By Grade (Reagent Grade and Industrial Grade), By Application (Antioxidant, Emulsifiers, Stabilizers, Detergents, Cleaning, Dispersing Agent, and Others), By End-Use (Chemical, Building and Construction, Food and Beverages, Automotive, Pulp and Paper, Agrochemicals, Oil and Gas, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Nonylphenol Market Insights Forecasts to 2035

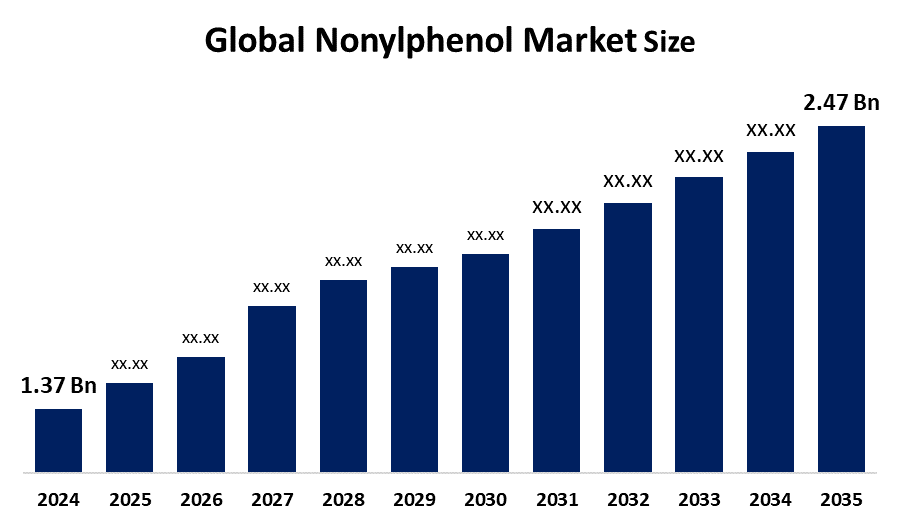

- The Global Nonylphenol Market Size Was Estimated at USD 1.37 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.5% from 2025 to 2035

- The Worldwide Nonylphenol Market Size is Expected to Reach USD 2.47 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global nonylphenol market size was worth around USD 1.37 billion in 2024 and is predicted to grow to around USD 2.47 billion by 2035 with a compound annual growth rate (CAGR) of 5.5% from 2025 to 2035. The nonylphenol market is expanding due to its use in industries, such as detergents, textiles, paints and adhesives, along with increasing industrial growth, urban development and heightened demand for surfactants and chemical intermediates, in both emerging and developed regions.

Market Overview

The Global Nonylphenol Sector Market Size involves the production and application of nonylphenol, a chemical intermediate widely used in consumer products. Nonylphenol serves as an ingredient in surfactants, detergents, paints, coatings, adhesives and rubber stabilizers, offering emulsifying and stabilising properties. The expansion of this market is primarily driven by industrial development, urbanization and increasing demand across the textile, automotive, construction and home care sectors. In September 2024, California’s Department of Toxic Substances Control in the US authorized the inclusion of detergents with ethoxylates (NPEs) on its Safer Consumer Products candidate list. This move highlights the durability of NPEs, their impact on living beings, and their breakdown into the even more hazardous nonylphenol (NP), which raises serious ecological and public health issues. The increasing use of these compounds in wastewater management and agriculture suggests potential for growth alongside research focused on improving product efficiency and developing eco-formulations. Major players in the nonylphenol market include BASF SE, Huntsman Corporation, Solvay SA, Sasol Limited and The Dow Chemical Company. These companies focus on product innovation, forging partnerships, and expanding production capacity to meet rising demand and capitalize on opportunities in emerging markets.

Report Coverage

This research report categorizes the nonylphenol market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the nonylphenol market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the nonylphenol market.

Global Nonylphenol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.37 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.5% |

| 2035 Value Projection: | USD 2.47 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Grade, By Application |

| Companies covered:: | The Dow Chemical Company Solvay SA BASF SE Sasol Limited Stepan Company Huntsman Corporation SI Group Sabic Daqing Zhonglan AkzoNobel N.V. India Glycols Limited Clariant AG Dover Chemical Corporation and others key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The worldwide need for nonylphenol is mainly propelled by its usage in industries such as detergents, textiles, paints, coatings and adhesives due to its surfactant and stabilizing characteristics. The growing demand for cleaning products and industrial surfactants in developing countries, coupled with the advancement of construction, automotive and textile industries, drives market growth. Rapid industrialization and urban development support the heightened manufacture of consumer and industrial goods containing compounds sourced from nonylphenol. Moreover, ongoing research and development aimed at improving product efficiency, combined with the growing utilization of nonylphenol in wastewater treatment and agricultural applications, are propelling the market growth.

Restraining Factors

The nonylphenol market faces restraints due to stringent environmental regulations, growing restrictions on NP and NPEO in detergents and industrial applications, and rising concerns over toxicity, endocrine disruption, and aquatic pollution. Increasing global shifts toward safer, biodegradable alternatives further limit market expansion and reduce industrial reliance on nonylphenol-based products.

Market Segmentation

The nonylphenol market share is classified into grade, application, and end-use.

- The industrial grade segment dominated the market in 2024, approximately 87% and is projected to grow at a substantial CAGR during the forecast period.

Based on the grade, the nonylphenol market is divided into reagent grade and industrial grade. Among these, the industrial grade segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The industrial grade segment dominated the market due to its use in manufacturing operations, including the production of nonylphenol ethoxylates, antioxidants, lubricants, resins and surfactants. Its suitability for purposes, cost-effectiveness and high demand from sectors such as chemicals, construction, textiles and oil & gas significantly boosted its growth and widespread application.

- The emulsifiers segment accounted for the largest share in 2024, approximately 28% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the nonylphenol market is divided into antioxidant, emulsifiers, stabilizers, detergents, cleaning, dispersing agent, and others. Among these, the emulsifiers segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The expansion of the emulsifiers segment is driven by the application of nonylphenol-based emulsifiers in detergents, paints, coatings, agrochemicals and industrial cleaning products. Their excellent emulsifying performance, temperature stability and compatibility with chemical systems contribute to strong demand. The segment’s growth has also been accelerated by the increase in manufacturing, construction and agricultural sectors.

Get more details on this report -

- The chemical segment accounted for the highest market revenue in 2024, approximately 31% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the nonylphenol market is divided into chemical, building and construction, food and beverages, automotive, pulp and paper, agrochemicals, oil and gas, and others. Among these, the chemical segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The chemical segment market growth is due to nonylphenol’s extensive use as an intermediate in producing surfactants, resins, antioxidants, and lubricants. Its effectiveness in enhancing chemical formulations, stabilizing reactions, and improving product performance drives strong demand. Expanding industrial activities, especially in polymers, coatings, and specialty chemicals, further accelerated segment growth.

Regional Segment Analysis of the Nonylphenol Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the nonylphenol market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the nonylphenol market over the predicted timeframe. The Asia Pacific region is anticipated to have a 42% market share of the nonylphenol market owing to paced industrial growth, growing chemical production, and high demand from sectors, like plastics, textiles, detergents and agrochemicals. China stands out with its chemical manufacturing and widespread use of NP-based surfactants, whereas India and Southeast Asia play a role through their construction, automotive and farming sectors. The lenient regulations compared to Western regions encourage wider utilization. Nevertheless, regulatory actions are on the rise, including Taiwan’s December 2024 plan to eliminate detergents with NP and NPEO, prohibiting items with concentrations exceeding 5% starting September 2026 and restricting them to 0.1% by March 2027.

North America is expected to grow at a rapid CAGR in the nonylphenol market during the forecast period. The nonylphenol market in North America is expected to have a 21% market share, driven by high demand from the chemical, construction and automotive industries. The United States is at the forefront of producing detergents, emulsifiers and industrial chemicals on a scale with nonylphenol. Growth is fueled by manufacturing investments, strict quality regulations and research into high-efficiency surfactants. Consistent industrial operations and a need for specialty chemicals also boost its utilization. In September 2024, California included detergents with nonylphenol ethoxylates (NPEs) on its Safer Consumer Products candidate list, due to their environmental persistence, toxicity to aquatic life and their breakdown into the more hazardous nonylphenol, which poses risks to health and ecosystems.

The expansion of Europe’s nonylphenol market is fueled by the requirements of the chemical, detergent and industrial manufacturing industries in Germany and France. Although stringent REACH regulations restrict the use of NP and NPEO in regulated applications in resins, coatings and lubricants persist. Ongoing investments in formulations that meet compliance and friendly substitutes, coupled with the demand for high-performance surfactants, bolster consistent growth. In February 2021, the EU’s REACH Annexe XVII banned textile products with ≥0.01% NPE, accelerating the shift to non-APEO surfactants, promoting safer laundering and environmentally responsible manufacturing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the nonylphenol market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Dow Chemical Company

- Solvay SA

- BASF SE

- Sasol Limited

- Stepan Company

- Huntsman Corporation

- SI Group

- Sabic

- Daqing Zhonglan

- AkzoNobel N.V.

- India Glycols Limited

- Clariant AG

- Dover Chemical Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Indovinya launched the Open Innovation Challenge, seeking nonylphenol-free solubilizers for personal care products, emphasizing bio-derived alternatives for detergents and cosmetics, offering USD 500K in funding to accelerate research and development.

- In October 2025, BASF’s Intermediates division opened a new neopentyl glycol (NPG) plant in Zhanjiang, China, adding 80,000 tons annually and raising global capacity to 335,000 tons. NPG, used primarily in powder coating resins, strengthens BASF’s leading market position, with first customer deliveries made in October.

- In September 2025, SI Group unveiled WESTON 705 Antioxidant, a next-generation, nonylphenol-free liquid phosphite for plastics and elastomers. FDA-approved in over 50 countries, it enhances thermal stability in recycled polypropylene and reduces environmental impact by 20%, showcased at K 2025 for sustainable polymer solutions.

- In January 2024, Dow Inc. launched EcoSense 2470 Surfactant, a sustainable, nonylphenol-free industrial cleaner, winning the BIG Innovation Award for its biodegradability and high performance in textile processing applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the nonylphenol market based on the below-mentioned segments:

Global Nonylphenol Market, By Grade

- Reagent Grade

- Industrial Grade

Global Nonylphenol Market, By Application

- Antioxidant

- Emulsifiers

- Stabilizers

- Detergents

- Cleaning

- Dispersing Agent

- Others

Global Nonylphenol Market, By End-Use

- Chemical

- Building and Construction

- Food and Beverages

- Automotive

- Pulp and Paper

- Agrochemicals

- Oil and Gas

- Others

Global Nonylphenol Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the nonylphenol market over the forecast period?The global nonylphenol market is projected to expand at a CAGR of 5.5% during the forecast period.

-

2. What is the market size of the nonylphenol market?The global nonylphenol market size is expected to grow from USD 1.37 billion in 2024 to USD 2.47 billion by 2035, at a CAGR of 5.5% during the forecast period 2025-2035.

-

3. What is the nonylphenol market?The nonylphenol market is a global industry for the chemical compound nonylphenol, which is primarily used as an intermediate to produce nonylphenol ethoxylates (NPEs) and other products like antioxidants and surfactants.

-

4. Which region holds the largest share of the nonylphenol market?Asia Pacific is anticipated to hold the largest share of the nonylphenol market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global nonylphenol market?The Dow Chemical Company, Solvay SA, BASF SE, Sasol Limited, Stepan Company, Huntsman Corporation, SI Group, Sabic, Daqing Zhonglan, AkzoNobel N.V., and Others.

-

6. What factors are driving the growth of the nonylphenol market?The growth of the nonylphenol market is primarily driven by strong demand in industrial applications across emerging economies, particularly in the Asia-Pacific region. Nonylphenol (NP) and its derivatives (NPEs) are valued for their superior properties as surfactants and chemical intermediates.

-

7. What are the market trends in the nonylphenol market?Market trends for nonylphenol include growing demand from industrial sectors like textiles, cleaning, and agrochemicals, especially in emerging economies. However, stricter environmental regulations are hindering growth in developed regions by driving the adoption of alternative, biodegradable surfactants.

-

8. What are the main challenges restricting wider adoption of the nonylphenol market?The main challenges restricting the wider adoption of the nonylphenol (NP) market are stringent environmental regulations, significant health and environmental concerns, and the increasing availability and adoption of safer, eco-friendly alternatives

Need help to buy this report?