Italy Data Center Market Size, Share, and COVID-19 Impact Analysis, By Data Center Type (Hyperscale/Self-Built, Enterprise/Edge, and Colocation), By Tier Type (Tier 1 and 2, Tier 3, and Tier 4), By End User (BFSI, IT and ITES, E-Commerce, Government, Manufacturing, Media and Entertainment, Telecom, and Other), and Italy Data Center Market Insights, Industry Trend, Forecasts to 2035.

Industry: Information & TechnologyItaly Data Center Market Insights Forecasts to 2035

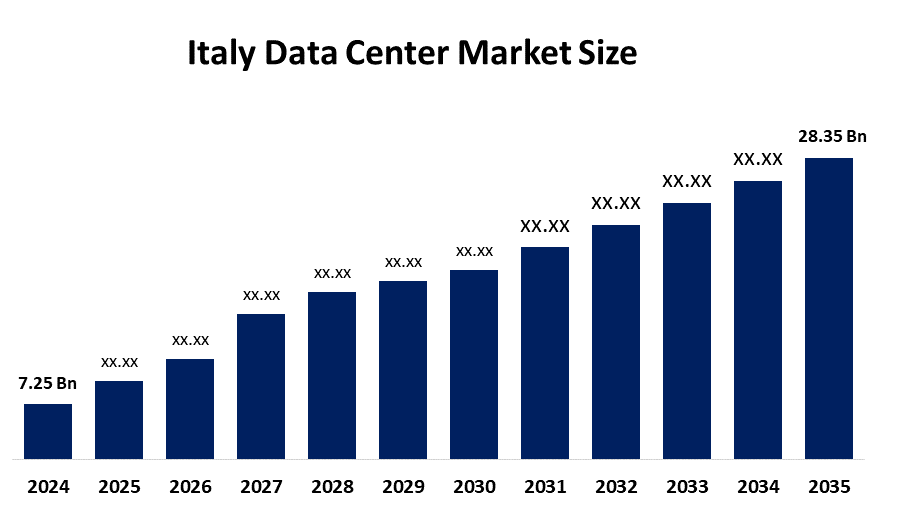

- The Italy Data Center Market Size Was Estimated at USD 7.25 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 13.2% from 2025 to 2035

- The Italy Data Center Market Size is Expected to Reach USD 28.35 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Italy Data Center Market Size is anticipated to reach USD 28.35 Billion by 2035, Growing at a CAGR of 13.2% from 2025 to 2035. Italy data center market is driven by rising cloud adoption, growing demand for data storage, digital transformation across enterprises, expansion of 5g networks, increasing internet penetration, and government initiatives supporting data localization, cybersecurity regulations, and sustainable energy-efficient infrastructure development.

Market Overview

The Italy data center market includes such facilities as those that are equipped with servers, storage, and networking infrastructure to support data processing, cloud services, and digital applications. The market expansion is mainly attributed to increasing cloud adoption, rising data generation, enterprise digital transformation, the expansion of 5G networks, demand for data localization, the growth of e-commerce and fintech, and the increasing need for secure, reliable, and energy-efficient data storage solutions in both the public and private sectors.

Several key trends that are transforming the Italy data center market are hyperscale and colocation data centers rapidly growing to provide for most of the market needs as global and regional players invest to meet the rising cloud demand. Another trend is the increasing use of colocation services by small and medium enterprises that seek cost efficiency, scalability, and reduced capital expenditure. Thirdly, sustainability has become the main concern by far as players seek to improve their operations using energy, efficient designs, renewable energy sourcing, and advanced cooling solutions to cut down their carbon footprints. Fourth, small and localized data centers are becoming popular for the provision of extremely low-latency applications, 5G, IoT, and real-time analytics that are mostly situated in urban and industrial areas.

Technological innovation, together with the supportive government policies, is a vital factor in the development of the market. Data center operators are using AI-powered energy management systems, modular data center designs, liquid cooling technologies, and high-density racks as ways of improving efficiency and performance. To support the growth of digital infrastructure, the Italian government is focusing on national digitalization strategies, giving incentives to energy, efficient buildings, and following the regulations of the European Union, such as GDPR and data sovereignty frameworks. Investments made under the bigger umbrella of the EU digital and recovery programs also serve to promote data center growth, innovation, and sustainable development all over Italy.

Report Coverage

This research report categorizes the market for the Italy data center market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy data center market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy data center market.

Italy Data Center Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7.25 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 13.2% |

| 2035 Value Projection: | USD 28.35 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Data Center Type, By Tier Type |

| Companies covered:: | Aruba S.p.A., Equinix, Inc., Data4 Group, Irideos S.p.A., Vantage Data Centers, STACK Infrastructure, Telecom Italia Sparkle, BT Italia, Keppel Data Centres, Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Italy data center market is driven by increasing cloud computing adoption, rapid digital transformation of enterprises, and rising data generation from e-commerce, fintech, and streaming services. Growing demand for data localization and compliance with GDPR is encouraging domestic data storage. Expansion of 5G networks and IoT applications is increasing the need for low-latency data processing. Additionally, rising investments in colocation facilities, improved internet connectivity, and the focus on energy-efficient and sustainable data center infrastructure are further supporting market growth across Italy.

Restraining Factors

The Italy data center market faces restraints such as high capital and operational costs, rising energy prices, and limited availability of suitable land in urban areas. Strict environmental regulations, lengthy permitting processes, power supply constraints, and challenges in achieving sustainability targets also slow new data center development and expansion.

Market Segmentation

The Italy data center market share is classified into data center type, tier type, and end user.

- The colocation segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy data center market is segmented by data center type into hyperscale/self-built, enterprise/edge, and colocation. Among these, the colocation segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The colocation segment dominates the market because it offers cost-effective, scalable, and flexible infrastructure for enterprises of all sizes. Many Italian companies prefer colocation to avoid high capital expenditure, complex operations, and energy management challenges associated with self-built facilities. Colocation providers also ensure high security, regulatory compliance, reliable connectivity, and access to multiple network carriers, making them attractive for cloud service providers, SMEs, and multinational enterprises operating in Italy.

- The tier 3, segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy data center market is segmented by tier type into tier 1 and 2, tier 3, and tier 4. Among these, the tier 3 segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Tier 3 data centers dominate the market because they provide a strong balance between reliability, uptime, and cost. These facilities offer concurrent maintainability and high availability, which meet the operational needs of enterprises, cloud service providers, and colocation customers. Compared to Tier 4, Tier 3 data centers require lower capital investment while still supporting mission-critical applications. This makes them the preferred choice for most commercial and industrial users across Italy.

- The IT and ITES segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy data center market is segmented by end user into BFSI, IT and ITES, e-commerce, government, manufacturing, media and entertainment, telecom, and other. Among these, the IT and ITES segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The IT and ITES segment dominates the market because these companies depend heavily on data centers for cloud services, application hosting, software development, and managed IT solutions. Rising demand for digital transformation, SaaS platforms, and remote working has increased data processing and storage needs. IT and ITES firms also require high availability, scalability, and strong connectivity, driving continuous investment in colocation and cloud data center facilities across Italy.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Italy data center market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aruba S.p.A.

- Equinix, Inc.

- Data4 Group

- Irideos S.p.A.

- Vantage Data Centers

- STACK Infrastructure

- Telecom Italia Sparkle

- BT Italia

- Keppel Data Centres

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent News:

In February 2025, VIRTUS Data Centers announced that it would be establishing its first Italian facility in Cornaredo, Milan. Set on a 71,000 sqm brownfield site, the data center will offer 70MW of grid power, catering to hyperscalers, enterprises, and service providers.

Market Segment

This study forecasts revenue at the Italy, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Italy data center market based on the below-mentioned segments:

Italy Data Center Market, By Data Center Type

- Hyperscale/Self-built

- Enterprise/Edge

- Colocation

Italy Data Center Market, By Tier Type

- Tier 1 and 2

- Tier 3

- Tier 4

Italy Data Center Market, By End User

- BFSI

- IT and ITES

- E-Commerce

- Government

- Manufacturing

- Media and Entertainment

- Telecom

- Other

Frequently Asked Questions (FAQ)

-

1.What defines the Italy data center market?The Italy data center market comprises facilities that host IT infrastructure, including servers, storage, and networking systems, enabling cloud services, data processing, and enterprise digital operations.

-

2.What factors are driving growth in the Italy data center market?Growth is fueled by rising cloud adoption, increasing data traffic, 5G expansion, digital transformation initiatives, and stricter data privacy regulations demanding local storage solutions.

-

3.Which deployment segment is most influential in Italy’s data center market?Colocation facilities dominate because they provide cost-effective, secure, and scalable infrastructure for enterprises and cloud service providers without heavy upfront investment.

-

4.Which tier of data centers is most widely used in Italy?Tier 3 data centers are dominant, offering high reliability, concurrent maintainability, and minimal downtime, making them ideal for mission-critical applications.

-

5.Which end-user sector contributes most to Italy’s data center demand?The IT and ITES sector leads due to its reliance on cloud computing, managed services, and high-performance data operations.

-

6.How is technology shaping Italy’s data center market?Innovations like AI-driven energy management, modular designs, high-density racks, and advanced cooling systems are improving efficiency, performance, and sustainability.

-

7.What challenges restrict growth in Italy’s data center market?High setup and operational costs, energy constraints, strict environmental regulations, and limited urban land availability slow new developments and expansions.

Need help to buy this report?