Italy Sulphuric Acid Market Size, Share, By End Use (Phosphate Fertilizers, Metal Processing, Phosphating, Fibers, Paints & Pigments, And Others), By Sales Channel (Direct Sales And Indirect Sales), And Italy Sulphuric Acid Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsItaly Sulphuric Acid Market Insights Forecasts to 2035

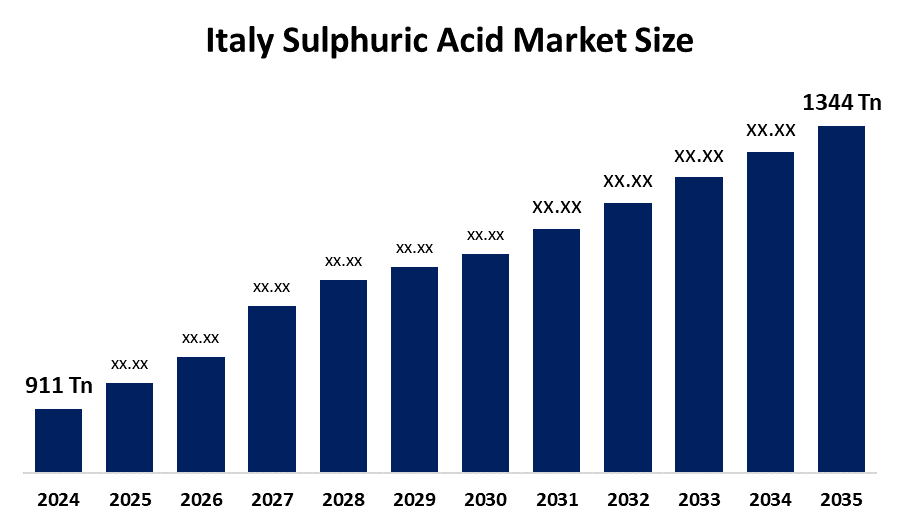

- Italy Sulphuric Acid Market Size 2024: 911 thousand tonnes

- Italy Sulphuric Acid Market Size 2035: 1344 thousand tonnes

- Italy Sulphuric Acid Market CAGR 2024: 3.6%

- Italy Sulphuric Acid Market Segments: End Use and Sales Channel

Get more details on this report -

Italy sulphuric acid market encompasses production and selling of sulphuric acid as a corrosive product that is used extensively in different industrial procedures. Commonly, it finds application in making phosphate fertilisers, processing metals, cleaning and etching semiconductors, and performing the chemical synthesis of a variety of other industrial products. Additionally, sulphuric acid also serves as the primary source of a wide range of industrially produced goods that are also produced by many different types of industry across the Italian manufacturing sector, including the traditional heavy industries and increasing amounts of technologies related to electronics and batteries.

The sulphuric acid in Italy are backed by government support, including the National Recovery and Resilience Plan (PNRR), a major policy program aligned with the EU’s green and industrial transition goals. Under this plan, the Italian government has allocated about €194.4 billion to investments and reforms across seven missions, including the “Green Revolution and Ecological Transition” mission, which supports sustainable industrial processes, energy efficiency, hydrogen infrastructure, and a circular economy approach to industrial chemicals including sulphuric acids.

As technology advances, Italian sulphuric acid providers are now using efficient methods and technology for producing and using their products to reduce environmental impact and increase production yields. The use of advanced process control, catalyst use, and monitoring have helped producers realize significant improvements in conversion efficiency and energy usage during the production process and are part of an effort to align producers with the broader EU industrial sustainability objectives. The development of these technologies will enable producers to meet stringent environmental regulations, while also positioning sulphuric acid as an important resource in creating cleaner industrial processes.

Italy Sulphuric Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 911 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 3.6% |

| 2035 Value Projection: | 1344 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 201 |

| Tables, Charts & Figures: | 145 |

| Segments covered: | By End Use, By Sales Channel |

| Companies covered:: | Versalis SOL Group Brenntag Aurubis AG Boliden Group Chemtrade Logistics Yara International PhosAgro Group Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Italy Sulphuric Acid Market:

The Italy sulphuric acid market is driven by the robust demand from fertilizer manufacturers, the expansion of battery manufacturing, increasing demand for acid in energy storage supply chains, Italy’s shift toward sustainability and digitalization in industrial processes, demand for sophisticated chemical inputs like sulphuric acid, and adoption of circular economy principles that elevate acid use in recycling and environmental compliance applications.

The Italy sulphuric acid market is restrained by the volatility in raw material and energy costs, significantly impact on production economics, relatively high electricity and gas prices, stringent EU environmental regulations, and logistical challenges related to the import of key feedstock.

The future of Italy sulphuric acid market is bright and promising, with versatile opportunities emerging from the growth of high technology industries like battery development and recycling offers new, more profitable types of applications for sulphuric acid beyond its conventional use in fertilisers and the recovery of metals. The growth of sustainable agriculture will also lead to the expansion of sulphuric acid markets and the expansion of enhanced waste water treatment facilities will increase the potential for the sulphuric acid market as it becomes a valuable chemical in circular economy as well as for environmentally friendly industries.

Market Segmentation

The Italy Sulphuric Acid Market share is classified into end use and sales channel.

By End Use:

The Italy sulphuric acid market is divided by end use into phosphate fertilizers, metal processing, phosphating, fibers, paints & pigments, and others. Among these, the phosphate fertilizers segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Essential feedstock for fertilizer industry, used for producing phosphoric acid, well-developed agricultural economy, and demand to improve crop yields and soil health all contribute to the phosphate fertilizers segment's largest share and higher spending on sulphuric acid when compared to raw material.

By Sales Channel:

The Italy sulphuric acid market is divided by sales channel into direct sales and indirect sales. Among these, the direct sales segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The direct sales segment dominates because of large-volume industrial consumption, safety and specialized logistics reducing risks associated with intermediaries, customized service with technical support and quality assurance, and integrated supply chains making direct delivery the most efficient route.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Italy sulphuric acid market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Italy Sulphuric Acid Market:

- Versalis

- SOL Group

- Brenntag

- Aurubis AG

- Boliden Group

- Chemtrade Logistics

- Yara International

- PhosAgro Group

- Others

Recent Developments in Italy Sulphuric Acid Market:

In April 2025, BASF announced the expansion of its production capacity for semiconductor-grade sulphuric acid in Europe to serve the growing microchip industry. This impacts Italian industrial customers relying on high purity chemicals.

In January 2025, Nuova Solmine, a major Italian sulphuric acid producer, acquired Titanium Dioxide plant in Scarlino. This move allowed for the integration of sulphuric acid production with titanium dioxide manufacturing.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Italy, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Italy sulphuric acid market based on the below-mentioned segments:

Italy Sulphuric Acid Market, By End Use

- Phosphate Fertilizers

- Metal Processing

- Phosphating

- Fibers

- Paints & Pigments

- Others

Italy Sulphuric Acid Market, By Sales Channel

- Direct Sales

- Indirect Sales

Frequently Asked Questions (FAQ)

-

Q: What is the Italy sulphuric acid market size?A: Italy sulphuric acid market is expected to grow from 911 thousand tonnes in 2024 to 1344 thousand tonnes by 2035, growing at a CAGR of 3.6% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the robust demand from fertilizer manufacturers, the expansion of battery manufacturing, increasing demand for acid in energy storage supply chains, Italy’s shift toward sustainability and digitalization in industrial processes, demand for sophisticated chemical inputs like sulphuric acid, and adoption of circular economy principles that elevate acid use in recycling and environmental compliance applications.

-

Q: What factors restrain the Italy sulphuric acid market?A: Constraints include the volatility in raw material and energy costs, significantly impact on production economics, relatively high electricity and gas prices, stringent EU environmental regulations, and logistical challenges related to the import of key feedstock.

-

Q: How is the market segmented by end use?A: The market is segmented into phosphate fertilizers, metal processing, phosphating, fibers, paints & pigments, and others.

-

Q: Who are the key players in the Italy sulphuric acid market?A: Key companies include Versalis, SOL Group, Brenntag, Aurubis AG, Boliden Group, Chemtrade Logistics, Yara International, PhosAgro Group, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs)

Need help to buy this report?