China Sulphuric Acid Market Size, Share, By Concentration (Standard Commercial Grade, Oleum, And Dilute Acid), By Distribution Channel (Online And Offline), And China Sulphuric Acid Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsChina Sulphuric Acid Market Size Insights Forecasts to 2035

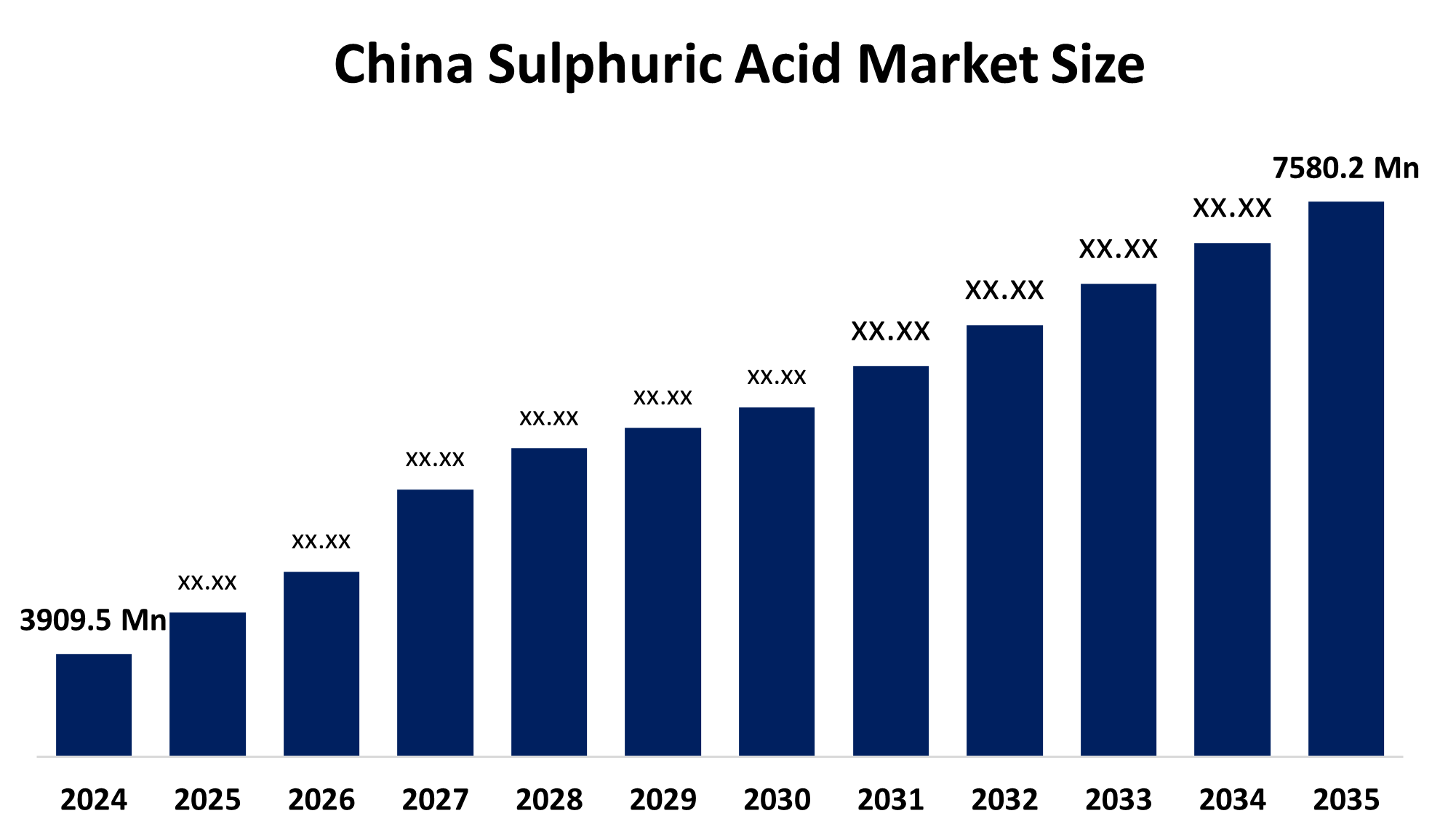

- China Sulphuric Acid Market Size 2024: USD 3909.5 Million

- China Sulphuric Acid Market Size 2035: USD 7580.2 Million

- China Sulphuric Acid Market CAGR 2024: 6.2%

- China Sulphuric Acid Market Segments: Concentration and Distribution Channel

Get more details on this report -

The China Sulphuric Acid Market Size includes the manufacturing and delivery of sulphuric acid produced domestically and used across all major industries that use sulphuric acid, such as fertilisers, chemicals, metallurgy, petro-chemical processing and battery production. Sulphuric acid is among the most widely manufactured and sold industrial chemicals in China and acts as a key ingredient in producing phosphoric acid, in the processing of metals and in the production of chemical intermediates. China is the largest producer and consumer of sulphuric acid in the world.

The sulphuric acid in China are backed by government support, including the Ministry of Ecology and Environment and the National Development and Reform Commission emphasis on environmental performance and industrial modernization, which in turn drive technological and capital investment decisions within the sulphuric acid market. China’s central government increased its annual central air pollution control funding from RMB 60 billion to RMB 330 billion, with cumulative allocations exceeding RMB 2,100 billion, aimed at supporting industrial emission controls, clean energy substitution, ultra-low emission retrofits, and other green upgrades that intersect with basic chemical production sectors like sulphuric acid.

As technology advances, Chinese sulphuric acid providers are now using sulphuric acid recovery technologies based on smelting plants where copper, zinc and lead are produced. Most contemporary smelting facilities have begun implementing double-contact double-absorption (DCDA) techniques, integrated heat recovery systems equipment to achieve better conversion rates of SO and to reduce the amount of SO released into the atmosphere. The improvements in recovery technologies enable copper, zinc, and lead producers to meet stricter environmental requirements established by China as well as reduce their energy costs, thereby improving the profitability of their operations.

Market Dynamics of the China Sulphuric Acid Market:

The China Sulphuric Acid Market Size is driven by the strong downstream demand from phosphate fertilizer production and non-ferrous metal smelting, strong support by government industrial and agricultural policies, rising demand from lithium-ion battery materials, demand for cathode precursor processing and metal refining, technological advancement, strong government support, and China’s aggressive push toward electric vehicles and renewable energy storage.

The China Sulphuric Acid Market Size is restrained by the complex environmental regulations and capacity controls, stricter emission standards, mandatory shutdowns of outdated plants, and limits on new chemical capacity approvals, increased compliance costs and restricted supply expansion.

The future of China Sulphuric Acid Market Size is bright and promising, with versatile opportunities emerging from the demand for high-quality sulphuric acid continues to grow due to multiple drivers including the energy transition and circular economy, the growth in demand for EV batteries as they become mainstream is expected to sustain long-term demand for high-quality sulphuric acid, particularly as new ways to recycle metals and process e-waste also create opportunities for producers to improve efficiency and meet regulatory compliance in a rapidly changing environment, while simultaneously capturing value from China's shift towards more sustainable industrial practices.

China Sulphuric Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3909.5 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.2% |

| 2035 Value Projection: | USD 7580.2 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Concentration, By Distribution Channel |

| Companies covered:: | China National Chemical Corporation, Hubei Xinga Chemicals Group Co., Ltd., Jiangyin Jianghua Microelectronic Materials Co., Ltd., Zhejiang Jiahua Energy Chemical Industry Co., Ltd., BASF (China) Co., Ltd., Suzhou Crystal Clear Chemical Co., Ltd., Jingrui Electronic Materials Co., Ltd., Qingdao Hisea Chem Co., Ltd., Xilong Scientific Co., Ltd., Shijiazhuang Yangda Import and Export and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The China Sulphuric Acid Market share is classified into concentration and distribution channel.

By Concentration:

The China Sulphuric Acid Market Size is divided by concentration into standard commercial grade, oleum, and dilute acid. Among these, the standard commercial grade segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Strong demand for fertilizer production, versatility in industrial applications, production process efficiency allowing manufacturers to meet high demand, and high volume trading and storage all contribute to the standard commercial grade segment's largest share and higher spending on sulphuric acid when compared to other concentration.

By Distribution Channel:

The China Sulphuric Acid Market Size is divided by distribution channel into online and offline. Among these, the offline segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The offline segment dominates because of specialized transportation, storage, and handling, massive industrial consumers for sulphuric acid, vertical integration with downstream industries, and structured around direct, long-term purchase and sales agreements.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China Sulphuric Acid Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Sulphuric Acid Market:

- China National Chemical Corporation

- Hubei Xinga Chemicals Group Co., Ltd.

- Jiangyin Jianghua Microelectronic Materials Co., Ltd.

- Zhejiang Jiahua Energy Chemical Industry Co., Ltd.

- BASF (China) Co., Ltd.

- Suzhou Crystal Clear Chemical Co., Ltd.

- Jingrui Electronic Materials Co., Ltd.

- Qingdao Hisea Chem Co., Ltd.

- Xilong Scientific Co., Ltd.

- Shijiazhuang Yangda Import and Export

- Others

Recent Developments in China Sulphuric Acid Market:

- In March 2025, Yunnan Copper announced that its Lianshan Mining subsidiary operates a 400,000 mt/year industrial sulphuric acid plant. The company reported a significant YoY increase in acid production, focusing on copper by-product sulphuric acid.

- In March 2025, Tongling Nonferrous successfully launched its Jinxin copper smelter in Anhui province, contributing 500,000 t/year of new smelting-derived sulphuric acid capacity.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China Sulphuric Acid Market Size based on the below-mentioned segments:

China Sulphuric Acid Market, By Concentration

- Standard Commercial Grade

- Oleum

- Dilute Acid

China Sulphuric Acid Market, By Distribution Channel

- Online

- Offline

Frequently Asked Questions (FAQ)

-

Q: What is the China sulphuric acid market size?A: China sulphuric acid market is expected to grow from USD 3909.5 million in 2024 to USD 7580.2 million by 2035, growing at a CAGR of 6.2% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the strong downstream demand from phosphate fertilizer production and non-ferrous metal smelting, strong support by government industrial and agricultural policies, rising demand from lithium-ion battery materials, demand for cathode precursor processing and metal refining, technological advancement, strong government support, and China’s aggressive push toward electric vehicles and renewable energy storage.

-

Q: What factors restrain the China sulphuric acid market?A: Constraints include the complex environmental regulations and capacity controls, stricter emission standards, mandatory shutdowns of outdated plants, and limits on new chemical capacity approvals, increased compliance costs and restricted supply expansion.

-

Q: How is the market segmented by concentration?A: The market is segmented into standard commercial grade, oleum, and dilute acid.

-

Q: Who are the key players in the China sulphuric acid market?A: Key companies include China National Chemical Corporation, Hubei Xinga Chemicals Group Co., Ltd., Jiangyin Jianghua Microelectronic Materials Co., Ltd., Zhejiang Jiahua Energy Chemical Industry Co., Ltd., BASF (China) Co., Ltd., Suzhou Crystal Clear Chemical Co., Ltd., Jingrui Electronic Materials Co., Ltd., Qingdao Hisea Chem Co., Ltd., Xilong Scientific Co., Ltd., Shijiazhuang Yangda Import and Export, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs)

Need help to buy this report?