Global Methyl Tertiary Butyl Ether Market Size Size, Share, and COVID-19 Impact Analysis, By Grade (Industrial Grade and Pharmaceutical Grade), By Application (Gasoline Additives, Isobutene, and Others), By End-User (Automotive, Oil and Gas, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Methyl Tertiary Butyl Ether Market Size Insights Forecasts to 2035

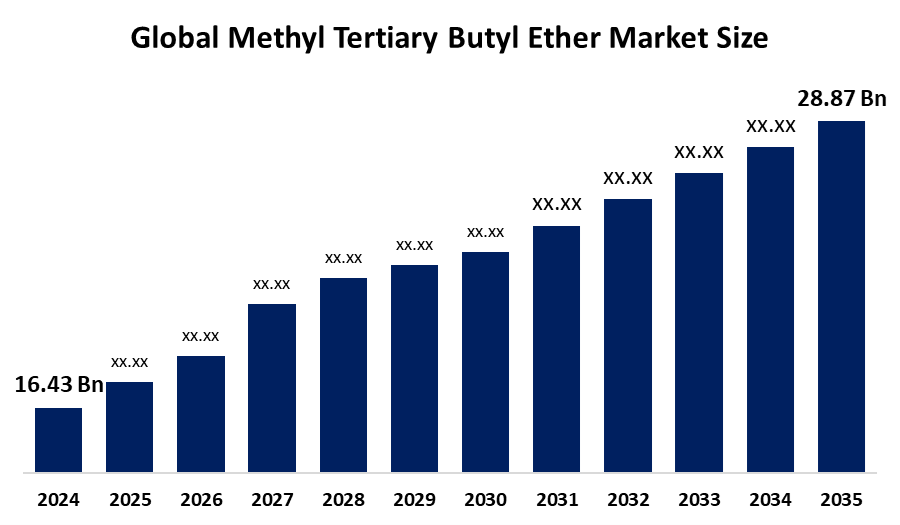

- The Global Methyl Tertiary Butyl Ether Market Size Was Estimated at USD 16.43 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.26% from 2025 to 2035

- The Worldwide Methyl Tertiary Butyl Ether Market Size is Expected to Reach USD 28.87 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Methyl Tertiary Butyl Ether Market Size was worth around USD 16.43 Billion in 2024 and is predicted to grow to around USD 28.87 Billion by 2035 with a compound annual growth rate (CAGR) of 5.26% from 2025 to 2035. The Methyl Tertiary Butyl Ether Market Size is expanding due to rising demands for high-octane gasoline and increasing automobile ownership in developing countries, especially in the Asia-Pacific region and the requirement for fuel oxygenates that fulfil stringent vehicle emission regulations. The market experiences increased demand because of both enhanced refining capabilities and additional industrial requirements.

Market Overview

The methyl tertiary butyl ether (MTBE) market produces a transparent organic compound that exhibits both explosive and flammable properties through the chemical reaction between methanol and isobutylene. The compound serves as an oxygenate in gasoline to increase octane ratings while enabling more effective combustion. The market experiences growth because emerging Asian and Middle Eastern economies demonstrate increasing demand for gasoline and because global air quality standards become more stringent and refinery capacities continue to grow.

Maharashtra will finalize a $2 billion contract with a US company to build a major bio-methanol facility in Chandrapur-Gadchiroli, which the state government announced in December 2025. Officials at a Confederation of Indian Industry seminar presented information about their bamboo biomass blending project and their sustainable fuel initiatives. The company will pursue future business opportunities by producing high-purity isobutylene for plastics and rubbers while developing bio-based MTBE products that meet sustainability requirements. The key market players who control the industry market space consist of SABIC, Evonik Industries, CNPC, Huntsman International and Reliance Industries.

Report Coverage

This research report categorizes the Methyl Tertiary Butyl Ether Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Methyl Tertiary Butyl Ether Market Size. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Methyl Tertiary Butyl Ether Market Size.

Methyl Tertiary Butyl Ether Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 16.43 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.26% |

| 2035 Value Projection: | USD 28.87 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Grade, By Application |

| Companies covered:: | SABIC, Evonik Industries AG, LyondellBasell Industries N.V., Eni S.p.A., Huntsman International, Sinopec, Petroliam Nasional Berhad, ExxonMobil Corporation, Shell plc, Reliance Industries Limited, QAFAC, Emirates National Oil Company, Formosa Plastics Corporation, China National Petroleum Corporation (CNPC), and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global methyl tertiary butyl ether (MTBE) market experiences its main market expansion through increasing demand for high-octane, cleaner-burning fuels, which particularly affects developing markets. The Asia-Pacific region leads demand because urban vehicle ownership increases the requirement for affordable octane boosters, which help decrease harmful emissions. Developing countries implement strict environmental regulations, which lead to increased MTBE usage because it enhances combustion efficiency. The growth of the market occurs because of two factors: expanding petrochemical infrastructure, which serves as a chemical intermediate for isobutylene production and growing use of the product in pharmaceutical solvents.

Restraining Factors

The global methyl tertiary butyl ether (MTBE) market faces its main obstacles through two factors, including environmental regulations that protect against groundwater contamination and the resulting regional bans, which affect areas such as the US. The market expansion faces obstacles because biofuels become more popular and the costs of raw materials (isobutylene and methanol) experience extreme fluctuations while production expenses remain high.

Market Segmentation

The Methyl Tertiary Butyl Ether Market Size share is classified into grade, application, and end-user.

- The industrial grade segment dominated the market in 2024, approximately 90% and is projected to grow at a substantial CAGR during the forecast period.

Based on the grade, the Methyl Tertiary Butyl Ether Market Size is divided into industrial grade and pharmaceutical grade. Among these, the industrial grade segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment market expansion is because it has wide applications as an oxygenate and octane booster in gasoline blending operations. The industrial-grade MTBE demand increased worldwide because automotive and refining industries from the Asia-Pacific and Middle East regions, along with large petrochemical facilities, created strong demand for the product.

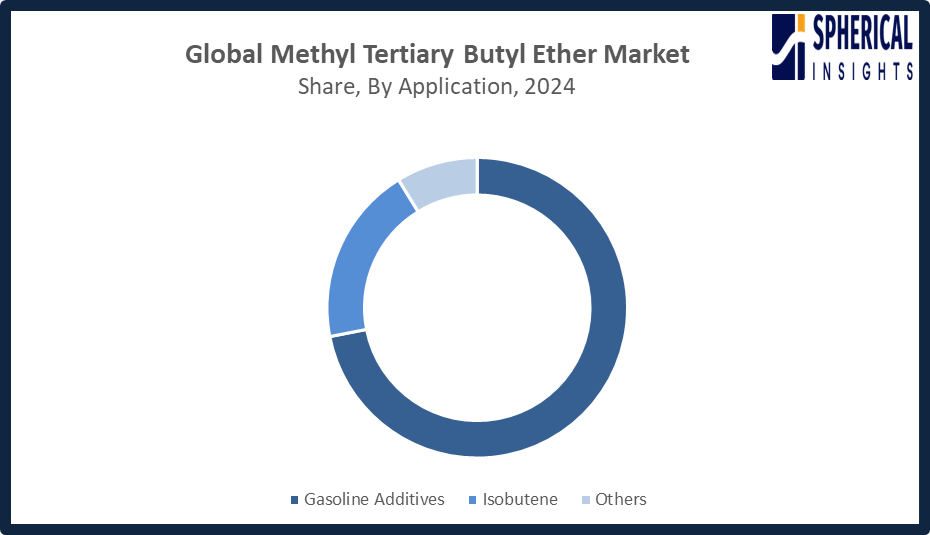

- The gasoline additives segment accounted for the largest share in 2024, approximately 72% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the Methyl Tertiary Butyl Ether Market Size is divided into gasoline additives, isobutene, and others. Among these, the gasoline additives segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The gasoline additives segment is growing owing to rising global fuel consumption, increasing vehicle ownership, and stringent fuel quality regulations requiring higher octane levels. MTBE achieved its primary market position during gasoline blending operations because it functions as an oxygenate and octane booster throughout the Asia-Pacific and Middle East regions.

Get more details on this report -

- The automotive segment accounted for the highest market revenue in 2024, approximately 61% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end use, the Methyl Tertiary Butyl Ether Market Size is divided into automotive, oil and gas, and others. Among these, the automotive segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The automotive segment market growth is driven by increasing vehicle production, rising transportation fuel demand, and the need for higher-octane gasoline drove progress. The worldwide consumption of MTBE in the automotive and transportation sectors increased because Asia-Pacific and Middle East refineries expanded their gasoline blending operations with the compound.

Regional Segment Analysis of the Methyl Tertiary Butyl Ether Market Size

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the Methyl Tertiary Butyl Ether Market Size over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the Methyl Tertiary Butyl Ether Market Size over the predicted timeframe. The Asia Pacific region will dominate methyl tertiary butyl ether (MTBE) market growth, with approximate 42% share due to its high gasoline usage, growing refinery capacity and increasing automobile manufacturing. The demand within the region is mainly met by China, which operates extensive petrochemical facilities that produce fuel blending materials. The vehicle ownership increase and ongoing refinery construction projects drive India's current rapid development. The region maintains its market dominance because South Korea and Japan operate advanced refining facilities while maintaining consistent fuel quality standards. The National Policy on Biofuels and the Ethanol Blended Petrol Programme enabled India to reach its 20% ethanol blending (E20) target in January 2026 before its expected date. The milestone strengthens energy security, reduces crude oil imports, and lowers carbon emissions under the country’s 2026 energy strategy.

North America is expected to grow at a rapid CAGR in the Methyl Tertiary Butyl Ether Market Size during the forecast period. North America will experience a 18% share of methyl tertiary butyl ether (MTBE) market expansion because petrochemical companies increase their investments, and demand for high-octane gasoline blending components continues to rise. The United States leads regional growth with strong refining infrastructure and export-oriented production. Canada meets market needs through its consistent fuel usage and its increasing petrochemical industry, while Mexico experiences regional growth through its refinery improvements and rising demand for transportation fuels. In June 2025, the U.S. Environmental Protection Agency proposed new Renewable Fuel Standard (RFS) blending volumes for 2026 and 2027. The plan establishes new ethanol and biofuel requirements, which will begin in 2026 to facilitate the development of cleaner transportation fuels.

The market for methyl tertiary butyl ether (MTBE) in Europe grows because fuel quality rules stay constant and high-octane blending components see increasing demand. Germany leads the market because it possesses strong refining and automotive manufacturing capabilities. France supports demand through regulated fuel standards, while Italy contributes via established petrochemical production and regional fuel consumption stability. The European Union implemented the revised Renewable Energy Directive (RED II) in January 2026 to establish biofuel requirements that support Green Deal objectives. Member States continue to transpose updated provisions into national laws to meet 2030 emission-reduction commitments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Methyl Tertiary Butyl Ether Market Size, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SABIC

- Evonik Industries AG

- LyondellBasell Industries N.V.

- Eni S.p.A.

- Huntsman International

- Sinopec

- Petroliam Nasional Berhad

- ExxonMobil Corporation

- Shell plc

- Reliance Industries Limited

- QAFAC

- Emirates National Oil Company

- Formosa Plastics Corporation

- China National Petroleum Corporation (CNPC)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2025, the FuelEU Maritime Regulation entered into force, mandating ships over 5,000 gross tonnage calling at EU ports to cut greenhouse gas intensity starting at 2% in 2025, reaching 80% by 2050. The regulation promotes renewable fuels and onshore power use.

- In December 2024, ENOC Group unveiled redesigned global packaging for its lubricant products during Automechanika Dubai 2024 at the Dubai World Trade Centre. The company also honored international distributors and outlined future collaboration plans.

- In October 2024, India reinforced its Ethanol Blended Petrol (EBP) Programme, promoting higher ethanol blends such as E20 and beyond. The policy push strengthens ethanol’s role as a preferred octane enhancer and emission-reduction solution, reshaping traditional oxygenate demand dynamics in the fuel market.

- In March 2023, LyondellBasell announced the startup of the world’s largest propylene oxide and tertiary butyl alcohol unit in Texas. The U.S. Gulf Coast facility has annual capacities of 470,000 metric tons of PO and one million metric tons of TBA derivatives.

- In June 2023, Axens signed an exclusive licensing alliance with ExxonMobil Catalysts and Licensing LLC to offer MTBE Decomposition technology. The agreement grants Axens global rights to market, license, and support high-purity isobutylene units for petrochemical applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Methyl Tertiary Butyl Ether Market Size based on the below-mentioned segments:

Global Methyl Tertiary Butyl Ether Market Size, By Grade

- Industrial Grade

- Pharmaceutical Grade

Global Methyl Tertiary Butyl Ether Market Size, By Application

- Gasoline Additives

- Isobutene

- Others

Global Methyl Tertiary Butyl Ether Market Size, By End-User

- Automotive

- Oil and Gas

- Others

Global Methyl Tertiary Butyl Ether Market Size, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Methyl Tertiary Butyl Ether Market Size over the forecast period?The global Methyl Tertiary Butyl Ether Market Size is projected to expand at a CAGR of 5.26% during the forecast period.

-

2. What is the market size of the Methyl Tertiary Butyl Ether Market Size?The global Methyl Tertiary Butyl Ether Market Size is expected to grow from USD 16.43 billion in 2024 to USD 28.87 billion by 2035, at a CAGR of 5.26% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Methyl Tertiary Butyl Ether Market Size?Asia Pacific is anticipated to hold the largest share of the Methyl Tertiary Butyl Ether Market Size over the predicted timeframe.

-

4. What is the global Methyl Tertiary Butyl Ether Market Size?The global Methyl Tertiary Butyl Ether Market Size involves the production and trade of MTBE primarily for gasoline blending and petrochemical applications.

-

5. Who are the top 10 companies operating in the global Methyl Tertiary Butyl Ether Market Size?SABIC, Evonik Industries AG, LyondellBasell Industries N.V., Eni S.p.A., Huntsman International, Sinopec, Petroliam Nasional Berhad, ExxonMobil Corporation, Shell plc, Reliance Industries Limited, and Others.

-

6. What factors are driving the growth of the Methyl Tertiary Butyl Ether Market Size?The MTBE market is driven by rising global gasoline demand, particularly in the Asia-Pacific region, increasing requirements for high-octane, cleaner-burning fuels, and its use as a cost-effective, versatile chemical solvent.

-

7. What are the market trends in the Methyl Tertiary Butyl Ether Market Size?MTBE market trends show rising demand in Asia-Pacific for gasoline blending, contrasted by regulatory restrictions in Western markets favoring cleaner alternatives.

-

8. What are the main challenges restricting wider adoption of the Methyl Tertiary Butyl Ether Market Size?Major challenges restricting the MTBE market include severe environmental regulations due to groundwater contamination risks, bans in key regions, rising competition from ethanol, and fluctuating raw material prices.

Need help to buy this report?