United States Reinforced Nonwoven Plastic Market Size, Share, and COVID-19 Impact Analysis, By Resin Type (Polypropylene (PP), Polyethylene (PE), Polyester (PET), Nylon (PA), and Polyamide (PA)), By Application (Automotive, Construction, Consumer Electronics, Medical & Healthcare, Packaging, and Textiles), By Reinforcement Type (Glass Fiber, Carbon Fiber, Aramid Fiber, Polyester Fiber, and Polyethylene Fiber), and United States Reinforced Nonwoven Plastic Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Reinforced Nonwoven Plastic Market Insights Forecasts to 2035

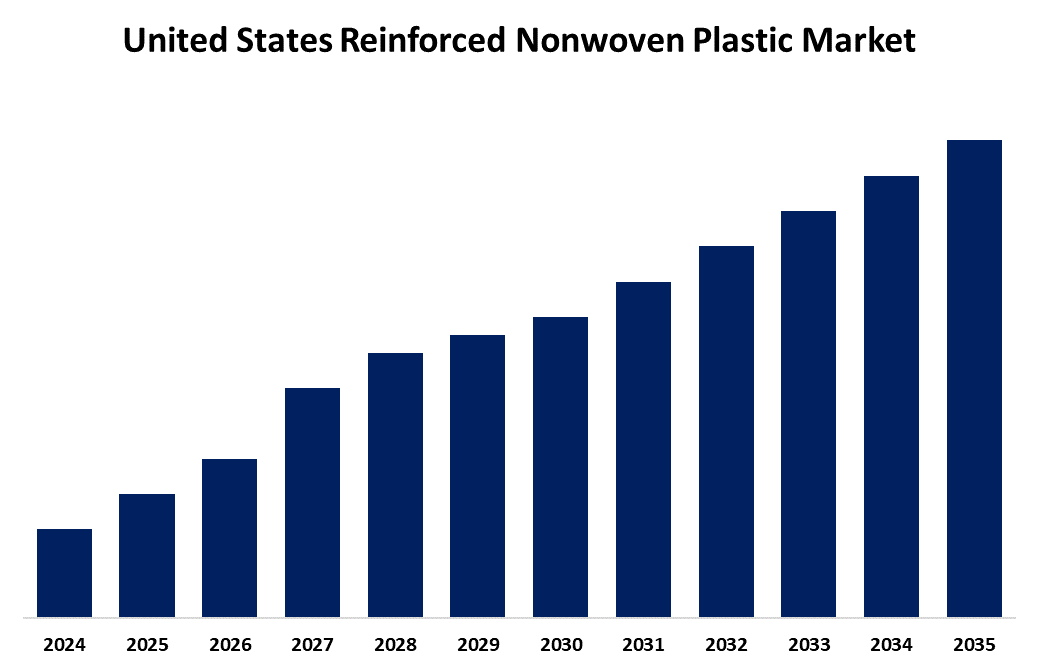

- The USA Reinforced Nonwoven Plastic Market Size is Expected to Grow at a CAGR of around 4.8% from 2025 to 2035.

- The United States Reinforced Nonwoven Plastic Market Size is Expected to Hold a Significant Share by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Reinforced Nonwoven Plastic Market Size is Expected to hold a significant share by 2035, Growing at a CAGR of 4.8% from 2025 to 2035. The United States reinforced nonwoven plastic market is experiencing growth due to increasing demand across the automotive, construction, and medical sectors. These materials offer superior strength, durability, and lightweight properties, making them ideal for applications like geotextiles, filtration, and protective gear. Advancements in manufacturing technologies and sustainability initiatives further drive their adoption.

Market Overview

The United States reinforced nonwoven plastic market refers to the engineered fabrics made by bonding synthetic fibers through mechanical, thermal, or chemical processes, resulting in materials with enhanced strength, durability, and lightweight properties. These reinforced nonwoven plastics find extensive use across automotive, construction, medical, and filtration industries due to their cost-effectiveness and versatility as alternatives to traditional composites. Market growth is driven by rising demand for lightweight and durable materials that improve fuel efficiency in vehicles and offer superior performance in construction applications. Strengths of reinforced nonwoven plastics lie in their versatility, ease of manufacturing, and ability to meet stringent performance standards. Additionally, increasing environmental concerns have led to innovations in sustainable production methods and recyclable materials, creating new opportunities in eco-friendly product development. The U.S. government supports these advancements through initiatives promoting advanced manufacturing technologies and environmental sustainability, such as funding from the Department of Energy.

Report Coverage

This research report categorizes the market for the United States reinforced nonwoven plastic market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the USA reinforced nonwoven plastic market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. reinforced nonwoven plastic market.

United States Reinforced Nonwoven Plastic Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.8% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 178 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Resin Type, By Reinforcement Type, and COVID-19 Impact Analysis |

| Companies covered:: | Berry Global Inc., Freudenberg Filtration Technologies, Kimberly-Clark Corporation, Ahlstrom-Munksjö Inc., Hollingsworth & Vose Company, Johns Manville, Conwed Plastics, TWE Group, Fitesa, Glatfelter, Neenah Inc., Lydall Inc., Delfingen Industry, Mitsui Chemicals America, Inc., Sandler AG, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The increasing demand from diverse industries such as automotive, construction, healthcare, and filtration drive the market growth. These materials offer excellent strength-to-weight ratios, enhancing fuel efficiency in vehicles and reducing overall structural weight in construction projects. Technological advancements in manufacturing processes have improved the durability and cost-effectiveness of reinforced nonwoven plastics, making them attractive alternatives to traditional materials. Growing environmental concerns and stricter regulations have accelerated the development of sustainable and recyclable reinforced nonwoven products. Additionally, rising investments in infrastructure and the medical sectors further boost demand. Government initiatives supporting advanced manufacturing and sustainability encourage innovation, expanding application opportunities.

Restraining Factors

The high production costs associated with advanced manufacturing technologies, raw materials, limited recycling infrastructure, and concerns over environmental impact hinder widespread adoption. Additionally, competition from alternative materials and fluctuating raw material prices pose obstacles to market growth and profitability.

Market Segmentation

The United States reinforced nonwoven plastic market share is classified into resin type, application, and reinforcement type.

- The polypropylene (PP) segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States reinforced nonwoven plastic market is segmented by resin type into polypropylene (PP), polyethylene (PE), polyester (PET), nylon (PA), and polyamide (PA). Among these, the polypropylene (PP) segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its excellent balance of cost-effectiveness, durability, and chemical resistance. PP offers lightweight properties and high tensile strength, making it ideal for applications in automotive, construction, and medical industries. Additionally, its recyclability and ease of processing contribute to its widespread adoption, supporting market dominance.

- The automotive segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States reinforced nonwoven plastic market is segmented by application into automotive, construction, consumer electronics, medical & healthcare, packaging, and textiles. Among these, the automotive segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the increasing demand for lightweight, durable materials that improve fuel efficiency and reduce emissions. Reinforced nonwoven plastics offer high strength-to-weight ratios, corrosion resistance, and cost-effectiveness, making them ideal for interior and exterior automotive components.

- The glass fiber segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States reinforced nonwoven plastic market is segmented by reinforcement type into glass fiber, carbon fiber, aramid fiber, polyester fiber, and polyethylene fiber. Among these, the glass fiber segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of its excellent mechanical strength, cost-effectiveness, and widespread availability. Glass fiber reinforcement offers high durability, thermal stability, and corrosion resistance, making it suitable for demanding applications in automotive, construction, and industrial sectors.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States reinforced nonwoven plastic market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Berry Global Inc.

- Freudenberg Filtration Technologies

- Kimberly-Clark Corporation

- Ahlstrom-Munksjo Inc.

- Hollingsworth & Vose Company

- Johns Manville

- Conwed Plastics

- TWE Group

- Fitesa

- Glatfelter

- Neenah Inc.

- Lydall Inc.

- Delfingen Industry

- Mitsui Chemicals America, Inc.

- Sandler AG

- Others

Recent Developments:

- In November 2024, Berry Global Group, Inc. completed the merger of its Health, Hygiene and Specialties Global Nonwovens and Films business with Glatfelter Corporation, forming Magnera Corporation, the world’s largest nonwovens company. This strategic move created a broad platform for specialty materials solutions. Magnera began trading on the NYSE under the symbol “MAGN”.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the U.S. reinforced nonwoven plastic market based on the below-mentioned segments:

United States Reinforced Nonwoven Plastic Market, By Resin Type

- Polypropylene (PP)

- Polyethylene (PE)

- Polyester (PET)

- Nylon (PA)

- Polyamide (PA)

United States Reinforced Nonwoven Plastic Market, By Application

- Automotive

- Construction

- Consumer Electronics

- Medical & Healthcare

- Packaging

- Textiles

United States Reinforced Nonwoven Plastic Market, By Reinforcement Type

- Glass Fiber

- Carbon Fiber

- Aramid Fiber

- Polyester Fiber

- Polyethylene Fiber

Need help to buy this report?