Japan Polypropylene Nonwoven Fabric Market Size, Share, By Product (Spunbound, Staples, Meltblown, Composite), By Application (Hygiene, Industrial, Medical, Geotextiles, Furnishings, Carpet, Agriculture, Automotive, Others), Japan Polypropylene Nonwoven Fabric Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsJapan Polypropylene Nonwoven Fabric Market Insights Forecasts to 2035

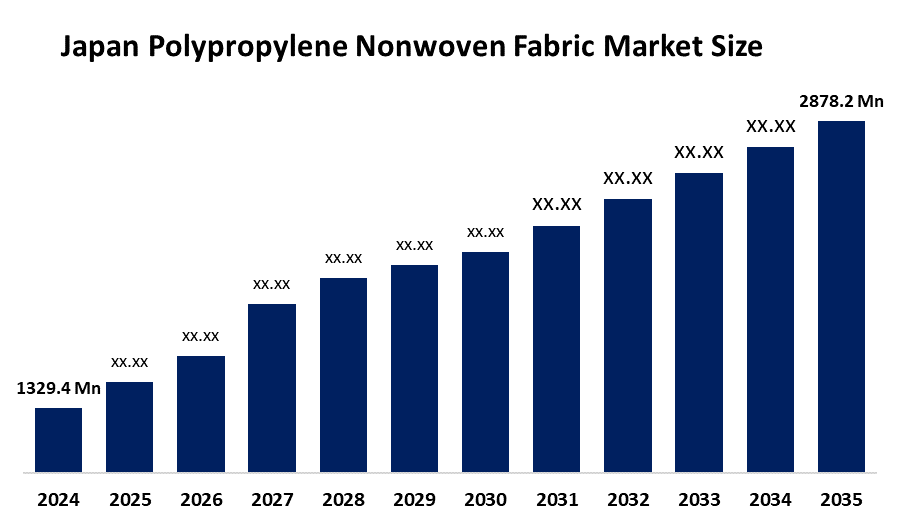

- Japan Polypropylene Nonwoven Fabric Market Size 2024: USD 1329.4 Mn

- Japan Polypropylene Nonwoven Fabric Market Size 2035: USD 2878.2 Mn

- Japan Polypropylene Nonwoven Fabric Market CAGR 2024: 7.27%

- Japan Polypropylene Nonwoven Fabric Market Segments: Phase Type and Service

Get more details on this report -

The Japan Polypropylene Nonwoven Fabric Market Size is Comprised of Production Sheets that Use Polypropylene Fibers that are Bonded Through the Spunbond Process, Melt Blowing, Stapling, and the Combination of these Processes. This type of fabric is lightweight, strong, and versatile and is used in wipes, medical products, filtration materials for industry and construction, geotextiles for building, interior automotive upholstery, home furnishings, and agricultural covers.

The market expansion is fueled by increased awareness about hygiene, growing applications related to healthcare and industries, and increased use of nonwoven materials in high-end construction and automotive industries. Technology advancements, including advanced melt-blown filters, composite materials, and eco-friendly manufacturing methods, are also helping enhance efficiency. Another factor that contributes to market expansion, especially in Japan, is government actions, including Japan’s Plastic Resource Circulation Promotion Law and METI’s regional resource circulation demonstration projects, which support recycling, a circular economy, and use of sustainable materials. Such factors, together with growing investments in healthcare facilities and sustainable industries, will show a prospective market expansion avenue in the medical, hygiene, car, and pollution control sectors.

Japan Polypropylene Nonwoven Fabric Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1329.4 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 7.27% |

| 2035 Value Projection: | USD 2878.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product ,By Application |

| Companies covered:: | Mitsui Chemicals Inc, Asahi Kasei Corp, Toray Industries Inc, Unitika Ltd, Dynic Corporation, Nippon Nonwoven Co., Ltd, Teijin Frontier Co., Ltd, Oji Holdings Corporation, Sekisui Chemical Co., Ltd, and Other Key Companies |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Polypropylene Nonwoven Fabric Market:

The Japan Polypropylene Nonwoven Fabric Market Size is fueled by the rise in demand in the medical, hygiene, and industrial sectors, increased awareness regarding hygiene and disposable products, and increased manufacturing of medical products such as masks, medical gowns, and medical wipes. The move towards more eco-friendly and lighter materials, coupled with initiatives by the government to manufacture and export, and the adoption of modern manufacturing technology such as spun-bond and melt-blown technology, will contribute to further fueling the market growth in Japan.

Japan Polypropylene Nonwoven Fabric Market Size is hindered by the high material cost, fluctuating polypropylene prices, plastic waste environmental concerns, rigid regulations regarding the disposal of nonwoven materials, and the difficulties involved in recycling the polypropylene nonwoven materials.

The future for the polypropylene nonwoven fabric market in Japan looks bright, with opportunities in the growing need for eco-friendly, biodegradable nonwovens, advances in high-performance multifunctional nonwovens, development in the medical, hygiene, or other industries, and the implementation of fully automated, energy-saving production technology that will improve quality at the same time as cutting costs.

Market Segmentation

The Japan Polypropylene Nonwoven Fabric Market share is classified into product and application.

By Product:

The Japan Polypropylene Nonwoven Fabric Market Size is divided by product into spunbond, staples, meltblown, and composite. Among these, the spunbond segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Large production volumes, superior tensile strength for medical masks & filters in the aftermath of the COVID pandemic regulations, and cost-effectiveness for usage in hygienic products drive the Spunbond segment to be the market leader with higher expenses compared to other types.

By Application:

The Japan Polypropylene Nonwoven Fabric Market Size is divided by application into hygiene, industrial, medical, geotextiles, furnishings, carpet, agriculture, automotive, and others. Among these, the hygiene segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Hygiene leads owing to Japan's super-aged population, which augments the demand for adult incontinence and diapers, because of nonwoven PP's properties that make it breathable and absorbent and suitable for disposable products, due to strict norms related to health, and growing e-commerce penetration in the personal hygiene category.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan polypropylene nonwoven fabric market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Polypropylene Nonwoven Fabric Market:

- Mitsui Chemicals Inc

- Asahi Kasei Corp

- Toray Industries Inc

- Unitika Ltd

- Dynic Corporation

- Nippon Nonwoven Co., Ltd

- Teijin Frontier Co., Ltd

- Oji Holdings Corporation

- Sekisui Chemical Co., Ltd

- Others

Recent Developments in Japan Polypropylene Nonwoven Fabric Market:

In January 2025, Japan Polypropylene Corporation has launched the brand name NOVAORBIS™, especially in the fields of carbon neutral and circular economy polypropylene products. This move came as a measure of responding to the global sustainability agenda, as well as adhering to the Japanese government's environmental policies in Japan.

In June 2024, Toray Industries has created a new polypropylene non-woven material specifically designed for use in the hygienic sector. The new material boasts improved softness and absorptive qualities in order to meet the rising need of consumers for quality and safe products with use-and-dispose characteristics, such as masks, wipes, and sanitary products.

In March 2024, Toray Industries joined forces with Fitesa in order to establish a strategic partnership for the development and launch of high-performance polypropylene nonwovens. Through the partnership, lightweight, strong, and sustainable materials can be developed that are meant to ensure efficiency while taking care of the need for autos in the Japanese market

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan Polypropylene Nonwoven Fabric Market Size based on the below-mentioned segments:

Japan Polypropylene Nonwoven Fabric Market, By Product

- Spunbond

- Staples

- Meltblown

- Composite

Japan Polypropylene Nonwoven Fabric Market, By Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

Frequently Asked Questions (FAQ)

-

What is the Japan polypropylene nonwoven fabric market size?Japan polypropylene nonwoven fabric market is expected to grow from USD 1329.4 million in 2024 to USD 2878.2 million by 2035, growing at a CAGR of 7.27% during the forecast period 2025–2035.

-

What are the key growth drivers of the market?Market growth is driven by rising demand in medical, hygiene, and industrial sectors, increased awareness about disposable and eco-friendly products, technological advancements such as spunbond and meltblown processes, and government initiatives supporting sustainable materials and recycling

-

What factors restrain the market?Market restraints include high material costs, fluctuating polypropylene prices, environmental concerns related to plastic waste, strict regulations on disposal of nonwoven materials, and challenges in recycling, which collectively slow production and increase overall costs.

-

How is the market segmented by product?The market is segmented into spunbond, staples, meltblown, and composite.

-

How is the market segmented by application?The market is segmented into hygiene, industrial, medical, geotextiles, furnishings, carpet, agriculture, automotive, and others.

-

Who are the key players in the Japan polypropylene nonwoven fabric market?Key companies include Mitsui Chemicals Inc, Asahi Kasei Corp, Toray Industries Inc, Unitika Ltd, Dynic Corporation, Nippon Nonwoven Co., Ltd, Teijin Frontier Co., Ltd, Oji Holdings Corporation, Sekisui Chemical Co., Ltd, and Others.

-

What are the recent developments in the market?In June 2024, Toray Industries launched a polypropylene nonwoven fabric for the hygiene sector with improved softness and absorbency. In March 2024, Toray Industries partnered with Fitesa to develop high-performance polypropylene nonwovens for automotive applications. In January 2025, Japan Polypropylene Corporation (JPP) launched the NOVAORBIS™ brand of carbon-neutral and circular economy polypropylene products.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?